TRON integrates USD1 to build a diversified stablecoin ecosystem, with the DeFi ecosystem providing cross-chain support for USD1's implementation and advancement

TechFlow Selected TechFlow Selected

TRON integrates USD1 to build a diversified stablecoin ecosystem, with the DeFi ecosystem providing cross-chain support for USD1's implementation and advancement

TRON is building a diversified stablecoin ecosystem comprising the mainstream stablecoin USDT, the decentralized stablecoin USDD, and the compliant stablecoin USD1.

Since May 2, when TRON founder Justin Sun announced at the TOKEN2049 Dubai Conference that TRON had formed a strategic partnership with World Liberty Financial (WLFI), a project backed by the Trump family, to support the decentralized stablecoin USD1, the integration of USD1 into the TRON ecosystem has accelerated rapidly.

TRON has carried out a series of swift and efficient deployments: On June 11, Justin Sun announced the official launch of USD1 minting on the TRON network; on July 7, Sun.io, an all-in-one decentralized exchange within the ecosystem, listed multiple USD1 trading pairs, enabling instant on-chain swaps; on August 19, the lending protocol JustLend DAO announced full support for USD1 deposits and loans, further expanding avenues for asset appreciation.

In just three months, TRON completed the full integration of USD1 from technical onboarding to deep ecosystem embedding, achieving end-to-end support for minting, circulation, free trading, and yield generation on the TRON blockchain. This rapid advancement not only reflects TRON’s high regard for the USD1 project but also leverages its mature and comprehensive DeFi infrastructure, which enables any stablecoin project to quickly go from zero to one.

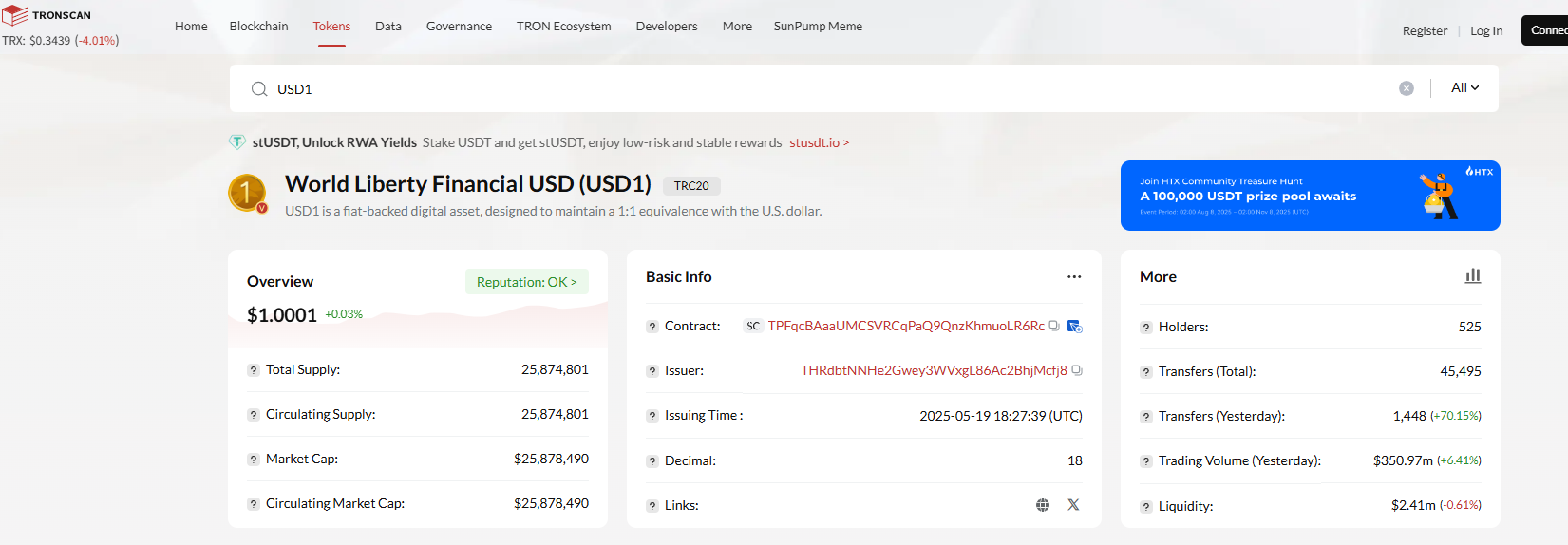

As of August 26, data from the TRONSCAN browser shows that the circulating supply of USD1 on the TRON blockchain has exceeded 25 million, with a 24-hour trading volume surpassing $350 million and over 520 token-holding addresses. These figures not only highlight USD1’s strong expansion momentum and active liquidity within the TRON ecosystem but also mark its formal inclusion as a core component of TRON’s stablecoin asset matrix.

This collaboration not only validates TRON’s strategic foresight in the stablecoin domain but also injects new DeFi momentum into the ecosystem through USD1’s rapid deployment, laying a solid foundation for building a diversified stablecoin matrix. As a significant new DeFi asset within the ecosystem, USD1 will bring fresh development opportunities to TRON.

TRON Embraces USD1: Building a Diversified Stablecoin Ecosystem and Strengthening Global Leadership

With the entry of the compliant stablecoin USD1, combined with existing strengths in USDT and USDD, TRON has formally established a diversified stablecoin ecosystem structure comprising “mainstream stablecoin USDT + native decentralized stablecoin USDD + compliant stablecoin USD1.” This matrix enriches the depth of TRON’s stablecoin ecosystem and, through functional complementarity and scenario synergy among different tokens, continuously strengthens its core influence and infrastructural value in the global stablecoin arena.

USD1, a compliant dollar-pegged stablecoin issued by WLFI linked to the Trump family, has rapidly gained market recognition since its launch in March this year, thanks to its “high transparency and strong compliance.” Fully backed 1:1 by cash equivalents such as short-term U.S. Treasury bonds and dollar deposits, its assets are custodied by professional institutions like BitGo, with regular monthly disclosures of minting, redemption, and reserve details—making it widely recognized in the industry as a representative compliant stablecoin project.

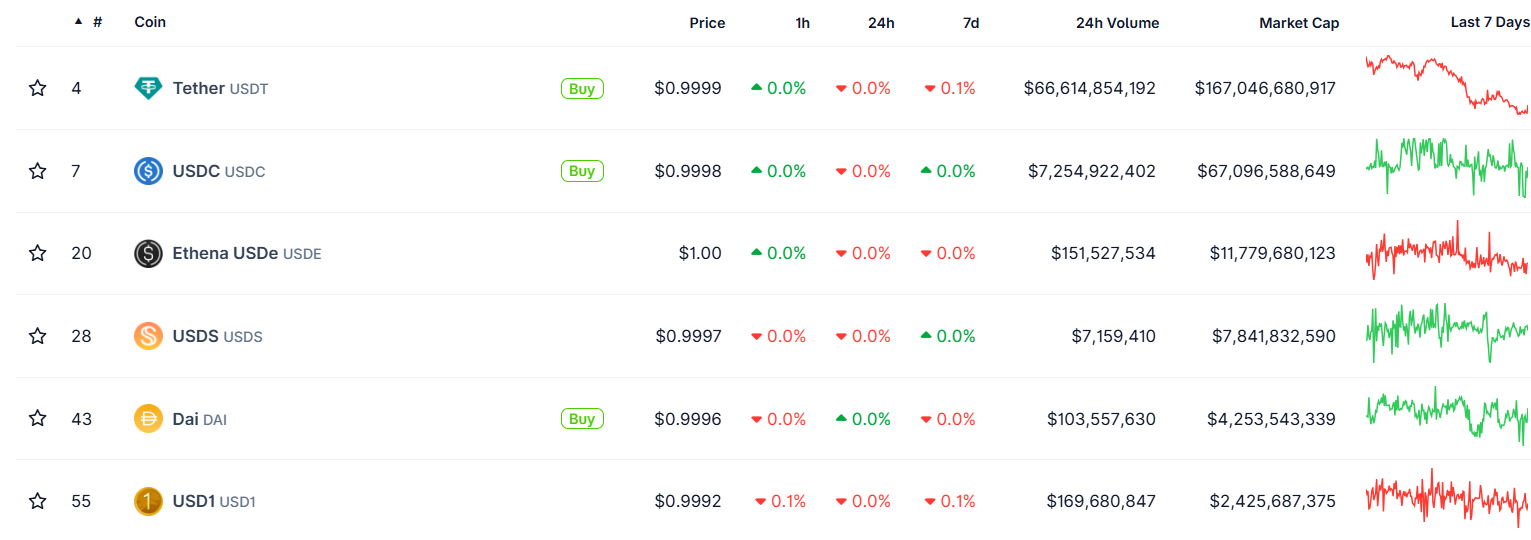

Leveraging the brand influence associated with the Trump family and its compliance advantages, USD1 expanded rapidly after launch. As of August 26, USD1’s circulating supply is close to $2.5 billion, making it the sixth-largest stablecoin globally.

Prior to partnering with TRON, USD1 was primarily deployed on Ethereum and BNB Chain. TRON serves as its third major blockchain platform for multi-chain expansion, making this collaboration a key strategic move for USD1 to accelerate its reach to global users.

The collaboration between USD1 and TRON began at the TOKEN2049 Dubai Conference in May: TRON founder Justin Sun, Eric Trump (second son of Donald Trump), and WLFI co-founder Zach Witkoff jointly announced their partnership to issue the native stablecoin USD1 on the TRON network.

On this partnership, Eric Trump stated clearly: “TRON’s robust technical capabilities and extensive user base provide the perfect platform for promoting USD1.”

Justin Sun further elaborated on the value of the collaboration: “Integrating USD1 will inject new vitality into the TRON ecosystem. Our goal is to enable every user to easily use stablecoins via their smartphones and participate in the global financial system. The cooperation between TRON and WLFI marks a significant step toward merging DeFi with traditional finance. We hope USD1 will allow global users to seamlessly use stablecoins in daily life, such as for hotel or retail payments.”

Thus, this partnership not only provides USD1 with technological infrastructure and a user base but also introduces a compliant asset to TRON’s stablecoin ecosystem for the first time, achieving full-spectrum coverage across “mainstream, decentralized, and compliant” use cases.

Since the announcement of the partnership, TRON has swiftly advanced the ecosystem integration of USD1, achieving several key milestones: On June 11, USD1 officially launched minting on the TRON network with an initial mint of 1,000 tokens, marking its formal integration into the TRON ecosystem; on July 7, Sun.io, TRON’s all-in-one DEX, launched multiple USD1 trading pairs, providing users with convenient trading access; on August 19, the lending protocol JustLend DAO fully supported USD1 deposits and loans, further expanding its yield-generating applications.

In just three months, TRON completed the entire process of integrating USD1 from technical connection to DeFi infrastructure deployment.

As of August 26, the issuance of USD1 on the TRON blockchain has surpassed 25 million, with a 24-hour trading volume exceeding $350 million, over 520 holding addresses, and a total of 41,000 on-chain transactions—indicating that its growth trajectory has only just begun.

Although USD1’s deployment on TRON came later than on Ethereum and BNB Chain, TRON demonstrates significant late-mover potential due to its user base of over 300 million, mature stablecoin ecosystem, and leading global infrastructure, positioning it well for rapid catch-up or even overtaking.

As the world’s most widely used stablecoin, USDT has long maintained the largest circulation on the TRON network, making TRON the most popular stablecoin settlement network.

According to CoinDesk’s “TRON Network Research Report” released on August 2, TRON became the most commonly used stablecoin transfer network in 35 out of 50 surveyed countries, including regions in Asia, Africa, and Latin America. Additionally, in June alone, TRON processed 65 million USDT transactions with a transaction value exceeding $600 billion.

Artemis’ “Stablecoin Payment Report” released in June also noted, based on data from 31 stablecoin payment companies, that USDT accounts for approximately 90% of stablecoin transaction volume, with TRON ranked as the most popular blockchain for stablecoin transfers.

Currently, the total market capitalization of stablecoins on the TRON network exceeds $83.4 billion, accounting for 30% of the global stablecoin market (approximately $279.8 billion). Among them, TRC20-USDT issuance has reached $82.4 billion, with about 23 billion additional tokens issued cumulatively since 2025—an increase of 40%. Currently, over 67 million accounts hold USDT on the TRON chain, with more than 1 million daily active transfer accounts, fully demonstrating its leading position as core stablecoin infrastructure.

Besides USDT, TRON’s native decentralized over-collateralized stablecoin USDD provides an important decentralized stability solution, forming a “centralized + decentralized” dual-track synergy with USDT. Since its upgrade in January, USDD has maintained steady growth, with current issuance nearing $500 million and collateral value in the protocol exceeding $521 million.

Through the integration of USD1, TRON has established a diversified stablecoin ecosystem of “mainstream stablecoin USDT + decentralized stablecoin USDD + compliant stablecoin USD1,” clearly segmented to meet diverse user needs and scenarios:

l TRC20-USDT serves as the core tool for payments and settlements, handling high-frequency global transfers and cross-border payments;

l USDD offers a decentralized algorithmic stability solution through over-collateralization and algorithmic pegging, meeting user demand for decentralized finance (DeFi);

l USD1 targets high-transparency, compliance-driven use cases.

The addition of USD1 not only injects new momentum into TRON’s stablecoin system but also further solidifies its status as a core global stablecoin infrastructure.

Full-Chain DeFi Ecosystem Drives USD1 Advancement – TRON’s Mature Infrastructure Becomes a “Super Stage” for Stablecoin Growth

USD1’s integration into the TRON ecosystem continues to accelerate—from listing trading pairs on the DEX Sun.io, to WINkLink oracle supporting price feeds, to lending platforms like JustLend DAO enabling deposit and borrowing functions. These developments not only reflect TRON’s high commitment to USD1 but also benefit from its already mature DeFi infrastructure, enabling USD1 to quickly achieve full coverage across liquidity, trading, and yield generation, facilitating seamless integration and value realization.

TRON has now built a multi-scenario DeFi application matrix that provides a solid foundation for the rapid deployment and expansion of stablecoin assets. From DEX platforms like SunSwap catering to trading needs and SunCurve focused on stablecoin swaps, to SunPump lowering barriers for Meme coin issuance; from the WINkLink oracle ensuring on-chain data security and JustLend providing financing services, to the BitTorrent protocol enabling cross-chain circulation, and further to APENFT NFT marketplace connecting digital art and RWA products like stUSDT anchoring real-world assets—this comprehensive infrastructure not only rapidly expands the application boundaries of stablecoins but also offers new entrants like USD1 one-stop support “from technical onboarding to scenario penetration,” helping them efficiently complete the launch cycle from zero to one.

As the “gateway” for USD1’s integration into the TRON ecosystem, on July 7, the all-in-one DEX platform Sun.io led the way by listing USD1 and simultaneously launching three core trading pairs: USD1/USDT, USD1/TRX, and NFT/USD1, directly opening convenient trading channels for users. According to Sunscan browser data, the initial USD1 pool size reached $3 million, with a near 24-hour trading volume exceeding $1.44 million, laying a solid foundation for subsequent liquidity accumulation and user adoption.

After establishing trading access, on-chain data support became crucial for USD1’s expansion into DeFi use cases. On July 21, WINkLink, the leading oracle project in the TRON ecosystem, announced the addition of USD1/TRX price feeds, providing secure, reliable, and real-time pricing data for on-chain applications. This move not only strengthened USD1’s foundational data infrastructure but also paved the way for its integration into complex DeFi scenarios such as lending, synthetic assets, and derivatives, removing technical barriers.

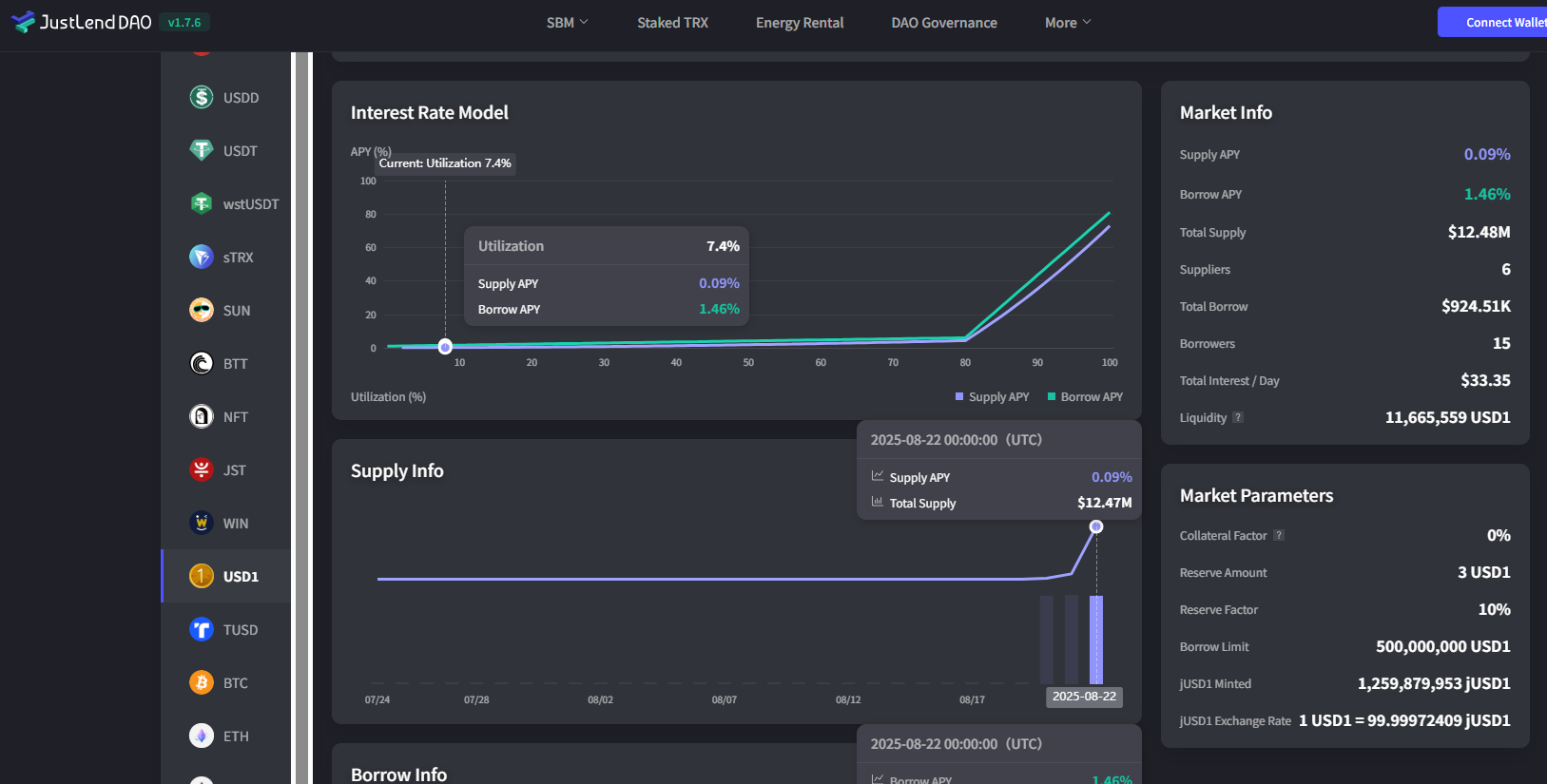

On August 19, the lending protocol JustLend DAO officially integrated USD1, fully supporting deposit, borrowing, and yield farming functions for the stablecoin. Users can now earn stable returns by depositing (supplying) USD1 on JustLend DAO or unlock idle funds by borrowing USD1 against collateral such as TRX or USDT. Within three days of launch, the value locked in the USD1 pool on JustLend DAO reached $1,248. This not only reinforces JustLend DAO’s role as a core lending hub in the TRON ecosystem but also incorporates USD1 into a closed-loop ecosystem of “trading to value growth,” injecting new liquidity and growth momentum into the broader TRON DeFi ecosystem and driving its evolution toward greater maturity and diversity.

Notably, TRON-based USD1 has also gained support from major centralized exchanges (CEX) such as HTX and Gate. Users can now directly deposit and withdraw USD1 on the TRON network via CEX platforms, further expanding access and trading channels and establishing a “DEX + CEX” dual-track circulation model.

The current deployment of USD1 in trading and lending is merely the starting point of its integration into the TRON ecosystem. Leveraging TRON’s mature application matrix, USD1 is accelerating its extension into more use cases, unlocking diversified value: for example, SunPump may soon allow users to issue Meme coins using USD1; APENFT may open channels for purchasing NFTs with USD1; the native stablecoin USDD could enable 1:1 exchange with USD1, bridging the value flow between “decentralized” and “compliant” stablecoins; or via the BitTorrent cross-chain protocol, USD1 could expand into the BitTorrent ecosystem for trading, further broadening its application scope.

This multi-scenario, deep-level ecosystem penetration exemplifies TRON’s “full-chain transformation” capability for stablecoins. By deeply integrating USD1 with DeFi, NFT, Meme, and cross-chain scenarios within the ecosystem, TRON not only increases the actual usage frequency of USD1 but also accelerates its adoption across broader user groups, extending stablecoin services beyond pure financial transactions into richer domains such as digital consumption and content creation.

For TRON, introducing USD1 is not only a critical enhancement to its stablecoin matrix but also a significant step toward entering global compliant finance. With its compliance attributes, USD1 injects new momentum into the TRON ecosystem and equips TRON with better-suited tools for interfacing with traditional finance and regional payment systems. In the long term, the deep integration of USD1 will not only diversify stablecoin options on TRON but also create synergies with USDT and USDD, collectively offering more efficient, transparent, and diverse financial services to 8 billion people worldwide, expanding the reach of inclusive finance.

From the globally leading USDT ecosystem, to the native decentralized USDD, and now the compliant newcomer USD1, TRON has built a multi-dimensional stablecoin ecosystem encompassing “mainstream + decentralized + compliant” solutions, fully addressing diverse needs across mass payments, DeFi innovation, and compliance scenarios. This diversified architecture will not only continue to strengthen TRON’s leadership in the stablecoin space but also establish TRON as a “super infrastructure” for stablecoins to achieve user growth and real-world application, delivering a more flexible and resilient stablecoin service system to users worldwide.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News