Bitget Wallet Institute: Trump's "Pension Pandora's Box": How Will $8.7 Trillion in 401(k)撬动 the Crypto World?

TechFlow Selected TechFlow Selected

Bitget Wallet Institute: Trump's "Pension Pandora's Box": How Will $8.7 Trillion in 401(k)撬动 the Crypto World?

When pension funds—the most traditional and conservative capital—begin to seriously examine the crypto world, a new era is gradually unfolding.

Author: Lacie Zhang, Bitget Wallet Researcher

Introduction: On August 7, 2025, Eastern Time, an executive order from the White House may become another historic inflection point to ignite the crypto market, following the approval of spot Bitcoin ETFs. President Trump signed an executive order directing the Department of Labor to revise regulations, proposing to formally include alternative assets such as cryptocurrencies, real estate, and private equity in investment options for 401(k) retirement plans.

This move involves not only the US's $8.7 trillion "national lifeblood fund" but could also pave an unprecedented compliance highway for a second wave of large-scale institutional capital inflow. When tens of millions of Americans' retirement accounts are directly linked to crypto assets, a profound transformation is already underway.

Let’s follow Bitget Wallet Research Institute into the heart of this transformation.

1. The $8.7 Trillion "Golden Key": Why Is 401(k) the Key Variable?

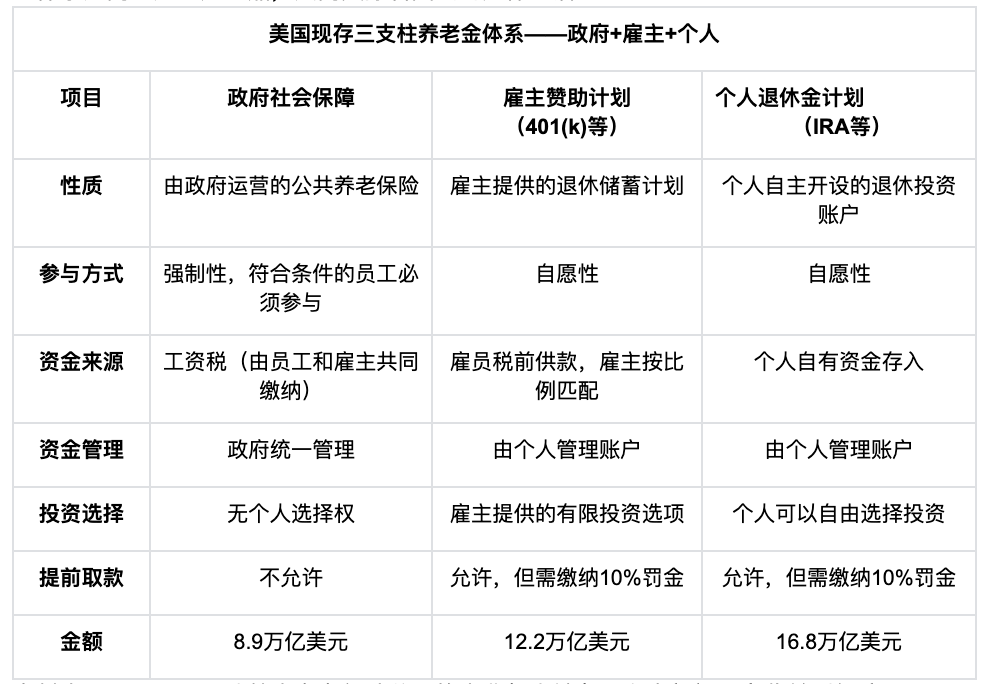

To understand the power of this transformation, we must first recognize the central role of 401(k) in the U.S. pension system. The American retirement framework resembles a three-legged cauldron, jointly supporting citizens' post-work lives:

Source: Fintax; corporate pension reserves held by insurers and private-sector defined benefit protections not considered here

-

First pillar: Government-led Social Security, similar to China's basic pension insurance—mandatory but without individual investment choice.

-

Second pillar: Employer-sponsored retirement plans, with 401(k) being the dominant force. Funded jointly by employees and employers, though investment choices are pre-set by employers, it has broad coverage and stable cash flow, serving as the core tool for middle-class wealth accumulation in retirement.

-

Third pillar: Individual Retirement Accounts (IRA), fully voluntary and self-managed, offering maximum investment freedom—an "open professional market" requiring active research and personal decision-making.

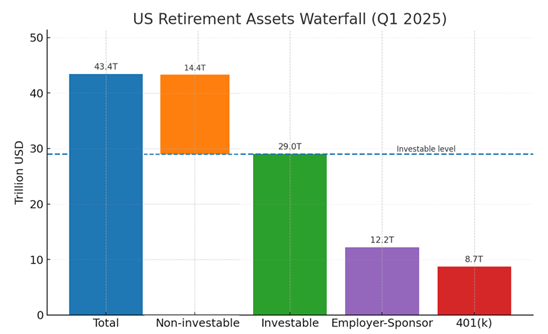

According to data from the Investment Company Institute (ICI) for Q1 2025, the total size of the U.S. retirement market reaches $43.4 trillion. Within this vast ocean of capital, approximately $29 trillion allows individuals to make investment decisions. Of that $29 trillion, 401(k) plans alone account for $8.7 trillion—30% of the total. This massive pool of funds is precisely the "gold mine" targeted by the new policy.

Average 401(k) Account Balances by Age Group in the U.S. (as of 2024)

Data source: Vanguard, "How America Saves 2024"

Vanguard's 2024 report paints a national portrait of 401(k): the average balance across all participants has reached $148,153. Notably, account balances rise exponentially with age, approaching $300,000 on average for those aged 65 and above. This means that 401(k) not only represents a massive amount of capital but also encompasses the most financially powerful middle-aged and older demographics in American society.

Until now, this vast sum has been strictly confined to traditional investments like stocks, bonds, and mutual funds. Now, the Trump administration intends to equip it with a "golden key" to unlock the door to the crypto world.

2. Three Waves Shaping the Future: How Will the New Policy Reshape the Crypto Market?

Including cryptocurrencies in 401(k) investment options will trigger far more than simple capital inflows—it will spark a structural transformation across users, institutions, and regulation.

1. First Wave: "National-Level" Shift in User Mindset

For the crypto industry, one persistent challenge has been "breaking out of the niche"—how to get mainstream audiences, especially conservative, high-net-worth middle-aged and older investors, to accept and allocate to crypto assets. This reform serves as a top-down, "national-level" market education campaign.

Imagine a 55-year-old American employee seeing an "Crypto Asset Allocation Fund" listed alongside the "S&P 500 Index Fund" and "U.S. Treasury Bond Fund" on their Fidelity or Vanguard 401(k) investment menu. This experience would be transformative. It ceases to be a distant, high-risk speculation seen on social media, and instead becomes a compliant retirement investment product approved by the U.S. Department of Labor, packaged by top-tier asset managers, and accepted by their employer. The dual endorsement of national sovereign credit and elite financial institutions will greatly reduce public skepticism and resistance toward crypto assets, achieving the lowest-cost, widest-reaching user onboarding possible.

2. Second Wave: A Steady Flow of Institutional "Lifeblood"

If the approval of spot Bitcoin ETFs opened a door for active institutional investment, then access to 401(k) plans establishes a continuous, automated "water pipeline." ETF flows largely depend on investor sentiment and active decisions—sometimes surging, sometimes stagnant. In contrast, 401(k) funding is fundamentally different: it is directly tied to the massive U.S. payroll system. This means that every payday, a portion of millions of salaries will be automatically allocated to selected crypto investment portfolios with almost no conscious effort from the holder. This stable and massive incremental capital will provide the market with unprecedented depth and resilience.

This certainty will ignite a new round of product "arms race" among Wall Street giants. Institutions like Vanguard and Fidelity will no longer be satisfied with simple, single crypto offerings. Instead, they’ll develop diversified, structured, risk-controlled "401(k)-customized" crypto funds. Examples might include a "basket" index fund containing Bitcoin, Ethereum, and select blue-chip DeFi tokens, or a "hybrid allocation fund" blending crypto with traditional stocks and bonds to smooth volatility. This not only diversifies entry channels for capital but also strongly pushes the entire crypto asset management industry toward maturity and standardization.

3. Third Wave: A Bipartisan "Political Moat"

Yet the most profound aspect of this new policy may lie beneath the noise of financial markets: it aims to forge a bipartisan "political moat" around the volatile crypto world.

Policy uncertainty caused by U.S. party alternation has long been a "sword of Damocles" hanging over the crypto industry, making long-term capital hesitant. Regulatory swings between Democrats and Republicans—even differences among leaders within the same party—have kept the industry’s future unpredictable. The brilliance of the 401(k) policy lies in its deep linkage between crypto assets and the "lifeblood savings" of tens of millions of American voters. This fundamentally changes the game: crypto is no longer just a topic for Wall Street and tech geeks, but becomes "the people's cheese"—an issue every ordinary household cannot ignore.

Imagine once the policy rolls out: any future government attempting harsh crackdowns or overturning existing crypto policies will face immense political pressure. Any move perceived as weakening the crypto market could be interpreted by voters as "touching my retirement funds," triggering strong political backlash. This raw alignment of interests transforms protection of the crypto market from a personal or partisan act by Trump into a "forced choice" for candidates seeking votes and incumbents protecting national wealth. Thus, a solid moat forms—one that compels both parties to seek more stable consensus on crypto regulation, freeing the industry from the fate of wild swings due to political turnover, and firmly welding "crypto-friendliness" into America's long-term financial agenda.

3. Vision and Caution: Opportunities and Challenges on the Path to a Trillion-Dollar Blue Ocean

We have good reason to remain optimistic about this policy. Just as the approval of spot Bitcoin ETFs propelled Bitcoin past $100,000 within a year, the growth of compliant products will inevitably lead to a revaluation of underlying assets. Even if only 5% of 401(k) funds (around $400 billion) initially enter the crypto market, this remains a massive influx—let alone the enormous multiplier effect it creates in user adoption and regulatory breakthroughs.

In the long term, if individually managed pension funds can invest in crypto assets, could the much larger government-held Social Security funds eventually open a crack? That would amount to a full restructuring of societal wealth and the financial system.

Yet optimism must not replace critical thinking. We must remain cautious, as core challenges persist:

-

Will investors buy in? Over 60% of current 401(k) assets still sit in traditional mutual funds. Convincing Americans accustomed to decades of conventional investing to allocate retirement funds to a highly volatile emerging market will require time and market validation.

-

How will risks be controlled? The extreme cyclical volatility of crypto assets is the natural enemy of retirement savings. How the Department of Labor, asset managers, and employers set investment limits and deliver risk warnings will be crucial to the policy’s success.

-

What form will the products take? The scope of investment determines risk breadth—will it stay limited to Bitcoin and Ethereum, or open up to a broader token market? Product design determines risk depth—how to smooth volatility to protect investors—remains an unresolved key question.

4. Conclusion

The Trump administration’s executive order is less a final answer and more a starting gun. Using the $8.7 trillion 401(k) as a lever, it seeks to move not only the massive U.S. pension system but also the future landscape of global crypto finance. Ahead lie vast opportunities and unknown hazards. But regardless, when retirement savings—the most traditional and conservative form of capital—begins seriously evaluating the crypto world, the door to a new era is slowly opening.

This article was written by Bitget Wallet researcher Lacie Zhang. If you have questions or thoughts about the content, feel free to connect with @Laaaaacieee on X.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News