Bonk Launches BONK Trust: How Many Tokens Can It "Lock Up"? What Attracts Off-Circle Users?

TechFlow Selected TechFlow Selected

Bonk Launches BONK Trust: How Many Tokens Can It "Lock Up"? What Attracts Off-Circle Users?

Up to $49.3 million worth of BONK can be locked, accounting for 3% of the total supply. "Moving from virtual to real" may become an inevitable path.

Written by: Nan Zhi, Odaily Planet Daily

In 2023, the most notable Meme token on Solana besides WIF was BONK. Its main price surge began around early November 2023, rising from a market cap of $20 million to $1.5 billion by mid-December—a 75x increase over roughly one and a half months.

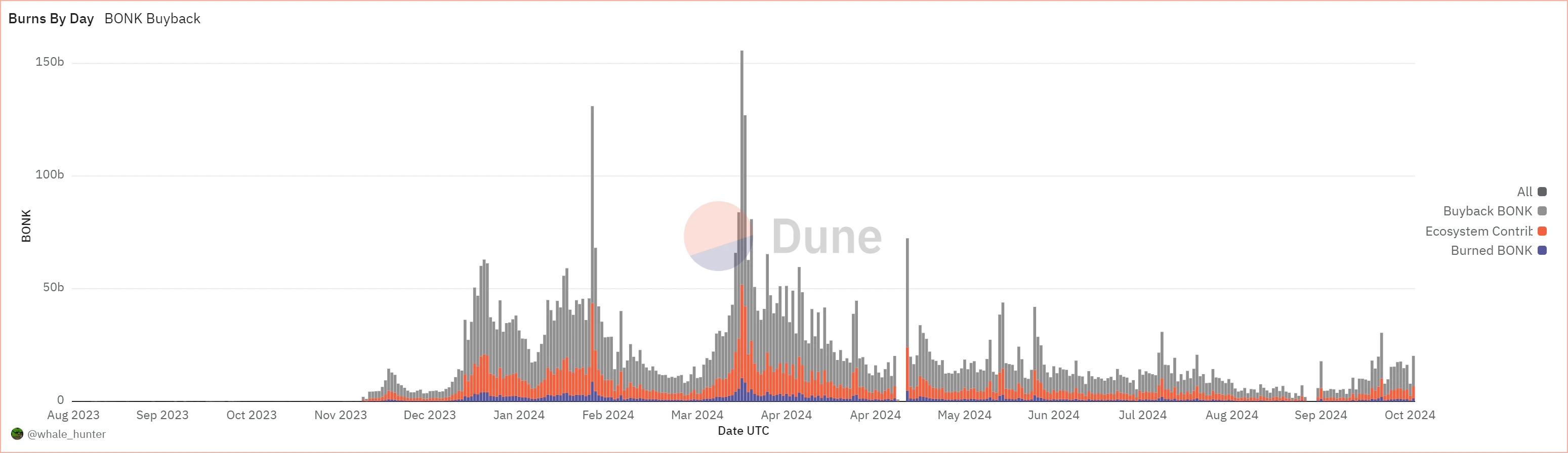

Unlike other tokens that rely solely on "community building" for growth, BONK has started moving "from speculation toward real utility." In August 2023, Bonk launched a Telegram trading bot on the Solana network, which burns BONK tokens through service fees. To date, it has burned over $10 million worth of BONK.

Today, Bonk announced the launch of the BONK ETP "Osprey BONK Trust," which will accept its first qualified investors, aiming to provide high-net-worth individuals with a simple and cost-effective way to gain exposure to BONK. Odaily will analyze this development in the following article.

Understanding the Osprey BONK Trust

According to Bonk’s product introduction page, the Osprey BONK Trust aims to offer a simple and secure investment vehicle for BONK, enabling "accredited investors" to invest in BONK without needing a wallet or managing private keys.

How many tokens will be locked?

The Osprey BONK Trust sets strict eligibility criteria for accredited investors, including:

-

Individuals with annual income exceeding $200,000 (or $300,000 jointly with a spouse), or net assets exceeding $1 million;

-

Investment professionals such as licensed associated persons of broker-dealers or investment advisors;

-

Entities with at least $5 million in liquid assets, or where all beneficial owners are accredited investors.

Another key aspect of the Osprey BONK Trust is that it currently does not allow redemption of BONK. Investors can only sell their shares on the secondary market in the near term. From the token's perspective, the purpose of launching this trust is to attract high-quality capital from outside the crypto ecosystem and lock up BONK tokens within the trust.

So under current terms, how much BONK could potentially be locked in the Osprey BONK Trust?

The terms state that each share represents 216,999.02 BONK tokens, with an initial outstanding share count of 9,792,000. Therefore, up to 216,999.02 × 9,792,000 = 2.12 trillion BONK tokens could be deposited into the trust. At the current price of $0.00002273 per BONK, this equates to approximately $49.3 million worth of locked-up tokens—about 3% of the total supply, a significant amount.

Additionally, the trust charges a 2.5% annual management fee, though it has not yet disclosed whether these fees will be used to burn BONK or support other price-growth mechanisms.

Why is it attractive to external capital?

Discussions in the comment section of the official announcement and replies from the team suggest additional implications behind the launch of the Osprey BONK Trust.

User A commented under the announcement asking: “What are the advantages of buying BONK through the trust compared to purchasing directly on-chain?”

@R89 Capital replied: “Memecoin sized gains from tax advantaged accounts.” The BONK official account liked this response, while another BONK team member @oskyment added: “Being able to invest using your 401 K for example.”

(Note from Odaily Planet Daily: A 401(k) is a retirement savings plan offered by U.S. employers, allowing employees to contribute pre-tax portions of their salary into an investment account.)

What does this mean? Simply put, investing in the BONK Trust via accounts like 401(k)s offers benefits such as tax deferral and pre-tax investment deductions, possibly qualifying for favorable tax treatment.

More specifically, investment returns—including interest, dividends, and capital appreciation—are not taxed immediately within a 401(k). Taxes are only due when funds are withdrawn during retirement. Additionally, contributions made from pre-tax income reduce taxable income in the year they are made.

However, the author believes that despite potential short-term tax advantages, true long-term appeal requires stable and reliable price performance—something closely tied to Bonk’s core revenue-generating product: BonkBot.

Risk Warning

It should be noted that the Osprey BONK Trust explicitly states: "None of the funds have been registered under the Securities Act, the Investment Company Act of 1940, or any state securities laws. Shares purchased directly from the fund are offered in private placements pursuant to exemptions...and similar exemptions under applicable state and local laws, and are issued and sold solely to accredited investors."

Therefore, shares purchased directly from the fund are restricted and subject to significant transfer and resale limitations. Prospective investors should carefully consider these liquidity constraints before making any investment decision, particularly given that none of the funds currently offer a redemption program.

From Speculation to Utility

For most Meme coins, once you strip away community, culture, and consensus, their essence remains a "capital game" and "attention economy," where profits come primarily from new entrants. Especially for newly launched Memes, the focus is often on creating events and capturing attention rather than developing practical use cases.

However, established Meme projects struggle to continuously attract new users, prompting some to shift "from speculation toward real utility." For example, Floki launched its RWA product TokenFi (TOKEN), while Bonk introduced BonkBot. BonkBot burns approximately $20,000–$30,000 worth of BONK daily, having burned over $10.53 million since launch, serving as a stabilizing anchor for the token’s price.

2024 has been a breakout year for Meme coins, with multiple tokens reaching market caps of hundreds of millions or even billions of dollars. Yet many once-popular Memes have collapsed after losing investor attention, fading into obscurity. As such, the "shift from speculation to utility" pioneered by BONK and FLOKI may become a core strategy for next-generation Meme coins seeking long-term survival in the years ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News