What should the Clear Act focus on after the Genius Act

TechFlow Selected TechFlow Selected

What should the Clear Act focus on after the Genius Act

The crypto industry has now entered the mainstream.

Original author: Zuo Yeye Waiwo Mountain

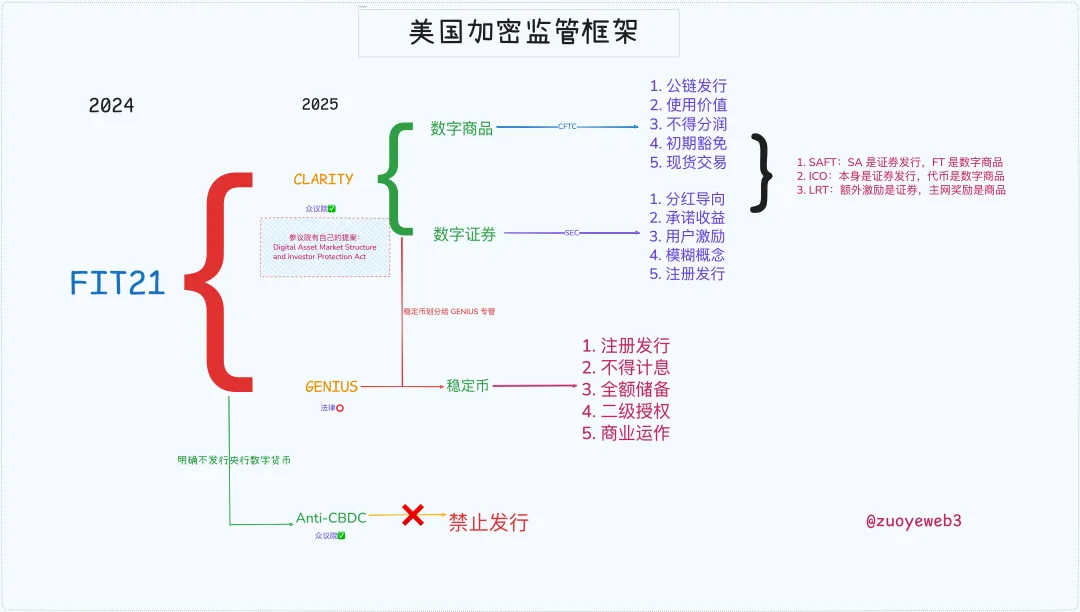

Crypto Week three-part legislative push: the Genius Act, specifically regulating stablecoins, has become law, while the anti-CBDC bill and the CLARITY Act remain in the legislative process.

Unlike the Genius Act, CLARITY focuses on foundational definitions and jurisdictional allocations for crypto—especially public blockchains, DeFi, token issuance, and the powers and responsibilities of the SEC and CFTC—and is closely tied to the 2024 FIT21 Act.

With this, the U.S. has established a comprehensive regulatory framework drawn from past practice—understanding history is key to clarifying the future.

Financial Liberalization, the Wild New West

The right to mint currency and inflation: the Fed guards the former under the pretext of controlling the latter, while Trump abandons the latter to amplify the former.

The Genius Act ushers in an era of free stablecoins. Powell’s insistence on independent monetary authority is fragmented and transferred to Silicon Valley newcomers and Wall Street old money—but this isn’t enough. Peter Thiel seeks absolute freedom for libertarians.

In 2008, the financial crisis made financial derivatives the target of widespread criticism. Obama urgently needed experts to rein in a $35 trillion futures market and a $400 trillion swaps market.

Thus, Gary Gensler was nominated as CFTC Chair, and in 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted, bringing derivatives markets into the existing regulatory system.

Gary declared, “We must tame the Wild West”—this marked his first regulatory victory over the market.

History repeats itself. In 2021, Obama’s ally, President Biden, once again nominated Gary Gensler as SEC Chair, attempting to bring order to a new frontier—the cryptocurrency market.

Two focal points emerged:

1. The SEC has no dispute over BTC/ETH being commodities, but considers all other tokens and IXOs illegal securities offerings, including SOL and Ripple;

2. Regarding exchanges’ high-leverage practices, Gary believes they “induce” users, leading to special regulatory actions against both onshore and offshore platforms like Coinbase and Binance.

However, despite careful planning, Gary ultimately stumbled on ETFs—products that initially seemed outside regulatory focus. In 2021, the SEC approved Bitcoin futures ETFs but remained resistant to spot ETF applications from Grayscale and others.

Yet, for better or worse, after the SEC partially lost its case against Ripple’s IXO in 2024, it finally approved Bitcoin spot ETFs, allowing MicroStrategy to openly engage in a bitcoin-stock-bond cycle.

This time, the crypto industry—representing a wilder force—conquered the SEC, CFTC, White House, Congress, Federal Reserve, and Wall Street. An unguarded era has arrived.

A small footnote: SBF successfully got himself imprisoned in 2022 by donating tens of millions to Biden’s campaign—possibly a key reason behind Gary’s strict stance toward the crypto industry.

The CLARITY Act: Crypto Finally Gets Legitimized

Trump repays favors. The crypto industry can now operate openly and legitimately.

In 2025, as a symbolic reversal of two Democratic presidencies, Trump immediately fired Gary upon taking office and appointed Paul Atkins—a friend since 2016—as successor, ushering in full laissez-faire governance.

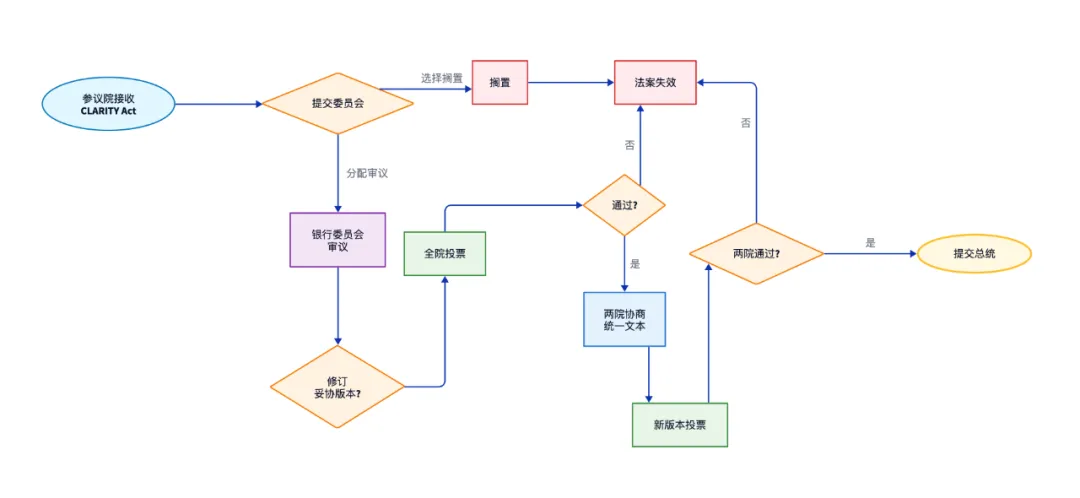

The CLARITY Act emerged against this backdrop. However, it must be noted: the CLARITY Act is still in the legislative process. It has passed the House but still requires Senate review.

The Senate also has its own Digital Asset Market Structure and Investor Protection Act, but under Republican-led agendas, crypto-friendly legislation is inevitable.

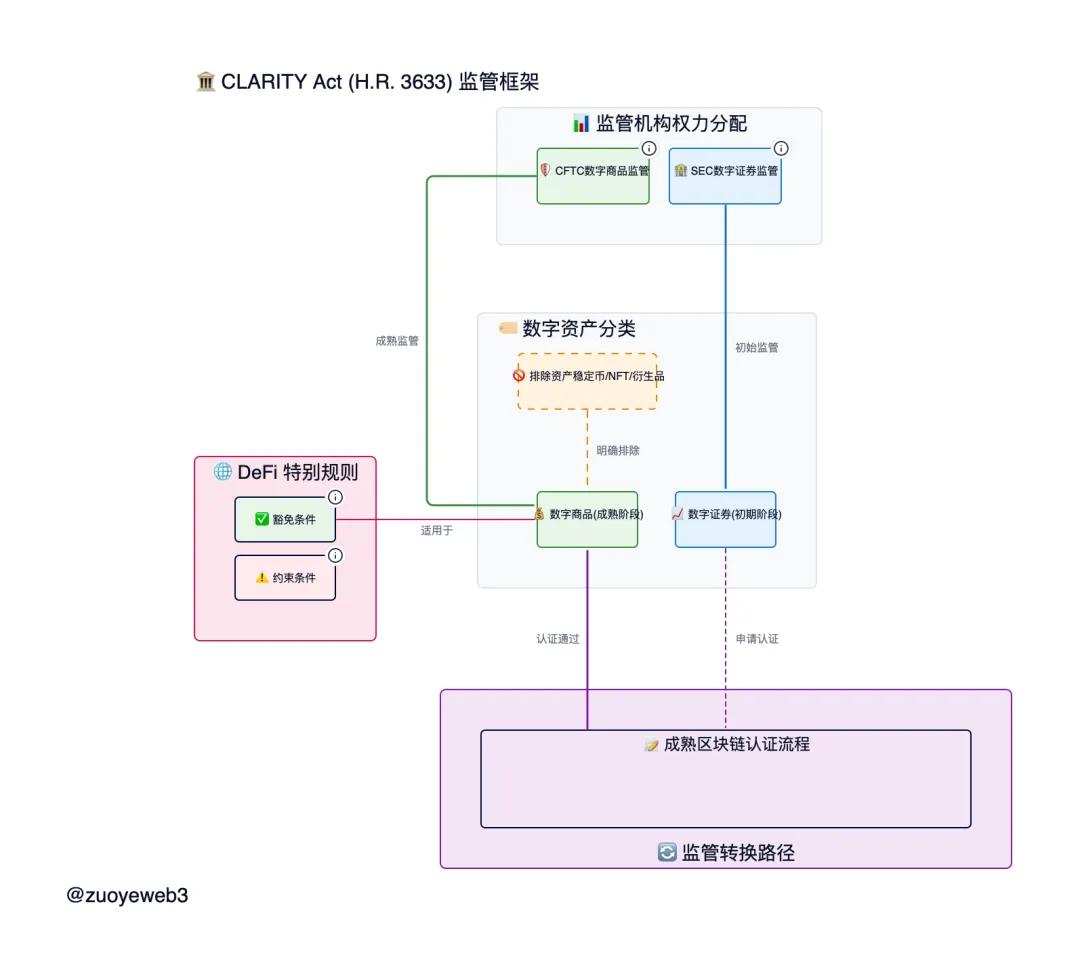

The current CLARITY Act designs a framework for digital commodities, digital assets, and stablecoins. It primarily limits stablecoins to payment instruments, assigns digital commodities to CFTC oversight, and digital assets to SEC regulation.

1. CFTC wins big: clearly establishes ETH and CFTC authority, blurs SEC boundaries with asset issuance.

ETH is a commodity. Truly decentralized blockchain tokens are all commodities, with trading falling under CFTC jurisdiction. Fundraising via IXO, SAFT, etc., remains under SEC oversight, but with a $75 million exemption threshold. Tokens issued thereafter may avoid penalties if transitioning to decentralization within four years.

2. Digital commodities: digital in form, commodity in substance.

Keeping pace with technological development, the act moves beyond crude distinctions between “physical goods” and “virtual assets,” recognizing digital commodities. Any token with practical utility for public blockchains, DeFi, or DAO protocol operations is no longer classified as a security.

However! NFTs must be classified as assets, not commodities, because each is unique and possesses only speculative or aesthetic value. They cannot serve as uniform exchange intermediaries like currency. Additionally, interest payments, rewards, and profit-sharing are only exempt from asset classification if they contribute to maintaining protocol decentralization; otherwise, they fall under SEC jurisdiction.

This definition remains abstract. At its core, the CLARITY Act distinguishes between token issuance and token operation. Below are three case categories I’ve compiled—please correct me if any inaccuracies exist:

-

IXO issuance is a security; issued tokens meeting conditions are not

-

Airdropped points are securities; airdropped tokens meeting conditions are not

-

Exchange distributions are not securities, but promised returns constitute securities

Meeting conditions refers to satisfying the definition of digital commodities, committing to transition into a decentralized protocol in the future, and enabling trading without intermediaries. Note: participation in a project itself may constitute investment; expecting returns classifies it as asset issuance.

Future definitions remain unclear, but many past cases offer guidance:

-

ETH is a digital commodity, but using SAFT to fund a project constitutes digital asset issuance under SEC jurisdiction. If the project later becomes fully decentralized, it becomes a digital commodity under CFTC oversight.

-

Native ETH staking is a commodity—it's a "system behavior" inherent to the PoS mechanism of the blockchain. Whether third-party DeFi staking protocols' tokens qualify as commodities remains uncertain. For example, Lido is debatable, while EigenLayer may lean more toward commodity status—specific regulatory details are needed.

-

Ethereum is a blockchain, but many L1/L2 chains launched via SAFT or IXO have four years to achieve decentralization, requiring no single centralized entity to control more than 20% of tokens or voting power. Current foundations or DAOs may not be automatically exempt—token distribution analysis is required.

The CLARITY Act is indeed detailed, establishing a joint SEC-CFTC regulatory framework. Digital commodities possess characteristics of both virtual securities and physical goods, necessitating joint oversight.

Conclusion

The CLARITY Act is a pivotal component of U.S. crypto regulation, defining core issues such as tokens and public blockchains, and clearly outlining digital commodities—the remainder naturally falls under assets, such as NFTs, stablecoins, and tokenized real-world assets (RWA).

However, DeFi operations remain in a gray area. Although the CLARITY Act amends the definition within securities law, DeFi is too significant. Just as there is dedicated securities legislation, the crypto market needs a specific DeFi Act, rather than lumping DeFi together with stablecoins, blockchains, and tokens.

This isn't overreaching. As the U.S. builds its crypto regulatory framework, the Tornado Cash case continues. The fate of co-founder Roman Storm will serve as a litmus test for judicial pressure driving legislative change.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News