Curve sequel conspiracy, Yield Basis: A new paradigm for stablecoin yields

TechFlow Selected TechFlow Selected

Curve sequel conspiracy, Yield Basis: A new paradigm for stablecoin yields

The path to expanding stablecoin trading beyond Ethena.

Author: Zuoye Waibo Mountain

After the Luna-UST collapse, algorithmic stablecoins were completely abandoned. CDP mechanisms (DAI, GHO, crvUSD) briefly became the last hope for the sector, but ultimately it was Ethena and its yield-backed paradigm that broke through the USDT/USDC dominance—avoiding the capital inefficiency of over-collateralization while leveraging native yield to open up the DeFi market.

In contrast, Curve’s ecosystem, having pioneered DEX markets via stablecoin trading, gradually expanded into lending with Llama Lend and stablecoins with crvUSD. However, under the shadow of Aave’s success, crvUSD issuance has long stagnated around $100 million, effectively relegated to a background player.

Yet as the flywheels of Ethena, Aave, and Pendle gain momentum, Curve’s new project Yield Basis now aims to claim a share of the stablecoin market—starting again with leveraged looping, but this time targeting AMM DEX’s core ailment: impermanent loss (IL).

Unilateralism Eliminates Impermanent Loss

Curve’s latest offering: your BTC is now mine; here’s your YB token—go stand guard.

Yield Basis represents a renaissance—an all-in-one DeFi masterpiece featuring liquidity mining, pre-mining, Curve Wars, staking, veTokens, LP tokens, and recursive leverage loans—truly the culmination of DeFi evolution.

Curve founder Michael Egorov was an early beneficiary of DEX development. Building upon Uniswap’s classic x*y=k AMM formula, he introduced the stableswap and cryptoswap algorithms—optimized respectively for “stablecoin trading” and more efficient generalized asset swaps.

Massive stablecoin trading established Curve as the dominant on-chain “lending/borrowing” marketplace for early stablecoins like USDC, USDT, and DAI. Curve became the most critical stablecoin infrastructure before Pendle’s rise—and UST’s collapse was directly triggered by liquidity shifts on Curve.

On tokenomics, the veToken model and subsequent “bribe” mechanism via Convex turned veCRV into a genuinely useful asset. Yet after four-year lockups, most $CRV holders’ silent suffering remains untold.

With the rise of Pendle and Ethena, Curve’s market position eroded. For USDe, hedging originates from CEX futures, yield capture flows through sUSDe, rendering stablecoin trading itself less relevant.

Curve’s first counterattack came via Resupply—a 2024 collaboration with legacy giants Convex and Yearn Fi. It predictably blew up, marking Curve’s first failed attempt.

Though not an official Curve project, Resupply’s failure hit close to home. If Curve doesn’t fight back, it risks missing its ticket to the future in this new stablecoin era.

But when experts step in, they do so differently. Yield Basis isn’t targeting stablecoins or lending—it’s attacking impermanent loss in AMM DEXs. But let’s be clear: Yield Basis was never truly about eliminating impermanent loss—it’s a vehicle to massively boost crvUSD issuance.

We begin with how impermanent loss occurs. LPs (liquidity providers) replace traditional market makers, supplying “bilateral liquidity” to AMM DEX pairs under fee-sharing incentives. For example, in a BTC/crvUSD pool, an LP deposits 1 BTC and 1 crvUSD (assuming 1 BTC = 1 USD), giving them a total value of 2 USD.

The BTC price p can be expressed as y/x—we define p=y/x. If BTC’s price changes, say rising 100% to 2 USD, arbitrage occurs:

A Pool: Arbitrageurs buy 1 BTC for 1 USD, forcing the LP to sell BTC and receive 2 USD

B Pool: In a pool where value reaches 2 USD, arbitrageurs net 2–1 = 1 USD profit

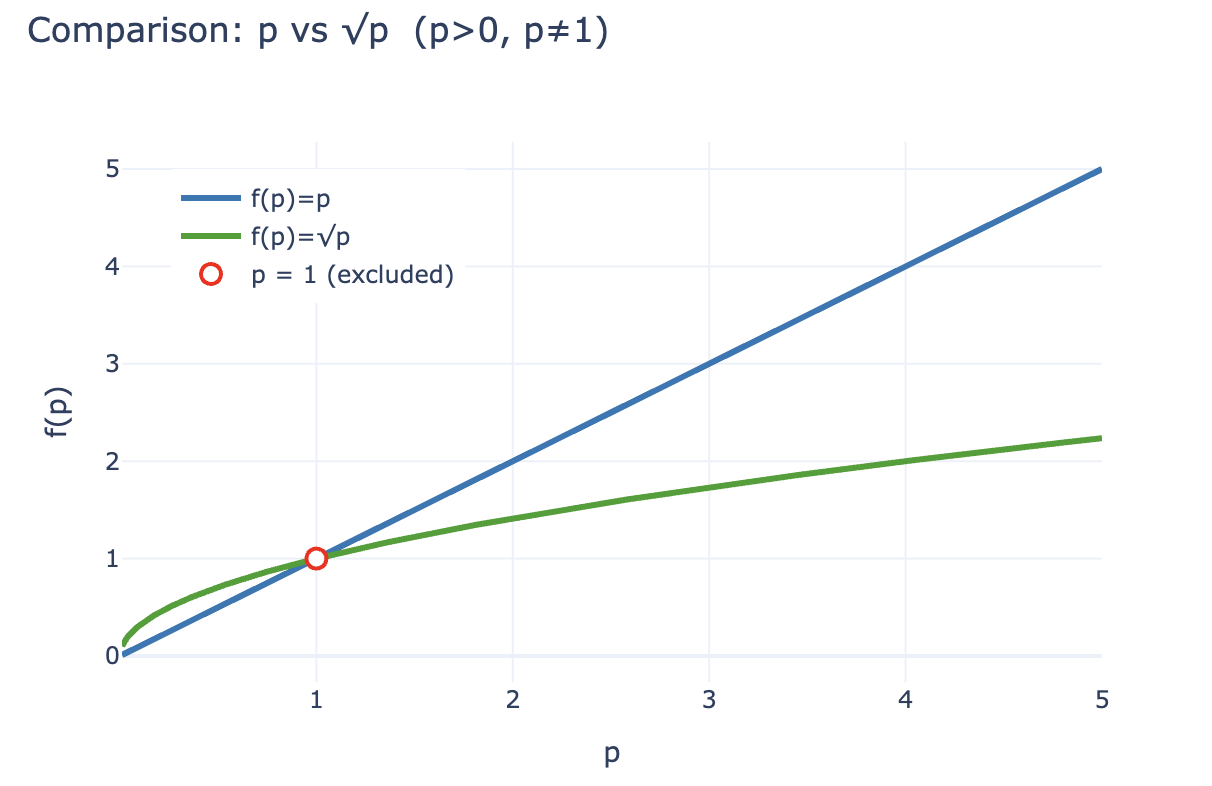

The arbitrageur’s profit is essentially the LP’s loss. To quantify this, calculate the LP’s post-arbitrage value LP(p) = 2√p (expressing x and y via p). If the LP had simply held 1 BTC and 1 crvUSD, their value would be LP~hold~(p) = p + 1.

From the inequality, for p > 0 and p ≠ 1, we always have 2√p < p + 1. Since arbitrage profits come at the LP’s expense, economic incentives push LPs to withdraw liquidity and hold crypto directly. AMM protocols must then offer higher fees and token rewards to retain LPs—this is why CEXs maintain a fundamental advantage over DEXs in spot trading.

Caption: Impermanent Loss

Image source: @yieldbasis

From a system-wide on-chain economic perspective, impermanent loss resembles an “opportunity cost”—by choosing to provide liquidity, LPs forfeit potential holding gains. Thus, impermanent loss is more of an “accounting” loss than real economic loss. Compared to holding BTC, LPs also earn trading fees.

Yield Basis disagrees. Instead of increasing fees or liquidity incentives to offset LP losses, it targets “market-making efficiency.” As shown earlier, LP value scales at 2√p versus holding value p+1—always trailing. But from a per-dollar return perspective: initial investment of 2 USD yields 2√p USD, so each dollar returns √p. Recall that p is the BTC price—so if you simply hold BTC, p becomes your return rate.

Assume a $2 initial investment. After a 100% price increase, LP returns are:

• Absolute gain: 2 USD = 1 BTC (1 USD) + 1 crvUSD → 2√2 USD (arbitrageurs take the difference)

• Relative return: 2 USD = 1 BTC (1 USD) + 1 crvUSD → √2 USD

Yield Basis reframes the problem around asset returns: transforming √p into p allows LPs to keep both fees and holding-like returns. This is simple: square √p to get p². Financially, this requires exactly 2x leverage—fixed. Any deviation breaks the economic model.

Caption: LP Value Scaling Comparison Between p and √p

Image source: @zuoyeweb3

The idea is to make 1 BTC deliver twice its market-making power, with no corresponding crvUSD sharing fee revenue. Only BTC participates in return calculations—transforming √p into p.

Believe it or not, Yield Basis raised $5 million in February—some VCs clearly bought in.

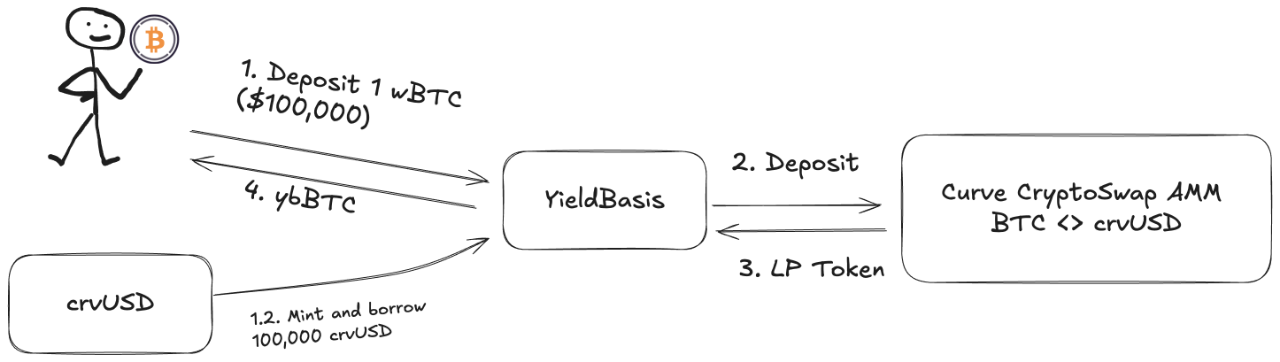

However! LPs must still deposit into BTC/crvUSD pools. A pool filled only with BTC won’t work. Enter Llama Lend and crvUSD, launching a dual-leveraging mechanism:

1. User deposits (cbBTC/tBTC/wBTC) 500 BTC. Yield Basis (YB) uses 500 BTC to borrow 500 crvUSD of equivalent value via flash loans—not a full CDP (normally ~200% collateralization)

2. YB deposits 500 BTC / 500 crvUSD into Curve’s BTC/crvUSD pool, minting $ybBTC as shares

3. YB uses the $1000 worth of LP shares as collateral to borrow another 500 crvUSD via CDP on Llama Lend, repaying the initial flash loan

4. User receives $1000-denominated ybBTC. Llama Lend holds $1000 in collateral, clearing the initial loan. The Curve pool gains 500 BTC / 500 crvUSD in liquidity

Caption: YB Operational Flow

Image source: @yieldbasis

In the end, 500 BTC “eliminate” their own loan and generate $1000 in LP shares—achieving 2x leverage. But note: the equivalent-value loan was issued by YB, acting as the crucial intermediary. Effectively, YB assumes the remaining $500 borrowing obligation to Llama Lend—thus YB also claims a cut of Curve’s fees.

If users believe 500U worth of BTC can generate $1000 in fee profits, they’re right—but expecting all of it is impolite. It’s not even a 50/50 split. YB’s subtle design pays pixel-perfect homage to Curve.

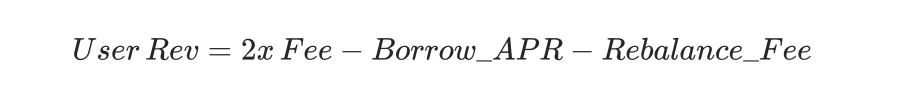

Let’s compute original returns:

Here, 2x Fee means 500U worth of BTC generates $1000 in fee revenue. Borrow_APR is Llama_Lend’s interest rate. Rebalance_Fee covers costs for arbitrageurs maintaining 2x leverage—still borne by LPs.

Now, one good news and one bad news:

• Good: All lending income from Llama Lend flows back into the Curve pool, passively boosting LP returns

• Bad: Curve pools automatically allocate 50% of fees to themselves—meaning both LPs and YB split the remaining 50%

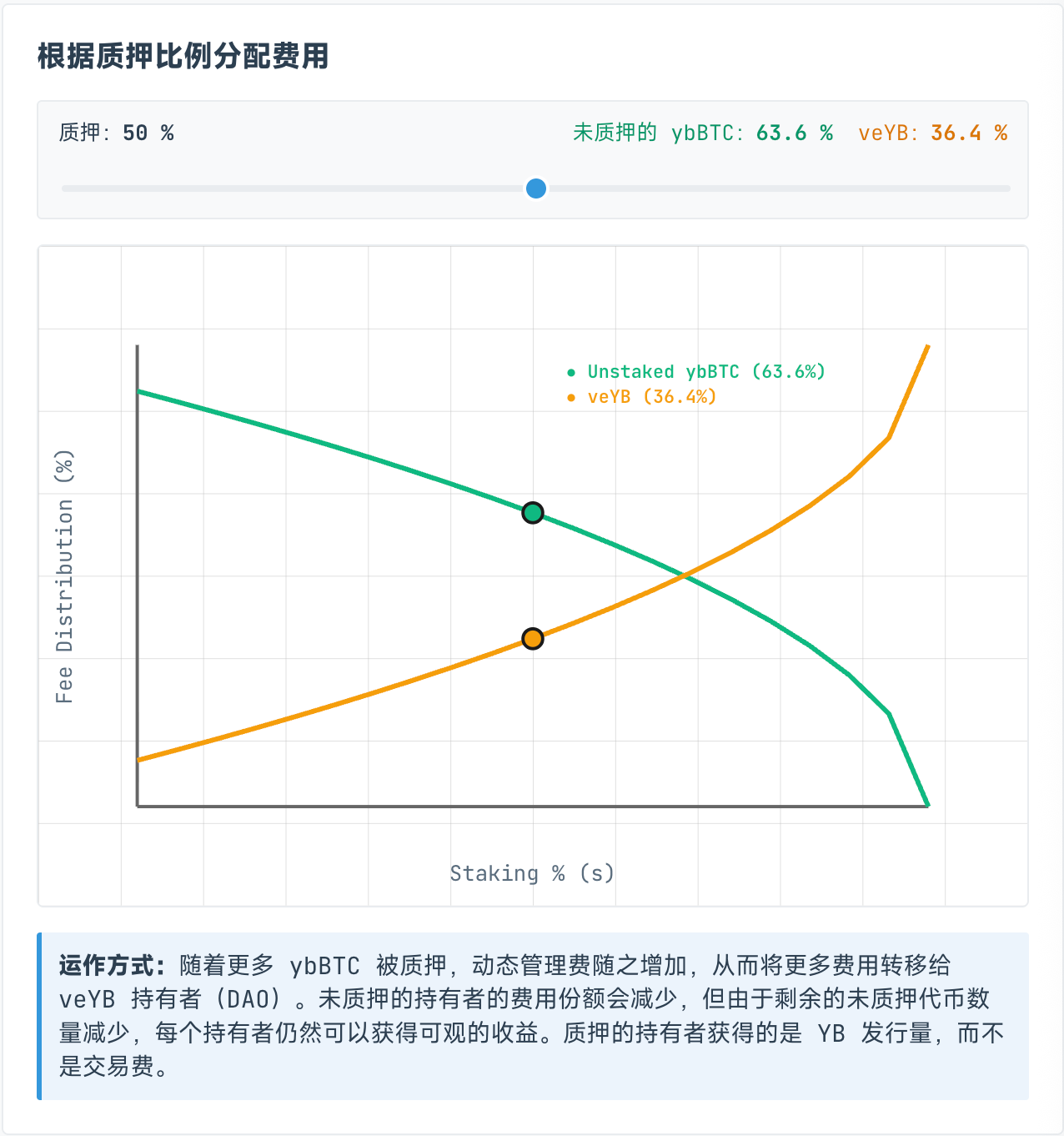

But the allocation to veYB is dynamic—split between ybBTC and veYB holders. veYB has a fixed minimum 10% floor. So even if no one stakes ybBTC, they get only 45% of total fees—while veYB (i.e., YB itself) keeps 5%.

The result is magical: even if users don’t stake ybBTC to YB, they still only get 45% of fees. If they stake ybBTC, they get YB tokens but forfeit fees. Want both? Stake YB to get veYB and reclaim fee rights.

Caption: ybBTC and veYB Revenue Split

Image source: @yieldbasis

Impermanent loss never disappears—it only transfers.

You thought 500U worth of BTC could achieve $1000 in market-making impact, but YB never promised you’d keep all the fees. And when you unstake from veYB, you need two withdrawals: veYB→YB, ybBTC→wBTC—to reclaim principal and earnings.

But to gain full veYB voting rights (i.e., bribe eligibility), congratulations—you’ve earned a four-year lockup. Otherwise, voting power and rewards decay with shorter lock periods. Whether locking BTC for four years to get YB is worth it depends on personal judgment.

As previously noted, impermanent loss is an accounting loss—only unrealized until liquidity withdrawal. Now, YB’s “elimination” plan is essentially “accounting income”—giving you paper gains pegged to holding returns, while building its own economic system.

You want to use 500U to capture $1000 in fee revenue. YB wants to “lock up” your BTC and sell you YB tokens.

Multilateral Negotiation Embraces the Growth Flywheel

In the era of yield, dreams are welcome.

Built on Curve, using crvUSD, it may empower $CRV—but also launches a new protocol and token $YB. Will YB retain or grow value in four years? Probably not…

Beyond Yield Basis’s complex economics, the real focus is crvUSD’s path to market expansion.

Llama Lend is effectively part of Curve, yet its founder proposed minting 60 million additional crvUSD to fund YB’s initial liquidity—a bold move.

Caption: YB hasn’t moved, but crvUSD has already launched

Image source: @newmichwill

YB promises benefits for Curve and $veCRV holders, but the core issue remains YB token valuation and appreciation. crvUSD is ultimately just another USD-pegged stablecoin—so is YB really a value-generating asset?

And what if another ReSupply event occurs? This time, Curve itself would suffer.

Thus, this article avoids analyzing token interplay and revenue sharing between YB and Curve. Given $CRV’s recent history, $YB is destined to be worthless—no point wasting bytes.

Yet in Michael’s defense of the mint, we glimpse his ingenuity: user-deposited BTC “mints” an equivalent amount of crvUSD, expanding supply. Each crvUSD goes into pools to earn fees—a real transactional use case.

But these crvUSD reserves are equally—not over—collateralized. Without improving reserve ratios, boosting crvUSD’s earning power becomes essential. Remember relative capital returns?

Per Michael’s vision, borrowed crvUSD will synergize efficiently with existing pools—e.g., wBTC/crvUSD and crvUSD/USDC will cross-pollinate, increasing volume in both.

Meanwhile, 50% of crvUSD/USDC pool fees go to $veCRV holders, the other 50% to LPs.

This is a dangerous assumption. Earlier, Llama Lend’s crvUSD to YB was in a dedicated, isolated pool. But crvUSD/USDC and similar pools are permissionless. Here, crvUSD reserves are inherently insufficient. During price volatility, arbitrageurs can easily exploit this, triggering the familiar death spiral. crvUSD failure would cascade to YB and Llama Lend, ultimately collapsing the entire Curve ecosystem.

Note: crvUSD and YB are tightly coupled. 50% of newly minted liquidity must enter YB’s ecosystem. While crvUSD issuance for YB is isolated, usage is not—this is the biggest potential explosion point.

Caption: Curve Revenue Distribution Plan

Image source: @newmichwill

Michael’s plan allocates 25% of YB token supply to bribe stablecoin pools for depth—borderline absurd. Asset safety ranking: BTC > crvUSD > CRV > YB. In crisis, YB can’t even protect itself—what else can it safeguard?

YB’s own issuance stems from fee revenue of the crvUSD/BTC pool. Sound familiar? So did Luna-UST: UST was minted as an equivalent of burned Luna—mutually dependent. YB Token ↔ crvUSD operates similarly.

It gets even more alike: according to Michael’s calculations based on six years of BTC/USD trading volume and price data, he claims a guaranteed 20% APR, 10% even in bear markets, reaching 60% during the 2021 bull peak. With slight enhancements to crvUSD and scrvUSD, surpassing USDe and sUSDe seems possible.

Due to massive data, I haven’t backtested his math—but remember, UST also promised 20%. Anchor + Abracadabra ran for a long time too. Will YB + Curve + crvUSD be different?

At least, unlike UST which frantically bought BTC as reserves before collapse, YB directly uses BTC as leveraged collateral—a significant upgrade.

Forgetting is betrayal.

It was Ethena that began the search for real on-chain yield—not just market-daydream valuations.

Ethena hedges ETH on CEXs to capture yield, distributes via sUSDe, and uses $ENA treasury strategies to maintain trust among whales and institutions. Only through such complex maneuvers has USDe stabilized at a multi-billion issuance scale.

YB seeks real trading yield—nothing wrong with that. But arbitrage differs from lending: trading is instantaneous. Every crvUSD is a shared liability of YB and Curve, and the collateral itself is borrowed from users—own capital is nearly zero.

crvUSD’s current issuance is small. Maintaining growth and 20% returns early on isn’t hard. But once scale expands, YB price swings, BTC volatility, and declining crvUSD value capture will create massive sell pressure.

The US dollar is a fiat currency without anchor—crvUSD is becoming one too.

Still, DeFi’s nested risks are already priced into the broader on-chain systemic risk. When everyone is exposed, risk ceases to be risk—those who opt out will passively absorb losses when things collapse.

Conclusion

The world gives people chances to shine—only those who seize them become heroes.

In traditional finance, yield basis refers to Treasury yields. On-chain, will Yield Basis become synonymous with BTC/crvUSD?

YB’s logic only holds if on-chain trading volume is massive—especially given Curve’s already huge volume. Only then does eliminating impermanent loss make sense. Consider this analogy:

• Electricity generated equals electricity consumed—there’s no static “electricity,” it’s used instantly

• Trading volume equals market cap—every token circulates, bought and sold immediately

Only through constant, deep trading can BTC’s price be discovered and crvUSD’s value logic close the loop—minted from BTC lending, profiting from BTC trading. I remain confident in BTC’s long-term upward trend.

BTC is the CMB (Cosmic Microwave Background) of the crypto universe. Since the 2008 financial big bang, as long as humanity avoids restarting world order via revolution or nuclear war, BTC’s overall trajectory will rise—not due to greater consensus on BTC’s value, but due to enduring confidence in dollar and fiat inflation.

Yet I only moderately trust Curve’s technical competence, and after Resupply, deeply question their ethics. Still, few other teams dare try in this direction. Money flows where it must—impermanent loss finds its destined victims.

UST frantically bought BTC before dying. USDe switched to USDC during reserve fluctuations. Sky went all-in on Treasuries. This time—good luck, Yield Basis.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News