Southeast Asia's Crypto-Driven Human Trafficking and Forced Labor Industry: Cryptocurrency-Powered Escrow Trading Platforms

TechFlow Selected TechFlow Selected

Southeast Asia's Crypto-Driven Human Trafficking and Forced Labor Industry: Cryptocurrency-Powered Escrow Trading Platforms

Cracking down on transnational human trafficking criminal networks in Southeast Asia relies not only on law enforcement actions by authorities worldwide, but also requires voluntary cooperation from operators of cryptocurrency industry infrastructure—such as CEXs, OTCs, and crypto payment services.

Cryptocurrency transaction escrow platforms primarily serve Southeast Asian black and gray market operations as intermediaries and matchmaking services, catering to entities involved in illegal activities such as money laundering, payment processing, data theft, smuggling, and gambling. These platforms have now become powerful tools for cybercriminal organizations.

Beyond these conventional criminal types, some escrow platforms also engage in human trafficking under the guise of "overseas labor." This article aims to expose the development status of this inhumane criminal industry and investigate its operational scale and financial contamination through cryptocurrency analysis.

Human Trafficking for Scam Compounds in Southeast Asia

Southeast Asian telecom fraud groups recruit workers of specific nationalities depending on their target victim demographics. For example, in "Pig Butchering Scams" targeting Chinese-speaking communities, large numbers of young Chinese individuals cross borders every year—either legally or illegally—to work in scam compounds.

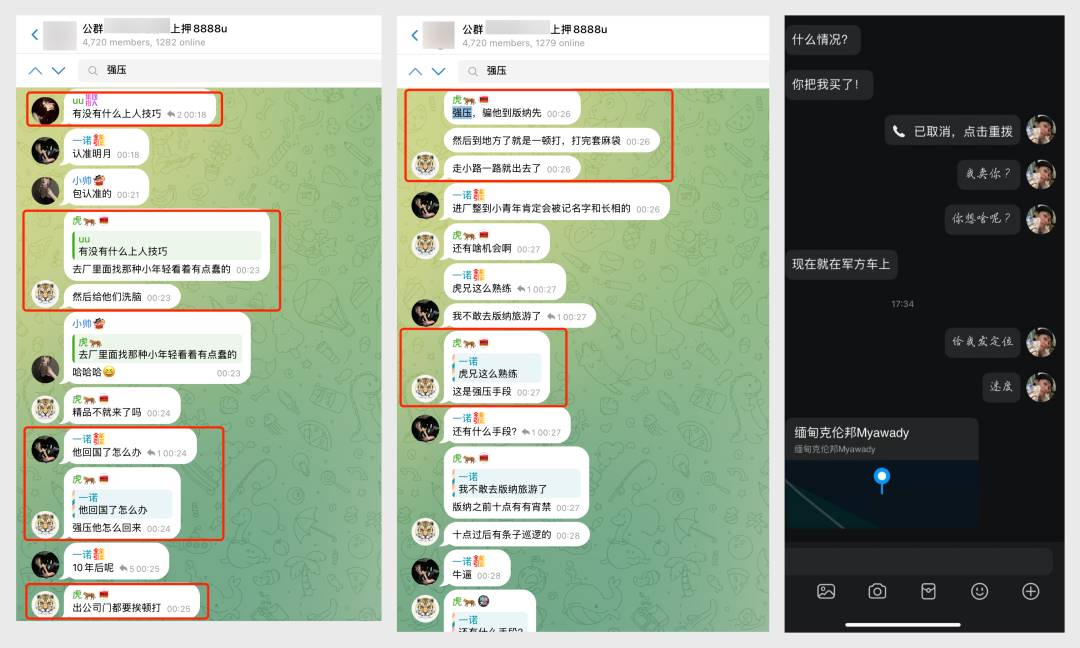

A public group vendor sharing tactics on deceiving/kidnapping young Chinese men

These youths are often deceived or forced into Southeast Asia, and by the time they realize they’ve been sold into scam compound slavery, it’s usually too late to escape.

Prices of human victims by age group (in USDT)

Typically, only males aged 20–30 are considered the most desirable "commodities," fetching higher prices. Those under 20 or over 35 are seen as "scraps," either priced lower or subject to stricter screening. Women are almost entirely excluded from such transactions.

The earlier high-profile case in mainland China involving actor Wang Xing—who was kidnapped—saw him trafficked into a scam compound via this very channel.

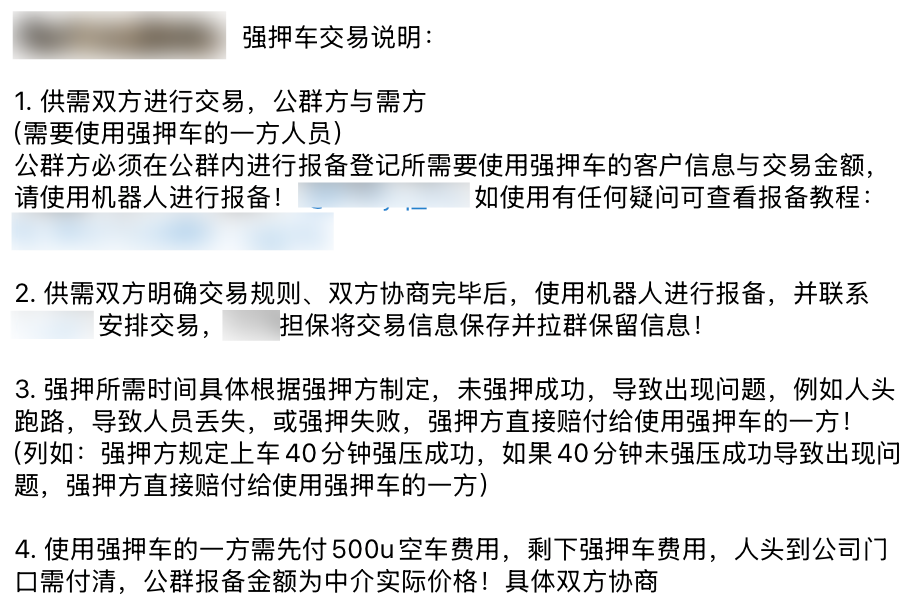

Escrow Services for Forced Transport ("Qiang Ya Che")

In standard black-market goods trading, the business model of escrow platforms resembles that of e-commerce platforms like Amazon or Taobao. Vendors must first deposit a bond with the platform before commencing operations, and the total value of active transactions cannot exceed the deposited amount at any given time. If a vendor fails to deliver goods or services due to their own fault, buyers can initiate arbitration and potentially claim compensation from the bond. This mechanism establishes trust between illicit trading parties.

Linghang Guarantee's private group rules for forced transport ("Qiang Ya Che") escrow services

In human trafficking, the model is similar: when humans become the traded commodity, vendors are referred to as "labor-type escrow vendors." However, since unwilling victims may attempt to escape (literally), report to authorities, or refuse cooperation, some vendors resort to intimidation, coercion, or physical violence during transportation. Escrow providers offering such enhanced enforcement services are known as "forced transport (Qiang Ya Che) escrow vendors."

"Qiang Ya" (强压), a term used in underground jargon, means kidnapping.

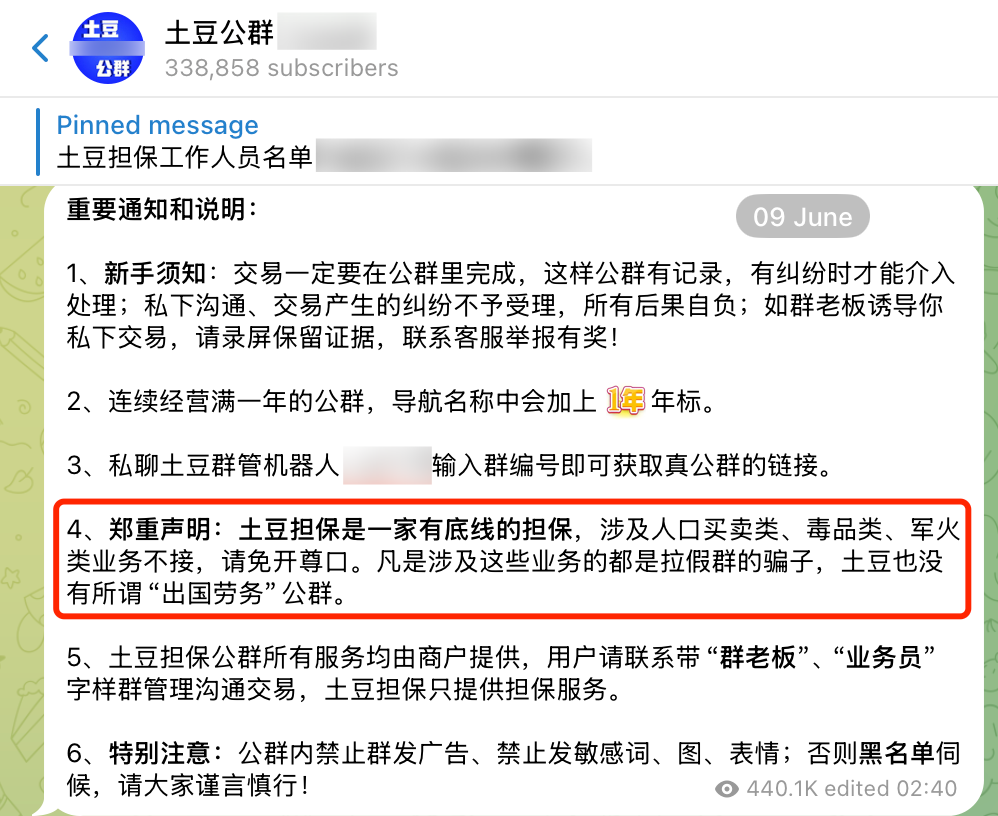

Tudou Guarantee, under Huwang Group, emphasizes its "moral底线"

Due to global law enforcement crackdowns on transnational human trafficking, most escrow platforms refuse to provide guarantees for such trades. Even Tudou Guarantee—one of the dominant players under Cambodia-based Huwang Group—publicly declares a "human moral底线," stating it will not participate, highlighting just how severe this crime is perceived within the industry.

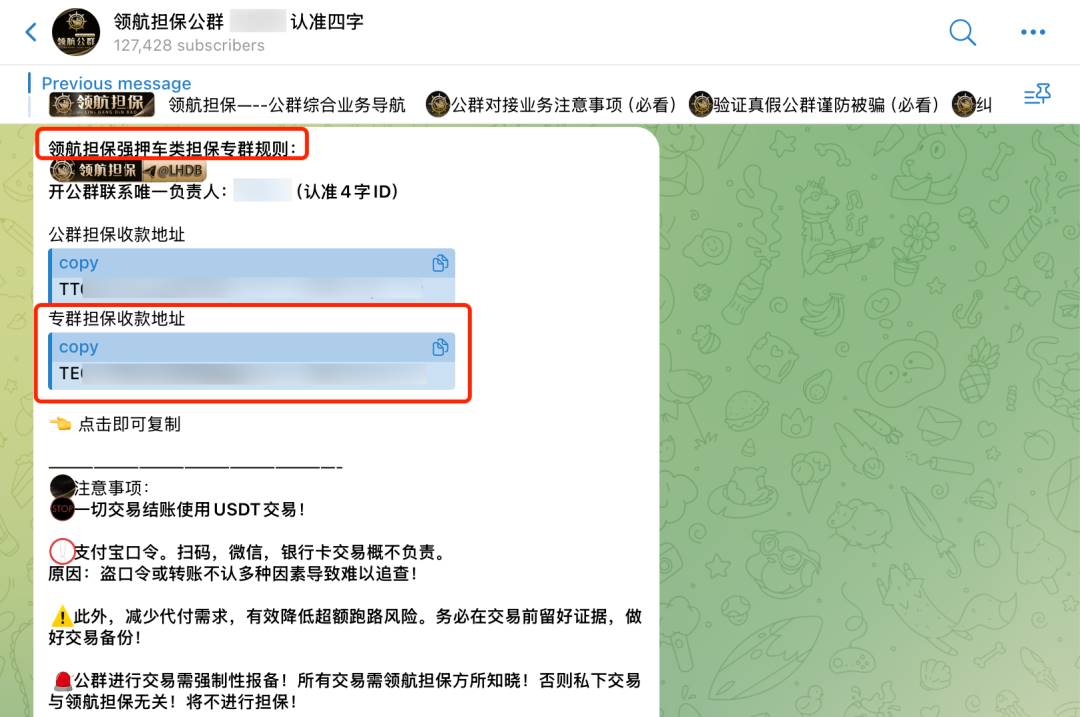

Analysis of Linghang Guarantee’s Private Group Deposit Address

Linghang Guarantee is the only one among Southeast Asia's top ten transaction escrow platforms that openly operates both public and private "overseas labor" groups, explicitly offering escrow services for "forced transport (Qiang Ya Che)" transactions.

Official announcement from Linghang Guarantee's Telegram channel

The pinned message on its official Telegram channel states that vendors providing "forced transport escrow" services must submit deposits via designated private group addresses. This indicates that all counterparties linked to these addresses are affiliated with transnational human trafficking networks in Southeast Asia.

This transparency enables blockchain investigations by Bitrace researchers.

Data from Bitrace Pro investigation tool

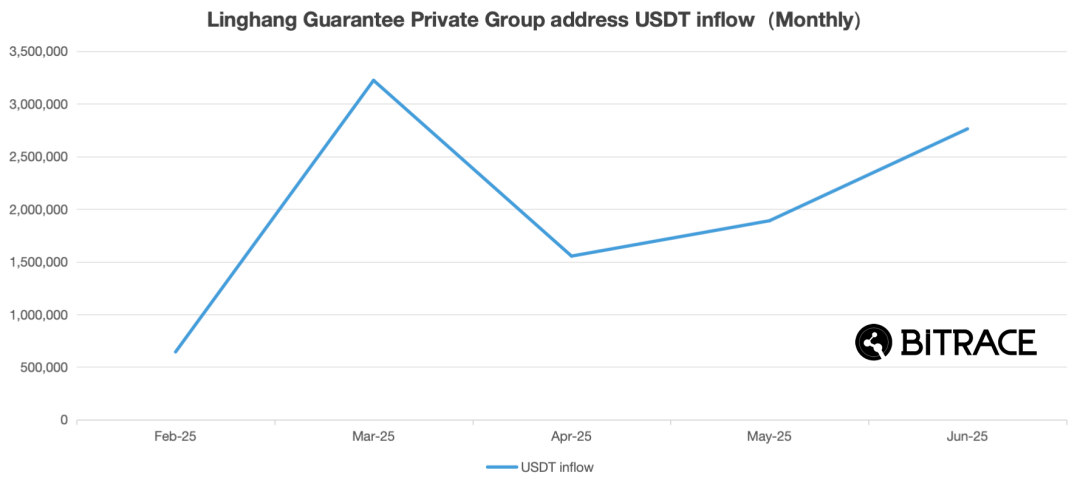

Linghang’s latest private group deposit address was activated on February 23, 2025. Within less than five months afterward, it received inflows totaling 10,074,805.56 USDT—worth over $10 million.

Notably, this sum represents only the **deposits made by vendors specializing exclusively in "forced transport escrow" services**. Within the limits of these bonds, vendors can repeatedly conduct transactions, meaning the actual volume of funds tied to transnational human trafficking in Southeast Asia far exceeds this figure.

Funds Contamination Analysis of Slave Labor Trade

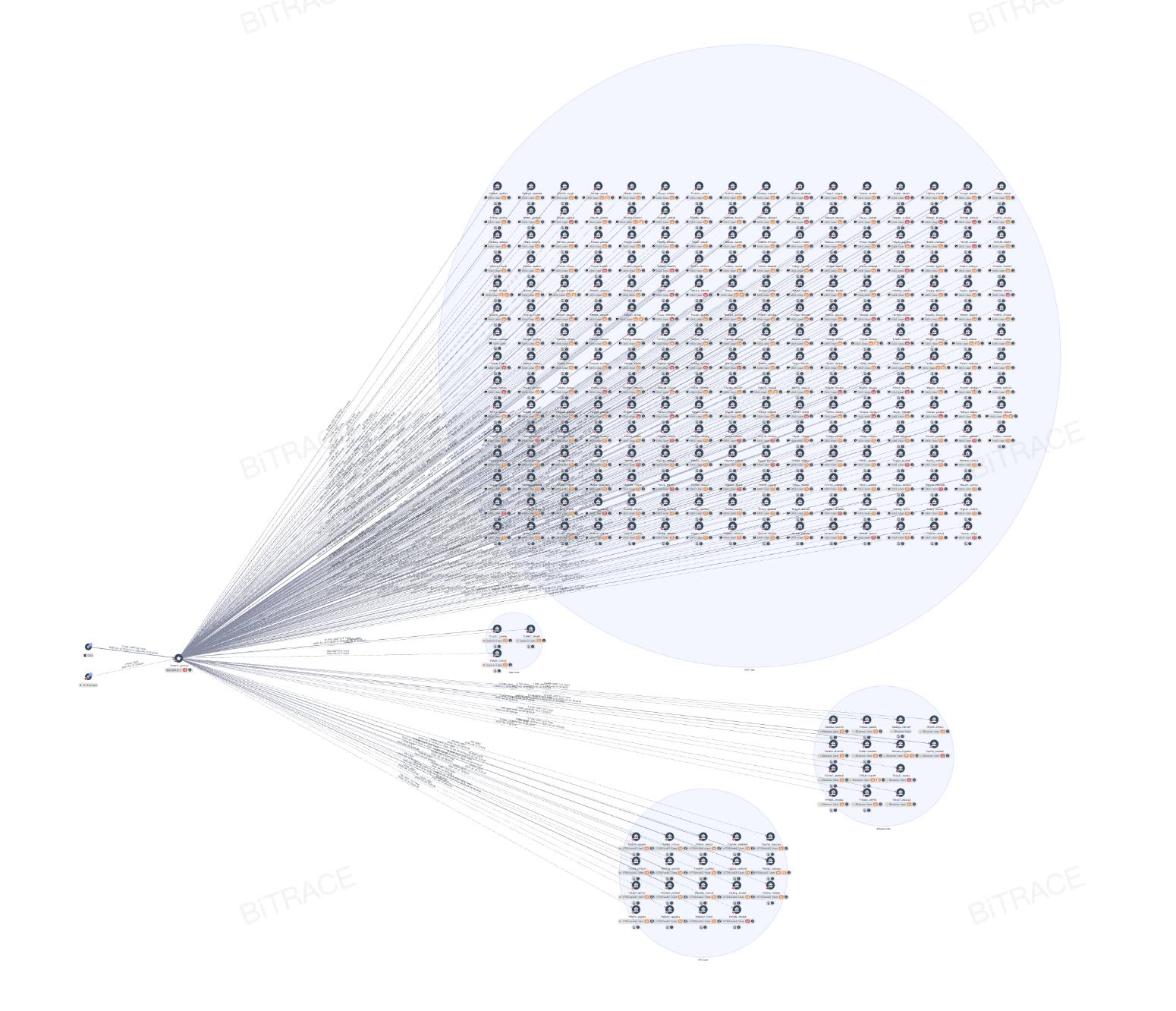

By analyzing fund flows from counterparties to Linghang Guarantee’s private group address, Bitrace investigators assessed the extent to which centralized exchanges are being exploited.

|

Entity Name |

USDT Deposit to Linghang |

Entity Name |

USDT Withdraw From Linghang |

|

OKX |

71,050 |

OKX |

1,449,300 |

|

HTX |

1,362 |

HTX |

156,513 |

|

- |

- |

Binance |

66,819 |

|

- |

- |

Gate.io |

17,098 |

Data from Bitrace Pro investigation tool

On the funding source side, two exchanges made a total of 18 deposits amounting to 72,418 USDT to the audited address. These transactions indicate that Linghang vendors directly used exchange addresses to pay their escrow deposits—funds used to back their human trafficking operations.

On the withdrawal side, 262 user addresses across four exchanges received 414 withdrawals totaling 1,689,730 USDT from the audited address. These represent cases where vendors, upon ceasing operations, transferred their returned escrow deposits directly into exchange accounts.

Screenshot from Bitrace Pro investigation tool

All four exchanges have strong ties to Chinese-speaking communities and primarily serve Mandarin-speaking users—consistent with Linghang’s business of trafficking Chinese nationals into Southeast Asian scam compounds.

Among them, OKX—a leading global centralized cryptocurrency exchange—is the most heavily exploited for deposit payments and storage of criminal proceeds. 17.3% of withdrawals from Linghang’s private group deposit address were sent to 236 distinct OKX user addresses.

Escrow Funding Threats

Illicit transaction escrow platforms often combine anonymous messaging apps with on-chain money laundering techniques, posing persistent and covert financial threats to crypto institutions.

Take Telegram—the most widely used messaging app—as an example. While many public group vendors openly advertise their services and wallet addresses in channels, the most dangerous illegal transactions typically occur in private or VIP groups, hidden from public view.

Frequent rotation of operational addresses further complicates continuous monitoring. Aside from top-tier escrow platforms that maintain relatively stable address rotation patterns, smaller and mid-sized platforms often reuse addresses irregularly, change them unpredictably, or overlap functionalities—posing significant challenges for risk detection teams needing rapid response capabilities.

Therefore, not only do illicit escrow platforms pose risks, but funds related to organized crimes such as online gambling, money laundering, and fraud also threaten centralized entities like exchanges.

Conclusion

Combating transnational human trafficking networks in Southeast Asia requires not only coordinated enforcement actions by law enforcement agencies worldwide but also voluntary cooperation from operators of cryptocurrency infrastructure—including CEXs, OTC desks, and crypto payment providers.

Bitrace has long maintained close collaboration with law enforcement and regulatory bodies across multiple regions in Asia, deeply participating in tracking and analyzing over a thousand virtual asset-related cases. Through this experience, we have accumulated extensive practical expertise and high-value risk intelligence. Leveraging this foundation, Bitrace has built a high-quality risk address database covering 20+ major and emerging blockchains, enhanced by proprietary AI models and large language model technologies to continuously improve risk labeling, fund path identification, and address clustering capabilities—enabling fast detection and intelligent analysis of complex on-chain money laundering and criminal behaviors.

Through Bitrace Pro, Bitrace Blacklist, and Bitrace AML solutions, Bitrace effectively meets diverse compliance needs across financial institutions, delivering secure and compliant experiences for operators and risk management professionals.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News