How to securely inherit cryptocurrency assets?

TechFlow Selected TechFlow Selected

How to securely inherit cryptocurrency assets?

Leave behind your investment philosophy and management skills—that's the key to ensuring a smooth transfer of digital assets.

Authors: Ye Yang, Liu Honglin

Since Satoshi Nakamoto released the first Bitcoin software in 2009, cryptocurrencies have undergone significant development and withstood market tests, evolving from niche speculative ventures into mainstream investment options. Today, cryptocurrencies are increasingly favored for their decentralization, anonymity, and global accessibility, prompting more individuals to consider allocating a portion of their portfolios to digital assets. However, these very advantages—decentralization and anonymity—can become disadvantages when it comes to one critical issue: inheritance.

During Life—Wallets and Private Keys

The key to passing on cryptocurrency and other digital assets lies in proactive planning during one's lifetime.

In the generally anonymous and decentralized world of cryptocurrency, a wallet—and its core component, the private key—serves as your identity. Conversely, transferring custody of the wallet and private key effectively completes the inheritance process.

A wallet is an application used to manage cryptocurrencies. Mainstream wallets include desktop wallets, browser extension wallets, mobile wallets, and hardware wallets. For desktop, browser, and mobile wallets, it’s important to clearly communicate the type of wallet to your heir. For hardware wallets, you must properly store the physical device and ensure it can be safely passed on.

The private key functions as a combined username and password for accessing the wallet. In practice, private keys are usually converted into a set of recovery phrases (mnemonic words). When conveying this information to an heir, accuracy is crucial. If a password is also involved, instructions for its use must be clearly explained as well.

So how should you securely pass wallet and private key information to your heirs? Since inheritance is ultimately an insurance measure, disclosing too early may lead to avoidable losses or disputes.

1. Written Documentation

You can record the wallet type (or location, if it’s a hardware wallet) and recovery phrase on paper and store it in a safe deposit box, similar to the commonly used "paper wallet" in crypto circles. The safe deposit box password can be included in your will, or the paper wallet itself can be stored directly in a bank’s safe deposit box, ensuring access only after inheritance procedures are completed.

2. Hardware Storage

Alternatively, store essential inheritance information on a USB drive or external hard disk, protected with encryption. Keep the storage device and its password separate, ensuring that heirs can only access the information after fulfilling inheritance requirements.

3. Dead Man’s Switch

You can also use a “dead man’s switch” service such as Sarcophagus, built on Ethereum and Arweave. With such tools, you upload critical inheritance data, which is encrypted and permanently stored across a decentralized network. You then set a decryption deadline and designate your heir as the recipient. As long as you remain active, you can extend the timer or cancel the service; otherwise, the file automatically decrypts and becomes accessible to the designated heir.

Each method has its own benefits and risks. Choose the one best suited to your needs for transmitting digital assets.

After Death—Centralized Exchange Accounts

If no wallet or private key information was left behind, inheriting digital assets becomes highly unlikely—after all, decentralization is a foundational feature of cryptocurrency. However, after years of evolution, centralized exchanges have emerged within the crypto ecosystem. These platforms trade some degree of decentralization and anonymity for enhanced security and convenience. If the deceased primarily managed their digital assets through a centralized exchange account, heirs may still inherit the assets by providing account details and initiating a claim through the platform.

Procedures and required documentation vary across platforms. This article uses Binance as an example to illustrate the inheritance process for a deceased user’s cryptocurrency holdings.

Previously, Binance’s inheritance claim process involved the heir registering an account and contacting customer support to declare themselves as the legal heir. They could then follow an AI-powered support link to access the inheritance claim portal.

The required documents were relatively straightforward. In addition to the deceased’s Binance account information, heirs needed to provide:

1. Identification documents for both the heir and the deceased;

2. A death certificate for the deceased;

3. Legal documents proving inheritance rights, such as a will or notarized certificate of inheritance.

These three documents must be notarized or lawyer-certified and accompanied by English translations.

The third requirement is often the most challenging, as claims typically arise precisely because no will was left to address the digital assets. If there is no dispute over inheritance, the heir can obtain a notarized certificate of inheritance by submitting documents including the death certificate, proof of familial relationship, the deceased’s personnel records, and asset verification. If disputes exist, legal representation and litigation are required, with the final court judgment serving as valid proof of inheritance rights.

Once these materials are submitted and approved by Binance, the digital assets can be transferred to the heir’s account.

Recently, Binance launched a new “Emergency Contact and Inheritance” feature within its app. Users can now add emergency contacts via the Account Security settings: Home – Profile – Account Security – Emergency Contact. If the account remains inactive for an extended period, Binance will automatically notify the designated contact, who can then initiate the inheritance claim process.

Binance founder Changpeng Zhao commented on Twitter: “This is a topic people don’t like to talk about, but humans haven’t achieved immortality yet. Every platform should have a ‘will function’ to ensure that when a user is gone, their assets can be distributed according to their wishes to designated accounts.”

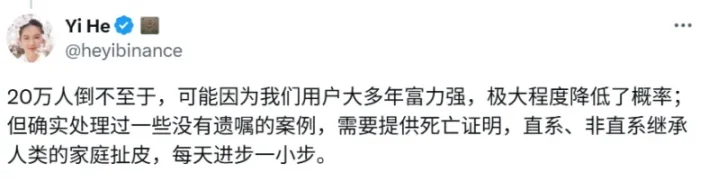

Binance co-founder He Yi responded in the comments, noting that since most users are young and healthy, the probability of unexpected death is low. Nevertheless, the platform has handled cases where no will existed, requiring death certificates and resolving disputes between direct and indirect heirs.

Manqin Lawyers Summary

Cryptocurrency is an asset with a high barrier to ownership. You may have successfully navigated market volatility, hacking threats, and legal risks to accumulate substantial digital wealth—but your family may know nothing about it. In extreme cases, investors pass away without their heirs even knowing they held digital assets. Or perhaps the family knows the person invested in crypto but has no idea which wallet was used or which platforms were involved. Even if heirs manage to recover the assets based on available clues, they might encounter pitfalls during withdrawal, leading to conflict.

Therefore, effective communication within the family is crucial. Manqin Lawyers recommend holding regular family meetings to explain how cryptocurrencies work, their value, and how to manage them. Through education and open dialogue, you’re not just leaving behind digital assets—you’re passing on your investment philosophy and management skills. That is the true key to ensuring a smooth and secure transfer of digital wealth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News