"Crypto Mortgages" Emerge Out of Nowhere: What Big Game Is Washington Playing?

TechFlow Selected TechFlow Selected

"Crypto Mortgages" Emerge Out of Nowhere: What Big Game Is Washington Playing?

This policy aims to alleviate the housing crisis, but has also raised concerns about systemic risks, potentially repeating the path of the 2008 financial crisis.

By Oliver, Mars Finance

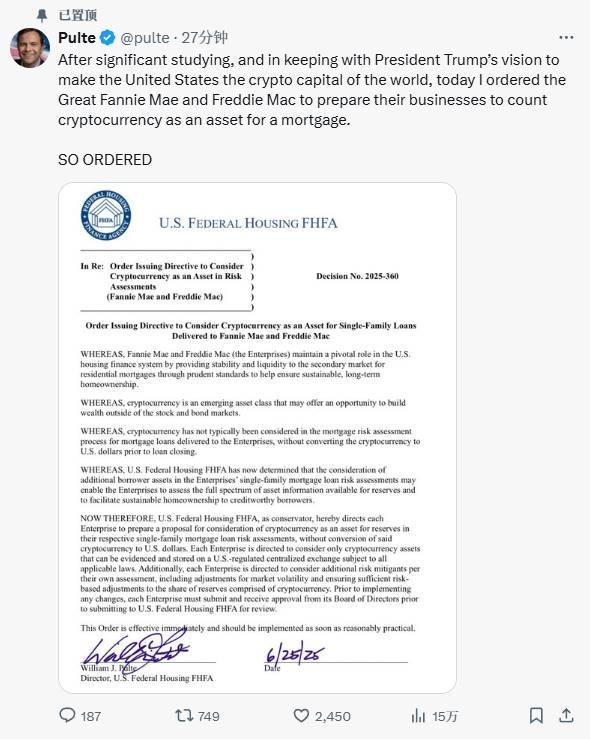

On Wednesday local time, a social media post ripped open a gateway into uncharted territory for the U.S. real estate finance world. William Pulte, Director of the Federal Housing Finance Agency (FHFA), personally stepped in to instruct Fannie Mae and Freddie Mac—the two "cornerstones" of America’s mortgage market—to prepare for accepting cryptocurrency as collateral. This announcement didn’t arrive through any official press release or formal buildup; instead, it made a bold, era-defining strike, thrusting forward an ambitious vision: transforming the United States into the “global capital of cryptocurrency.”

This is far more than a minor policy adjustment—it resembles a high-stakes gamble across the financial Rubicon. An asset class known for extreme volatility and speculation is now being grafted onto the most sensitive foundation of the American economy: a colossal market valued at over $13 trillion. Financial nerves were instantly triggered, and painful memories of the 2008 financial crisis resurfaced. Is this an innovative remedy for the housing crisis, or a reckless cut on old scars that could spark systemic infection? To find the answer, we must cut through the fog and examine every player’s hand at the table.

Paving Stones: The Regulatory 'Tacit' Shift

Pulte’s directive may seem sudden, but it’s actually the first step taken on a carefully cleared runway. Before this, Washington’s regulatory winds had already begun shifting quietly. A coordinated “thawing” campaign has been paving the way for this audacious bet.

The core of this transformation lies in the systematic dismantling of past barriers. In early 2025, the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) joined forces to rescind multiple restrictive guidance documents previously limiting banks’ involvement in crypto-related activities. These documents once acted as tight constraints—“mind control bands”—preventing traditional banks from engaging with the crypto world. Officially, the rationale was “supporting innovation,” but the market interpreted it more bluntly: the green light is on.

Shortly afterward, the U.S. Securities and Exchange Commission (SEC) removed another towering barrier by repealing the controversial Staff Accounting Bulletin No. 121 (SAB 121). That rule had forced banks to record client-held crypto assets on their own balance sheets as liabilities, significantly increasing the cost of offering custody services. With this stumbling block cleared, the door swung wide open for banks to enter the crypto custody arena at scale.

These seemingly independent moves, when connected, reveal a clear trajectory: from permitting custody, to encouraging participation, and now mandating core financial institutions to accept crypto as collateral. Regulators have delivered a powerful one-two punch, building a seamless “highway” that transports digital assets from the periphery into the heart of the financial system.

Center Stage: Giants Bearing History

To grasp the weight of this acceleration, one must understand the monumental roles—and checkered history—of Fannie Mae and Freddie Mac. Created by Congress as government-sponsored enterprises (GSEs), they inject life-sustaining liquidity into the entire mortgage market by purchasing and guaranteeing home loans. Their underwriting standards are nothing less than the industry’s “gold standard.”

The FHFA, which oversees these giants, was itself born out of the 2008 crisis, with its primary mission being to prevent history from repeating itself. This creates the most dramatic irony of all: an agency created to reduce risk is now instructing its charges to embrace an asset class defined by high risk. It’s akin to prescribing a potent experimental drug with unknown ingredients to a patient still recovering from major illness. Given the aggressive push by the new FHFA director, Pulte, market concerns are far from unfounded.

Domino Effect: How Individual Bets Could Trigger Systemic Storms

Long before Fannie Mae and Freddie Mac were pushed onto the table, a niche lending market serving crypto holders already existed. Fintech firms like Milo and Figure played a simple game: borrowers pledge crypto assets worth significantly more than their loan amount to secure funds for home purchases. The biggest risk here is the dreaded margin call—if prices crash and borrowers can’t top up, their collateral gets liquidated. Until now, this risk has remained tightly contained within the bilateral relationship between lender and borrower.

But once Fannie Mae and Freddie Mac enter the picture, a disturbingly familiar script begins to unfold—one eerily reminiscent of 2008. That crisis began with the packaging and spreading of risk. Banks bundled subprime mortgages into securities that appeared safe (MBS), which were then guaranteed by the GSEs and sold globally. Eventually, no one knew where the risks truly lay—until the entire structure collapsed.

Now, we can easily envision a similar scenario: banks issue loans backed by crypto assets, sell them to Fannie Mae and Freddie Mac, who then package them into “Crypto Mortgage-Backed Securities” (CMBS). Backed by implicit government guarantees, these instruments flow into global pension funds, insurance companies, and investor portfolios. When individual-level risks are amplified and injected into the entire financial system, the negative feedback loop warned about by the Federal Reserve could be triggered. FHFA’s directive seeks to plug this speculative game into the nation’s housing infrastructure—an unimaginably high-stakes wager.

Cure or Poison: The Collision of Two Futures

Supporters and critics paint starkly different visions of this policy’s future.

To supporters, this is a genius solution to America’s housing crisis. The data speaks for itself: nearly three-quarters of American households are locked out of homeownership due to soaring prices. At the same time, a large population of young crypto holders has emerged—rich in digital wealth but equally stuck on the sidelines. The essence of this policy is to build a bridge connecting this group of “asset-rich, cash-poor” individuals with their fundamental need for housing.

Yet to critics, this is merely the ghost of 2008 returning. Economists like Nouriel Roubini have long dismissed cryptocurrencies as “speculative bubbles with no intrinsic value.” One official from the Department of Housing and Urban Development (HUD) put it bluntly: “This is tantamount to introducing another unregulated security into the housing market—as if 2008 never happened.” They argue that such measures will only inflate an already overheated property market during bull runs, while triggering forced liquidations that simultaneously crash both crypto and real estate markets during downturns, creating a deadly downward spiral. Even more troubling, amid already tight housing supply, a surge of new buying power will almost certainly drive prices higher, widening existing wealth gaps.

Unresolved Challenges

Pulte’s directive has merely fired the starting gun. The real challenge lies in navigating the countless details ahead of the finish line. Critical questions remain unanswered: Which cryptocurrencies will qualify as collateral? How do you value an asset that fluctuates 24/7 in real time? What will the “haircut” ratios be for risk hedging?

Interestingly, throughout all the noise, the two central players—Fannie Mae and Freddie Mac—have maintained a telling silence. This underscores the top-down, politically driven nature of the directive. They now find themselves passively drawn into a technological and risk-management arms race, forced to rapidly develop risk control systems rivaling agile fintech startups. For any large bureaucratic institution, this is an enormous challenge.

FHFA’s move is undoubtedly a watershed moment. It marks the convergence of a clear political agenda, a newly relaxed regulatory environment, and the massive inertia of the U.S. housing finance system. The real estate market—one of the most critical pillars of the American economy—has officially become the next main battlefield for the integration of digital assets and the traditional world.

This action elevates cryptocurrency from a mere spectator in speculative markets to a potential cornerstone in wealth creation and the realization of the American Dream. Whether this leads to a historic leap in financial inclusivity or becomes another rehearsal for systemic instability hinges entirely on the devilish details of the implementation framework yet to come. This time, the world will be watching closely to see whether the U.S. has truly learned from the lessons of 2008. The story has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News