Crossing the C2C "Minefield": A Ultimate Guide to Deposit and Withdrawal Safety for All Web3 Users

TechFlow Selected TechFlow Selected

Crossing the C2C "Minefield": A Ultimate Guide to Deposit and Withdrawal Safety for All Web3 Users

The "last mile" challenge of C2C deposits and withdrawals is an absolute prerequisite for the cryptocurrency industry to achieve its next wave of large-scale growth.

Editor's Note

For every Web3 participant—whether a trader, KOL, or retail newcomer—C2C deposits and withdrawals represent the indispensable "last mile" connecting the digital world with real-world wealth. Yet this necessary journey has long been fraught with obstacles. The shadow of account freezes, endless scams, and platform abandonment at critical moments are severely eroding user trust, forming a major barrier to the industry’s mainstream adoption.

This article aims to deeply analyze the core challenges in today’s C2C market and explore how a new paradigm centered on "proactive defense" can fundamentally resolve user pain points and set a safer, more trustworthy standard for the industry.

"Trust Black Hole": User Pain and Merchant Struggles in the C2C Market

The protagonist of this story could be any crypto investor we know—we’ll call him "Alex." After securing profits, when he attempted to cash out via a major exchange’s C2C marketplace, an unexpected disaster struck. Three days after completing the transaction, he discovered his bank card had been judicially frozen, rendering all funds in his account inaccessible.

Alex’s experience is not isolated—it’s a microcosm of the current C2C ecosystem’s fragility. The root problem lies in criminal groups exploiting C2C channels to launder illicit proceeds from telecom fraud, online gambling, and other illegal activities. In this process, honest users and merchants, no matter how cautious, may unknowingly become the final link in a contaminated financial chain, forced to bear disproportionate risks.

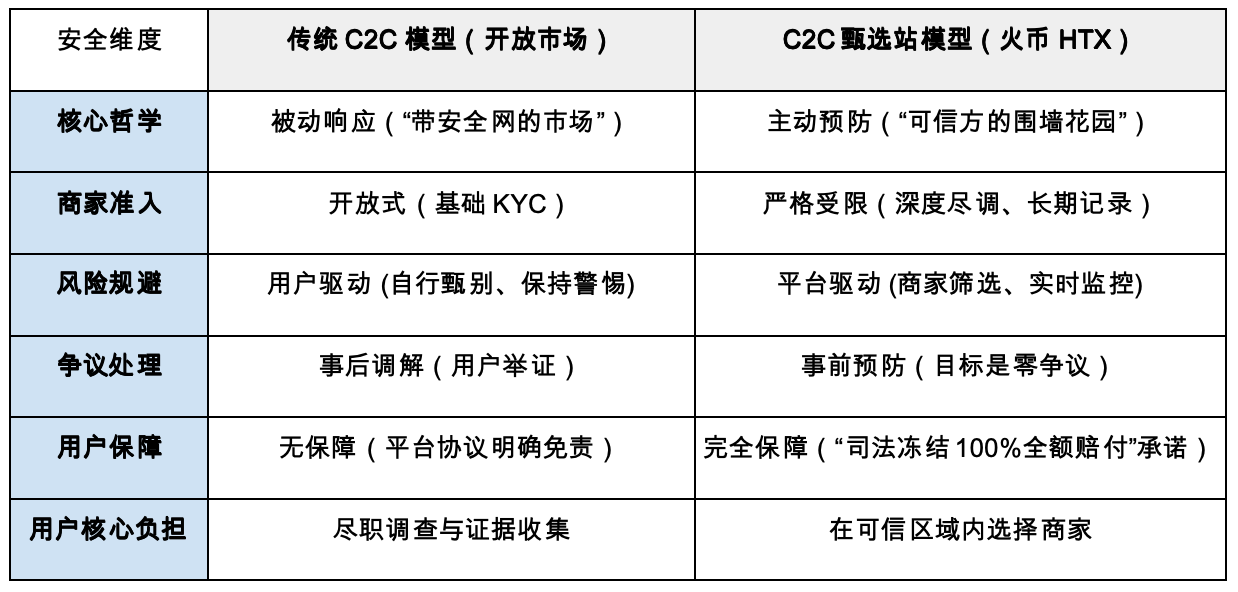

For years, mainstream C2C platforms have relied on a passive security model. They offer basic KYC verification, reputation systems, and asset escrow services, but philosophically, this system is rooted in "buyer beware." Platforms largely outsource risk assessment and ultimate liability to the users themselves.

When a freeze actually occurs, users are plunged into an exhausting appeals process. Reviewing public appeal procedures on some major platforms reveals that users are typically required to submit strictly formatted evidence—such as recording a full video of themselves logging into their bank app using another device (screen recordings are often not accepted)—along with official bank documents. The entire process resembles a mysterious "black box," leaving users anxious and waiting, only to eventually confront a cold免责 clause buried in the platform’s terms: "The platform bears no obligation to resolve disputes arising from payment issues for completed transactions."

This model exhausts retail investors and puts legitimate OTC merchants on shaky ground. They must invest significant effort vetting counterparties, yet still cannot fully avoid the risk of receiving "dirty money." Once entangled, they face not only financial loss but also potential reputational and legal consequences. An unsafe environment ultimately harms every well-intentioned participant in the ecosystem.

Paradigm Shift: From "User Self-Protection" to "Platform Guarantee"

Market pain is driving a profound paradigm shift. In response to users’ strong demand for fund security, a new solution has emerged, centered on "proactive defense" and "strong platform guarantees." Rather than applying scattered patches to a chaotic open market, it aims to build a highly curated and tightly monitored "high-security zone." Huobi HTX’s newly launched "C2C Select Zone" exemplifies this new paradigm and serves as a market pioneer.

The core of this new model is a philosophical leap from "passive response" to "proactive prevention." Instead of focusing on resolving disputes after they occur, the platform dedicates its resources to preventing risks before they arise.

For ordinary users, this means a fundamental transformation in deposit and withdrawal experiences. They no longer need to blindly "mine" among countless merchants, worrying about the source of counterparties' funds. Instead, they can trade confidently within a "whitelist" rigorously vetted by the platform.

For high-quality OTC merchants, this creates a "sanitized zone" where they can operate with peace of mind. Access to the "C2C Select Zone" goes beyond simple KYC checks—it involves a multidimensional, high-standard due diligence process evaluating a merchant’s fulfillment capacity, service quality, and fund security history. This shields them from significant risks while enabling them to serve high-value users who prioritize safety, creating a virtuous cycle.

Redefining Standards: The Strategic Commitment Behind "Zero Freezes + Full Compensation"

What truly closes the loop and gives this model the potential to redefine industry standards is its revolutionary accountability commitment. Take Huobi HTX’s "C2C Select Zone" as an example: its "0 Freezes + 100% Full Compensation" mechanism completely overturns the old unfair dynamic where platforms disclaim responsibility and users bear all risks.

● "0 Freeze" Record: Since its launch in April 2025, the "C2C Select Zone" has maintained a public record of zero judicial freezes. This is not just impressive marketing data—it’s the strongest proof of the effectiveness of its "preemptive risk control" model.

● "100% Full Compensation": This acts as a safety net backing the "0 freeze" goal. Huobi HTX pledges that if a user’s bank card is judicially frozen due to actions by a verified merchant on the "C2C Select Zone," the platform will provide full compensation (up to 10,000 USDT per transaction). More ingeniously, this compensation is shared equally—50% borne by the platform and 50% by the responsible merchant.

This shared-risk mechanism binds the interests of the platform, merchants, and users like never before. It sends a clear market signal: security is no longer an empty slogan, but a financial commitment with defined costs and accountable parties. This is the essence of building a "truly user-friendly platform"—placing user interests at the center of the business model.

The Road Ahead: A Necessary Choice Under Compliance Pressure and the Trust Moat

This user-driven transformation aligns perfectly with the global trend of tightening regulation. Recently, news of a major global exchange being fined hundreds of millions of dollars for violating U.S. anti-money laundering regulations served as a wake-up call for the entire industry. This case clearly shows that global regulators have raised compliance expectations to unprecedented levels, especially regarding preventing illegal funds from exploiting financial systems. Legal precedents indicate that claims of "ignorance" or shifting blame onto users are no longer valid defenses.

A loosely managed open C2C market has now become a massive compliance liability for any major trading platform. In this context, models like Huobi HTX’s "C2C Select Zone"—which proactively builds a "secure zone" and backs user fund security with real financial commitments—are not just smart business strategies, but effective hedges against regulatory risk.

It’s foreseeable that future C2C competition will revolve not just around liquidity depth and trading fees, but around verifiable, systemic security safeguards and robust compliance frameworks. Platforms that fail to adapt may gradually be marginalized. Meanwhile, users’ "migration toward safety" will force more platforms to follow suit, pushing the entire industry from its early "Wild West" phase toward a more standardized and trustworthy ecosystem.

Conclusion

Solving the "last mile" challenge of C2C deposits and withdrawals is an absolute prerequisite for the crypto industry to achieve its next wave of mass-scale growth. The new paradigm represented by Huobi HTX’s C2C Select Zone centers on rebuilding trust through accountability. It not only resolves the most urgent security concerns for users and merchants but also charts a path for the entire industry toward broader mainstream markets. The bridge to the future must be built not just with code, but with unwavering security and responsibility. That, perhaps, is the deepest moat of trust.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News