Will the formation of a "perfect narrative" in macroeconomics mark the beginning of a quarterly trend for the crypto market?

TechFlow Selected TechFlow Selected

Will the formation of a "perfect narrative" in macroeconomics mark the beginning of a quarterly trend for the crypto market?

If a rate cut is completed and the tone is dovish, it may push the market to break through resistance; if unexpectedly hawkish (a low-probability event), it could trigger a pullback.

Author: Hotcoin Research

Crypto Market Performance

The current total market capitalization of cryptocurrencies is $4.01 trillion, with BTC accounting for 57.21% at $2.29 trillion. Stablecoin market cap stands at $287.8 billion, down 0.12% over the past seven days—the first weekly decline in the last three months, with USDT representing 58.88%.

Among the top 200 projects on CoinMarketCap, most rose while a few declined: MYX surged 1324% over 7 days, WLD increased 85.13%, MNT gained 35.1%, ATH climbed 87.11%, and PLUME rose 42.85%.

This week, net inflows into U.S. spot Bitcoin ETFs were $2.324 billion; net inflows into U.S. spot Ethereum ETFs were $637.5 million.

Market Outlook (September 15–19):

The current RSI index is 63.05, indicating neutral-to-strong momentum. The Fear & Greed Index stands at 53 (higher than last week). Notably, the Altcoin Season Index has reached 78, entering the FOMO zone. On September 17, the Federal Reserve will announce its interest rate decision, with a 96.4% probability of a 25-basis-point rate cut. If the Fed cuts rates and signals dovishness, it may push markets past resistance levels. A hawkish surprise (low probability) could trigger a pullback.

BTC core range: $112,000–117,000

ETH core range: $4,500–4,800

SOL core range: $220–250

Conservative strategy: Accumulate gradually near support levels (e.g., BTC ≤ $112k, ETH ≤ $4.5k, SOL ≤ $220), with stop-loss set 3–5% below support.

Aggressive strategy: If resistance levels are breached (BTC > $117k, ETH > $4.8k, SOL > $250) with rising volume, consider light long positions.

Hedging risk: Avoid high leverage, as volatility may double around the Fed meeting.

Understanding the Present

Weekly Major Events Recap

1. On September 8, stablecoin issuers Paxos, Frax Finance, Agora, among others, are competing for the right to issue Hyperliquid’s upcoming USDH stablecoin;

2. On September 8, Arbitrum-based modular trading platform Kinto suffered a smart contract attack in July, losing 577 ETH (approximately $1.55 million), and announced it will shut down on September 30. Founder Recuero pledged to compensate some hacker victims after Kinto's closure;

3. On September 11, WLFI announced Project Wings on Solana in collaboration with ecosystem partners. Centered on traders, this initiative aims to bring a more dynamic and deeper market experience to the community. The USD1 trading pair is now live on BONK.fun and Raydium Launchlab, allowing user participation;

4. On September 11, SEC Chairman Paul S. Atkins reaffirmed key points from his speech at the inaugural OECD Global Financial Markets Roundtable, stating that the convergence of blockchain and AI will usher in a new era of prosperity, and the SEC is determined to seize the opportunity;

5. On September 12, gold prices surpassed their inflation-adjusted peak from 45 years ago. Amid growing concerns about the U.S. economic outlook, gold continues its strong bull run over the past three years, entering uncharted territory.

6. On September 10, the U.S. SEC postponed the review of Franklin's spot SOL and XRP ETF applications, moving the deadline from September 15 to November 14, 2025.

Macroeconomics

1. On September 9, the preliminary value of the U.S. 2025 benchmark nonfarm payroll revision was -911,000, worse than the expected -700,000;

2. On September 10, the U.S. August PPI year-on-year rate was 2.6%, below the expected 3.3% and prior 3.30%;

3. On September 11, the U.S. August unadjusted CPI year-on-year rate came in at 2.9%, the highest since January and in line with expectations;

4. On September 11, the European Central Bank held its key interest rate steady at 2% for the second consecutive meeting, as officials assess the impact of trade agreements between the EU and the U.S.

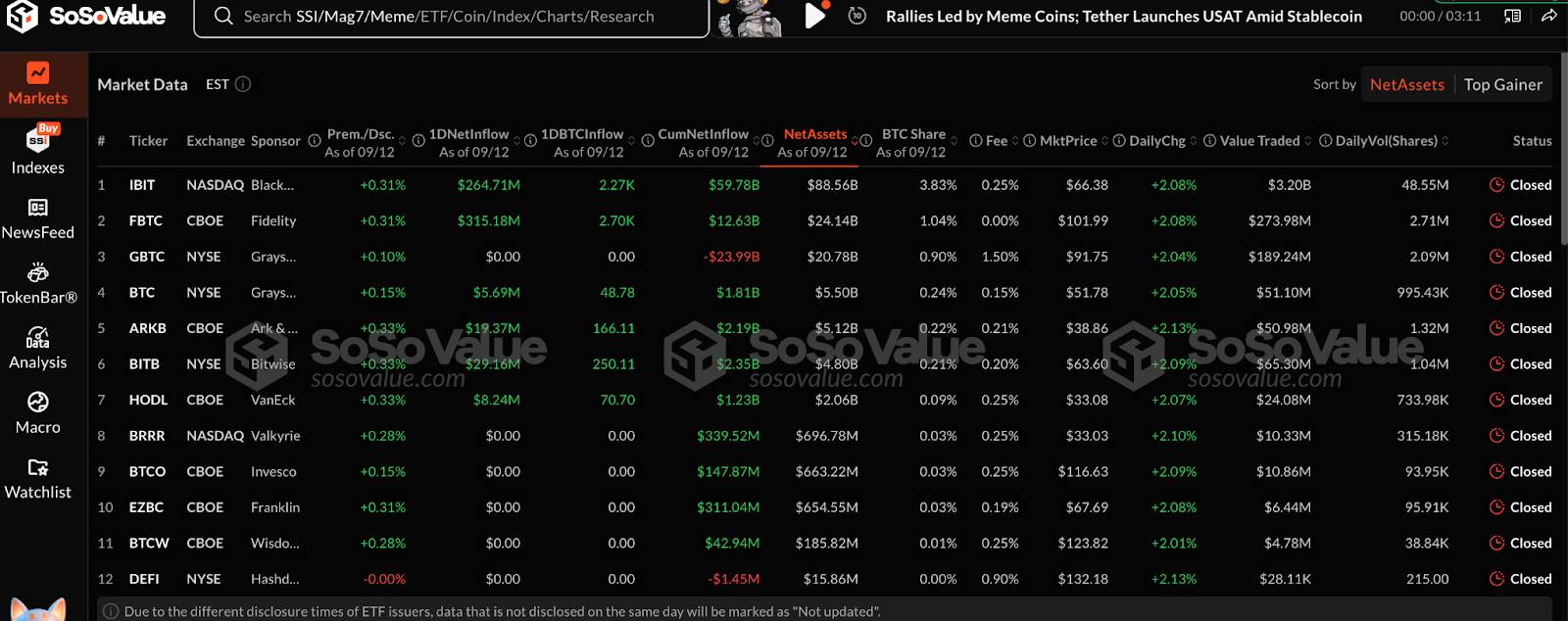

ETFs

Data shows that from September 8 to 12, net inflows into U.S. spot Bitcoin ETFs totaled $2.324 billion. As of September 12, GBTC (Grayscale) has seen cumulative outflows of $23.947 billion, currently holding $20.803 billion, while IBIT (BlackRock) holds $88.187 billion. Total market cap of U.S. spot Bitcoin ETFs: $153.567 billion.

Net inflows into U.S. spot Ethereum ETFs: $637.5 million.

Looking Ahead

Event Calendar

1. EDCON 2025 will take place in Osaka, Japan, from September 16 to 19, bringing together members of the global Ethereum community to discuss protocol upgrades, ecosystem development, and the future of Web3;

2. Korea Blockchain Week 2025 will be held in South Korea from September 22 to 28;

3. TOKEN2049 Singapore 2025 will take place in Singapore on October 1–2, 2025.

Project Updates

1. Japanese national clothing chain Mac House plans to start purchasing Bitcoin from September 17, 2025, with a total investment of 1.715 billion yen (approximately $11 million);

2. Union’s U Drop airdrop claim deadline is September 18.

Key Events

1. September 17 at 21:45: Bank of Canada will announce its interest rate decision;

2. September 18 at 02:00: U.S. Federal Reserve will announce its interest rate decision (upper bound) for September 17;

3. September 18 at 20:30: U.S. will release the weekly initial jobless claims (in thousands) for the week ending September 13.

Token Unlocks

1. Starknet (STRK) will unlock 127 million tokens on September 15, worth approximately $17.04 million, representing 5.98% of circulating supply;

2. Sei (SEI) will unlock 55.56 million tokens on September 15, worth approximately $18.64 million, representing 1.18% of circulating supply;

3. Arbitrum (ARB) will unlock 92.65 million tokens on September 16, worth approximately $49.06 million, representing 2.03% of circulating supply;

4. ZKsync (ZK) will unlock $173 million worth of tokens on September 17, valued at approximately $10.52 million, representing 3.61% of circulating supply;

5. Fasttoken (FTN) will unlock 20 million tokens on September 18, worth approximately $89.8 million, representing 2.08% of circulating supply;

6. Velo (VELO) will unlock 3 billion tokens on September 20, worth approximately $46.48 million, representing 13.63% of circulating supply.

About Us

Hotcoin Research, the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for investors. Through our flagship reports "Weekly Insights" and "In-Depth Research," we dissect market trends. With our exclusive column "Top Pick Tokens" (powered by dual AI and expert screening), we help identify high-potential assets and reduce trial-and-error costs. Each week, our analysts engage directly with users via livestreams to explain hot topics and forecast trends. We believe that warm, consistent support combined with professional guidance can help more investors navigate market cycles and capture the value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and conduct investments within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News