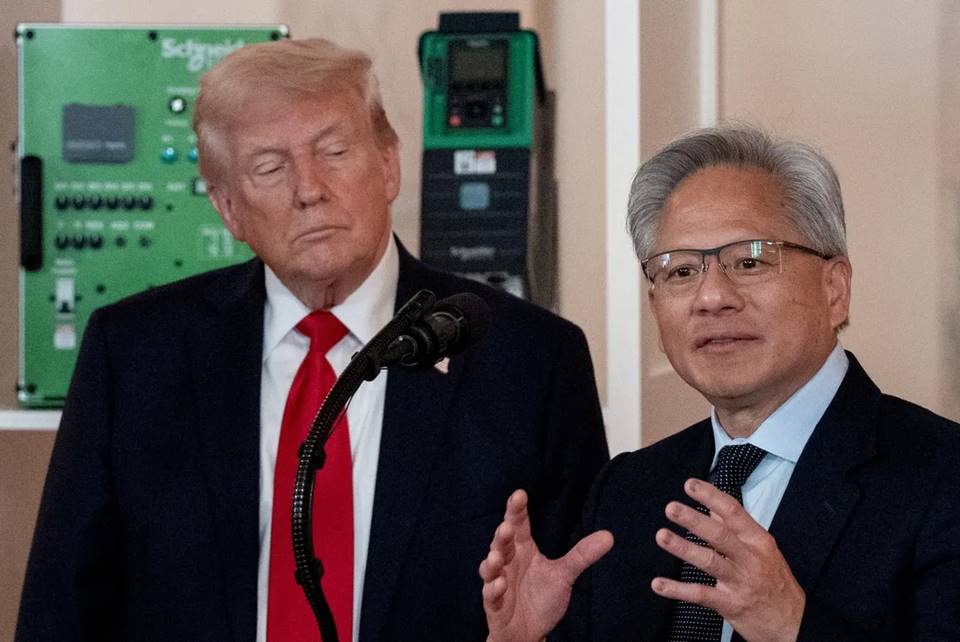

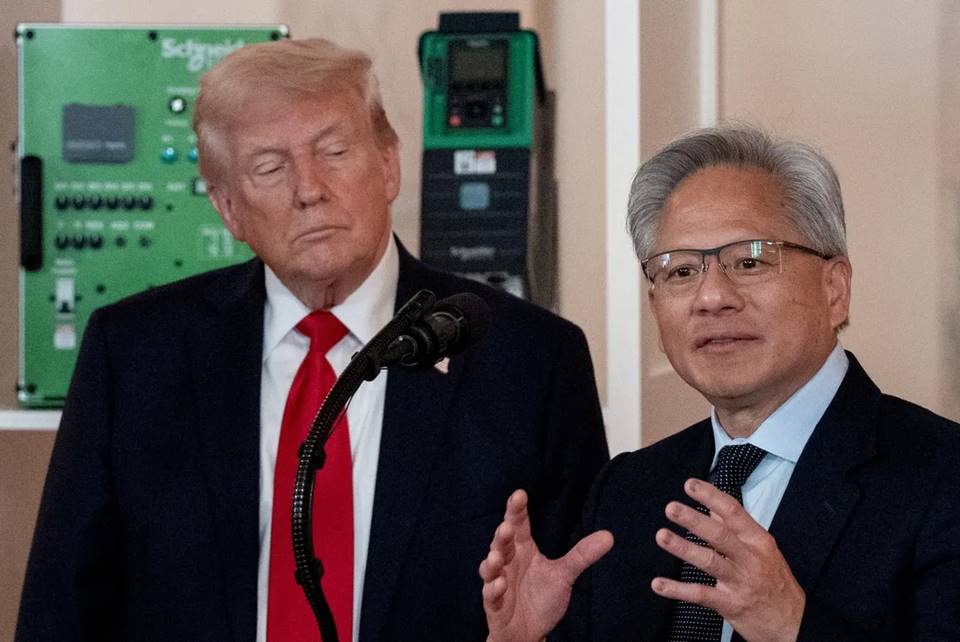

Before coming to China, Jensen Huang met with Trump.

TechFlow Selected TechFlow Selected

Before coming to China, Jensen Huang met with Trump.

This meeting comes as Nvidia became the first company to surpass a $4 trillion market capitalization, with Trump praising Nvidia's stock price surge.

By Dong Jing, Wall Street Insights

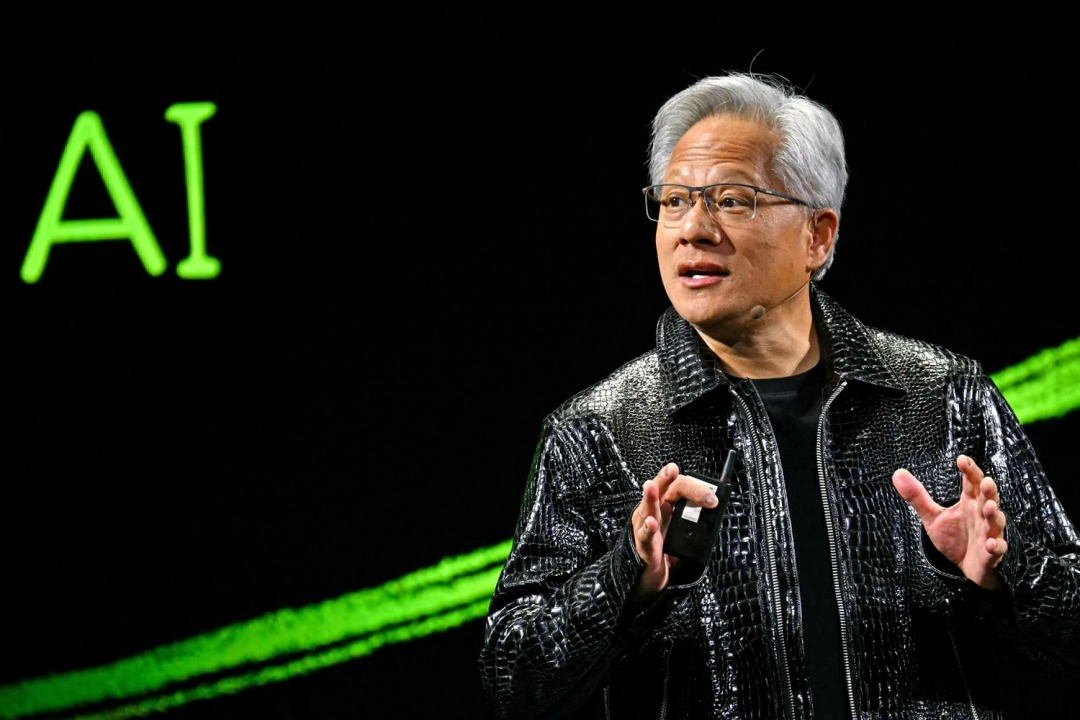

According to reports, Jensen Huang, CEO of Nvidia, met with U.S. President Donald Trump at the White House on Thursday, a day before the head of the world's largest chipmaker was reportedly scheduled to visit China.

On July 11, citing sources from Reuters and Bloomberg, Global Times reported that insiders revealed Jensen Huang traveled to the White House on the 10th local time to meet with President Trump, before departing for China the following day. The specific agenda of the meeting between Huang and Trump has not been disclosed.

At a regular press briefing on Thursday, He Yongqian, spokesperson for China's Ministry of Commerce, responded to questions regarding Huang’s planned visit to China and potential meetings with senior officials including Minister Wang Wentao by stating there was no information available at this time.

Reports note that Huang has long been a frequent visitor to the Chinese market and has publicly emphasized the importance for U.S. companies to access the world’s largest semiconductor market. He has previously called repeatedly for loosening U.S. restrictions on technology exports.

Nvidia Market Cap Reaches Record High

The meeting between Huang and Trump coincided with Nvidia becoming the first company ever to surpass a $4 trillion market capitalization. Continued investor enthusiasm for the AI boom has driven broader gains across the tech sector.

Earlier on Thursday, Trump referenced Nvidia’s soaring stock price in a social media post, citing the tech rally as one reason the Federal Reserve should cut interest rates. He wrote:

"Tech stocks, industrial stocks, and Nasdaq hit all-time highs! Cryptocurrency is going straight up. Nvidia is up 47% since Trump tariffs!"

As noted in a Wall Street Insights article, on Thursday both the S&P 500 and Nasdaq reached record highs, with Nvidia marking three consecutive days of new highs, becoming the first firm to achieve a $4 trillion valuation.

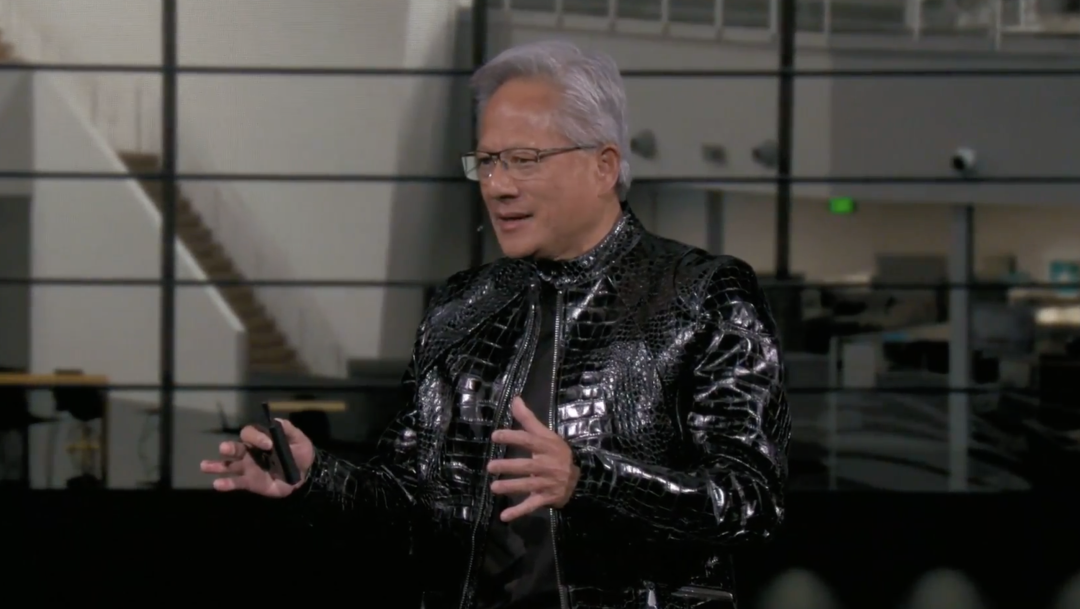

Export Controls Significantly Impact Performance

U.S. restrictions have already had a material impact on Nvidia’s financial performance.

As previously reported by Wall Street Insights, due to export controls, Nvidia expects an $8 billion revenue reduction in its H20 product line in the second quarter—highlighting the critical importance of the world’s largest semiconductor market to Nvidia’s business.

It is estimated that tech giants such as Microsoft, Meta, Amazon, and Alphabet will spend approximately $350 billion in capital expenditures in the coming fiscal year, further underscoring massive demand for AI infrastructure. This creates vast market opportunities for AI chipmakers like Nvidia.

Nvidia dominates the AI chip market, with its products widely used in machine learning and artificial intelligence development. As global competition in AI intensifies, access to advanced chip technologies has become a key factor in national technological advancement.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News