Behind OKB's 500% surge: a sentiment rally or value revaluation?

TechFlow Selected TechFlow Selected

Behind OKB's 500% surge: a sentiment rally or value revaluation?

The OKB token burn and OKX's potential U.S. IPO next year continue to generate buzz.

By: 1912212.eth, Foresight News

On August 22, OKX continued to hit new all-time highs, briefly reaching $258.6, with a 24-hour surge of over 30%, achieving three consecutive daily gains. In just 10 days from its low of $50, the price rose more than fivefold, and at one point, its 24-hour spot trading volume surpassed that of BTC and ETH. As of now, OKB has a market cap of $5.094 billion, ranking 27th.

Notably, after yesterday's sharp price increase, OKB on the Ethereum chain showed a 42% positive premium compared to the price on the OKX platform.

Burning 52% of Circulating Supply, Capped at 21 Million Tokens

The announcement on August 13 completely changed OKB's trajectory. OKX announced the largest token burn in its history: destroying 65.2567 million OKB tokens, equivalent to 52% of the circulating supply, and permanently capping the total supply at 21 million. This move pushed OKB's scarcity to the extreme, mirroring Bitcoin’s 21 million supply cap design.

Holders of Ethereum-based OKB must deposit their assets into OKX and complete the chain migration via "Withdraw to X Layer." Meanwhile, OKTChain will be phased out, with trading halted on OKX starting August 13, 2025, at 14:10 (UTC+8). OKT will be periodically exchanged for an equivalent value in OKB based on the average closing price between July 13 and August 12, 2025, with on-chain OKT conversion supported until January 1, 2026.

After the burn, OKB surged 183% within 24 hours, jumping from around $50 to over $140. On August 21, OKB broke past the $200 mark, hitting an all-time high of $239.91; the following day (August 22), it continued rising, nearing a $4 billion market cap. This series of record highs not only marked milestones for OKB but also triggered short-term rebounds in other exchange tokens like BNB.

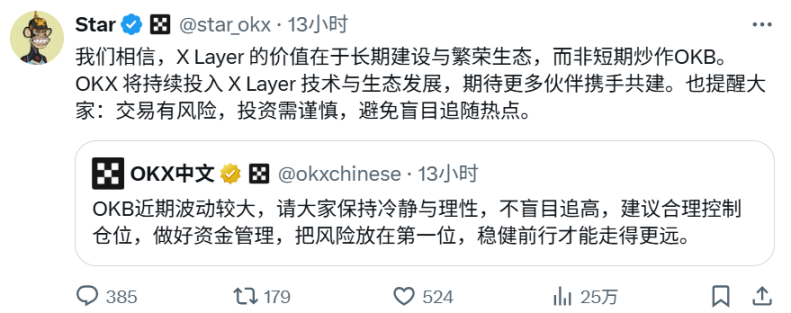

Faced with the frenzied price rise, OKX CEO Star personally posted a reminder urging caution: trading carries risks, and investors should avoid blindly chasing trends.

Cryptocurrency exchange OKX was founded by Star Xu. Today, OKX’s ecosystem includes a Web3 wallet, the Layer 2 network X Layer, and a suite of DeFi and GameFi applications, all providing solid value support for its native token OKB.

OKB was initially launched in 2018 as OKX’s platform token with an initial total supply of 300 million. It serves not only as a fee discount tool on the exchange but also enables ecosystem governance, staking rewards, and cross-chain bridging. After OKX partnered with Polygon in 2023 to launch its L2 network, OKB became the native currency on that chain.

According to historical data, due to early market volatility and regulatory uncertainty, OKB hit a low of just $0.57 in 2019. With the arrival of the crypto bull market, OKB climbed to $44 in 2021, only to fall below $10 during the 2022 bear market. In 2025, OKB fluctuated around $50 until the burn announcement sparked its upward journey.

Preparing for U.S. IPO

In June this year, reports emerged that OKX plans to conduct an IPO in the United States next year.

From a financial perspective, an IPO would provide OKX with substantial capital for technological upgrades, marketing, and global expansion. A successful listing would allow OKX to optimize its balance sheet through equity financing and boost its parent company's valuation—critical for attracting institutional investors. Additionally, going public could lend legitimacy to its platform token OKB, potentially driving further price appreciation.

However, viewing the IPO merely as a financial move may underestimate its strategic intent. OKX’s return to the U.S. market and consideration of an IPO reflect a long-term plan to enter the American market. The U.S. is the world’s largest cryptocurrency market, with a vast user base and deep institutional capital. By listing, OKX can enhance brand visibility and directly compete with players like Coinbase and Kraken.

The latter two are intensifying their L2 strategies. Coinbase’s L2 has become one of the most active layer-2 networks, while Kraken is rapidly launching its Superchain ink.

The underlying reason lies in the shift from centralization to decentralization.

First is diversified revenue and profit models. Traditional CEXs rely on trading fees, but L2s open new revenue streams. As the sole sequencer of Base, Coinbase captures transaction fees, significantly boosting income. L2s help exchanges transition from custody fees and stablecoin interest to on-chain fees and NFT minting (such as Coinbase’s Onchain Summer event, which generated $500 million in assets), helping withstand bear market fluctuations. Coinbase’s latest earnings report shows that due to a sharp drop in DA costs and a surge in users, Base achieved double the gross profit in March alone compared to Arbitrum’s entire quarterly gross profit, excluding $6.34 million in DA costs.

Second is strengthening ecosystem development, guiding users from centralized platforms toward self-custody and DeFi, expanding market reach, and attracting developers to build dApps, creating a closed-loop ecosystem. By leveraging L2s to lower barriers (e.g., zero gas fee experiences), they accelerate crypto adoption and offer compliant pathways under U.S. regulation to avoid SEC scrutiny.

In August this year, OKX conducted a major upgrade to its Layer 2 network X Layer by integrating Polygon’s Chain Development Kit (CDK), boosting transaction speeds to 5,000 TPS and achieving near-zero gas fees. This upgrade established X Layer as an efficient Web3 infrastructure, attracting more DeFi projects and developers. As the network’s utility token, OKB directly benefits from this ecosystem expansion.

As of now, according to official X Layer data, the network has over 2.18 million addresses, adding 47,000 in the last 24 hours. Over 786,000 addresses hold OKB, with 3,387 new holders added in 24 hours. Its ecosystem includes launchpad DYORSWAP, and its on-chain meme coin XDOG once reached a market cap exceeding $10 million.

Overall, OKB’s surge reflects investor optimism about X Layer’s future and OKX’s potential U.S. listing. In this fast-evolving market, OKB’s story may just be the prelude to a much larger wave.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News