The Battle for Anchored Asset Trading

TechFlow Selected TechFlow Selected

The Battle for Anchored Asset Trading

This article explores the historical evolution of anchored asset trading, the emerging importance of liquidity management, and future development trends.

Author: tokenbrice

Translation: LlamaC

Early Days of Pegged Asset Trading (2018–2019)

Once upon a time, more than five years ago, the only options available on mainnet for trading were Uniswap, Bancor, and some clunky order-book-based decentralized exchanges (DEXs) like EtherDelta. As such, choices for pegged asset trading were extremely limited—we had to rely solely on Uniswap V2’s USDC/USDT pool, which was nothing short of madness.

Let’s zoom into this historical anecdote to grasp the extent of inefficiency back then. For liquidity pools, the key parameter is the relative price movement between two assets—you’re likely very familiar with this if you’ve ever provided liquidity (LP) in volatile pairs. For example, when providing liquidity for LINK/ETH, the biggest impermanent loss pain point occurs when ETH surges while LINK plummets: your LP position ends up with fewer ETH (which rose in price) and more LINK (which dropped).

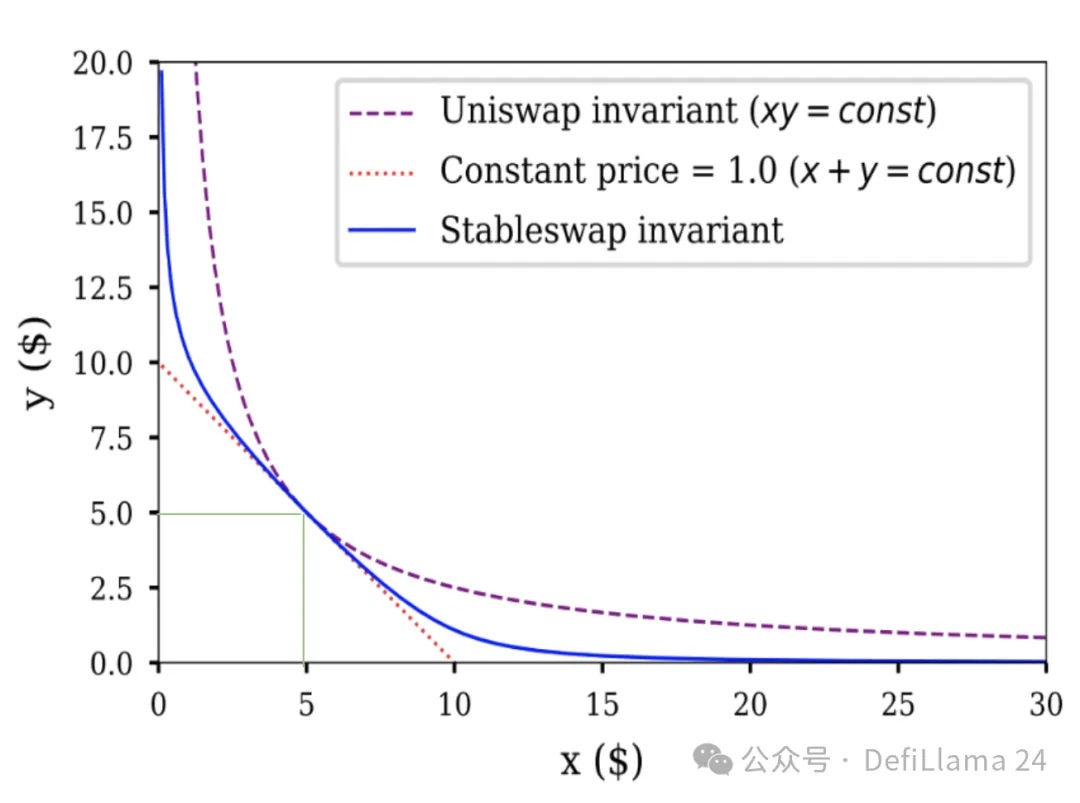

But USDC/USDT is different—these two assets are highly correlated. Their prices diverged by up to around 10% during a specific event (the USDC SVB depeg); under normal conditions, their spread stays within basis points. However, UNIv2 spreads liquidity across the entire price range, meaning it allocates equal liquidity from 1 USDC = 0.0000000001 USDT all the way to 1 USDC = 10000000000000 USDT. Simply put: 99.9% of the liquidity in UNIv2_USDC/USDT will never be used. A chart makes this clearer:

◎ x*y=k vs StableSwap

The only valuable liquidity (assuming 1 USDC ≃ 1 USDT) lies at the intersection of the two green lines—just a tiny fraction of the entire liquidity curve.

On the other hand, note the blue curve showing stableswap liquidity distribution for stablecoin trading in the same chart. For assets with similar prices, the area covered by this curve is vastly larger than under Uniswap’s invariant.

The StableSwap Revolution in Pegged Asset Trading (2020)

As soon as StableSwap launched, stablecoin liquidity quickly migrated there due to its dramatically improved efficiency (we’re talking over 100x more efficient than UNIv2). It was the first instance of concentrated liquidity on mainnet, predating UNIv3. Direct comparison is difficult—UNIv3 is more flexible, while Curve-StableSwap is more focused—but credit must be given where it's due. Beyond efficiency gains, Curve also introduced an incentive model—veCRV+CRV rewards—which has been discussed multiple times in this blog.

Incentives are crucial for pegged asset pairs due to their unique characteristics: compared to volatile pairs, they generally have lower overall volume and LPs earn far less in fees (until recently, volatile assets charged 0.3%–1% per trade, while pegged pairs were at 0.05%). Their volume spikes are tied to events related to the asset (e.g., the USDC depeg was one of the highest-volume days in USDC history).

For all these reasons, until recently I believed incentives were even more critical for pegged asset pairs than for volatile ones. But with the emergence of Fluid DEX and EulerSwap, I no longer think so. Before diving into them, however, we must revisit another milestone in the history of pegged asset liquidity: the launch of Uniswap V3.

The Arrival of Uniswap V3 Concentrated Liquidity (2021)

Uniswap V3 launched, offering customizable concentrated liquidity for nearly all asset types, significantly boosting efficiency for all liquidity providers. Yet because it applied broadly—not just to pegged assets—this also meant LPs in volatile pairs faced higher impermanent loss. Given the novelty of this liquidity structure and the lack of early infrastructure, UNIv3 adoption initially progressed slowly.

Nevertheless, this customizable concentration brought tangible benefits, especially for what I call “loosely pegged” subcategories: pairs like wstETH/ETH (correlated, but wstETH unilaterally appreciates against ETH), or LUSD/USDC (correlated, but LUSD may float slightly above or below par).

In such cases, UNIv3’s concentrated liquidity allowed LPs to replicate Curve’s Stableswap-level efficiency, but adjusted according to the token’s price trajectory—again leading to massive efficiency gains. Still, the ultimate breakthrough (by today’s industry standards) didn’t arrive until years later, with Fluid DEX and EulerSwap.

Debt as Liquidity (2025)

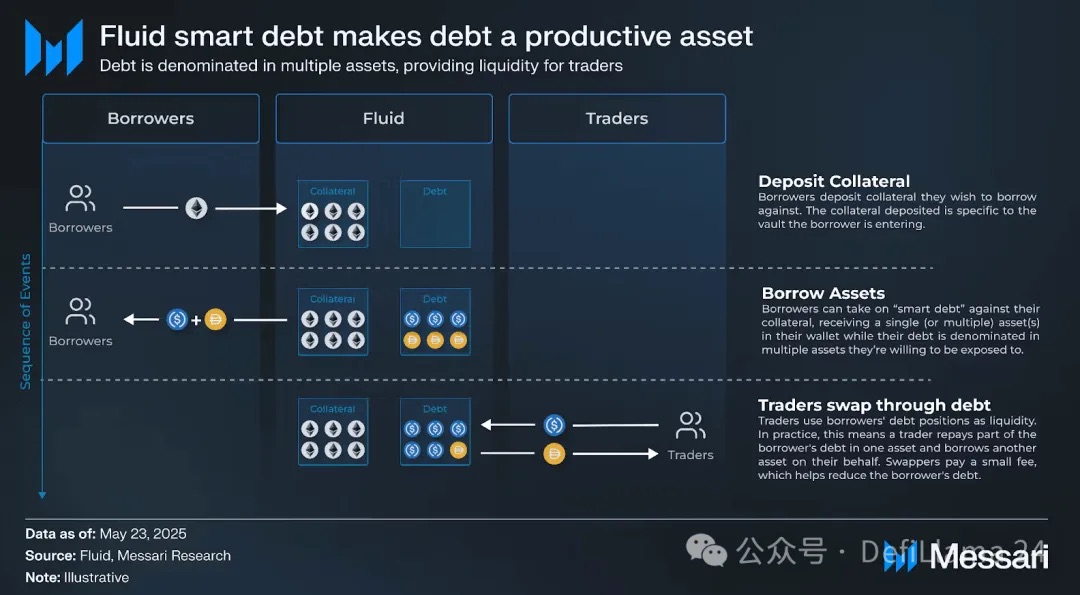

For brevity, I won’t delve deeply into Fluid and EulerSwap’s models here—I’m more interested in their implications for liquidity building. In short, Fluid found an innovative way to turn debt into liquidity via “smart debt.”

Imagine a regular user depositing ETH as collateral and borrowing USDC. Does he truly care about getting USDC specifically? Likely not—as long as the borrowed asset is a safe, USD-pegged stablecoin. He’d probably accept USDT just as well.

This is exactly what smart debt enables. In a smart debt vault, borrowers draw a mix of USDC and USDT that dynamically shifts—their debt now serves as liquidity for the USDC/USDT pair. For the borrower, this means lower borrowing costs, as they can now earn trading fees, potentially offsetting interest expenses.

That’s the borrower’s perspective. Now let’s shift to the protocol mindset. What does this mean for Circle and Tether? Essentially: near-zero-cost liquidity, with no need for incentives. This isn’t new for Circle, which has long been supported by the ecosystem—but for other stablecoins like GHO, BOLD, or FRAX, this is transformative.

I’m focusing mainly on Fluid here, but the logic is similar with EulerSwap, albeit implemented differently. EulerSwap is still in testing, but already generates significant volume on the USDC/USDT pair.

If you understand this, you’ll see my point: “I believe in DeFi, ultimately no pegged asset trading will be dominated by anything other than Euler/Fluid/similar projects.”

Still unclear? Keep these points in mind:

Pegged asset pairs typically have low volume ⇒ low fees. Therefore, on traditional DEXs, they require heavy incentives to sustain liquidity. Fluid and Euler can maintain such liquidity at almost zero cost.

⇒ If (and it’s already starting) fee competition in pegged asset trading turns into a “price war,” traditional DEXs have zero chance of winning.

0xOrb, a Potential Challenger (~2026)?

To give you a full picture of the pegged asset trading landscape, I must mention another project not yet live but potentially promising: 0xOrb. Its promise is simple: stablecoin trading, but supporting n assets, with n up to 1000.

Take stablecoins as an example: imagine a super pool well-supplied with USDC and USDT, gradually incorporating “alternative” stablecoins and offering excellent liquidity for their trades against mainstream ones. This approach has advantages for long-tail pegged assets, but I don’t believe such pools will dominate core volumes (like USDC<>USDT or cbBTC<>wBTC).

Additionally, such pools could enable cross-chain functionality, though I believe the benefits here are negligible or even harmful (⇒ increased infrastructure risk and complexity without meaningful upside), especially since products like CCTP now allow USDC and USDT to transfer 1:1 across chains faster than ever.

What does this mean for existing pure-play DEX participants?

First, the most important caveat: we’re discussing pegged asset trading. Replicating this strategy on volatile pairs is far more difficult, as evidenced by losses suffered by Fluid’s Smart Debt+Collateral ETH/USDC vault and its LPs.

DEXs like Aerodrome, which generate most of their volume and fees from volatile pairs, may remain unaffected by these newcomers. However, the reality is much harsher for DEXs focused on pegged assets. At the end of this article, I’d like to examine two such examples:

Curve: Game Over Unless Major Changes Happen

Pegged asset trading remains crucial for Curve, which is still seen as the home of stablecoin liquidity. True, there were attempts to capture volatile volume via CryptoSwap, but they ultimately failed.

With the arrival of Fluid and EulerSwap, I believe Curve is the DEX most likely to lose market share. I don’t think it can retain significant volume (it’s already fallen out of the top ten), unless major changes occur: veCRV rework—learning from newer models like veAERO to optimize CRV incentive distribution; leveraging crvUSD to boost DEX efficiency—e.g., offering crvUSD loans to Curve LPs; new liquidity structures for volatile assets—to help Curve capture correlated volume.

Ekubo: Confident Latecomer Accelerating Toward Demise

Ekubo’s case is arguably worse, as they entered the space recently. On the surface, Ekubo is a fast-growing DEX on Ethereum with substantial volume. Fundamentally, it’s an alternative to UNIv4 with more customizable liquidity structures and a DAO fee capture lower than Uniswap’s (though this is already minimal, it still exists).

The problem lies in the source of volume: the vast majority (over 95%) is concentrated in the USDC/USDT pair, with a mere 0.00005% fee and heavy incentives. Ekubo is essentially fighting a price war it cannot win long-term, because Ekubo cannot sustain ultra-low fees indefinitely (LPs need yield), whereas Fluid/Euler can (if borrowers gain even 0.1% via smart debt, they’re better off and satisfied).

◎ Ekubo statistics as of July 7, 2025

A pool with $2.6M TVL processing ~$130M daily volume, collecting $662 in daily fees, and incentivizing ~8% in EKUBO tokens—they’re rapidly approaching their operational limits.

Most ironically, it was Ekubo itself that initiated this “price war” with its USDC/USDT fee rate, only to be crushed under its own rules. DeFi never fails to entertain.

As always, I hope this piece offered insights and deepened your understanding of the pegged asset trading game. I look forward to being “roasted” by the Ekubo community simply for stating fact-based opinions—their reaction only strengthens my confidence, as I’ve observed the same pattern before:

I criticized MAI’s absurd security measures, and it was soon hacked and depegged.

I called out R/David Garai’s manipulation and lies, and less than six months later, R was hacked and nearly vanished.

I questioned Prisma team’s actions, and within twelve months, they were hacked and shut down the protocol.

The list goes on. Best of luck to all.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News