Solana Foundation: Over $2 billion in trading volume in 6 weeks—what are the advantages of xStock's tokenized US stocks?

TechFlow Selected TechFlow Selected

Solana Foundation: Over $2 billion in trading volume in 6 weeks—what are the advantages of xStock's tokenized US stocks?

Listing on NASDAQ, global trading, instant settlement, DeFi integration.

Author: Solana Foundation

Translation: TechFlow

Summary

xStocks tokenizes U.S. stocks and ETFs and brings them onto the Solana blockchain. Each token is backed 1:1 by real shares held in regulated custodians. Non-U.S. traders gain access to 24/7 markets, instant on-chain settlement, fractional ownership of stocks, and the ability to use stock exposure in DeFi applications such as lending, AMMs, and collateral. In just six weeks since launch, xStocks has achieved nearly $500 million in cumulative on-chain trading volume.

Highlights

-

Tokenization of U.S. Stocks and ETFs: xStocks tokenizes U.S. equities and ETFs, with each token backed 1:1 by real shares held in regulated custody, enabling 24/7 trading, T+0 settlement, and fractional ownership.

-

Launch Timeline and Coverage: Since launching on June 30, 2025, xStocks offers over 60 tokenized stocks and ETFs, including major U.S. companies and index funds (e.g., Apple, NVIDIA, S&P 500). Non-U.S. users can buy and hold them like any SPL token.

-

Distribution and Composability: Available across multiple platforms from day one—listed on Kraken and Bybit, tradable via Raydium and Jupiter, usable as collateral on Kamino, and natively supported in Phantom and Solflare wallets.

-

Programmable Compliance: Leverages Solana Token Extensions for programmable compliance features (e.g., corporate action handling, freeze/transfer controls) while maintaining DeFi compatibility.

-

Early Market Performance: Achieved approximately $2.1 billion in total trading volume within six weeks, with around $500 million occurring on-chain. As of August 11, 2025, xStocks captured about 58% of the tokenized stock trading market share, with Solana holding the majority of market value.

Simple Problem

Many people worldwide face slow speeds, high costs, or operational difficulties when purchasing U.S. stocks. Traditional equity markets have limited trading hours, require intermediaries, involve cumbersome paperwork, and often take days to settle. These frictions complicate investing and exclude potential participants.

But what if a stock could be as liquid as a token? What if it could be stored in a wallet, instantly transferred, and used across financial applications? This is precisely the vision xStocks promises on Solana.

Tokenized stocks provide non-U.S. traders with equity exposure and enable usage as collateral, participation in automated market maker (AMM) liquidity pools, or seamless cross-platform transfers—all available 24/7. This not only unlocks new investment strategies but also creates entirely new forms of liquidity.

xStocks officially launched on Solana on June 30, 2025, by Backed—one of the most experienced real-world asset issuers—ushering in a new era of U.S. stock trading for global investors.

Original video link: Click here

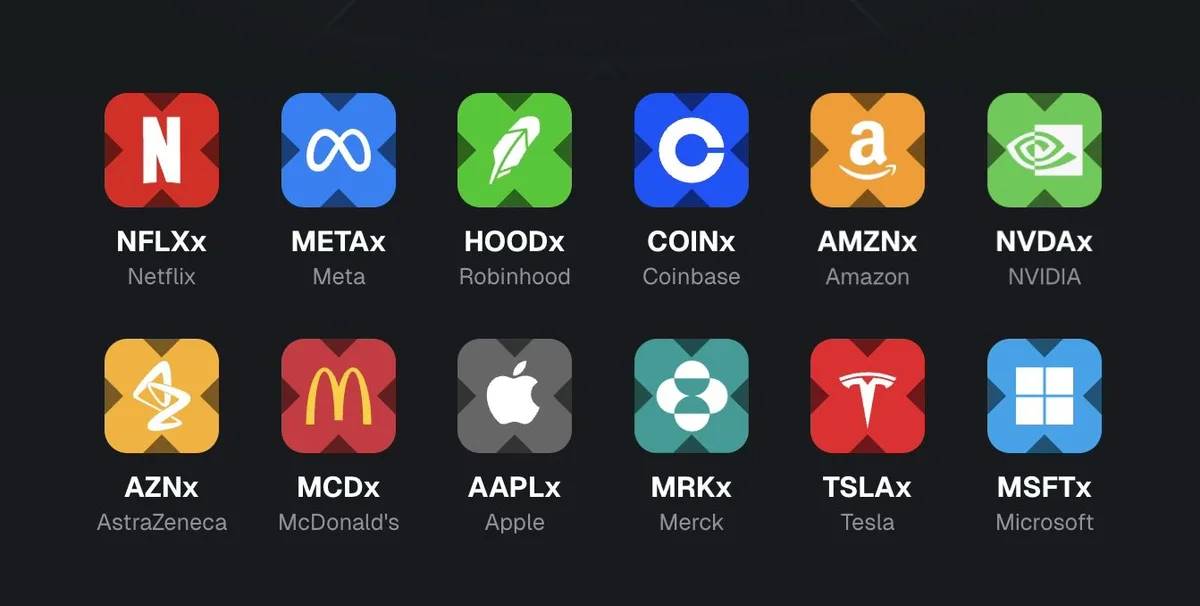

The initial batch of xStocks includes over 55 tokenized stocks and ETFs, covering well-known companies such as Apple, Microsoft, NVIDIA, Tesla, and Meta. Users can now trade shares of these iconic firms directly on Solana.

xStocks ticker symbols end with "x", such as NVDAx (NVIDIA) and AMZNx (Amazon), creating a distinct identity for tokenized equities.

Image source: xStocks

As of August 2025, the full list of 60+ xStocks live on Solana is as follows:

-

ABTx - Abbott xStock

-

ABBVx - AbbVie xStock

-

ACNx - Accenture xStock

-

GOOGLx - Alphabet xStock

-

AMZNx - Amazon xStock

-

AMBRx - Amber xStock

-

AAPLx - Apple xStock

-

APPx - AppLovin xStock

-

AZNx - AstraZeneca xStock

-

BACx - Bank of America xStock

-

BRK.Bx - Berkshire Hathaway xStock

-

AVGOx - Broadcom xStock

-

CVXx - Chevron xStock

-

CRCLx - Circle xStock

-

CSCOx - Cisco xStock

-

KOx - Coca-Cola xStock

-

COINx - Coinbase xStock

-

CMCSAx - Comcast xStock

-

CRWDx - CrowdStrike xStock

-

DHRx - Danaher xStock

-

DFDVx - DFDV xStock

-

LLYx - Eli Lilly xStock

-

XOMx - Exxon Mobil xStock

-

GMEx - Gamestop xStock

-

GLDx - Gold xStock

-

GSx - Goldman Sachs xStock

-

HDx - Home Depot xStock

-

HONx - Honeywell xStock

-

INTCx - Intel xStock

-

IBMx - International Business Machines xStock

-

JNJx - Johnson & Johnson xStock

-

JPMx - JPMorgan Chase xStock

-

LINx - Linde xStock

-

MRVLx - Marvell xStock

-

MAx - Mastercard xStock

-

MCDx - McDonald's xStock

-

MDTx - Medtronic xStock

-

MRKx - Merck xStock

-

METAx - Meta xStock

-

MSFTx - Microsoft xStock

-

MSTRx - MicroStrategy xStock

-

QQQx - Nasdaq xStock

-

NFLXx - Netflix xStock

-

NVOx - Novo Nordisk xStock

-

NVDAx - NVIDIA xStock

-

OPENx - OPEN xStock

-

ORCLx - Oracle xStock

-

PLTRx - Palantir xStock

-

PEPx - PepsiCo xStock

-

PFEx - Pfizer xStock

-

PMx - Philip Morris xStock

-

PGx - Procter & Gamble xStock

-

HOODx - Robinhood xStock

-

CRMx - Salesforce xStock

-

SPYx - SP500 xStock

-

TBLLx - TBLL xStock

-

TSLAx - Tesla xStock

-

TMOx - Thermo Fisher xStock

-

TQQQx - TQQQ xStock

-

UNHx - UnitedHealth xStock

-

VTIx - Vanguard xStock

-

Vx - Visa xStock

-

WMTx - Walmart xStock

Effortless Stock Exposure: As Easy as Buying a Token

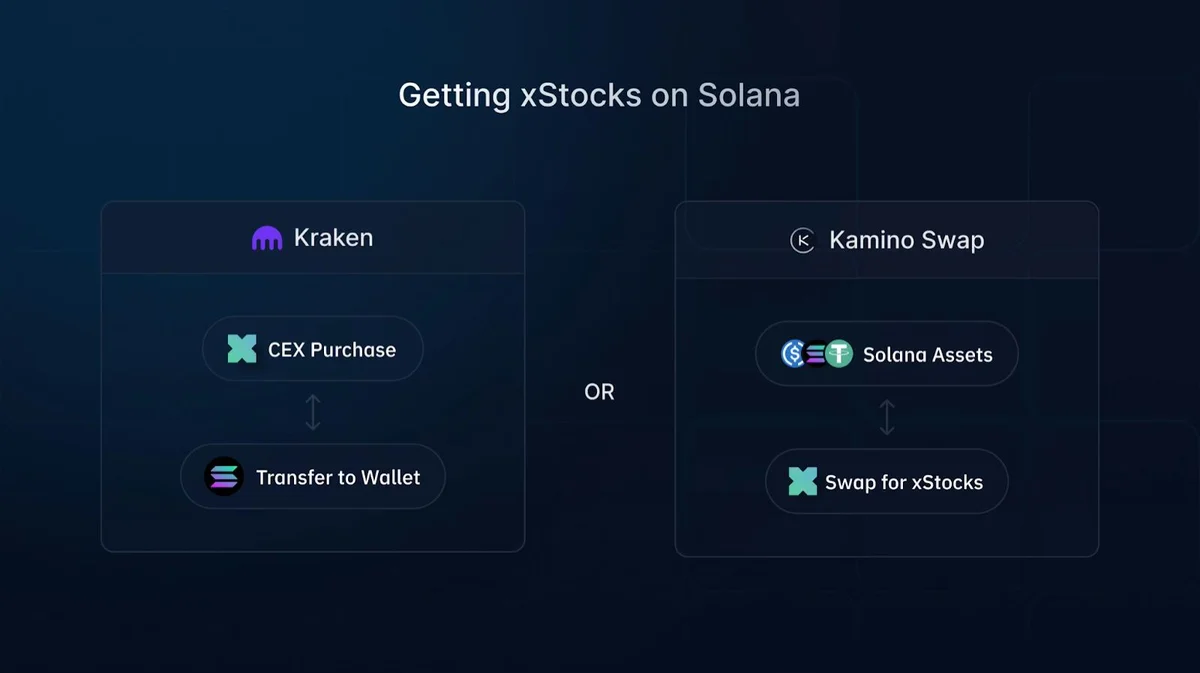

Purchasing stocks is no longer a cumbersome process! With xStocks, buying equities on Solana feels almost identical to buying any other token.

Users can purchase AAPLx (Apple), SPYx (S&P 500 ETF), and other xStocks through decentralized exchanges or aggregators such as Raydium, Kamino, or Jupiter. On centralized exchanges like Kraken or Bybit, xStocks behave similarly to crypto assets—users can buy them and withdraw to self-custodied wallets, achieving full control over their assets.

Image source: Kamino

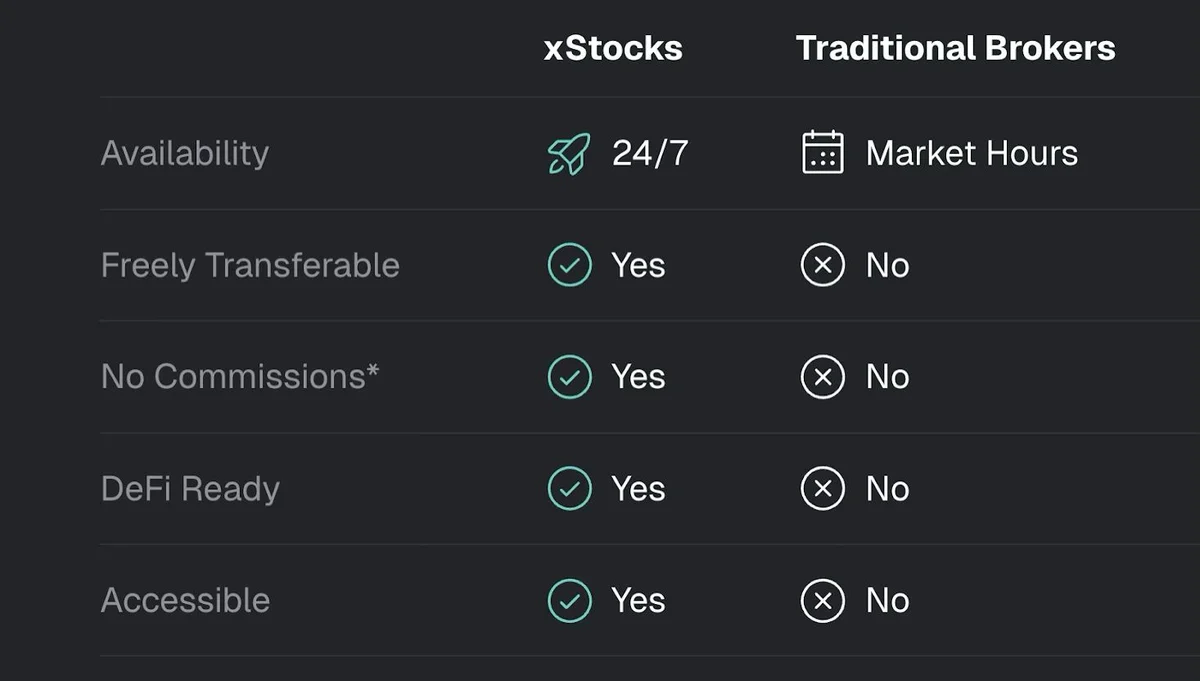

User Experience Advantages: Beyond Traditional Stock Trading and Brokerage Models

xStocks revolutionizes traditional stock trading and brokerage models, offering numerous advantages. It significantly lowers investment barriers, allowing global users to enter the market without brokers. This shift is significant because classic wealth-building vehicles like index funds and stock investments were previously monopolized by specific regions.

With xStocks, non-U.S. users worldwide can now invest in tokenized U.S. equities, free from geographic constraints.

Beyond accessibility, xStocks unlocks new possibilities, providing investors with innovative financial tools and strategies.

-

xStocks enable continuous trading on Solana, allowing users to trade 24/7 on-chain via self-custodied wallets. Transactions settle instantly, eliminating reliance on clearing institutions and dramatically improving efficiency.

-

Each xStock is divisible on-chain, enabling flexible fractional ownership. Users don’t need to buy full shares—small amounts of capital are sufficient to start investing, with no minimum investment requirements or management fees.

-

Composability is another key strength: tokenized stocks can serve as collateral, be lent out, or added to liquidity pools. This innovation enables yield strategies previously impossible in traditional finance, opening new opportunities for investors.

Imagine a user in Brazil purchases $50 worth of AAPLx at night. He can immediately pledge part of his holdings as collateral on Kamino to borrow stablecoins, while depositing the remainder into a Raydium liquidity pool to earn trading fees. All of this can happen within minutes—no broker, no settlement delays.

This isn't just a transformation in how people invest in stocks—it's a breakthrough beyond the traditional “buy and hold” strategy, redefining the potential and value of stock ownership.

Image source: xStocks

xStocks realizes the vision of bringing Wall Street onto the blockchain, seamlessly merging regulated equity exposure with the programmability of cryptocurrency, ushering investors into a new financial era.

How Do xStocks Work?

The core idea behind xStocks is simple: each stock is tokenized as an SPL token, allowing users in permitted jurisdictions to buy, hold, and use it via their wallets. However, beneath this simplicity lies a complex operational framework.

xStocks issuance operates under a regulated framework:

-

Stock Acquisition: Backed purchases actual shares of companies like Tesla or Apple through traditional brokers and stores them in regulated custodial accounts.

-

Token Minting: For every real share held, Backed mints a corresponding SPL token on Solana. For example, one Tesla share equals one TSLAx token. This strict 1:1 asset backing ensures token supply perfectly matches actual share holdings.

-

Trading Readiness: Chainlink provides dedicated data feeds to update real-time prices and corporate actions (such as dividends and stock splits). In the current xStocks design, dividends are automatically reinvested into the token balance.

xStocks Leverage Solana’s Token Extensions for Custom Features and Compliance

Token Extensions allow issuers like Backed to enforce rules, manage metadata, integrate with DeFi, and maintain compliance frameworks on Solana. Notably, once a token is created, its extension settings cannot be changed, so some functions may remain inactive upon initialization.

Each xStock token uses the following Token Extension features:

-

Metadata Pointer: Links token mint information to off-chain metadata (such as name, symbol, description, and market data) hosted by the issuer. This ensures xStocks display correctly in wallets and apps, with up-to-date information.

-

UI Amount Scaling Configuration: Allows the issuer to set a multiplier representing corporate actions on-chain, such as stock dividends, splits, and reverse splits. When the issuer updates this multiplier, all wallet balances visually adjust automatically. This enables traditionally expensive corporate events to be handled efficiently in a single operation.

-

Pause Capability: Enables the issuer to pause all token interactions during emergencies, regulatory requests, or security incidents, providing critical safeguards.

-

Permanent Delegate: Assigns ongoing authority to an authorized entity (Backed) to transfer or burn tokens from any address without user-level permissions. This is typically used to meet regulatory obligations, such as seizing assets per legal court orders.

-

Default Account State: Currently set so all token accounts begin in an “initialized” state. Adding this extension allows Backed to support sRFC-37 in the future, improving blocklist management efficiency. As adoption grows, this feature will see broader support.

-

Transfer Hook: Enables custom logic on every token transfer. It can replace sRFC-37 to support blocklists and fulfill compliance needs. Currently initialized but disabled.

-

Confidential Transfers: Adds a privacy-preserving transfer framework that hides transfer amounts and balances while maintaining verifiability and auditability. Currently initialized but disabled.

-

Token Metadata: Stores on-chain metadata, including official name, ticker symbol, and a link to the issuer-hosted metadata file, ensuring asset details are transparent and verifiable.

These capabilities make xStocks far more programmable than traditional securities and assets, perfectly combining compliance tools with DeFi composability. For more details, refer to our 2025 Report on Security Tokenization.

Launch and Early Progress

Backed launched xStocks on June 30, 2025, initially releasing over 55 stock and ETF assets.

xStocks' initial distribution and growth momentum came from two fronts:

-

Centralized Exchanges: Through key partners Kraken and Bybit, xStocks instantly became available to users in 185 countries worldwide.

-

On-Chain Integration: Within hours of launch, xStocks gained support across major DeFi platforms. Raydium emerged as the primary on-chain AMM for liquidity, while Jupiter aggregated optimal pricing. Kamino introduced xStock collateral pools, enabling borrowing against tokens like AAPLx or TSLAx. Wallets like Phantom and Solflare natively support token labeling, displaying xStocks alongside regular tokens.

Subsequently, more industry participants joined, forming the “xStocks Alliance.” This coalition—comprising exchanges, protocols, and service providers including Backed, Kraken, Bybit, Solana, AlchemyPay, Chainlink, Kamino, Raydium, and Jupiter—is committed to advancing widespread xStocks adoption.

Rapid adoption, driven by composability.

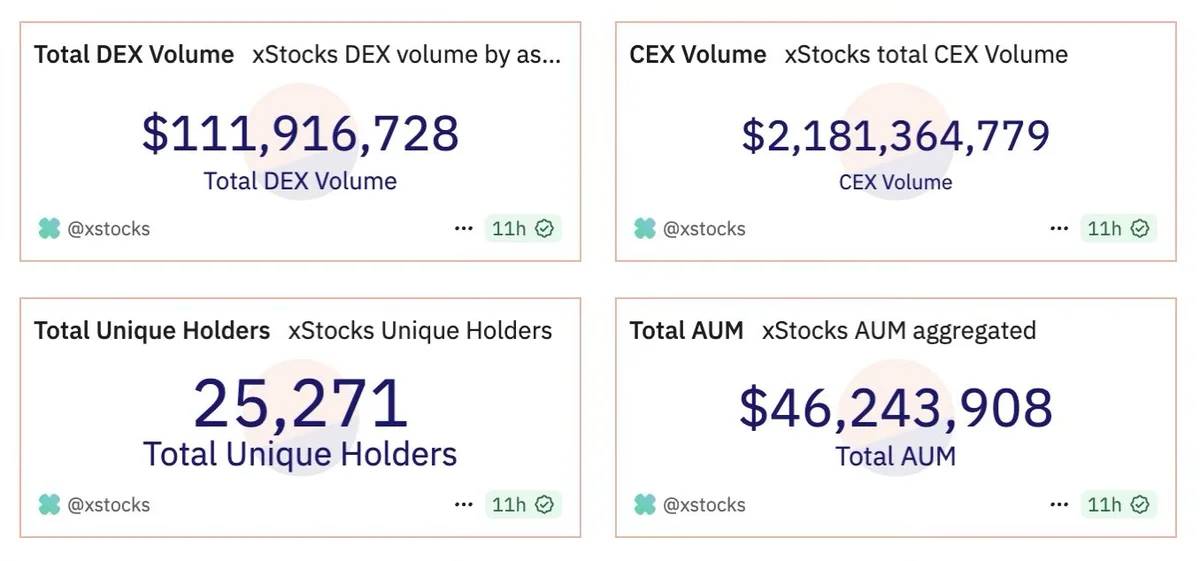

Thanks to ecosystem collaboration, xStocks achieved fast market penetration. In the first month, trading volume surpassed $300 million; by week six, cumulative volume exceeded $2.1 billion, with over $110 million generated through on-chain decentralized exchanges.

Image source: Dune

According to rwa.xyz data, as of 2025, xStocks on Solana accounted for approximately 58.4% of all tokenized stock trading volume. As of August 11, 2025, total trading volume approached $86 million, with Solana capturing over half the market at $46 million.

A $120 Trillion Opportunity

The global stock market is vast, with a total market capitalization exceeding $120 trillion. While tokenization initially targets only a fraction, the potential opportunity is enormous.

xStocks addresses three primary market segments with unique value propositions.

-

Non-U.S. Residents: Representing the largest potential market, these users can now access U.S. stocks easily, without restrictions from traditional brokerage accounts.

-

Crypto-Native Investors: Seek equity exposure within the DeFi ecosystem. For them, self-custody, 24/7 access, and asset composability are crucial.

-

Retail Investors: Fractional ownership, weekend trading, and instant settlement make small-scale investing cheaper and more flexible.

This tokenization trend aligns with the theory of an “internet capital market.” By reducing barriers between capital and individuals, xStocks can expand market participation and democratize investing.

Bridging to the Future

xStocks can be seen as a bridge—an important and practical step toward bringing traditional markets onto the blockchain, while narrowing the gap between traditional finance (TradFi) and decentralized finance (DeFi).

It brings two transformative changes:

-

Market Access: People previously excluded from U.S. markets can now participate easily. This significantly expands the investor base.

-

New Ways to Use Assets: Stocks are no longer just investment instruments—they can serve as collateral for loans, participate in yield-generating strategies, or flow in fractional form across different applications. Asset composability creates entirely new product forms never before possible in traditional finance (TradFi).

Making public equities tokenizable marks a significant upgrade in market infrastructure. With its first-mover advantage, exchange partnerships, and technological support from Solana’s high-speed network, xStocks is well-positioned to grow into a robust ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News