Hotcoin Research | Unveiling the Rotation Patterns, Current Phase, and Trend Forecast of the Altcoin Season

TechFlow Selected TechFlow Selected

Hotcoin Research | Unveiling the Rotation Patterns, Current Phase, and Trend Forecast of the Altcoin Season

The alt season in the crypto market is both a stage for ordinary investors to achieve financial leaps and a battleground where greed and fear intertwine.

1. Introduction

As Bitcoin's price breaks through a new high of $120,000, the bull market's "altseason" is brewing and gaining momentum. Altseason refers to a frenzied cycle in the crypto market where non-Bitcoin assets (altcoins) collectively outperform Bitcoin, during which various altcoins surge in price and investor sentiment runs high. However, the backdrop of this bull market differs from previous ones—for example, global macro interest rates remain elevated, crypto regulation is trending toward loosening, institutional capital continues entering via ETFs, enterprises are actively building crypto asset reserves and treasury strategies, and meme coins are rampant—giving rise to new characteristics in this round of altcoin performance.

This article will analyze the new trends and differences of the 2025 altseason by reviewing historical patterns of sector rotation during past bull markets, combined with current macroeconomic conditions and capital flow dynamics. It will also break down the stage divisions and rhythm features of altcoin rotation, assess the current market phase, identify promising sectors and potential assets worth watching, and provide participation strategy recommendations for retail investors—helping everyone stay rational amid the market frenzy, seize opportunities, and avoid unnecessary risks.

2. Historical Review: Altseason and Sector Rotation Patterns in Bull Markets

The concept of altseason truly entered mainstream awareness around 2017. In early crypto markets, Bitcoin dominated while other "alt" coins were relatively small. But as Bitcoin climbed past $3,000 and then $10,000 in 2017, capital began spilling out of Bitcoin into Ethereum and various ICO tokens, triggering the first large-scale altcoin frenzy in history. The period from Q4 2017 to early 2018 is often seen as the first typical "altseason," when investors were astonished to find nearly every token surging in value. Several notable phenomena emerged at that time:

- Fund rotation: After Bitcoin surged for some time and started stagnating or consolidating, smart money gradually took profits from BTC and sought higher-risk, higher-return assets, flowing sequentially into ETH, major public chains, large-cap altcoins, and eventually even small-cap tokens and MEME coins. During this process, Bitcoin’s market cap share dropped significantly—BTC dominance peaked at around 80% in February 2017 but fell below 32% by January 2018. This rapid decline in BTC dominance is typically viewed as a key signal of an altseason launch.

- Price performance: Overall gains in altcoins far exceeded those of Bitcoin. During the 2017 ICO boom, Bitcoin rose from under $1,000 at the start of the year to nearly $20,000 by year-end—an increase of about 20x. Meanwhile, Ethereum surged from around $10 to a peak of $1,400, more than 100x growth, while certain altcoins like XRP achieved hundreds-of-times returns. According to CoinMarketCap data, during the early 2021 altseason, many large altcoins posted 90-day gains of several times to over tenfold. Overall, more than 75% of the top 50 altcoins outperformed Bitcoin during that quarter—the classic sign of an altseason. For instance, from February to May 2021, major altcoins on average gained 174%, while Bitcoin rose only 2%.

- Sentiment and trading heat: FOMO swept across the market—any coin would attract buyers. Social media buzzed with questions like “Did XX coin double again? Did I buy too late?” Telegram groups and Discord channels overflowed daily with screenshots of overnight riches, and new retail investors rushed in en masse. Experienced KOLs frequently made calls, centralized exchanges raced to list new tokens, and it became normal for small-cap coins to double immediately upon listing. Market sentiment hovered in the “extreme greed” zone, with speculative fever rising wave after wave.

- Sector rotation: Although it appeared broadly bullish at the peak, closer observation revealed internal sector rotation rhythms. In 2017, the spotlight first fell on ICO concepts (led by Ethereum’s ERC20 token wave), followed by platform coins/public chains (such as EOS and NEO) taking center stage, with privacy coins (e.g., Monero, Dash) enjoying brief rallies in between. By the 2021 bull run, sector rotation was even clearer: DeFi mania in summer 2020 kicked off the alt rally, succeeded by Layer1 chain battles (the rise of BSC ecosystem, Solana, etc.) and NFT craze in early 2021, followed by meme coins (Dogecoin DOGE, SHIB soaring under Musk’s influence) and finally the metaverse/GameFi boom by year-end. Each sub-sector typically led the charge for a period before slowing down, allowing market attention to shift to new themes. The overall altseason usually lasted a window of several months.

While altseason brought astonishing wealth effects, it often signaled the approaching end of the entire bull cycle. Historical data shows that whenever altcoins surged widely and the public reveled in the joy of “small coins multiplying tenfold,” fresh capital inflows were often nearing exhaustion, leaving the market in an extremely excited yet fragile state. Once buying pressure failed to keep up, the bubble burst rapidly. For example, after altcoins peaked in January 2018, their market caps halved within weeks, trapping many investors at the top before they could exit. Similarly, the May 2021 crash demonstrated sharply increased risks following the frenzy. Altseason may present opportunities in each bull market, but it often comes with extreme volatility and risk—investors must seize opportunities while staying alert to potential turning points.

3. Macro Background of the 2025 Altseason: Capital Flow Characteristics and Differences from the Past

In July 2025, the altcoin market displayed broad-based gains: CryptoBubbles data showed monthly increases of 20%–200% across numerous mainstream altcoins, creating a vast “green sea,” signaling capital flowing from Bitcoin into broader crypto assets.

Source: https://cryptobubbles.net/

In this cycle, both the market environment and altcoin performance have undergone subtle changes. On one hand, after Bitcoin’s fourth block reward halving (April 2024), the market entered its expected upward phase. However, the macroeconomic backdrop differs significantly from previous major bull markets: major global central banks underwent tightening in 2022–2023, and high-interest-rate policies have not fully pivoted to easing. In other words, this crypto bull market did not begin amid “flooded liquidity,” but rather resembles a structural reorganization of existing capital driven by future expectations. This is reflected in new characteristics in capital inflow sources:

- Stablecoins as primary source of incremental capital: In past altseasons, the typical pattern was Bitcoin surging, increasing holders’ paper wealth, with part of the profits reinvested into altcoins. This cycle is different—capital no longer flows mainly from selling BTC into altcoin markets, but instead enters directly via stablecoins. This means both retail and institutional investors increasingly prefer purchasing altcoins directly with fiat-converted stablecoins. This phenomenon reflects the maturity of stablecoin infrastructure and indicates a significant portion of new capital is bypassing BTC entirely to enter other sectors. Bitcoin is no longer the sole entry point—stablecoins are becoming a “reservoir” role.

- Institutional capital and ETF effect: Another key difference in this bull market is heightened participation from traditional institutions. With spot Bitcoin and Ethereum ETFs approved in early 2025, institutional capital flooded in—largely diverted from traditional stocks, gold, and similar assets—primarily focused on Bitcoin and major assets, avoiding high-risk small-cap coins. Institutional bull markets and retail-driven bull markets have become somewhat decoupled in this cycle: ETFs helped Bitcoin absorb capital independently, creating a “magnet effect” on funds that might otherwise flow into altcoins. This contrasts with prior cycles—where BTC’s rise pulled ETH and alts upward together—while now BTC absorbs market attention more independently due to institutional inflows.

- Meme coin分流 (diversion): If institutional capital favors Bitcoin, then among the more speculative retail segments, another unique phenomenon has emerged this cycle: low-market-cap meme coins on-chain have absorbed massive speculative capital. The launch and rise of one-click meme coin platforms like Pump.fun provided endless speculative narratives. These meme coins typically lack fundamental support but attract waves of followers inspired by early participants' explosive gains. As a result, capital that would normally flow into mainstream alt projects has been largely diverted to ultra-small-cap on-chain meme coins. Some early adopters multiplied their wealth several or even dozens of times within days, but for latecomers, most such meme coins suffered 70%–90% drawdowns shortly after spikes, with liquidity drying up quickly—becoming traps that drain retail wealth. This intense “internal capital burnout” was not prominent in previous altseasons. Indeed, retail speculation this cycle has been partially siphoned off by the meme sector, diluting capital available to mainstream altcoins.

- Narrative explosion and political factors: Macroeconomic narratives and political events have also exerted direct impact on crypto markets—a rare feature in past altseasons. Former U.S. President Trump actively promoted pro-crypto policies; his Trump Organization made a high-profile entry into crypto, launching the World Liberty Financial platform and issuing the $WLFI token, advocating for Bitcoin inclusion in U.S. strategic reserves—igniting the so-called “political narrative” sector and driving short-term surges in related tokens like MAGA and TRUMP. Meanwhile, signs of easing in U.S. policy and interest rate environments further fueled market imagination. Political involvement not only created short-term hotspots but elevated crypto issues to the level of national strategy—a scenario unseen in previous bull runs. Additionally, tech-driven narratives like “AI,” “Web3 social,” and others emerged one after another, developing in parallel and leading to highly fragmented market themes.

Taken together, the 2025 altseason reveals an ecosystem unlike any before: capital no longer uniformly lifts all altcoins, but instead rotates rapidly across different sectors, with themes rising and falling swiftly. Based on thematic strength and funding backgrounds, various sectors exhibit “fragmented” price movements. The crypto market has successively seen mini-booms in AI Agents, SocialFi (social finance), Politifi (political finance), SciFi (science finance), Ethereum restaking, DePIN, RWA, and others. Each sector briefly attracted a flood of capital before quickly fading. Under this rhythm, the traditional image of “all altcoins rising and falling together” has faded—the “altseason” is no longer a period of synchronized prosperity for all altcoins, but rather a series of narrative-driven rotational moves.

4. Stages and Rhythm of Altcoin Rotation: Where Are We Now?

Despite evolving expressions of the current alt market, the阶段性 nature of capital rotation remains evident. Drawing from historical patterns and current conditions, altseasons typically follow a rotation from “large” to “small” and can be roughly divided into four stages:

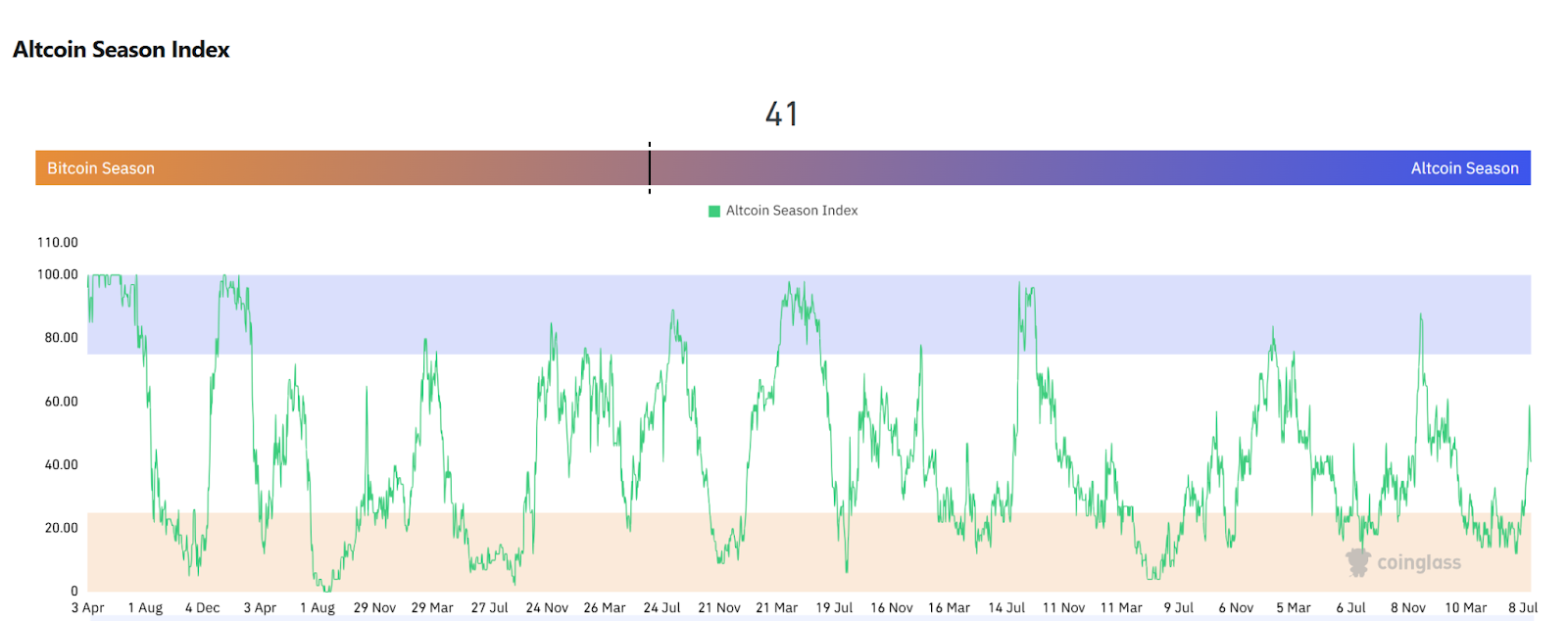

- Stage 1 – Bitcoin Dominance (Altseason Index: 0–25):

In this phase, the entire market is led by Bitcoin, with capital flooding into BTC and pushing up its price and market cap share. The altseason index typically stays low (0–25 range), indicating clear BTC dominance—altcoins may rise alongside but generally underperform BTC. This structure is common in early bull or recovery phases. From early 2025 onward, Bitcoin led most of the time, with BTC.D rising to multi-year highs above 65%. Investor mindset during this phase is usually “hold core assets and wait for gains.”

- Stage 2 – Ethereum and Large Alts Launch (Altseason Index: 25–50):

Next, when Bitcoin’s surge slows or stalls, a “capital spillover effect” emerges. Smart money takes partial profits from BTC and shifts into Ethereum and other large-cap alts. A typical signal is ETH/BTC exchange rate beginning to rise, with Ethereum outperforming Bitcoin. Market discussions emerge about “Ethereum surpassing Bitcoin.” Combined with rising DApp activity on Ethereum, ETH attracts outsized attention. Toward the end of Stage 2, capital begins gently flowing into other high-market-cap altcoins, with noticeable catch-up rallies in top 20–30 coins (e.g., BNB, SOL, ADA). Current market features suggest we are in the late part of this stage (Altcoin Season Index approaching 50): Ethereum outperforms Bitcoin, and capital flows are diversifying.

- Stage 3 – Broad Rally in Large-Cap Alts (Altseason Index: 50–75):

After Ethereum achieves substantial gains and risk appetite rises further, capital flows into other large-cap altcoins. In this stage, leading mainstream coins (L1 chains, platform tokens, etc.) tend to rise together, showing strong and sustained gains, with optimistic but not yet manic sentiment. The altseason index sits in the mid-to-high range (50–75), meaning over half of major altcoins begin outperforming Bitcoin. At this point, rational investors should start evaluating which coins have risen too far and consider taking partial profits.

- Stage 4 – Small-Cap Mania and Emotional Frenzy (Altseason Index: 75+):

This is the peak—and also the end—of altseason. During this phase, regardless of project fundamentals, nearly all tokens across market caps soar, amid wildly euphoric and irrational sentiment. The altseason index reaches extreme levels (75–100), indicating the vast majority of altcoins are outperforming Bitcoin, reflecting irrational exuberance. Typical signs include emotional bellwethers like Dogecoin spiking sharply in short bursts; media language filled with terms like “mania” and “feast”; and Bitcoin dominance dropping below 50%, even 45%. Yet this phase is also the riskiest, with the largest bubbles. When the altseason index exceeds 75 and keeps climbing, investors should exercise high caution and gradually reduce exposure.

Source: https://www.coinglass.com/pro/i/alt-coin-season

Market features since July 2025 indicate altseason has begun but hasn’t reached its most frenzied phase. Specifically, Bitcoin surged first in the first half of the year and stabilized its dominance above 60%, completing Stage 1. Recently, ETH has consistently outperformed BTC, signaling the start of Stage 2. With Ethereum leading, large-cap alts (SOL, ADA, etc.) are showing clear signs of upward movement—a transition signal toward Stage 3. However, the full-blown small-cap frenzy (Stage 4) appears not yet arrived: the Altcoin Season Index currently hovers around 40–50, far from extremes; Bitcoin dominance has only dipped from ~65% to just above 60%, without a cliff-like collapse. While some sentiment indicators, such as meme coin activity, have warmed up, the market remains distant from true “mania.” Therefore, the current phase roughly corresponds to late Stage 2 to early Stage 3—the period when large-cap alts lead gains and momentum spreads to mid- and small-cap coins.

5. Analysis of Currently Promising Sectors and Tokens

Although this altseason features “fast sector rotation and fewer synchronized rallies,” this doesn’t mean investment opportunities are absent. Correctly identifying hot sectors and quality tokens remains key to achieving alpha. In this highly fragmented narrative market, investors need sharp eyes to distinguish which tracks are genuinely backed by capital and fundamentals versus pure hype. This section reviews several key sectors and tokens worth watching based on market trends and research insights.

- RWA Sector: RWA has been one of the standout performers in this cycle. Data shows RWA protocol tokens have already achieved average gains exceeding 15x, far outpacing most other sectors. The strength of RWA lies partly in its narrative alignment with institutional needs—tokenizing real-world assets (e.g., bonds, bills, real estate rights) on-chain is seen as a bridge between traditional finance and crypto. For RWA, prioritize projects with proven scale and survival through bear markets (e.g., ONDO, SKY), as they offer stronger advantages in institutional adoption and risk management.

- AI Sector: AI narratives are equally red-hot in Web3. Blockchain-AI convergence includes using blockchain to ensure credibility of AI data sources and model training, incentivizing AI compute or data contributions via tokens, and creating autonomous AI agents that execute tasks on-chain. The earlier 2025 “AI Agent” boom exemplified this trend. Investors should beware many AI projects lack clear revenue models and rely solely on hype. However, technically solid projects with big-tech partnerships deserve attention. For example, Bittensor (TAO) aims to build a blockchain-based decentralized machine learning network. Fetch.ai, Ocean Protocol, and SingularityNET merged in July 2024 to form the Artificial Superintelligence Alliance (ASI), planning to first merge AGIX and OCEAN into FET, then convert all FET into ASI. Virtuals Protocol (VIRTUAL) combines blockchain and AI to overcome current limitations in deploying, monetizing, and interacting with AI agents.

- DePIN Sector: DePIN (Decentralized Physical Infrastructure Network) refers to projects using crypto incentives to build real-world infrastructure. Examples include Helium incentivizing distributed IoT hotspot networks, Pollen Mobile attempting decentralized cellular networks, and Filecoin using blockchain to incentivize distributed storage. Research reports name DePIN as a key theme in 2024, with potential to extend crypto incentives into physical domains. DePIN attracts industrial capital and tech pioneers, often delivering independent price moves during bull markets. Helium created a buzz in 2021, and Filecoin’s decentralized storage has recently regained attention. If infrastructure tokens (e.g., FIL, HNT) have lagged for long despite solid fundamentals, they may see valuation rebounds when market preference shifts from pure financial speculation to real-world tech deployment. DePIN suits patient, long-term investors—but positions should be sized carefully due to high technical and regulatory risks (involving spectrum rights, hardware deployment, etc.).

- Layer2 and Modular Blockchain Sector: L2 tokens (e.g., ARB, OP) stand to benefit from rising on-chain activity and user migration in bull markets, emerging as new “large-cap alts.” For example, Robinhood announced tokenized stock trading and launched a dedicated RWA-focused L2 on Arbitrum. Also noteworthy is the modular blockchain concept—Celestia’s architecture separates execution and data layers to improve efficiency, hailed as a new paradigm in blockchain tech. If such foundational innovations prove viable, related tokens (e.g., Celestia’s TIA) could attract strong capital inflows.

- DeFi 2.0 and Native New Finance Sector: Compared to the 2020 DeFi boom, this bull market has seen a quieter DeFi scene. After the 2022 crash and cleanouts, valuations of leading DeFi projects shrank drastically—Uniswap, Aave, Compound, etc., saw market caps drop over 70% from peaks. If the broader market continues warming and capital flows back into on-chain activity, these protocols with real revenue and user bases could undergo value re-rating. Post-Ethereum Shanghai upgrade enabling staking withdrawals, LSD and restaking ecosystems spawned new yield strategies and protocols (e.g., EigenLayer, Pendle). To invest in DeFi, monitor metrics such as protocol revenue and fee growth, TVL trends, community governance, and token buyback/burn activities.

- Meme Coin Sector: Meme coins remain a constant in crypto—every late-stage bull market sees them sprout like mushrooms after rain. This cycle has seen temporary stars like BONK, PENGU, USELESS, not to mention evergreen giants like Doge, SHIB, PEPE. Investing in meme coins resembles participating in a social psychology experiment—price swings depend almost entirely on sentiment and narrative, not intrinsic value. As previously noted, many on-chain meme coins plunged 70%–80% shortly after spikes, confirming their “hot potato” nature. If interested, investors must prepare for risk: small positions, strict take-profit and stop-loss rules. Treat meme coins as entertainment or seasoning—never go all-in, or you risk being the last one holding the bag.

6. Participation Strategy for Retail Investors: Navigating Altseason Rationally

Altseason may get your blood pumping, but for retail investors, staying calm amid the frenzy and avoiding risks while seizing opportunities is key to long-term success. This section offers practical advice from three angles—risk management, position sizing, and timing—to help mainstream investors participate skillfully in altseason.

1. Risk Awareness Before Profit Dreams: Entering altseason requires recognizing that big risks come with big opportunities. History repeatedly shows altcoin surges bring extreme volatility—those with the highest gains often suffer the steepest falls. Mentally prepare for drawdowns of 30%, 50%, or more. When everyone around you talks about a coin multiplying tenfold, jumping in then likely means nearing the peak. Remind yourself: “Markets always follow the 80/20 rule—others may be in the 20% profiting, but you might end up in the 80% holding the bag.” Only by constantly keeping risk awareness front of mind can you stay sober amid the madness.

2. Position Control and Diversification: Given altcoins’ high volatility, position management is crucial. Never bet everything on a single altcoin—no matter how much you believe in a project, guard against black swans and sudden reversals. A sound approach divides capital: allocate core holdings to relatively stable assets (e.g., BTC, ETH, or top-10 coins) to ensure your portfolio retains resilience even if alts correct sharply. Use only a smaller portion for high-risk, high-reward plays on small caps or trending themes. For instance, limit altseason speculation to 20%–30% of total funds, keeping the rest in core assets or stablecoins. That way, even if wrong, losses stay manageable. Also diversify within alt positions—don’t put all eggs in one basket.

3. Ride the Wave, Watch the Rhythm: Altseason investing should follow market rhythm, not fight it. During Stages 1–2 (BTC and ETH leading), hold more BTC/ETH and avoid frequent swapping—strong trends persist, and switching prematurely to weaker coins may cost you gains. When entering Stages 3–4 and multiple alts ignite, gradually rotate BTC profits into strong alts—but closely monitor market winds. For example, when even tiny coins are rocketing and newbies flood in, it may signal the end—time to reduce risk exposure. Use objective indicators: the Altcoin Season Index is a useful tool—when it climbs very high (e.g., >75) and stays there, altseason overheating is likely. Also watch for Bitcoin dominance breaking key levels (e.g., 50%) and media headlines turning irrationally euphoric.

4. Set Targets and Stop-Losses, Stick to the Plan: Discipline is vital in fast-moving altseasons. Always define exit conditions before buying any altcoin. For example: “Sell portions incrementally if gain hits +50%, +100%”; “Stop out if price drops -20% to avoid deep losses.” Setting and following such rules prevents emotion from hijacking decisions. Especially for small-cap investments, always set a stop-loss—mistiming can trigger consecutive plunges. For profit-taking, use gradual exits—sell in tranches during rallies rather than waiting for an absolute peak (nearly impossible). Tranching locks in gains while letting some position chase tail-end surges, reducing psychological stress.

5. Stay Rational, Don’t Be Driven by Greed or Fear: Altseason tests human greed and fear. When your coin hits green daily, it’s easy to grow overconfident, pile on leverage, or even borrow—but that’s often when risks peak. Conversely, when the market crashes and panic spreads, emotional sell-offs may dump positions at irrational lows. Constantly remind yourself of discipline. If high volatility makes rationality hard, reduce trading frequency, cut positions, or even step aside. As the old saying goes: “The market always offers the next opportunity—first, survive.” Never gamble everything out of greed, nor lose judgment to fear.

Conclusion

The crypto altseason is both a stage where ordinary investors can leapfrog wealth and a battlefield where greed and fear collide. Looking back at past bull markets, we’ve observed cyclical patterns in alt sector rotation and witnessed countless legends and bubbles. Likewise, in the 2025 cycle, although altseason displays more fragmentation and faster rotation, its core drivers remain unchanged: human risk appetite and the pursuit of new opportunities. For retail investors, embracing altseason’s chances must go hand in hand with respecting the market and its risks. Opportunities belong to the prepared. We hope everyone enjoys rewards in this grand altseason drama while exiting safely.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We have built a “trinity” service system combining “trend assessment + value discovery + real-time tracking,” offering precise market interpretations and practical strategies for investors at all levels through deep dives into industry trends, multi-dimensional evaluations of promising projects, and round-the-clock market volatility monitoring. With weekly dual-updated strategy livestreams “Top Coins Selection” and daily news brief “Blockchain Headlines Today,” supported by cutting-edge data analytics models and industry networks, we continuously empower novice investors to build cognitive frameworks and help professional institutions capture alpha, jointly seizing value growth opportunities in the Web3 era.

Risk Warning

Cryptocurrency markets are highly volatile and inherently risky. We strongly recommend investors fully understand these risks and operate strictly within a sound risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News