Did I wake up too early? NFTs seem to be surging?

TechFlow Selected TechFlow Selected

Did I wake up too early? NFTs seem to be surging?

It's time to pull out the legendary little picture!

Author: Azuma, Odaily Planet Daily

The long-cold NFT sector seems to be showing signs of回暖 for the first time in a while.

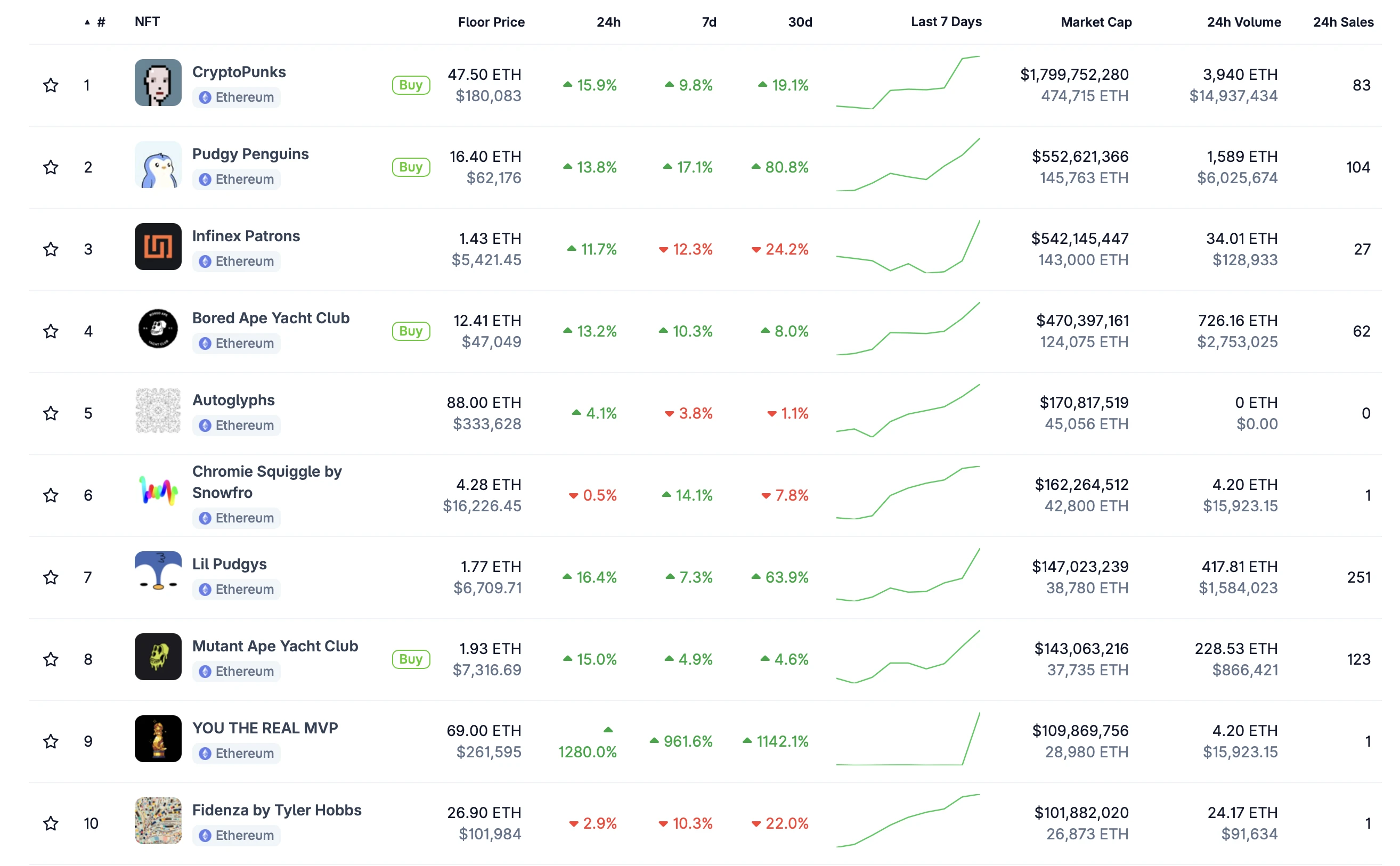

CoinGecko data shows that the total market cap of the NFT sector has rebounded above $6 billion, currently at $6.417 billion, with a 24-hour increase of 23.2%; trading volume growth is even more dramatic, with approximately $40 million traded in the past 24 hours, representing a surge of about 318.3%.

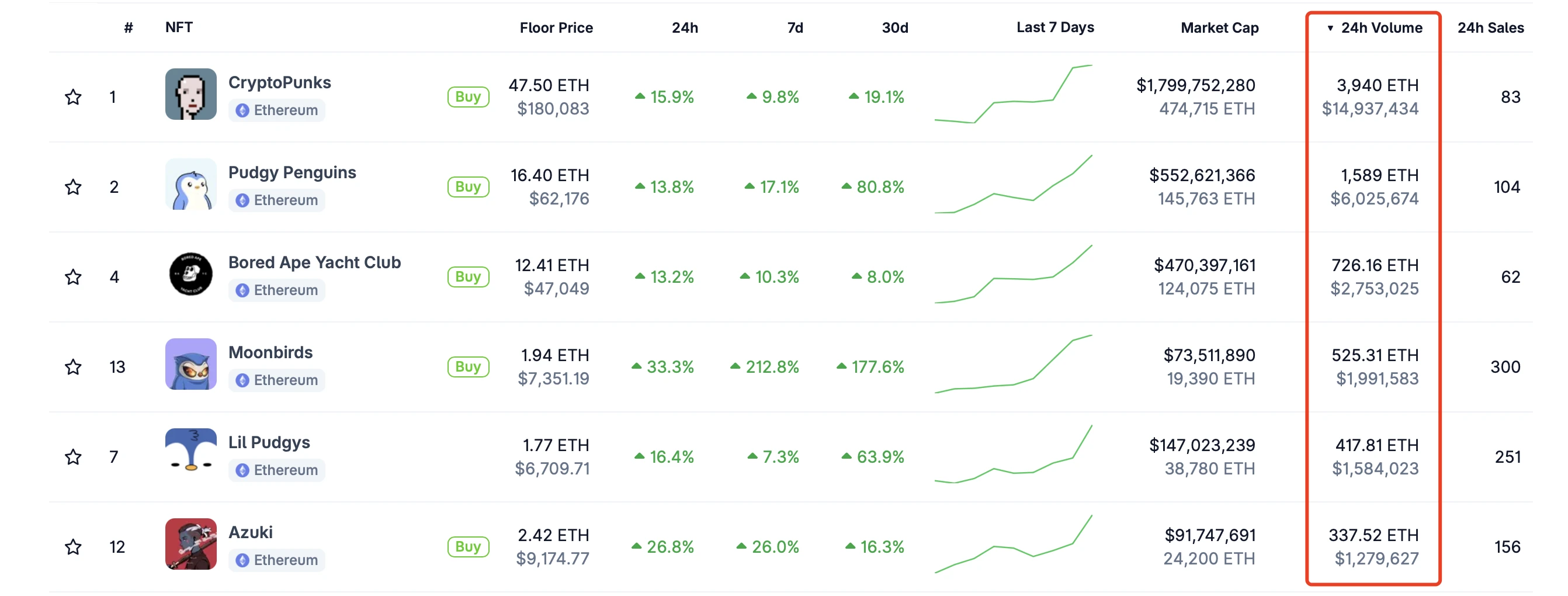

Among mainstream NFT projects, CryptoPunks, Moonbirds, and Pudgy Penguins have stood out particularly.

-

CryptoPunks surged after a whale spent millions of dollars last night acquiring 45 units (the same whale also bought multiple Chromie Squiggles). Artist Jediwolf reported that within just five hours from last night to this morning, a total of 76 CryptoPunks changed hands—the largest-scale buying spree for the collection since 2021. At the time of writing, the floor price of CryptoPunks was temporarily reported at 47.5 ETH, up 15.9% over 24 hours.

-

Moonbirds gained momentum after OpenSea briefly replaced its official X profile picture with an image from the Moonbirds series last night, boosting visibility. At the time of writing, the floor price of Moonbirds stood at 1.94 ETH, up 33.3% over 24 hours.

-

Pudgy Penguins, hailed as a "beacon of the industry" during the NFT winter, recently appeared on screen in Season 2 of the American TV series *Poker Face*, capturing some external attention. At the time of writing, the floor price of Pudgy Penguins was 16.4 ETH, up 13.8% over 24 hours.

Besides these standout performers, most other NFT projects posted solid gains. At the time of writing, BAYC was up 13.2% over 24 hours, Azuki up 26.8%, and Bitcoin ecosystem projects followed suit—Taproot Wizards rose 30.3%.

In addition, NFT-related tokens also surged. According to OKX data, BLUR was trading at 0.1176 USDT at the time of writing, up 27.4% over 24 hours, ranking third on OKX’s gainers list.

Regarding the NFT market's recovery, although there had been previous calls for bullish action, over the past few years such predictions—often wildly varied—had surfaced too many times, only to result in the sector growing colder by the day. Retail investors have long become numb to such bullish rhetoric.

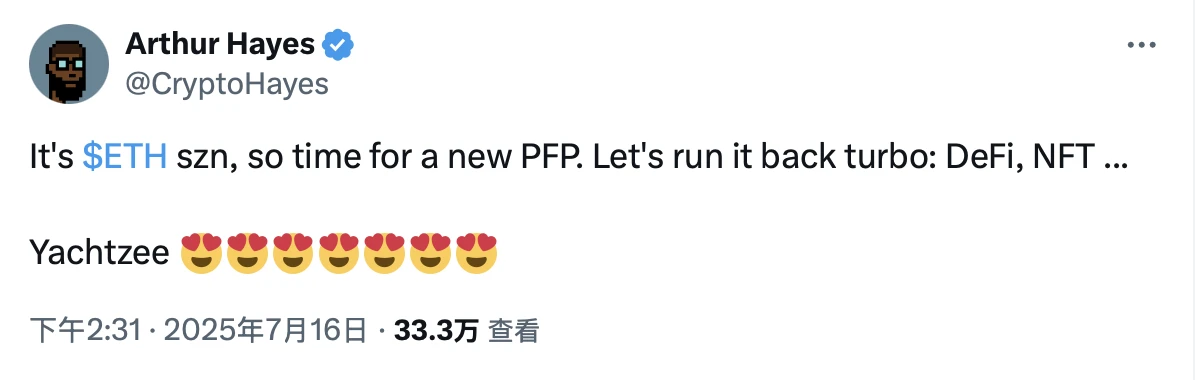

On July 16, Arthur Hayes, co-founder of BitMEX, predicted on X that "ETH Season is here, and DeFi and NFT markets will benefit and make a comeback." However, most replies under his post were largely mocking at the time.

Yet, as the long-anticipated "alt season" finally begins to show delayed signs, discussions around whether the NFT market can truly recover are increasing.

FreeLunchCapital, founder of BitmapPunks and a well-known NFT collector, said today that institutions have already reached out attempting to accumulate positions—"Starting two weeks ago, several institutions contacted me with interesting offers. Everyone knows I don’t sell NFTs, but it’s not entirely true. If the counterparty brings resources that can attract more attention to NFTs and help the industry advance, I’d consider off-market deals."

Longtime players like 0xCygaar, a contributor to Abstract who was active during the last NFT cycle, are now openly declaring, "NFT Season is finally back."

Logically, the sudden rebound in NFTs isn't hard to understand.

On one hand, as ETH rebounds strongly and quickly climbs to higher levels, incoming capital paying attention to ETH also considers related investment opportunities. Since NFTs originated on the Ethereum ecosystem and most top-tier projects remain concentrated there, the NFT sector can be seen as a substitute play on ETH. In terms of trading volume, the most actively traded NFTs are still top-tier projects with relatively high liquidity on Ethereum, indicating that the capital behind this mini-recovery primarily comes from within the Ethereum ecosystem.

On the other hand, after a prolonged downturn, the entire NFT market has undergone sufficient cleansing—weak holders have exited, and potential manipulators may have already completed asset selection and position accumulation. Given the inherently illiquid, non-fungible nature of NFTs, they could represent an easier target for market manipulation compared to altcoins.

The current issue, however, is that the NFT market had cooled so completely before that sector consensus nearly collapsed. Even if short-term interest rises, it remains uncertain whether broader retail participation and sustained capital inflow will follow.

In other words, right now—if you say alt season is coming, many retail investors might still buy in. But if you claim NFTs are about to skyrocket, it sounds less believable than claiming I’m Qin Shi Huang…

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News