Super Gambling-ization from the Zhenghe Financial Perspective

TechFlow Selected TechFlow Selected

Super Gambling-ization from the Zhenghe Financial Perspective

Gambling is no longer a marginal vice, but has become the most powerful distribution channel in the market.

Author: Lauris

Translation: Saoirse, Foresight News

For centuries, gambling has been viewed as a zero-sum game. The house always wins, extracting value from both sides of every bet. From national lotteries to Las Vegas casinos, gambling has effectively become a tax on "hope," a mechanism for transferring wealth from the many to the few.

But what if this view is incomplete? Look around: people flooding into Zora's content token markets, speculating heavily in small-cap coins, or blindly following any trending investment narrative. At their core, these behaviors are speculation. And speculation is simply gambling repackaged.

From this perspective, gambling is more than just entertainment. It can be understood as a fundamental coordination mechanism—a way to pool risk, attention, and capital toward shared outcomes. Games that once seemed like futile chance-taking are now revealing themselves as engines of distribution and culture.

The Shared Origins of Finance and Gambling

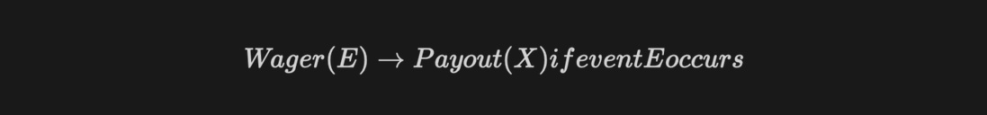

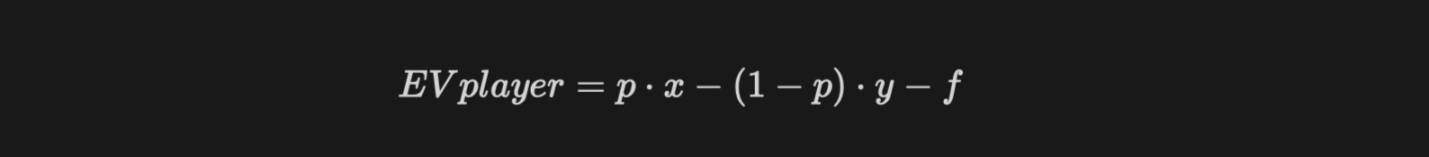

At its essence, gambling is a simplified market. A bet is fundamentally a contingent claim:

Mathematically, this is identical to an option or futures contract—both involve exchanging present certainty for future uncertainty. What finance calls "speculation" is simply gambling in plainer form. Both are mechanisms for pricing uncertainty.

The task today is to redesign this structure into a positive-sum model, where liquidity, participants, and creators grow together through interaction.

This difference exists at the linguistic and cultural level, not the structural one. Keynes, Schumpeter, and Galbraith would all agree on this.

(Note: Keynes, Schumpeter, and Galbraith were highly influential economists of the 20th century whose theories profoundly shaped modern economics, financial markets, and social policy.)

Casino bet: wager $1 on red, receive $2 if outcome matches.

Call option: pay $1 premium, gain $2 if strike condition is met.

A casino bet and a call option are identical: both exchange present certainty for future uncertainty, and both rely on market makers for liquidity. The only difference is packaging. In a building with marble columns, it's called gambling; on an Etherscan page, it's called finance. The real mistake has always been pretending they are different, when in fact they are one and the same.

The cognitive error of modern society is artificially separating the two.

From Zero-Sum to Positive-Sum

The reason traditional gambling is zero-sum lies in its "take" mechanism. If 10 players each bet $100, and the house takes a 10% edge, only $900 is redistributed. This structure ensures long-term losses for players:

Formally:

For most games:

However, in on-chain environments, when gambling scenarios interact with spot markets, the "house" no longer needs to profit by extraction.

It can act as a liquidity router or market-making mechanism. Every bet becomes a buy order, adding liquidity to long-tail assets, tokens, and even structured positions in credit and prediction markets.

Instead of extracting value from players, the house routes capital back into the ecosystem itself, transforming speculation into liquidity and distribution power.

A simplified positive-sum model is as follows:

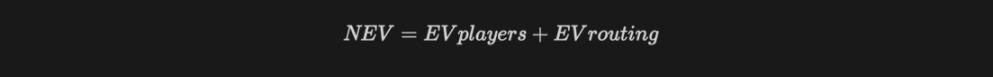

Ecosystem expected value = sum of all players' expected values + routing expected value

(Routing expected value represents the liquidity value created by the house's capital flows)

In this structure, the take no longer destroys value—it creates it. Speculation itself becomes a mechanism for injecting liquidity, distributing assets, and deepening markets.

Cultural and Coordination Multiplier Effects

What makes gambling especially suited for transitioning to a positive-sum model is not just its entertainment value, but its role as a distribution channel. Price is a function of distribution, and gambling enables mass-scale distribution. Each bet triggers a chain reaction: tokens are bought, liquidity is injected, attention is focused.

Streaming and communities amplify this dynamic. Streamers turn risk into entertainment, communities turn bets into rituals of belonging, and protocols capture this energy and convert it into capital flow.

When these cycles are tokenized, each bet means more than just value transfer—it also creates distribution. Tokens issued through gambling can accumulate holders in real time, increase liquidity depth, and gain narrative appeal. A single spin that once ended at a slot machine can now create market presence.

Unlike traditional casinos, its returns are no longer limited by the bets themselves, but multiplied through network spillover effects—here, speculation becomes a dual channel for liquidity and distribution. Gambling ceases to be a moral hazard and becomes a foundational mechanism for capital formation.

A Formal Model of Positive-Sum Gambling

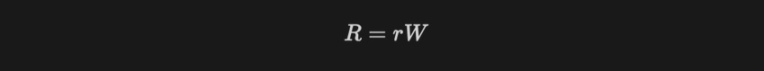

Let W be the total wagered amount, and r the take rate. Protocol revenue is:

In a traditional casino, R is extractive; in this model, R is used for liquidity operations that deepen markets and expand distribution.

Net ecosystem value is then:

Where routing expected value represents the liquidity and distribution value generated by the house's capital flows.

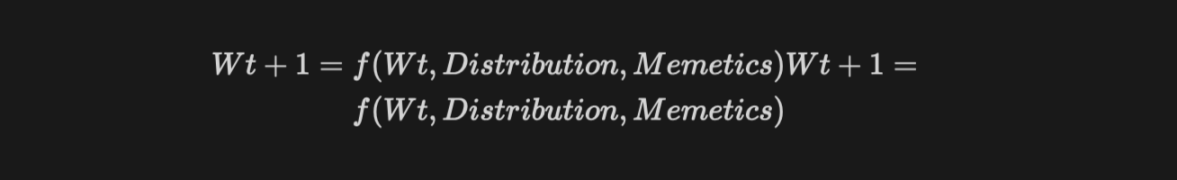

Since W itself grows with distribution and cultural propagation, we obtain a recursive flywheel:

Price is a function of distribution, and in this case, gambling is the engine that creates distribution.

As bets accumulate, liquidity deepens, tokens circulate, and cultural energy amplifies the cycle.

The Normative Shift and the G Multiplier

If the above holds true, the future of gambling has nothing to do with casinos. It's about entertainment becoming a market force. People's love for entertainment transcends everything, and large-scale entertainment activities can drive market change.

The Apple Store exemplifies this: the largest portion of mobile revenue comes from speculative activities disguised as games.

Gameified trading experiences and hyper-gamblification extend this logic into finance. Just as embedded finance transformed consumer fintech, embedded speculation will transform retail trading. Gambling is no longer a marginal vice, but the most powerful distribution channel in the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News