Stablecoin newcomer: the rise and controversy of USD1

TechFlow Selected TechFlow Selected

Stablecoin newcomer: the rise and controversy of USD1

As the circulation of USD1 surged, an increasing number of people, including even politicians, began questioning whether the Trump family was leveraging their political positions for personal business gains.

Author: FinTax

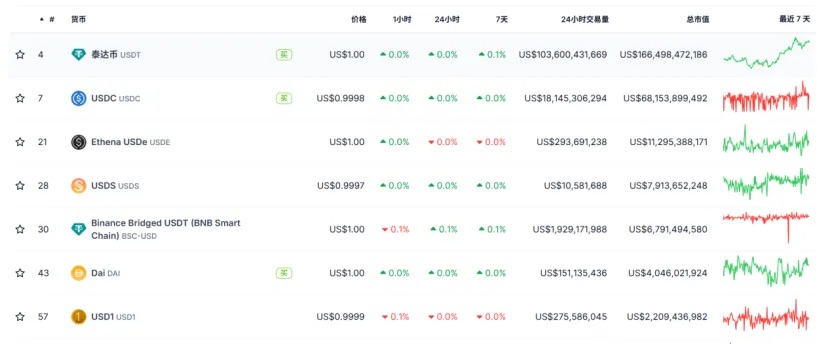

1. Sudden Rise: Rapid Expansion of USD1

At the beginning of this year, WLF first announced plans to launch USD1, an institutional-focused stablecoin. USD1 is pegged 1:1 to the US dollar, with reserves composed of cash, U.S. Treasury securities, and equivalents. BitGo serves as custodian, and accounting firm Crowe LLP issues monthly attestation reports on the reserves—widely regarded in the industry as highly transparent and credible. In early March, USD1 officially launched with an initial supply of $3.5 million. To date, its market capitalization has exceeded $2.7 billion, ranking it seventh among stablecoins.

(Figure 1: Stablecoin Market Cap Ranking. Source: CoinGecko)

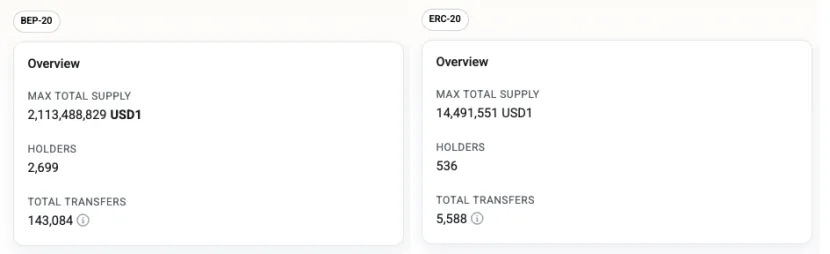

USD1 has drawn significant attention since its inception, and in recent months has rapidly risen due to its strong backing. USD1 is almost entirely issued on the BNB Chain. According to BscScan data, the supply of USD1 on BNB Chain amounts to $2.1 billion, accounting for over 99% of its total circulation. In contrast, according to Etherscan data, the Ethereum version totals only $14.5 million. Subsequently, major public chains with high trading volumes, such as Tron, have listed USD1 to meet on-chain capital demand. Within just a few months, USD1 was listed on major exchanges including Binance, Bitget, and Bybit, quickly entering multiple on-chain ecosystems.

(Figure 2: Comparison of USD1 on BNB Chain (BEP-20) and Ethereum (ERC-20). Source: BscScan, Etherscan)

The rapid expansion of USD1 has been driven by strong support from major exchanges. Binance was the first to list USD1 in April, followed by PancakeSwap which boosted visibility through promotional campaigns. Related memecoins quickly swept the market—for example, $B surged past $400M within ten days, triggering another mini-boom on the BNB Chain. Bitget and Bybit followed suit by listing USD1 in June and July respectively, launching airdrops and incentive programs that further expanded liquidity and user access.

2. Political Element: Off-Chain Controversy Surrounding USD1

While users pay attention to USD1's product design, they are also deeply interested in its political background. It is well known that USD1 originates from WIF, which is backed by the prominent Trump family. One of USD1’s defining characteristics is its deep association with the Trump family—a factor that may partly explain its exceptional market mobilization capability. For instance, Abu Dhabi investment fund MGX chose to invest in Binance using approximately $2 billion worth of USD1. Backed by the Trump family’s resources and international capital endorsement, USD1 entered a growth environment fundamentally different from most other stablecoins.

However, as USD1’s circulation surges, growing numbers of citizens—and even politicians—have begun questioning whether the Trump family is leveraging political influence for commercial gain. For example, several members of the U.S. Senate Banking Committee have sent an open letter to regulators demanding a review of USD1’s compliance and potential conflicts of interest. They argue that if a sitting president’s family directly profits from a stablecoin business, the independence of regulatory institutions could be severely compromised.

In fact, these concerns are not unfounded. The widely discussed memecoin $TRUMP in January triggered similar scrutiny. At the time, the token was suspected of circumventing campaign finance regulations, potentially serving as a channel for the Trump family to receive opaque revenues or even political bribes. Although USD1 differs significantly from Trump coin in both positioning and nature, they share a core concern: whether the Trump presidential family is gaining undue political or economic advantages through the cryptocurrency market. Some media outlets have pointed out that the collaboration between USD1 and Binance might involve deeper quid pro quo arrangements, especially considering Binance has long faced scrutiny from U.S. regulators, yet has shown exceptional enthusiasm in promoting USD1. There is widespread concern that such dynamics could turn stablecoins into rent-seeking tools for politicians, increasing regulatory complexity and undermining social fairness.

Currently, the U.S. Congress is pushing for new stablecoin legislation and broader crypto asset regulations. Whether USD1 can obtain and maintain compliance will directly impact its long-term development. Particularly against the backdrop of partisan rivalry, some lawmakers may propose special restrictions targeting the Trump family’s involvement in crypto assets. As a frontrunner, USD1 faces notable political uncertainty and compliance risks.

Despite these controversies, USD1 continues to provide crypto investors with additional transaction mediums and creates a more convenient market environment, gaining increasing favor among investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News