The flames of conflict between Israel and Palestine have "spread" to the crypto market

TechFlow Selected TechFlow Selected

The flames of conflict between Israel and Palestine have "spread" to the crypto market

For the global crypto industry, geopolitical factors will become the dominant market driver in the short term, and risk sentiment will significantly influence cryptocurrency movements.

Author: Tuoluo Finance

For the past two weeks, global attention has been focused on the Middle East.

As the two most powerful nations in the region, the conflict between Iran and Israel not only abruptly shattered the surface-level peace in the Middle East and intensified ongoing chaos, but also triggered broader global repercussions. Currently, this nuclear-fueled war is no longer confined to Iran and Israel—it has escalated from proxy warfare into direct confrontation and drawn rapid involvement from the United States, causing the situation to spiral further out of control.

Under rising risk-aversion sentiment, global markets have plunged into turmoil. Hard assets such as gold and the U.S. dollar surged, while riskier markets faced mounting pressure. It must be acknowledged that the flames of conflict between Iran and Israel are now spreading into the cryptocurrency sector.

To understand the current Iran-Israel conflict, one cannot ignore the Iranian nuclear issue. In fact, Iran's nuclear program began earlier than many realize. As early as 1957 during the Cold War, to prevent Soviet influence from expanding southward, the United States signed a "Civilian Nuclear Energy Cooperation Agreement" with Iran’s then pro-American Pahlavi dynasty, marking the beginning of Iran's nuclear ambitions.

In 1967, under the agreement, the U.S. delivered a 5-megawatt research reactor to Tehran University. In 1968, Iran signed the Treaty on the Non-Proliferation of Nuclear Weapons (NPT), formally establishing its legal right to peaceful nuclear energy use within the international non-proliferation framework. The oil crises of the 1970s further accelerated Iran's nuclear development. Backed by high-revenue oil exports, Iran established its Atomic Energy Organization (AEOI) in 1974 and began engaging in nuclear technology cooperation with countries worldwide. By 1979, construction of two reactors at the Bushehr nuclear power plant was approximately 80% complete, laying the foundation for a relatively comprehensive domestic nuclear industry.

The turning point came with the Islamic Revolution in Iran. After the revolution, Iran transitioned from a secular monarchy to a theocratic state, ending its close relationship with the United States. The Khomeini regime adopted an explicitly anti-American stance, prompting the U.S. to impose strict sanctions and isolate Iran. The nuclear program, once a symbol of U.S.-Iran collaboration, fell into dormancy. Following the Iran-Iraq War, however, Khomeini recognized the importance of modern military systems and began seeking technological partnerships with the Soviet Union and others. In 1992, Iran signed the "Agreement on Peaceful Uses of Nuclear Energy" with Russia, initiating intensive cooperation.

Since Iran's nuclear program was first exposed to the international community in 2002, multiple multilateral negotiations have taken place over the following years. In 2015, Iran reached the Joint Comprehensive Plan of Action (JCPOA) with six world powers—the U.S., UK, France, Germany, Russia, and China—temporarily freezing its uranium enrichment activities in exchange for the lifting of Western sanctions. However, the election of Donald Trump reignited tensions when the U.S. unilaterally withdrew from the deal in 2018 and reimposed harsh sanctions. In response, Iran adopted a more aggressive strategy in its nuclear program, successfully deploying IR-6 centrifuges in 2023 with five times greater efficiency than before. According to the latest 2025 data from the International Atomic Energy Agency (IAEA), Iran has accumulated 408 kilograms of 60%-enriched uranium—dangerously close to weapons-grade levels.

This April, the Trump administration announced plans to resume nuclear talks. But on June 12, 2025, the IAEA Board of Governors officially determined that Iran had failed to comply with its nuclear obligations, leading to the collapse of negotiations and a sudden deterioration in Middle Eastern stability. Amid this crisis, Israel emerged as the most anxious actor.

The tension between Israel and Iran runs deep. Absolute ideological and religious opposition forms the bedrock of their rivalry, while competition over regional dominance has exacerbated the conflict. Iran has sought to encircle Israel through its "Shia Crescent" alliance network and advanced its nuclear capabilities, leaving Israel—geographically constrained and existentially threatened—in a state of constant alarm. With U.S. tacit approval and support, Israel has responded aggressively. Over recent years, the Iran-Israel proxy conflict has become a defining feature of Middle Eastern geopolitics. This time, however, covert proxy battles have rapidly evolved into open, direct confrontations.

On June 13 local time, the Israeli Air Force launched overt airstrikes codenamed "Strength of the Lion" targeting dozens of nuclear and military facilities inside Iran. Iran retaliated swiftly with waves of missile and drone attacks against Israel. Since then, both sides have escalated the scale and intensity of their strikes, drawing in international actors. A review of the timeline reveals that the United States bears significant responsibility. Long-standing disputes over geopolitics, ideology, historical grievances, and regional flashpoints have led Washington to back Israel as a strategic counterweight to curb Iran’s rise. In this latest escalation, while publicly advocating for peace talks and non-intervention to pressure Iran diplomatically, the U.S. secretly directed American forces to destroy three key Iranian nuclear sites on June 21—an act that dramatically increased the scale and complexity of the conflict, posing serious threats to global security.

Geopolitical instability is a core driver of financial markets. With U.S. involvement, the ripple effects have grown significantly. In response, Iran threatened to close the Strait of Hormuz, which handles about one-third of global seaborne crude oil trade, sparking widespread panic. Today, international crude oil futures jumped over 5%, and gold prices briefly surpassed $3,400 per ounce.

Risk markets fared far worse. Amid escalating fear, U.S. stock index futures opened lower, and the crypto market suffered heavy losses. Over the past three days, the cryptocurrency market has declined consecutively. Yesterday, Bitcoin broke below the $100,000 mark, dipping as low as $98,000, before rebounding to $101,961. Altcoins plummeted—ETH retreated above $2,200, and SOL dropped again to around $130. According to Coinglass, within the past 12 hours up to 9 a.m. today, total liquidations across the market reached approximately $559 million, including $452 million in long positions and $107 million in short positions. Of these, Bitcoin accounted for $223 million in liquidations and Ethereum for $156 million.

Meanwhile, beyond triggering risk-off sentiment in crypto markets, the Iran-Israel conflict is rapidly spilling into domestic crypto industries. On the afternoon of June 18, a mysterious hacker group called Gonjeshke Darande claimed responsibility for a large-scale cyberattack on Nobitex, Iran’s largest cryptocurrency exchange, asserting they had obtained its source code, internal network data, and customer asset information. So far, nearly $90 million worth of digital assets have been affected, mostly in stablecoin USDT. Notably, despite gaining control of the platform, most funds were not transferred but rather directly destroyed—a move appearing more symbolic or demonstrative in nature.

The hackers explicitly stated their motive: “Nobitex Exchange serves as a core instrument for the Iranian regime to fund global terrorism. Collaborating with infrastructure that supports terrorist financing and violates sanctions puts your assets at risk.” Although the group has never revealed its identity, given its precise and repeated attacks on Iranian targets since 2022, many industry experts believe it is linked to Unit 8200, Israel’s elite military intelligence unit.

It must be admitted that the strike was highly accurate and effectively disrupted Iran’s external financial flows. Due to prolonged international sanctions and hyperinflation, Iran’s domestic crypto sector has developed rapidly. According to data provided by Maria Noor, there are currently 90 active cryptocurrency exchanges in Iran, more than 10 of which operate as centralized platforms offering websites and apps. Between 15 and 19 million Iranians—about one-fifth of the population—are actively involved in cryptocurrency trading. Clearly, crypto has become a vital channel for Iran to engage with the global economy.

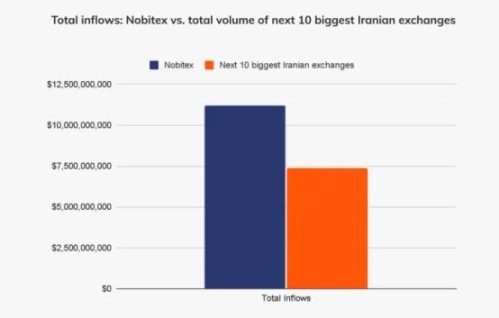

Nobitex, the exchange targeted in this attack, is Iran’s largest, boasting 6 million active users and processing up to 68 million transactions annually, capturing nearly 87% of the market share. Reuters previously reported that the vast majority of domestic crypto transactions in Iran occur via Nobitex or similar platforms connecting to international markets.

Beyond cryptocurrencies, the Iranian government has invested in blockchain technology for industrial applications, launching official projects like Kuknos and Borna to enhance financial infrastructure and operational efficiency. While supportive of blockchain innovation, the government maintains a complex and ambivalent stance toward the growing popularity of cryptocurrencies.

Firstly, Iran’s position on mining is ambiguous. Unlike other regions dominated by large-scale mining farms, Iran’s mining ecosystem is largely driven by individual retail miners. In 2018, Iran attracted numerous miners by legalizing cryptocurrency mining, quickly becoming a hotspot in the global mining landscape. Driven by transactional demand, retail mining became widespread. However, problems soon followed. Due to inadequate power infrastructure, Iran frequently faces electricity shortages. Data confirms this: although around 300 mining projects received government approval, according to Masih Alavi, CEO of ViraMiner, cited by Wu Shuo, the country’s legal mining capacity today stands at just 5 megawatts, whereas illegal underground operations reach nearly 2 gigawatts—400 times larger. This illicit consumption accounts for roughly 5% of Iran’s total electricity usage in 2023. Faced with this imbalance, the government has tightened restrictions. In 2020, the Central Bank banned domestic transactions using cryptos mined illegally. In December 2024, authorities explicitly prohibited advertising of mining equipment. Though no further actions have been taken recently, the government’s attitude clearly leans against open support.

This skepticism extends even more strongly to crypto trading. Concerned about cryptocurrencies undermining national monetary sovereignty and enabling capital flight, Iranian authorities have cracked down repeatedly, attempting to block conversions between crypto and the rial. Earlier this year, the Central Bank temporarily suspended all rial settlements for crypto exchanges, mandating that all platforms use government-designated gateways to enable fund tracking and user surveillance. Then in February, Iran outright banned any domestic advertising of cryptocurrencies. Following the Nobitex attack, the central bank introduced a “crypto curfew,” strictly limiting domestic platforms to operating only between 10 a.m. and 8 p.m. daily.

A range of such restrictions reflects the government’s underlying anxiety. On one hand, under current sanctions, cryptocurrencies serve as a crucial avenue for economic survival and foreign exchange acquisition—an essential window to the outside world. Objectively, they fulfill real needs. On the other hand, due to concerns over monetary sovereignty erosion and massive electricity waste from mining, the state cannot allow unchecked growth. Thus, it attempts to strike a fragile balance between innovation and regulation. This tension also manifests in religious discourse: in Iran’s deeply theocratic society, speculative instruments like crypto carry inherent taboo, drawing strong disapproval from traditional clerics. Yet Supreme Leader Khamenei advocates for a forward-looking approach, resulting in a delicate equilibrium between reformists and conservatives.

Whether embracing or resisting, one thing is clear: the fires of the Iran-Israel war have already spread from physical battlefields into cyberspace and deeper into the financial realm. As part of this landscape, the crypto sector can only brace itself for impact. For Iran domestically, the attack on its exchange may be just the beginning. Future struggles in this domain will likely grow more intricate, sophisticated, and invisible.

For the global crypto industry, geopolitical developments will dominate market narratives in the short term, with risk aversion heavily influencing price movements. At present, positive developments within the industry have kept sentiment relatively stable, and market volatility remains manageable. Bitcoin held firm at the $98,000 support level, showing signs of resilience. There are indications of BTC outflows from exchanges, and Bitcoin ETFs recorded net inflows of $1.02 billion last week—both signals reflecting continued investor confidence. However, U.S. involvement introduces profound uncertainty. The scope and depth of American engagement will broadly shape the battlefield. Should future actions lead to the closure of the Strait of Hormuz, markets could face much larger shocks.

Moreover, it’s important to note that soaring oil prices caused by the conflict will force the Federal Reserve—already navigating tariff and inflation uncertainties—to extend its observation period. A prolonged high-interest-rate environment in Q3 is gradually becoming market consensus, a scenario that could have deeper and longer-lasting implications for the cryptocurrency market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News