Crypto dreamers, dare to think to win

TechFlow Selected TechFlow Selected

Crypto dreamers, dare to think to win

Pessimists seem smart and wise, while optimists make real money.

Author: Ignas

Translation: TechFlow

It's 2032:

You wake up at the Four Seasons, slightly tired. The two Negronis from last night are still giving you a headache.

A notification pops up: Open your Rabby wallet on the iPhone 23 XXL and see that BTC dropped 3% overnight. Another FUD wave caused by Sailor’s strategy.

Still, BTC is trading high at $1.2 million. You smile—Udi was actually right!

You recall how you leveraged 3x on Hyperliquid back when Bitcoin was $114,000—late, but it set your family on the path to financial freedom.

Cobie’s prediction was slightly off: the hard road was from $80K to $250K; the easy one, from $250K to $1M.

The 2024–2029 bull run truly was different—the year the “four-year cycle” officially ended—and you were lucky not to get liquidated on 3x leverage.

Thanks to Trump’s third term, the U.S. successfully acquired 5% of global Bitcoin supply, reshaping the crypto landscape.

A twinge of regret hits: If only I hadn’t sold some ETH to OpenAI and SpaceX in private equity rounds. Neither company went public. They directly tokenized on Nasdaq’s Ethereum L2.

Still, tokenized private equity can be used as collateral on Aave and Fluid.

You won’t stop—you dream bigger:

Monad mainnet launches soon, and testnet airdrops are coming. Once claimed, you plan to buy a second home—and citizenship—in Antigua and Barbuda. After all, next year the EU will launch a 50% crypto "solidarity tax," so you need to prepare.

But your friends weren’t so lucky.

Experts from the UK’s Financial Times and BBC convinced them to hold euro-CBDC at 4% annual yield as EU defense bonds, saving for a down payment on a one-bedroom flat. With inflation at 8%, even with €2,500 monthly universal basic income, that goal grows more distant.

You feel sad—but it’s not your fault: You told them to buy crypto. They didn’t listen.

You get dressed, brush your teeth, and open X. Ugh! A notification pops up: “Verify your age using government-issued ID to log in.”

Per UK and upcoming EU laws, users see this message on content deemed “potentially harmful.”

Damn! Your VPN crashed again. Set IP to Afghanistan and reopen X. Success!

Visiting friends in the UK feels very different now.

Time to do some “work” before flying home.

Crypto: Selling Dreams

Crypto’s greatest strength is its ability to inspire dreams of a better, wealthier life.

This message stands out sharply amid today’s geopolitical and economic mood—contrasted against struggles to pay bills, find jobs, and growing privacy erosion (e.g., UK Online Safety Act).

Scrolling news, TikTok, Instagram—despair dominates. Yet crypto remains one of the few sparks of hope.

Despite global unease, crypto Twitter feels unusually positive. Crypto and Bitcoin are seen as answers to financial hardship. That’s why my 2032 intro highlights non-crypto friends’ struggles—they contrast sharply with crypto-driven hope.

Coinbase gets it—and delivers the message perfectly.

Their ad on the UK situation, “Everything is Fine,” made me laugh—but they’re not wrong.

Original video: Everything is Fine

I love crypto because it’s a place where “big dreams” can fly. But this is also why crypto skeptics dislike us.

They don’t believe our stories—they seem too wild, unrealistic. How can blockchain change society? To them, it’s just an “advanced spreadsheet.”

As Nat Friedman said: “Pessimists look smart. Optimists make money.”

Crypto’s power to dream big (and permissionless tech) is also why scammers love our industry: they sell richer lives, then destroy them.

I wrote a dedicated article explaining why many people hate crypto so much.

Original link: Why Everyone Hates Crypto—and How to Change It

We’re not scammers. You’re not a scammer.

We genuinely believe crypto can positively impact individuals and society by strengthening private property, freedom, and privacy in finance and the internet.

Yet despite huge progress in just a few years, I feel crypto natives are slowly forgetting how to chase “big dreams.”

Crypto Lost: Forgetting How to Dream

Once, our big dreams attracted countless retail investors.

But why would new retail buy ETH today? Native crypto folks haven’t updated ETH price targets since the last bull run—still stuck at $10,000.

Yet ETH has made massive progress: spot ETFs, TradFi adoption, stablecoins, regulation, RWAs (real-world assets), Robinhood launching an L2, and more.

Was all this effort just for a 2x or 3x short-term gain?

Maybe we wanted legitimacy, so when TradFi joined, Lambos and “to the moon” dreams left the crypto narrative.

Now only “dumb coins” (XRP, ADA, etc.) and Bitcoin attract dreamers. At least BTC has a $1M target.

ETH and (most) altcoins aren’t selling big dreams.

But ETH still has hope.

For years, Ethereum fans pushed the “Ultrasound Money” meme. But scaling lowered gas fees, killing deflation dreams. (Tech and marketing teams failed to align!)

Now the narrative returns to fundamentals: institutional adoption, stablecoins, RWAs.

Nothing new—but this time, louder, more credible voices tell it, like Thomas Lee and Joseph Lubin.

Who tells the story matters as much as the story itself.

Public companies adding ETH to their balance sheets became another catalyst. This gives hesitant buyers confidence—even bears admit the shift is real.

But is all this just for a $10,000 ETH target?

ETH needs a more compelling story—one where holding ETH itself becomes worth far more than $10K. BTC is digital gold. What is ETH… digital oil?

I believe such a story will emerge. Long-term bullish on ETH!

Take Solana as another example.

In 2024, it thrived on memecoin rags-to-riches stories. But after memecoin traders lost heavily, Solana and SOL lost appeal.

SOL isn’t a TradFi chain like ETH, nor a store of value like BTC. People lost money on memecoins and can no longer dream.

How to Make People Dream

“When I buy a token, I want big dreams.

Yet most projects sell features, not grand visions.

A token should help your community achieve their dreams.” — DefiIgnas on X

Looking back, it’s amazing that $LINK (an oracle protocol) once gave us all big dreams.

I remember thinking:

“LINK is the most egalitarian project we’ve seen. Ambitious. If successful, it could truly reshape society.” — Popular Copy Pasta

Or take any Compound’s COMP. What’s exciting about a lending protocol? Or a DEX aggregator? A cross-chain protocol?

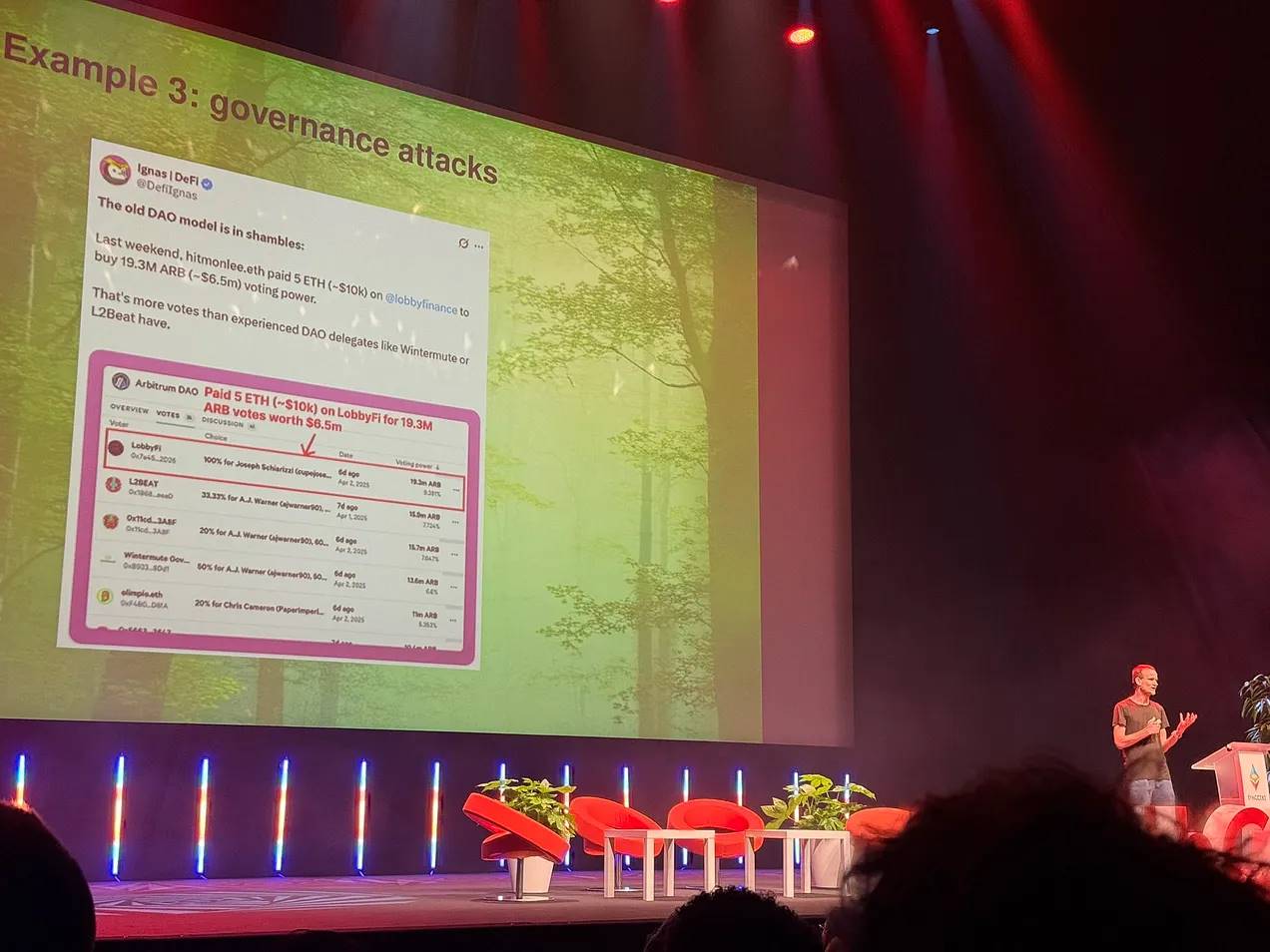

These tokens inspired because they were part of a larger movement—DeFi (decentralized finance). Be your own bank. If unhappy with team direction, vote via DAO (decentralized autonomous organization) and influence outcomes!

Revolutionary!

Now people don’t trust DAOs, and DeFi tokens are just investment assets valued by revenue or fees—losing their compelling story.

One of my proudest moments

When LINK, COMP, UNI, YFI launched, they were leaders, pioneers, first-movers in DeFi.

Something entirely new.

Today, yet another new DEX, lending protocol, oracle, or infrastructure project tries to inspire us or ignite big dreams.

Is this the cost of crypto becoming a mature asset class?

Few new projects or TGE announcements on X excite anymore—most offer minor upgrades over current market leaders, or involve founders and VCs launching tokens for personal BIG DREAM profits, not their communities.

My advice to founders: Invest time and money into crafting a coherent story and use storytelling to convey big dreams. Marketing isn’t just paid technical posts on X, pretty UIs, and social media managers posting memes.

It’s hard work—but it makes you stand out.

Investors back big dreams. But those selling big dreams often lack technical innovation—or are pure scammers.

That said, here are some projects doing well in selling big dreams (not necessarily the best projects).

Crypto Projects & Tokens That Sell Big Dreams Well

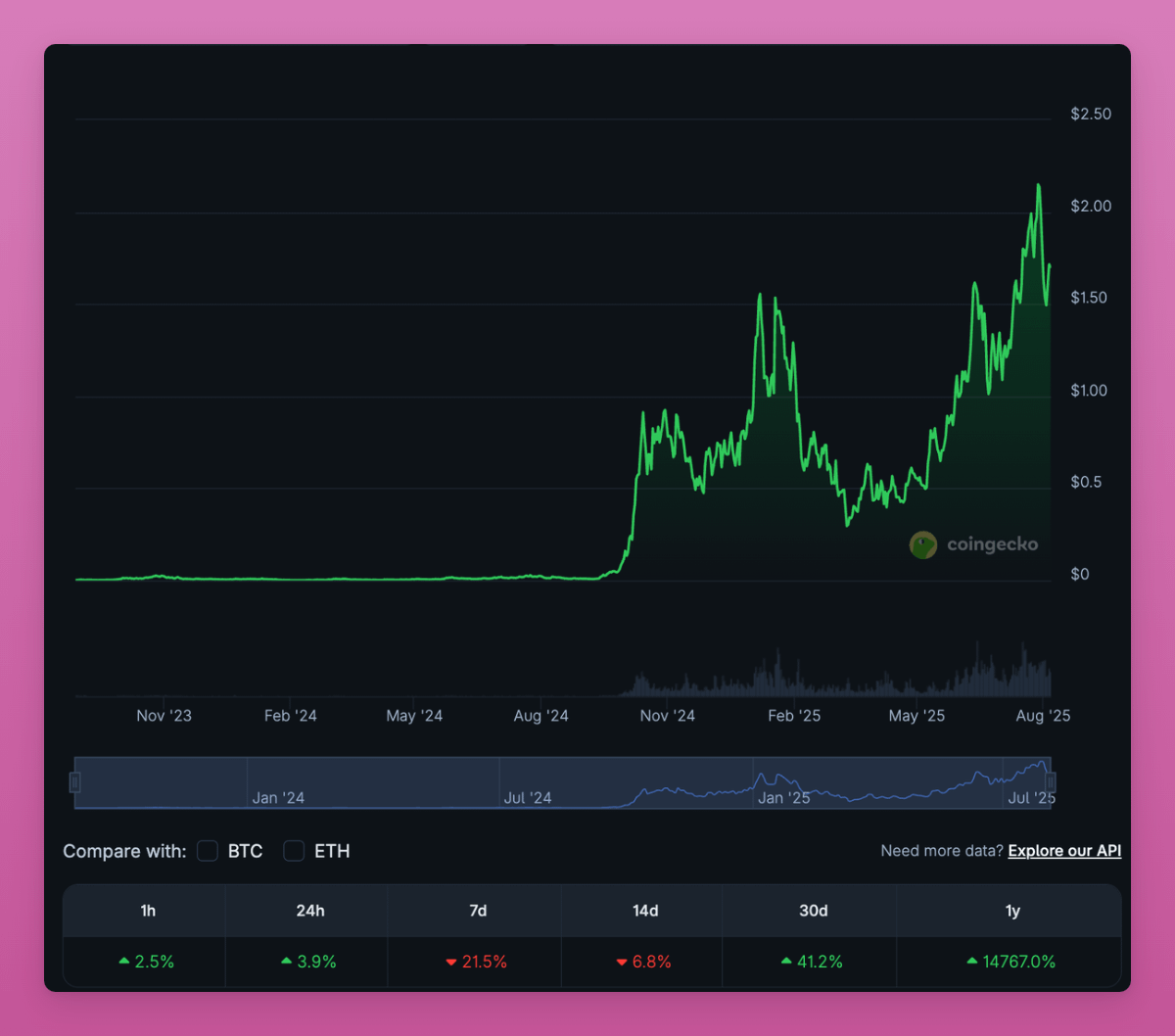

SPX6900

To be honest, I still don’t know what this token does. It’s just a meme, right?

Yet Murad is a great storyteller—and the token surged ~15,000%.

His X thread: “150 Reasons SPX6900 Will Reach a $1 Trillion Market Cap.”

That’s over twice the current $ETH MC! Ridiculous? Absurd?

Maybe. But who cares? He delivered his community’s dream.

Sure, it might feel scammy, but he’s holding these tokens—not dumping on his community like others.

Crypto founders have a lot to learn from him.

Disclaimer: I don’t hold this token.

Pudgy Penguins

Pudgies are my favorite crypto brand.

Who wouldn’t love them? Cute, prices up (my NFT cost only $2,000), and their mission is spreading “good vibes” across the metaverse.

With billions of views on social media, Pudgy Penguins are poised to become crypto’s best outward-facing ambassador.

Crucially, $PENGU is the first truly crypto-native memecoin—others (DOGE, PEPE, SHIBA) migrated from Web2.

So perhaps it’s time for Pudgy Penguins to be our PR face, helping fix our negative image.

Worldcoin

You may dislike their eerie AI orb scans or criticize their “extractive” tokenomics, but one thing is undeniable: their ambition.

Worldproof of Human aims to build a global identity and financial network to distinguish humans from AI online while expanding global economic access.

This is also one of crypto’s core missions.

Farcaster

Farcaster’s X bio might be the least ambitious-sounding among all crypto projects: “A social network that’s sufficiently decentralized.”

“Sufficiently decentralized” doesn’t sound bold. But Farcaster quietly achieved it.

They’re building an open social network like X—but censorship-resistant and user-owned.

Rather than putting everything on-chain and sacrificing UX, they only decentralize key parts: usernames, messages, and read/write permissions.

This ensures freedom while avoiding full decentralization’s downsides.

Anyone can build apps on top; no one can remove you from the network. While certain frontends may ban you, users can easily migrate.

Base proved Farcaster works by natively integrating it into their latest Base app.

Can’t wait for their token launch!

Hyperliquid

This seems like an obvious choice.

But I only became a true believer when OKX + Binance tried to crush Hyperliquid.

Now HYPE is a movement—to move all trading from centralized exchanges (CEX) to decentralized exchanges (DEX).

Even beyond Binance. Isn’t that ambitious? Dream-filled?

HL is already strong in perps, but I believe they’ll grow stronger in spot.

Hyperliquid.

Polymarket

Spreading misinformation or fake news costs almost nothing in time or money.

But answering questions like “Do vaccines cause autism?” requires billions in research and years of work.

Truth is expensive. In an era flooded with disinformation and AI content, revealing what’s really happening has never been more valuable.

Polymarket’s strength is already proven: it outperformed traditional media in predicting U.S. election results.

That’s why Polymarket is one of the protocols that lets me dream big. Can’t wait for their token airdrop!

Liquity

After Terra collapsed, most abandoned the dream of building a truly decentralized stablecoin.

Maker shifted toward TradFi and RWA; even Rai—an algorithmic stablecoin championed by Vitalik Buterin—changed course.

Liquity might be our last chance at a fully decentralized, minimally governed stablecoin.

Liquity V2 is growing slowly—TVL at just $136M, LQTY market cap under $100M.

Adoption has a long way to go, but their vision inspires. One day, crypto will need a decentralized stablecoin again.

Higher. Further.

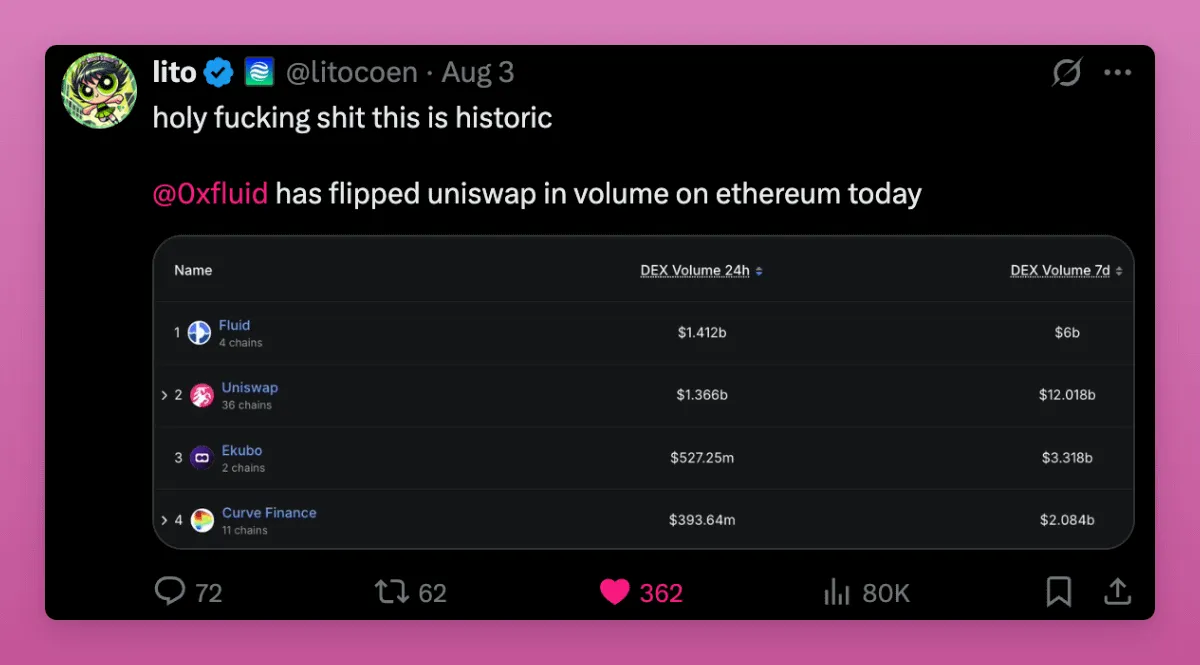

Fluid

Look, I know I’m their ambassador, but there’s a reason Fluid is the only project I personally joined.

When they announced aiming to surpass Uniswap in volume—while being a lending protocol—I was shocked and inspired.

And then one day, Fluid briefly surpassed Uniswap on Ethereum.

With the recent launch of Fluid DEX Lite, my targets for volume, lending TVL, and $FLUID price are going sky-high.

Which projects or tokens make you dream? Share in the comments!

Aim Higher

The 2017/18 crypto cycle was the peak of dreaming.

Every token had grand ambitions: Uber, Airbnb on blockchain, IoT (IOTA), supply chain (VeChain), decentralized ad markets (Brave), decentralized banks (Bankera), etc.

But these stayed on whitepapers—no tech to back them.

2020/21 was different: DeFi and self-governance visions were supported by smart contracts and real dApps.

Yet DAO governance and true on-chain decentralization remain unfulfilled—DeFi evolved into onchain finance.

Today’s cycle focuses on external factors: ETFs, RWA, regulation.

Internal crypto dreams have shrunk, price targets reduced—despite many positive developments.

We’re at the cusp of mass crypto adoption, yet many refuse to dream bigger. Your price targets are too conservative.

NVIDIA alone has a market cap larger than the entire crypto market. Yet NVIDIA’s stock rose 604% in a few years.

With pro-crypto regulation and active TradFi adoption, crypto is entering a new era.

Time to amplify your dreams—raise your targets tenfold! The future of crypto is broader than you imagine.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News