The Death of the Geek — The Imperial Pardon in the Crypto World

TechFlow Selected TechFlow Selected

The Death of the Geek — The Imperial Pardon in the Crypto World

The entire history of cryptocurrency development seems like a modern-day "Water Margin"—a tale of being forced onto the outlaw path, only to later receive an imperial pardon.

Author: Dave.bc1q.0xU (@0xDave852)

Water Margin Chapter 75: "Song Gongming's Loyalty Moves the Emperor, Prefect Su Bears the Decree for Pacification." The outlaw heroes, once forced onto Liangshan, eventually surrender to imperial authority under combined pressures. How similar it is—Bitcoin’s genesis block in 2008 carried a headline about the UK Chancellor making a second rescue plea to Europe, filled with Satoshi Nakamoto’s criticism of the existing financial system. Now, this former rebel has also submitted to the establishment, willingly becoming a new tool for old capital. With stablecoin legislation passing and Circle and Tron racing toward Nasdaq listings, discussions around U.S. equities and crypto have reached a fever pitch. This article will systematically trace the logic behind crypto’s integration into traditional finance—and to add some fun, I, your hardcore research blogger, will unusually sprinkle in bits of my personal story.

"Life regrets too little joy, who would trade gold for laughter? I raise my cup to urge the slanting sun, lingering still among flowers for twilight’s glow." Writing is hard—please like, comment, and share 🫶🫶🥲

I first encountered Bitcoin at age 15, inspired by Satoshi Nakamoto’s revolutionary spirit that drew me into this industry. Now Bitcoin has transformed from an outlaw into an official player—what would Satoshi think if he saw this world today? Then again, I’ve gone from a passionate youth to a jaded long-form blogger muttering “what a cool autumn,” haha—truly, everything is fate, not a bit within our control.

Still, stay optimistic. Without further ado, let’s begin.

1. Crypto & U.S. Equities Overview

To provide a big picture, this chapter briefly outlines the intertwined landscape of crypto and equities—including how traditional finance and crypto exchanges are testing each other’s domains. Let’s feel the inseparable entanglement.

"Wealth and power leave no room for freedom, dragons rise, phoenixes soar—beyond restraint. All guests drunk on flowers across the hall, one sword chills fourteen provinces."

1. **Crypto-linked Stocks (Coin-Stocks)**: My own categorization. Currently, there are three main types of crypto-related stocks in the U.S. market. Some break them down further into mining or coin-focused stocks, but those details aren’t necessary. We’ll call them all “coin-stocks”—a widely accepted term in the market. The three categories are:

-

Crypto mining operations: MARA Holdings (MARA), Riot Platforms (RIOT), Hut 8 Mining (HUT)

-

Comprehensive crypto financial services: Circle (CRCL) USD stablecoin, Coinbase Global (COIN) exchange, Galaxy Digital (GLXY) integrated finance and tech services.

-

Bitcoin/Solana hodling businesses: MicroStrategy (MSTR) holding Bitcoin, Metaplanet Inc. (3350.T) Japan’s Bitcoin holder, Sol Strategies (HODL) Canadian-listed Solana holder. Broadly speaking, this category also includes traditional public companies adding crypto to their balance sheets—classic examples being Tesla (TSLA) and Trump Media Technology Group (DJT).

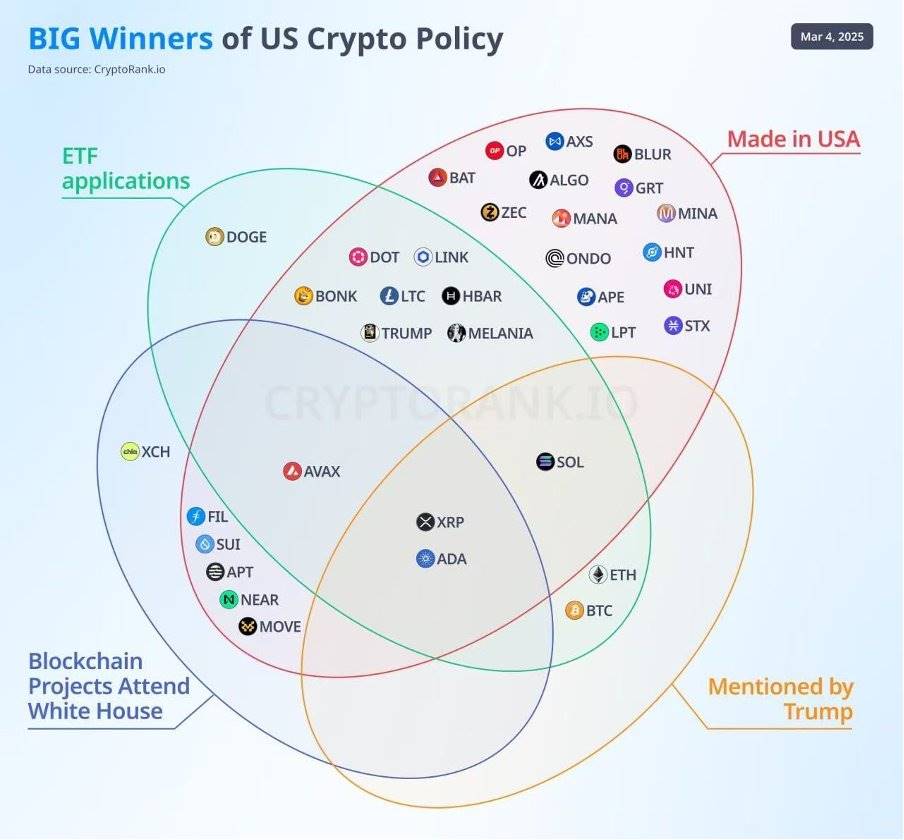

2. **Blue-Chip Cryptocurrencies**: I define blue-chip cryptos as those recognized by major institutional capital. Evaluation criteria vary—being included in Coinbase’s Coin50 index or having launched an ETF are strong indicators. These are large-cap assets. See the detailed chart below (slightly outdated, may need updates).

Here are some ETF ticker names for those interested in trading:

-

Bitcoin: ProShares Bitcoin Strategy ETF (BITO), iShares Bitcoin Trust ETF (IBIT)

-

Ethereum ETF: Grayscale Ethereum Trust (ETHE), Bitwise Ethereum ETF

-

Solana: On June 13, seven major asset managers (e.g., VanEck, 21Shares) filed revised S-1 forms responding to SEC requests on redemption and staking. Bloomberg analysts estimate a 90% approval probability by 2025, with some reports predicting July approval.

3. **Viewing TradFi from Crypto**: Two relatively mature crypto sectors are moving closer to traditional finance:

-

Payments: One of the few truly useful crypto applications. No offense, but running in Nike shoes vs. mining-enabled shoes makes little difference to your run. But cross-border payments via crypto clearly outperform traditional channels. Some consumer-facing projects—like @0xinfini, recently trending—solve real pain points: helping crypto users cash out and spend outside crypto circles. It’s a genuine market need. This sector deeply intersects with TradFi—regulation, partnerships with major banks, and collaborations with legacy payment providers like Visa and Mastercard.

-

Selected RWA (Real World Assets): Most RWAs are scams, but some are mature products tightly linked to traditional finance. Examples include @Bybit_ZH's commodity and U.S. stock trading services, and @binancezh's gold token trading. These are native crypto products attempting to bridge into traditional capital markets.

4. **Viewing Crypto from TradFi**: For old-school investors like Warren Buffett, crypto is a dynamic new frontier. From traditional finance expanding into crypto, two main models exist:

-

Traditional brokers offering crypto trading: Primarily Hong Kong-based regulated brokers who obtained crypto licenses, allowing users to trade crypto directly on their platforms—e.g., Futu. Broadly speaking, we can also include ETF issuers who offer traditional investors access to “alternative assets.” (Yes, to large funds, crypto is still classified as alternative—same tier as antiques and calligraphy.)

-

Hedge and venture capital: Professional investors have long entered crypto. I interned at a compliant Hong Kong hedge fund in summer 2024. Family offices and large corporations now allocate crypto assets to optimize portfolios. As of June 17, 2025, 18 public companies hold Bitcoin, 5 hold Ethereum, and 2 hold Solana.

This entire section took me half a morning to manually compile. If you read through it all, you must be amazed at how closely these two industries are intertwined. But do you remember, back when blockchain began, a group of geeks shouted they’d overthrow traditional finance—how did the dragon-slayer suddenly become the dragon? Before diving into that, let’s tell an interesting story—about the internet.

2. The Internet’s Downfall

"If only life were as beautiful as first sight, why then the autumn wind mourn over painted fans? Ordinary people change hearts easily, yet claim others’ hearts shift fast."

⌨️ The internet was initially built by tech geeks and pioneers who envisioned a decentralized, open platform opposing capitalist monopolies. These “hackers” followed the “hacker ethic”—championing information freedom, anti-authority, decentralization. Richard Stallman founded the free software movement, advocating software sharing and resisting proprietary control. (This explains why Microsoft later became such a frequent hacker target.)

The early internet was used mainly by academic and government institutions, adhering to open and shared principles. Even in 1989, when Tim Berners-Lee invented the World Wide Web (www), his design emphasized open standards and no copyright restrictions—to promote free information flow.

Doesn’t this sound just like crypto’s 2008–2016 era, or Ethereum’s ongoing cypherpunk ethos? Cypherpunk, coined by Jude Milhon—an internet scholar—declared in her “Cypherpunk Manifesto” that privacy is the foundation of liberty, and the internet should resist surveillance.

Hard to believe, right? Today’s internet—rife with eavesdropping, data abuse, filter bubbles, and arbitrary account bans—once aimed to resist surveillance.

🖥️ The internet’s shift from idealistic platform to capitalist tool began with the commercial wave of the 1990s. Policy changes like the 1995 NSFNET privatization and technical advances like HTTPS enabled e-commerce to flourish. Growing market demand attracted venture capital and startups, turning the internet from an academic tool into a commercial platform.

The web was invented in 1989, and by 1995, the dot-com bubble had begun. The bubble (1995–2001) exploded after Netscape’s IPO sparked frenzy, browsers boosted e-commerce, and internet stock prices soared. Why “dot-com”? Any company with “.com” in its name saw valuations skyrocket—price-to-dream ratios went wild. .com became the ultimate buzzword. The entire market drowned in low rates and new-economy dreams.

But all feasts end. In March 2000, the Fed raised rates, U.S. stocks crashed, Nasdaq plunged 78%, and countless fake internet firms collapsed.

For comparison, the internet bubble crisis was even more destructive than the 2008 financial crisis.

This phase fundamentally changed the internet’s participant structure—from ivory tower to江湖 (jianghu). Speculators, scammers, and corrupt employees feasted. In 2002, the Sarbanes-Oxley Act strengthened financial reporting oversight to prevent fraud. The SEC investigated investment banks (like Goldman Sachs) for improper IPO conduct. These performative measures merely proved the internet’s wild growth—but offered little practical value.

Does this remind you of crypto’s 2017 bull run? Blockchain moved from idealism to the streets—CX door-to-door sales, bubble business models, blatant Ponzi schemes ran rampant. Yet it was also the most liquid period—the golden age in many old-timers’ eyes.

💻 From 2009 to today, the internet completed its journey from江湖to庙堂 (temple/hall of power). BlackRock, Vanguard, State Street, Fidelity—the top four collectively hold over 20% of the “Magnificent Seven” stocks. Smaller internet firms might even see 30% ownership by a single institution. Giants like Google, Facebook, and Amazon achieved monopolies by controlling infrastructure and data. Advertising and data harvesting became dominant revenue models. Net neutrality and digital privacy—once sacred doctrines—are now buried in dust.

The internet’s total data monopoly and invasion of user privacy began with Google. Later giants copied this sweet business model. There’s a film called *Surveillance Capitalism*—not about surveilling capitalism, but capitalism defined by surveillance. It meticulously shows how tech giants manipulated the masses, converted political capital, and climbed to the apex of power.

After 40 years of development, the internet successfully married capital. In a sense, it joined the elite—without early investments and later institutional speculation, the internet’s business model couldn’t have scaled so rapidly.

What about power? No need to elaborate—countless domestic and international examples come to mind. Whether lured or threatened by power, internet giants have long intertwined with political forces.

Back to crypto—doesn’t this resemble the 2020–present phase? Institutions entering, countless projects aiming to join traditional finance (e.g., going public). Ironically, wasn’t ICO invented to revolutionize IPO? While admiring Sun Yuchen’s master moves, have you ever wondered why both the defiant internet and rebellious crypto ultimately face pacification?

Now we arrive at the core of this article: The Death of the Geek—Why Crypto Will Ultimately Submit

3. The Death of the Geek

I graduated high school in summer 2023. Back then, RWA was already a hot topic. Since November 2023, I firmly believed crypto’s future lies in convergence with traditional finance. So in summer of freshman year, I interned at a compliant crypto hedge fund in Hong Kong to better understand traditional finance. Those familiar with me in @0xUClub know—Dave is an odd crypto dissident, actually thinking of surrendering to TradFi. Now, seeing Trump and Sun Yuchen bring crypto into the mainstream, I can’t help but reflect.

"On Qinwang Mountain, watching chaotic clouds and sudden rain, rivers upside down. Who knows whether clouds become rain, or rain becomes cloud? The vast sky shifts in moments under the west wind. Turning back, moonlit nature sings, ten thousand earthly apertures roar."

3.1 The Real Mass Adoption: The Godfather’s Business

In *The Godfather Part II*, young Vito Corleone in 1910 New York’s Little Italy resists local mob boss Fanucci. Fanucci tells him: “Young man, you gotta pay for protection for your business, or there’ll be trouble.”

A century later, a senior U.S. SEC official may have said the same to @cz_binance.

The narrative of mass adoption has been told forever—from post-college days until now. Why hasn’t any truly application-level product emerged? Why hasn’t crypto had its iPhone moment? What does real mass adoption require?

This deserves deep discussion. Here, I’ll focus on one angle: business confrontation—the Godfather’s business. The mob rule: if you operate in my territory, you pay me. This applies perfectly to crypto’s path to mainstream. Why is blockchain exciting? Not just because of new business models, but because it disrupts distribution structures. Take pump.fun—anyone can now participate in asset games without barriers. This is intolerable to institutions like major investment banks who monopolize financial rules. DApps returning data privacy to users could cut off Big Tech’s revenue streams.

If you want to do business in my domain, you must share the profits. If you don’t, powerful institutions controlling mainstream resources won’t allow you to operate in their space.

Capital deals with newcomers in two ways:

-

Suppression: Like the UK’s Red Flag Act, requiring every vehicle to have three operators—one walking 55 meters ahead waving a red flag (or lantern at night) to warn others. This protected horse carriages and railways—a victory for industrial lobbying groups. Or Hong Kong’s current taxi protection laws, which ban ride-hailing services to protect outdated, poorly serviced, route-extending taxi drivers. The goal: eliminate the enemy. Many weak innovations get wiped out this way.

-

Assimilation: Institutional investors buy Microsoft stock; Soros and financiers make political donations; the once-dominant Jack Ma gets sidelined, Alibaba partially taken over by state capital. The goal: turn enemies into vassals. Whether through coercion or temptation, your future depends on their approval.

Regarding crypto, mainstream capital initially tried suppression—China’s actions were most notable: seven-department notices, nine-department directives, ten-ministry documents—all very aggressive. But then capital realized crypto was too resilient to destroy. So strategy shifted to assimilation: BlackRock leads ETF creation; IBIT’s daily volume now exceeds Binance—pricing power rests entirely with traditional institutions. Trump hosts crypto roundtables, gathering once-independent crypto leaders for pacification talks. Money and power crush resistance—this tactic works too well.

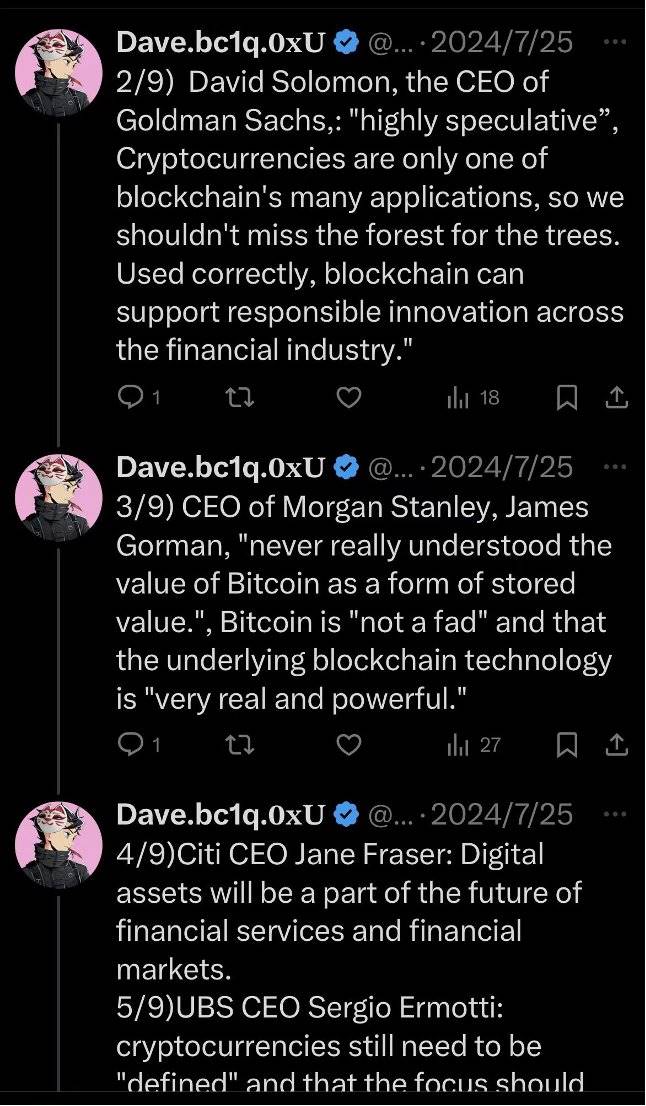

Back to the Godfather—this method is common in organized crime: eliminate enemies or turn them into loyal subordinates. Below is my summary from last year of the Big Eight (BB) bank CEOs’ views on crypto. At the time, I hadn’t monetized it, so posted piecemeal—partial screenshots here prove I’ve long focused on TradFi-crypto convergence. Feel free to check.

https://x.com/0xdave852/status/1816409472899920370?s=46

3.2 Liquidity Support: The Greater Force

Why is this secondary market so tough? Why are altcoins struggling to rise? The root cause: marginal liquidity hasn’t improved. With global monetary supply unchanged, existing capital is exhausted, and new inflows are blocked. Exchange wars for users, project-driven user acquisition—all symptoms stem from the same disease: capital fighting over scraps, no new blood.

Crypto lacks liquidity. Without liquidity, high valuations can’t be sustained—or more precisely, people can’t exit. Compared to traditional assets, crypto’s scale is negligible. Accessing institutional capital means abundant liquidity can sustain current token bubbles. And traditional-world investors bring massive new capital—that’s super bull logic.

3.3 Glory Bows to Me: The Endgame of the New Elite

If a person or group accumulates immense wealth, they must also gain matching political resources and social status. Otherwise, money (fluid) and influence (closed-class) create dangerous misalignment. Misalignment breeds crisis—late Qing China was wealthy but lacked international political clout or military strength, making it easy prey.

This logic applies fully to crypto. When I saw CZ—likely 10x richer than Goldman Sachs’ CEO—fined $4 billion and jailed, I realized crypto would fully co-opt political power. FTX’s SBF was Biden’s second-largest individual donor in 2020, after Bloomberg. Crypto lobby efforts led by Coinbase CEO and MicroStrategy CEO are highly active. This is called rent-seeking: gaining economic benefits or privileges via political power, not productive activity. Don’t look down on it—backroom dealings often drive real progress.

Vice versa, the powerful need money—it’s a mutual embrace. Sun Yuchen’s moves since Trump took office are textbook perfect.

4. Old Story? New Era? The Future of Crypto

I recall mid-2024—quite bearish, everyone suffering—so we debated where the industry should go. Three main schools emerged: first, decentralized computing, represented by Ethereum’s value camp; second, crypto casinos, financial nihilism led by meme coins (many still on Ethereum); third, compliance advocates, believing crypto would inevitably be pacified—a minority voice then.

Looking back, honestly, none of us were sure. My stance was: like saving China from Qing rule, different revolutionaries proposed different plans—no one knew which would work. No problem—try them all. I believed TradFi would intervene. If I was wrong, it didn’t matter—what if I was right?

Now, looking forward—where is crypto headed? I agree with @yuyue_chris: “Let God’s belong to God, let the rebels remain rebels.” We can divide it: for new players building initial capital, on-chain, crypto-native, fairer games will dominate. For established players, compliant, safe, large-scale games will prevail. So we may see polarization: native Web3 becomes more native, mature Web3 becomes more mature—moving into the mainstream.

"I’d rather die amid wine and flowers, than bow before carriages and horses."

Recently, my dear teacher @thecryptoskanda commented on a meme coin related to an Indian air crash, criticized by righteous beauty @yuxin_pig. Wei Tuo is king of pumps, Yuxin a staunch Ethereum builder. Both are close mentors I deeply respect—but I enjoy their fights. This clash of values is exactly what I love about crypto. The future will keep growing through disagreement.

Finally, a personal lesson:

5. Lessons Learned:红利 or Illusion?

"Don’t idle away youth, only to grieve with white hair."

Two trends have thrived since last fall: financial nihilism/crypto casinos, and compliance-driven mainstreaming. I foresaw crypto’s move toward the mainstream early—but underestimated a fatal point: this opportunity is nearly inaccessible to ordinary people. I thought slowly building bridges between TradFi and crypto would yield arbitrage potential. But I didn’t expect integration to accelerate so fast, nor how hard it would be to enter top-level design. So while friends grinding meme coins and on-chain apps got rich, I struggled studying fundamentals—deeply painful.

Now many crypto firms rush toward IPOs, and traditional institutions eagerly buy in. Everyone’s thrilled. But after reading my story, ask yourself: is this feast a real红利 or just illusion?

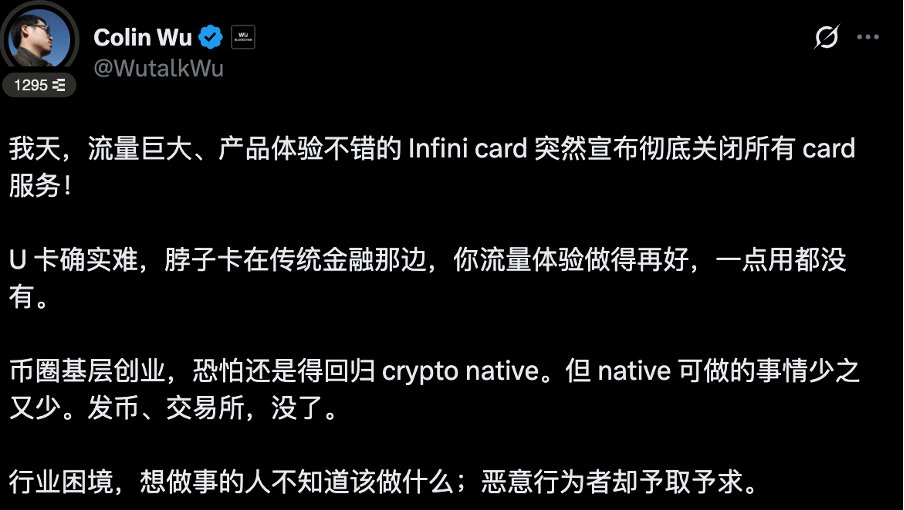

Infini’s C-card shutdown sparked debate. Wu Shuo published a thread:

Right now, operational红利 are scarce—some asset-side opportunities remain. As清醒 participants, we must realize: though crypto remains early-stage overall, certain segments are already saturated. We must always seek exponentially growing sectors. Exact strategies come from实战 experience. Key takeaway: reflect constantly. Don’t get swept up by mainstream hype. Think calmly—how can you capture the few remaining红利 windows?

Conclusion: From a crypto-centric view, the entire history resembles a modern *Water Margin*—from “forced onto Liangshan” to “bearing the decree of pacification.” Behind this irony lies humanity’s murky operating rules. An interesting historical insight: heaven favors life; history tends toward neutrality. Fusion and compromise are normal. Conflict and revolution are rare.

Wrote a lot again—both concrete and abstract. To summarize: Part 1 gave practical investment overviews. Part 2 shared fun stories. Part 3 delivered my favorite logical reasoning.

"The Yangtze flows eastward, waves washing away heroes. Right and wrong, success and failure—all vanish in time. Green hills remain, how often red sunsets shine. White-haired fishermen on river islets, accustomed to autumn moons and spring breezes. A jug of cheap wine, joyful reunions. Ancient and modern affairs—all become laughter over drinks."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News