Bitcoin falls below $110,000 as Trump takes action against the Federal Reserve

TechFlow Selected TechFlow Selected

Bitcoin falls below $110,000 as Trump takes action against the Federal Reserve

All Bitcoin holding groups have clearly entered the selling and profit-taking phase.

By: 1912212.eth, Foresight News

On August 26, the market ultimately failed to hold the $110,000 level. After Federal Reserve Chair Powell adopted a dovish stance, BTC surged to $117,000, but quickly entered a four-day consecutive decline on the daily chart, dipping as low as $108,666.66 earlier today. Ethereum, after hitting a new all-time high, swiftly dropped to $4,334, posting over a 6% decline in 24 hours. Altcoins also broadly corrected sharply due to the broader market downturn.

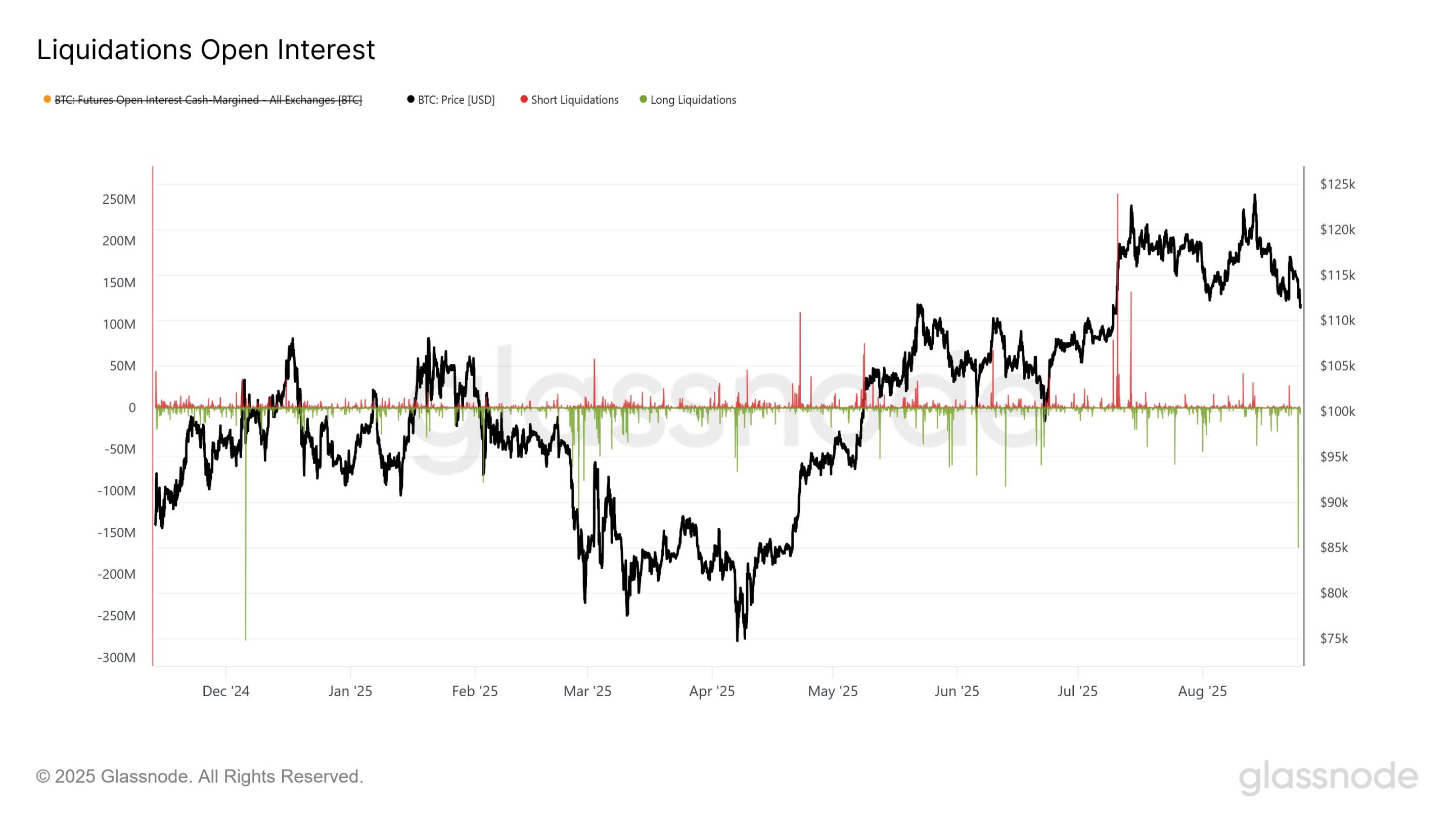

Data from Coinglass shows that total liquidations across the network reached $935 million in the past 24 hours, with $821 million coming from long positions—once again dealing heavy losses to bulls. On August 24, Glassnode data revealed that more than $150 million in bullish positions were rapidly liquidated within a short period, marking one of the largest BTC long liquidation events since December 2024.

Trader Eugene Ng Ah Sio stated on August 24: "We are now at the endgame of the bull cycle that began in January 2023—I expect this phase won’t last more than a few months. Every marginal buyer around the globe has already turned and bought crypto to some extent, with both Bitcoin and Ethereum reaching new highs. My predetermined ETH/BTC exchange rate target of 0.04 has now been achieved, which means for me, ETH trading is effectively over. The strategy now shifts from capital accumulation to capital preservation."

Debate over whether the bull or bear market is underway has intensified—has the bull run truly ended? This question weighs heavily on countless retail investors.

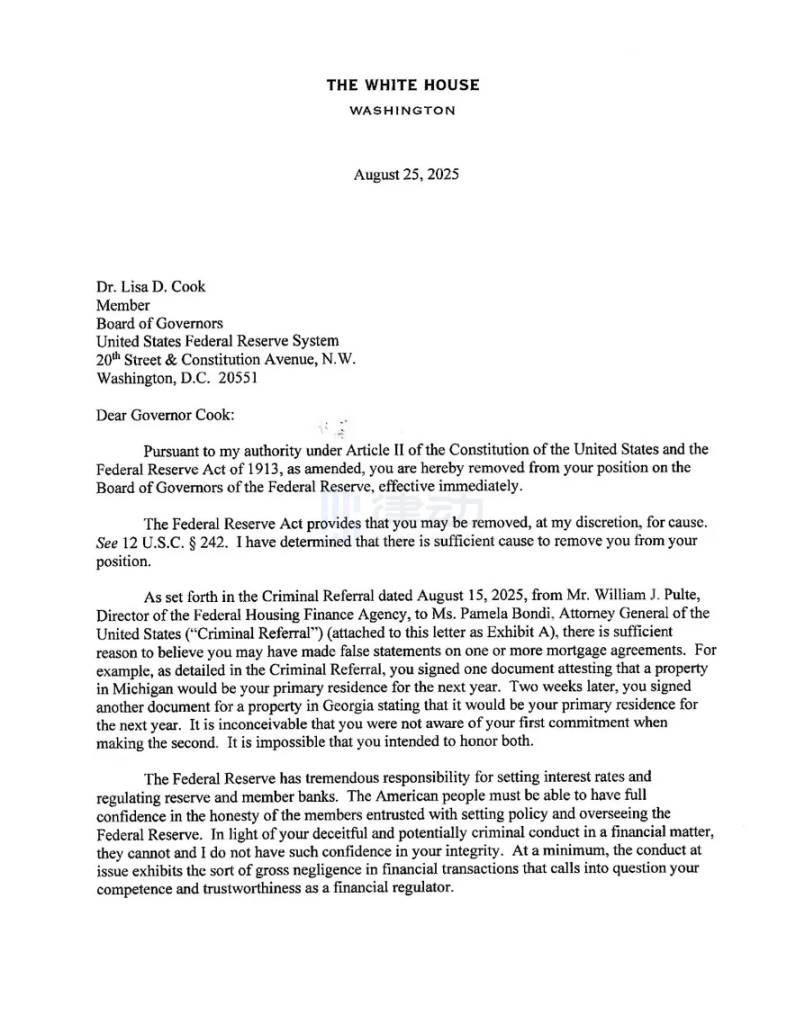

Trump Removes Fed Governor Cook

On August 26, U.S. President Trump signed a document removing Federal Reserve Governor Cook from office, effective immediately. This sudden move disrupted market participants’ judgment and expectations.

In the document, Trump stated: "Pursuant to the authority vested in me by Article II of the United States Constitution and the amended Federal Reserve Act of 1913, I hereby immediately remove you from your position on the Board of Governors of the Federal Reserve System. Given your dishonest conduct in financial matters, and possible criminal involvement, I cannot have confidence in your integrity. At a minimum, these actions reveal serious negligence in financial transactions, raising questions about your competence and credibility as a financial regulator."

Nick Timiraos, known as the "Fed whisperer," cited his previous tweet, stating Trump’s removal of Cook was transparently clear—it was an outright act of extortion, an attempt to pressure policymakers into cutting interest rates.

The Federal Reserve declined to comment on Trump’s dismissal of Governor Cook. However, Governor Cook stated that U.S. President Trump has no authority to fire him and that he will continue performing his duties.

Financial markets hate uncertainty. Trump’s move against the Fed undoubtedly casts a shadow over future market sentiment.

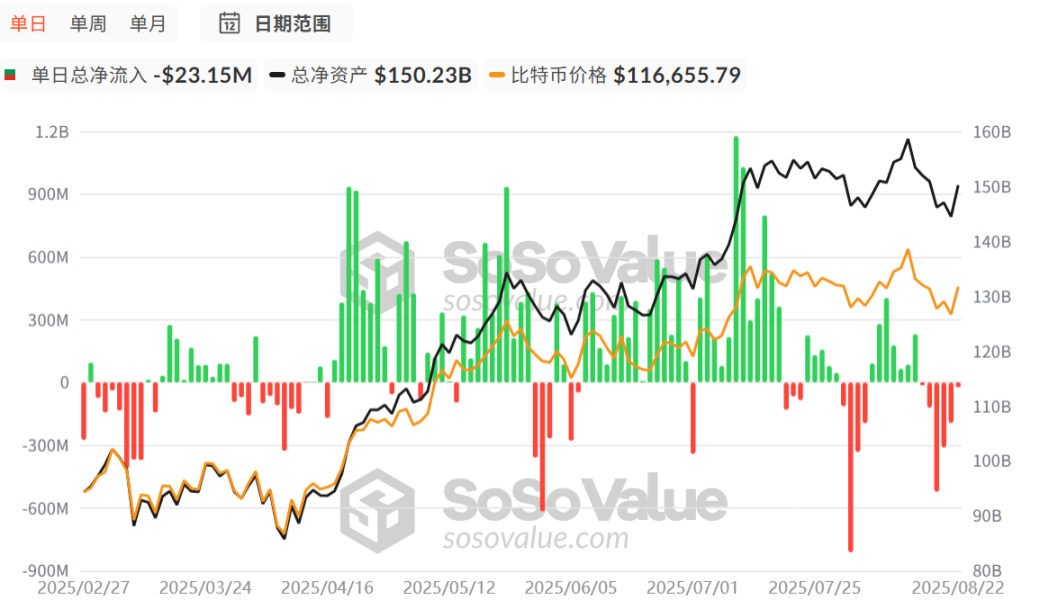

Bitcoin Spot ETFs Record Six Consecutive Days of Net Outflows

A key market indicator, bitcoin spot ETF data, showed net outflows for six consecutive days from August 15 to August 22. According to sosovalue, net outflows hit $523.31 million on August 19 alone, followed by $311.57 million on August 20.

In addition, single-day net outflows reached $812.25 million on August 1 and $333.19 million on August 4. The outlook for ETF spot inflows remains bleak.

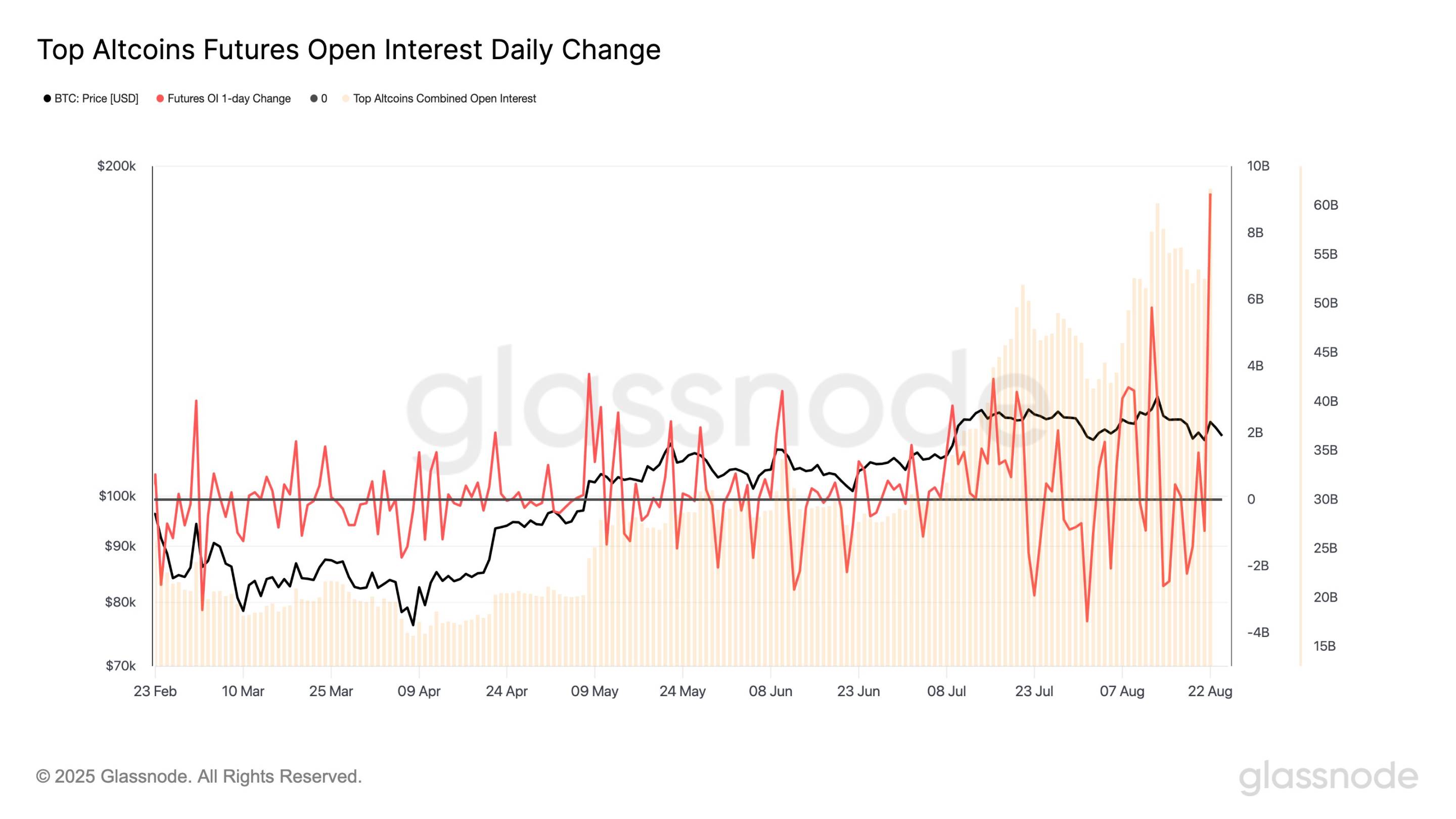

Futures Speculative Positions Surge, Whales Take Profits

After Fed Chair Powell turned dovish last Friday, open interest in altcoin futures surged by $9.2 billion in a single day, pushing total open interest to a record high of $61.7 billion.

This rapid influx of funds highlights how altcoins are increasingly becoming key drivers behind rising leverage, increased volatility, and growing fragility in the digital asset market.

When market participants uniformly anticipate further upside and sentiment runs high, price movements often move contrary to expectations, triggering deleveraging.

Another critical chart shows that whales—market-savvy and sensitive players—are beginning to take profits.

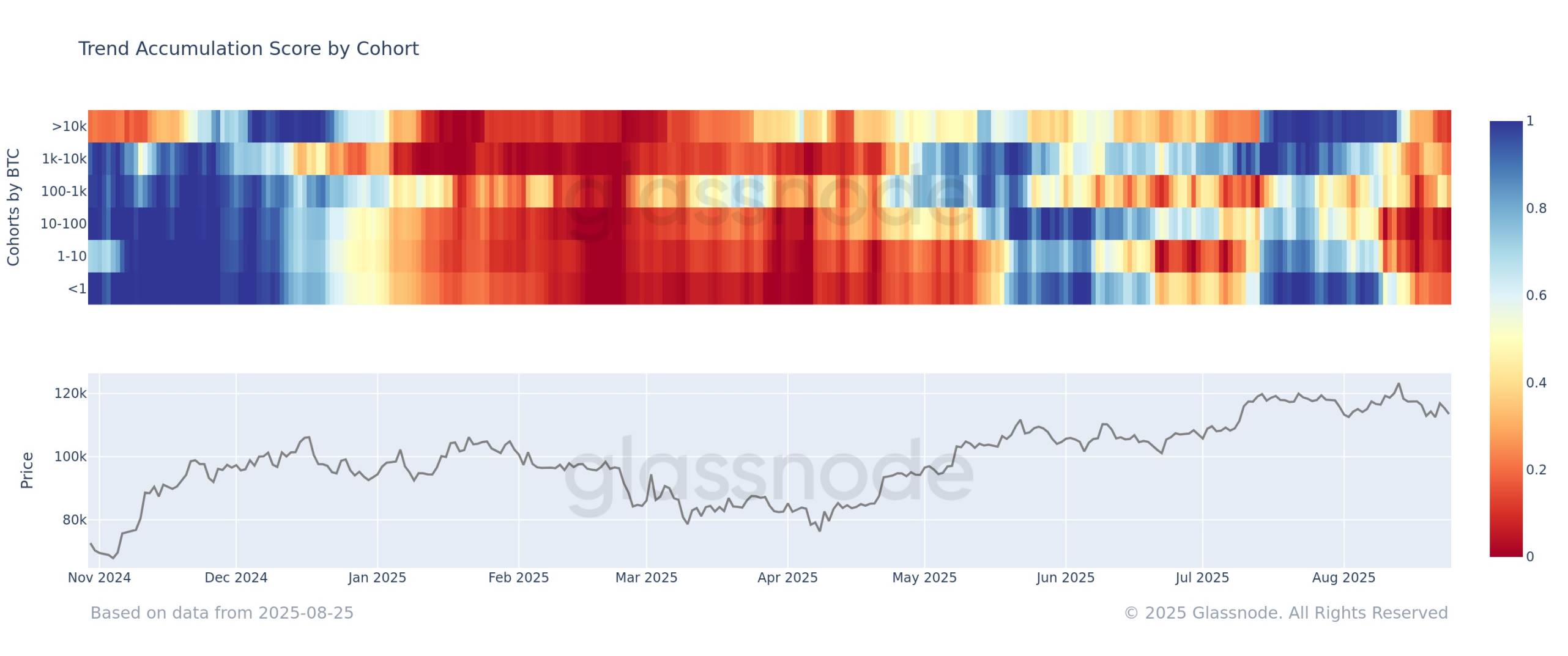

Glassnode data indicates that all Bitcoin holder cohorts have clearly entered a profit-taking and selling phase, led by those holding between 10 and 100 BTC. The consistency in behavior across groups underscores widespread selling pressure emerging in the market.

Market Perspectives

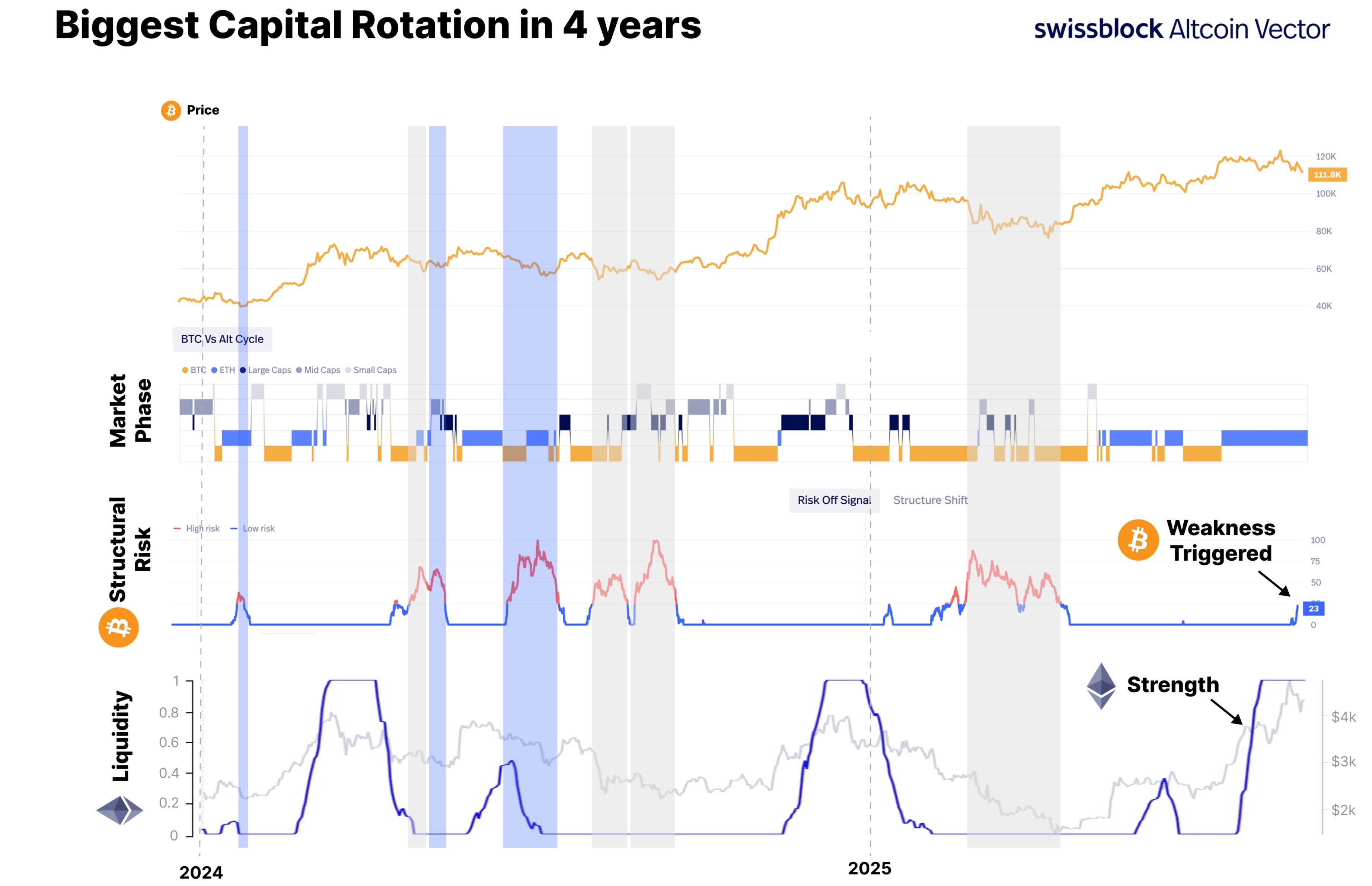

Altcoin Vector analysis notes unusual dynamics between BTC and ETH:

In this three-year cycle, a rare situation has emerged for the first time: Ethereum is showing independent strength.

🔹 Ethereum performance → Strong → Positive (attracting capital inflows)

🔹 Bitcoin performance → Neutral (trading within a range)

🔻 Under risk-off sentiment: Large Bitcoin wallets are taking profits and reallocating into Ethereum

For Ethereum to lead the market, Bitcoin must hold key support levels—the rotation of capital is driving Ethereum toward a cyclical leadership role.

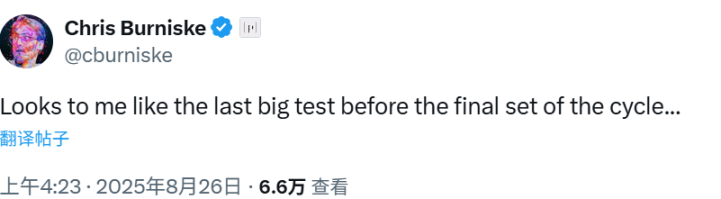

A partner at Placeholder tweeted: "To me, this looks like the final major test before the endgame of this cycle."

Glassnode tweeted that $110,800 is the average cost basis for investors who entered during the May-to-July rally to new highs and held for 1 to 3 months. Historically, if Bitcoin fails to defend this level, the market often enters a prolonged period of weakness, potentially leading to deeper corrections.

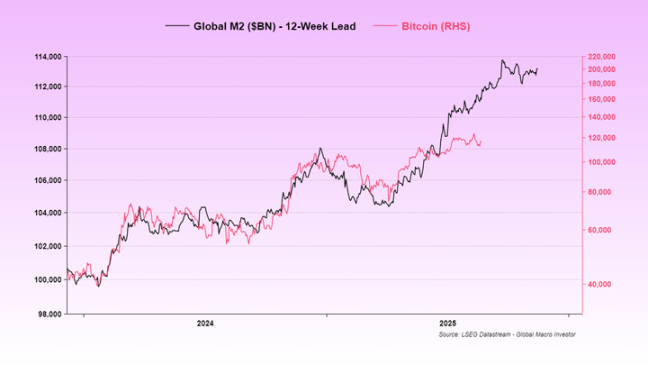

Raoul Pal, founder of Real Vision, hinted in a tweet reply that BTC still has room to rise: "We've consistently emphasized it won't be a perfect mirror image, but the overall context needs to be accurate... There have been significant reverse spreads in the past, all eventually resolved by BTC prices catching up to M2 money supply growth."

JackYi, founder of Liquid Capital, posted that the pullbacks from $4,800 to $4,100 and $4,300 presented optimal buying opportunities, and the bull market trend remains unchanged.

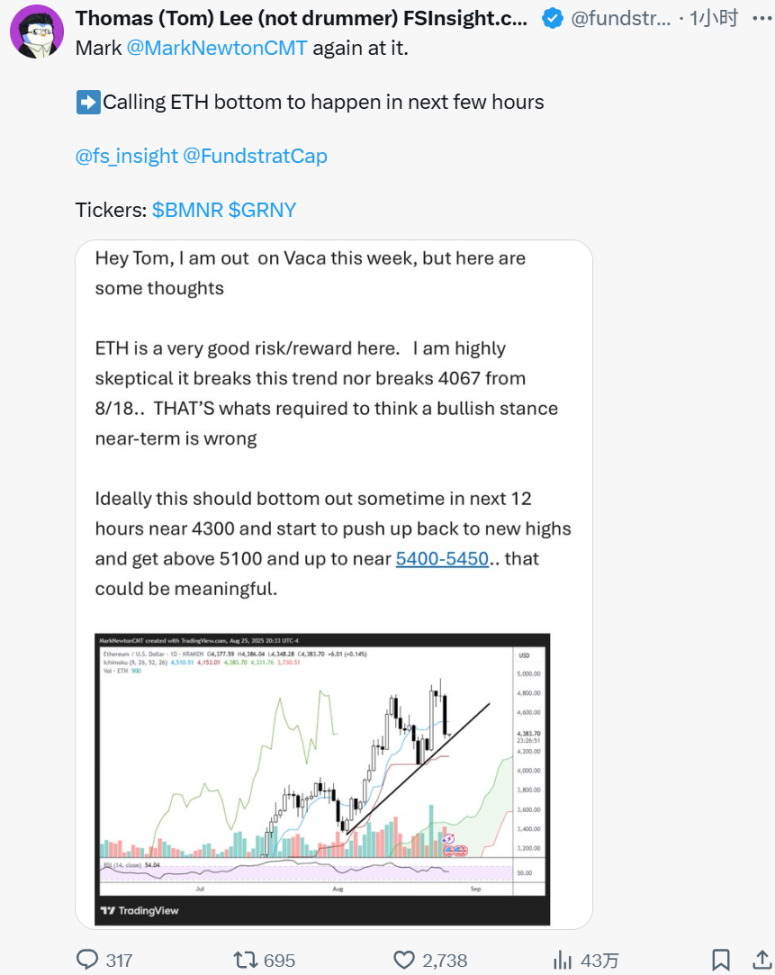

Tom Lee, Chairman of BitMine, shared market analysis from Mark Newton, analyst at his fund, forecasting that ETH will bottom out within the next few hours. Newton analyzed: "Ideally, ETH should bottom around $4,300 at some point within the next 12 hours, then resume its climb to new highs, breaking above $5,100 and reaching near $5,400–$5,450."

Data analytics firm Santiment tweeted that since early April, when tariff concerns peaked, Bitcoin ETFs have experienced their longest continuous outflow period (six trading days). Growing evidence suggests these inflows and outflows are increasingly driven by retail investors rather than institutions as in earlier phases. When retail traders believe the market has topped, many may make emotional decisions to withdraw funds from ETFs. This could temporarily drive prices lower but often signals that the market is nearing a bottom (as we saw in April).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News