When a beverage company decides to exchange equity for BONK dividends

TechFlow Selected TechFlow Selected

When a beverage company decides to exchange equity for BONK dividends

Safety Shot and Bonk are engaging in a brand-new type of collaborative relationship.

Author: Yanz, TechFlow

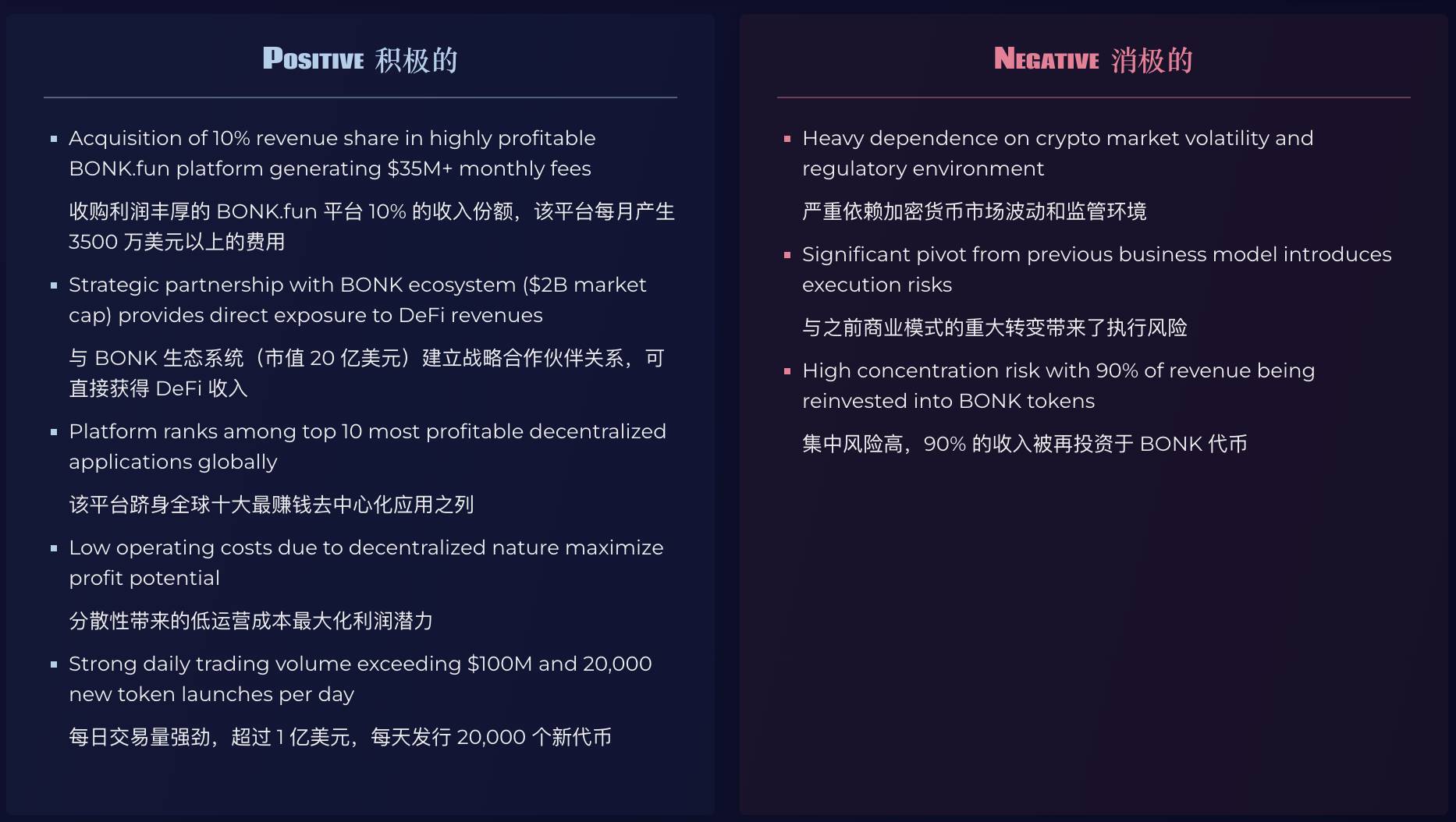

On August 11, 2025, Safety Shot, Inc. (NASDAQ: SHOT), a beverage company, announced a breakthrough strategic alliance with the BONK founding contributors, deeply integrating the company into the BONK ecosystem.

In a private placement, the Bonk founding team provided approximately $25 million worth of Bonk tokens—around 77 trillion tokens—while Safety Shot issued $35 million worth of convertible preferred shares (convertible into common stock). Through this arrangement, Safety Shot aims to transform from a traditional beverage company into one integrated with DeFi (decentralized finance), though it also brings the risk of diluting existing shareholders' equity.

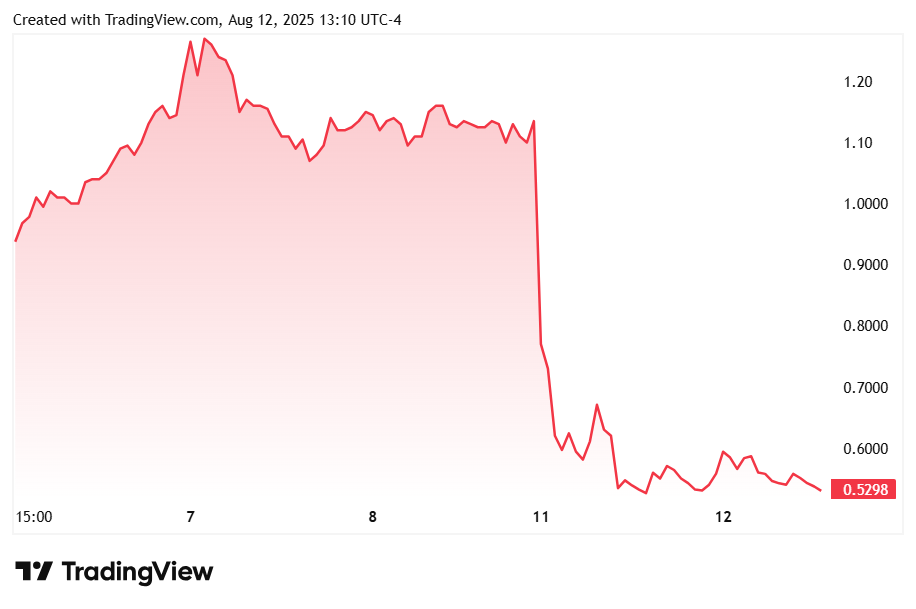

At first glance, this partnership appeared to be yet another attempt by a public company to pivot into a crypto-reserve business model. The market reacted negatively, and Safety Shot's stock price plummeted immediately after the announcement, dropping sharply by 55%.

However, the reality is more complex—Safety Shot and Bonk are engaging in a novel form of collaboration.

On August 12, Safety Shot further disclosed that it had acquired a 10% revenue-sharing interest in letsBONK.fun (BonkFun), a core platform within the BONK ecosystem, and appointed key members of the Bonk founding team (such as Mitchell Rudy) to its board of directors, occupying 50% of the board seats. Rudy will also serve in a strategic role guiding the accumulation of $BONK and advising on on-chain operations. The company has also reserved the Nasdaq ticker symbol "BNKK" for potential future strategic use.

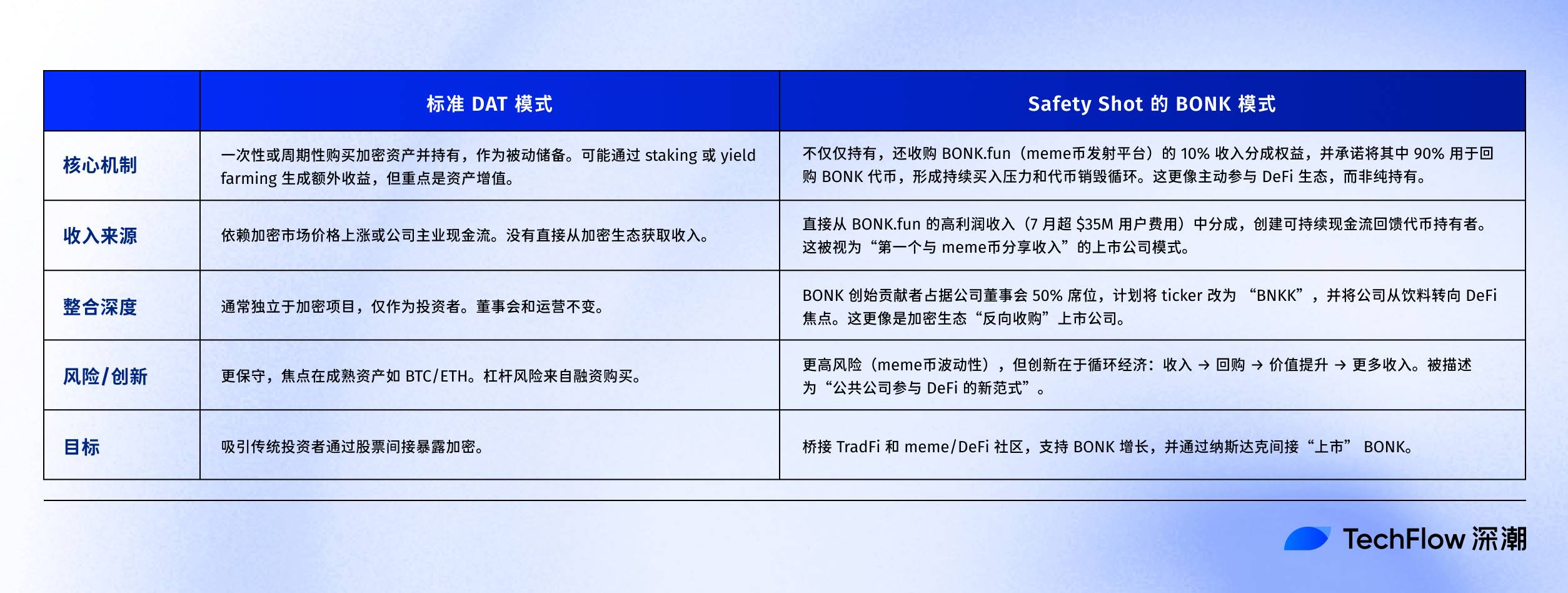

This suggests that the collaboration between these two companies goes beyond the traditional corporate playbook of simply buying cryptocurrencies to diversify asset holdings.

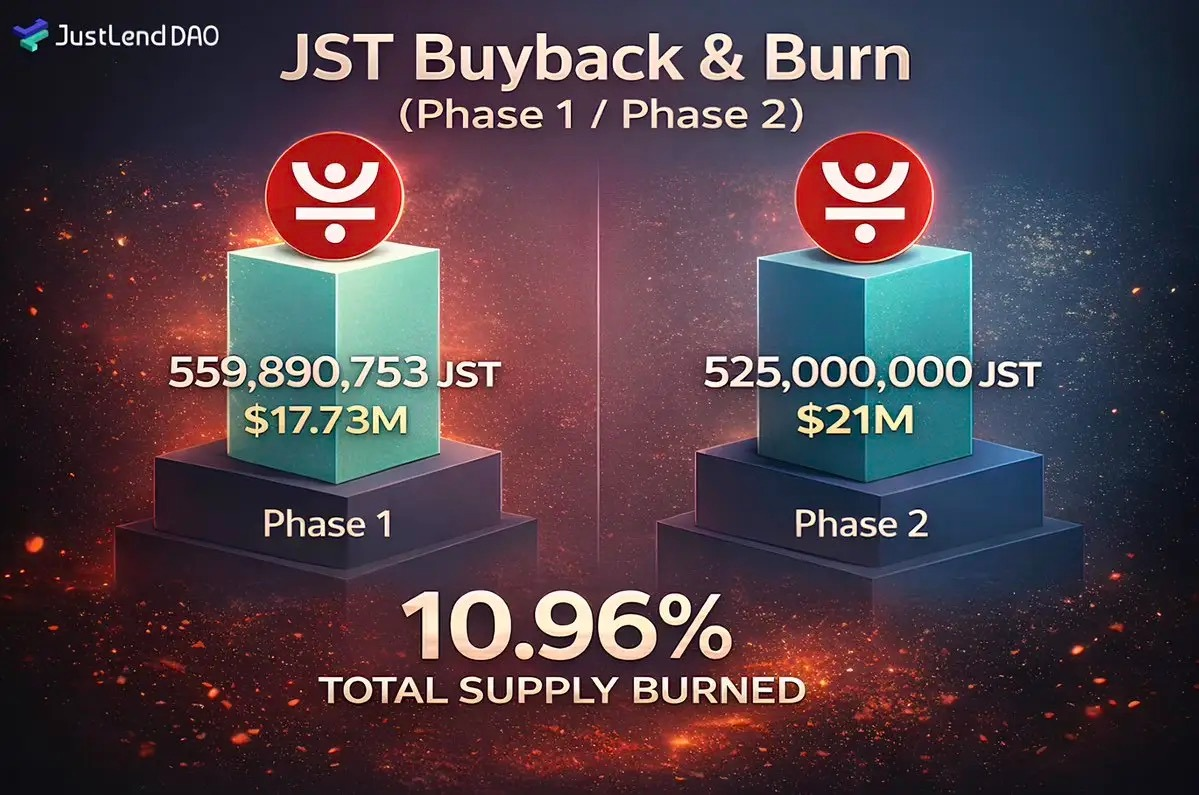

Safety Shot will receive 10% of revenues generated by BONK.fun and has committed to using 90% of those proceeds to repurchase BONK tokens for its treasury. This creates ongoing buying pressure for BONK, supporting its value appreciation. Meanwhile, BONK.fun itself will use part of its income to conduct open-market buybacks and burn BONK tokens, further reducing supply and enhancing value.

Unlike previously announced cryptocurrency reserve strategies, Safety Shot will generate income through active participation in letsBONK.fun, rather than merely profiting from token trading gains.

Rudy stated: "Staking yields are relatively stable but limited, and always dependent on the underlying token’s price. Revenue sharing, however, offers unlimited exponential growth potential tied directly to the success of a market-leading enterprise. It's a bet on the entire industry's expansion, not just a single asset. For Safety Shot investors, this means the company's value is now linked to real, high-margin cash flows—far more powerful and exciting than simply holding a token and hoping it appreciates."

Impact of the partnership on Safety Shot

Source:

https://www.stocktitan.net/news/SHOT/safety-shot-acquires-10-revenue-sharing-interest-in-revenue-3axg64322ylq.html

This move is seen as the **first time in Nasdaq history that a public company has “shared revenue with a meme coin”** in such a manner, and it will also share returns with token holders, since revenues ultimately flow back into the BONK ecosystem, benefiting holders.

Jarrett Boon, CEO of Safety Shot, said: "This strategic partnership marks the first step in our broader corporate transformation. By aligning with one of the most dynamic ecosystems in the digital asset space, we’ve taken a bold first step."

Notably, Dominari Securities, the investment advisor behind this bold deal, is no obscure player—it is a holding company linked to the Trump family. Its parent company, Dominari Holdings, Inc. (NASDAQ: DOMH), is headquartered in Trump Tower.

As early as February 11, 2025, Dominari Holdings announced that Donald Trump Jr. and Eric Trump had joined its advisory board, each investing approximately $1 million via private placements. According to FactSet data, the Trump sons collectively hold a 6.7% stake in the company, valued at over $6 million per person.

To date, this firm has become the go-to advisor for multiple Trump family transactions, including ventures in crypto, data centers, and manufacturing projects. Kyle Wool, President of Dominari Holdings, previously praised the advisory board—especially Eric Trump—for helping one subsidiary secure a Bitcoin mining partnership, referring to American Data Centers’ collaboration with Hut 8.

Returning to the seemingly wild and risky collaboration between Bonk and Safety Shot, the connection to Dominari and the Trump family positions it as part of the Trump business network. Although the Trump brothers are not directly involved, their association adds an element of risk to this "new kind of partnership."

This so-called "Trump effect" has drawn significant attention to Safety Shot and Bonk, amplifying interest across both crypto and traditional financial markets—but it also raises investor concerns about speculative risks tied to the Trump affiliation.

As of September 1, SHOT’s stock performance remains bleak, continuing to languish since the initial announcement. The future trajectory of this partnership remains uncertain and awaits further observation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News