Tether launches U.S.-compliant stablecoin USAT to rival Circle?

TechFlow Selected TechFlow Selected

Tether launches U.S.-compliant stablecoin USAT to rival Circle?

USAT is expected to officially launch by the end of 2025, initially available to U.S. residents, businesses, and institutional users.

Author: 1912212.eth, Foresight News

On September 12, Tether announced the launch of its new stablecoin USAT, a fully compliant, dollar-backed stablecoin designed specifically for the U.S. market. It also announced the appointment of Bo Hines as CEO of the future U.S.-based Tether USAT entity.

In the cryptocurrency space, Tether's USDT has a market capitalization exceeding $170 billion and is widely used in trading, cross-border payments, and DeFi applications. Tether generated over $13 billion in profit in 2024, with approximately $5.7 billion in total profit during the first half of 2025, including a record net profit of $4.9 billion in Q2 alone, primarily driven by U.S. Treasury yields and reserve appreciation.

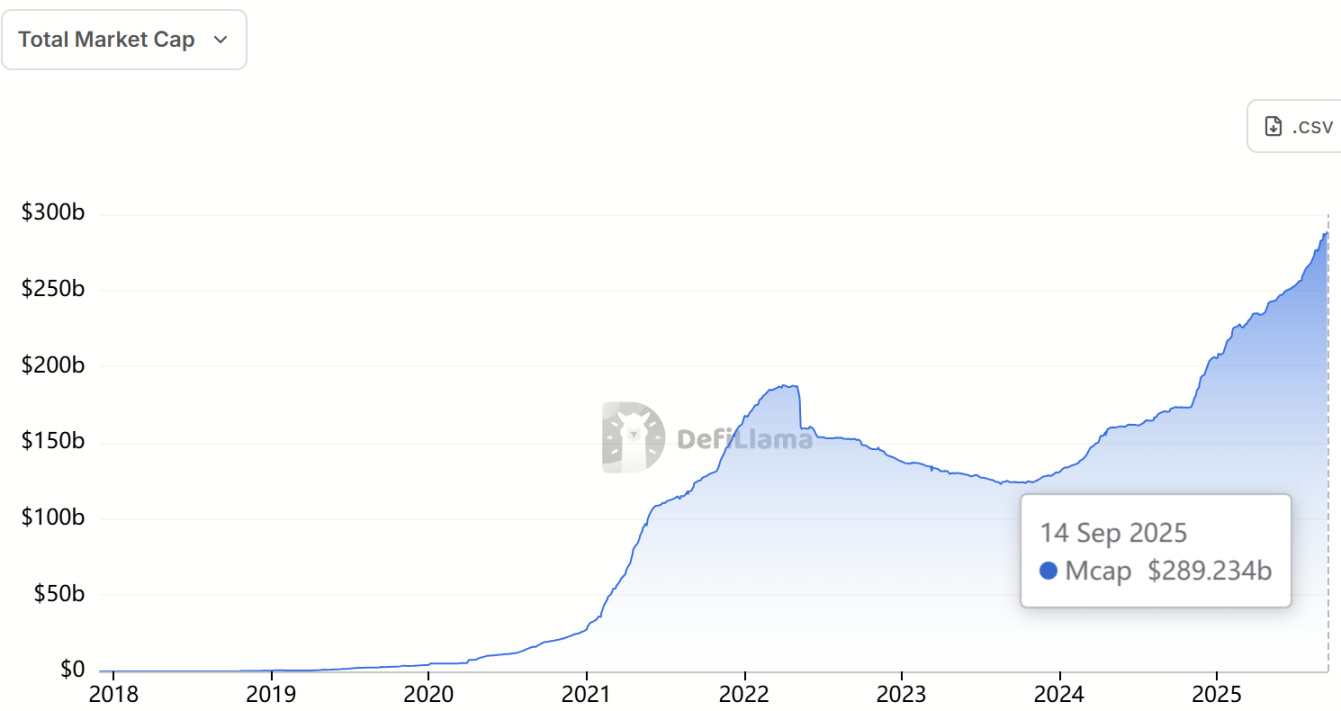

According to defiLlama data, as of September 14, the total stablecoin market cap was approximately $289.234 billion, with USDT accounting for 58.96%, maintaining its dominant market position.

However, with increasing regulatory scrutiny in the United States, Tether faces mounting compliance pressure. The launch of the new stablecoin USAT is seen as a strategic move to enter the domestic U.S. market.

Tether’s decision is not impulsive but rather a response to global regulatory trends. Since 2022, agencies such as the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have intensified oversight of stablecoins. As a product not issued within the U.S., USDT has been repeatedly involved in controversies, including concerns about reserve transparency and anti-money laundering (AML) compliance. Headquartered in the British Virgin Islands, Tether’s stablecoins circulate globally but face usage restrictions in the U.S., where certain exchanges and institutions are reluctant to directly support non-compliant assets. The introduction of USAT aims precisely to fill this gap by offering a stablecoin option that aligns with the U.S. legal framework. USAT will be pegged 1:1 to the U.S. dollar and backed by Tether’s reserves, including cash and highly liquid assets such as U.S. Treasuries.

The key feature of USAT lies in its “U.S. compliance” attribute. According to Tether’s official statement, the stablecoin will be issued and managed by a newly established U.S. subsidiary, expected to officially launch before the end of 2025, initially available to U.S. residents, businesses, and institutional users. Unlike USDT, USAT will strictly adhere to the Bank Secrecy Act (BSA) and anti-money laundering (AML) regulations and support KYC verification.

In addition, the USAT website includes an important notice stating that USAT is not legal tender and is not issued, supported, approved, or guaranteed by the U.S. government. USAT is not insured by the Federal Deposit Insurance Corporation (FDIC), the Securities Investor Protection Corporation (SIPC), or any other government agency.

Notably, Tether appointed Bo Hines as CEO of the new business. Hines is an experienced figure in both politics and business, having served as an advisor to former President Donald Trump and ran for a congressional seat in North Carolina in 2022. He is known for his conservative stance and particularly supportive views on cryptocurrency regulation and innovation policy.

Hines’ appointment is seen as a signal of Tether’s effort to strengthen its influence within U.S. political circles. Hines revealed that the company’s new U.S. headquarters will be located in Charlotte, North Carolina.

In terms of market impact, the launch of USAT could reshape the U.S. stablecoin landscape. Currently, USDT dominates global trading volume, but in the domestic U.S. market, Circle’s USDC has taken an early lead due to its compliance advantage. With a market cap of approximately $73.1 billion, USDC primarily serves U.S. institutions, and companies like Visa and Mastercard have already integrated it into their payment systems.

The emergence of USAT will directly challenge USDC’s position, especially in enterprise-level applications. Tether claims that USAT will support lower transaction fees and higher liquidity, making it suitable for supply chain finance, real estate transactions, and cross-border remittances. For example, a U.S. exporter could use USAT to instantly settle overseas orders, avoiding the high fees and delays associated with traditional banking. This holds significant appeal amid growing global economic uncertainty.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News