JPMorgan Launches JPMD "Deposit Token" Experiment: Claims Superiority Over Stablecoins, Piloting with Institutions

TechFlow Selected TechFlow Selected

JPMorgan Launches JPMD "Deposit Token" Experiment: Claims Superiority Over Stablecoins, Piloting with Institutions

JPMD, deployed on the Base blockchain supported by Coinbase, will undergo a pilot phase for several months and may feature interest-earning capabilities in the future.

By Weilin, PANews

On June 18, JPMorgan announced the launch of a pilot program for a new deposit token called JPMD, to be deployed on the Base blockchain supported by Coinbase. In the coming days, JPMorgan is expected to transfer a certain amount of JPMD from its digital wallet to Coinbase, the largest cryptocurrency exchange in the United States.

Initially, the token will only be available to JPMorgan's institutional clients, with plans to gradually expand to broader user groups and additional currencies following regulatory approval in the U.S.

JPMD Pilot to Last Several Months; Interest-Bearing Functionality Possible in Future

The launch of JPMD is not a hasty move. As early as 2023, JPMorgan had begun exploring the feasibility of deposit tokens through its blockchain division, Kinexys. Just one day before the official announcement of the JPMD pilot, it was discovered that the bank had filed a trademark application for "JPMD," covering services such as crypto asset trading, payments, and custody. At the time, speculation arose that this could signal JPMorgan’s entry into the stablecoin market.

However, instead of launching a stablecoin, JPMorgan emphasized “deposit tokens” as a more robust and regulated alternative.

Naveen Mallela, Global Co-Head of Kinexys at JPMorgan, told Bloomberg that the issuance and transfer of the token will occur on Base—a public blockchain associated with Coinbase—and will be denominated in U.S. dollars. He added that Coinbase’s institutional clients will eventually be able to use this deposit token for transactions. The pilot is expected to run for several months, with plans to expand to other users and currencies after receiving regulatory approvals.

Mallela said: “From an institutional perspective, deposit tokens are a superior alternative to stablecoins. Because they’re based on a fractional reserve banking system, we believe they’re more scalable.” He noted that deposit tokens like JPMD could potentially offer interest-bearing features and even fall under deposit insurance protection in the future—features typically absent in mainstream stablecoins today.

The JPMD pilot marks the bank’s effort to extend digital asset products beyond its internal systems. JPMorgan has long been at the forefront of Wall Street’s push to adopt blockchain technology and currently operates a network known as Kinexys Digital Payments (formerly JPM Coin), which enables corporate clients to transfer U.S. dollars, euros, and British pounds from their bank accounts.

According to Bloomberg, JPMorgan reported that transaction volume on this network grew tenfold last year and now averages over $2 billion per day. Still, this represents only a small fraction of the approximately $10 trillion in total daily transactions processed by the bank’s payments division.

Mallela stated that JPMorgan will continue operating and expanding the Kinexys Digital Payments network, but JPMD is expected to initially attract a different user base—particularly clients seeking alternatives to stablecoins backed by commercial banks.

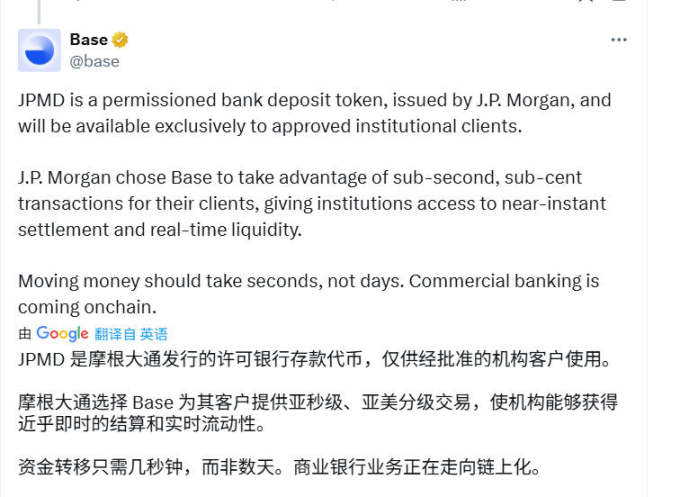

The JPMD pilot also further supports the growth of Base. “Funds should move in seconds, not days,” Base said in a post on social media platform X on June 18. “Commercial banks are going on-chain.”

Although JPMD is designed to operate on a public blockchain, Mallela emphasized it will remain a permissioned token, accessible only to JPMorgan’s institutional clients.

Is the Stablecoin Market 'Too Crowded'? How Deposit Tokens Differ from Stablecoins

In the meantime, another JPMorgan executive expressed caution about the “overcrowded” stablecoin market during the DigiAssets 2025 conference on June 17.

“I just think, as an industry, we all need to take a step back and consider whether we’re ultimately going to overcrowd the market or create even more fragmentation, as every company chooses to issue its own [stablecoin],” said Emma Lovett, Executive Director at JPMorgan, speaking at the event in London, where she leads work on distributed ledger technology and credit markets.

She noted that the market is currently “at the peak of the stablecoin hype cycle.” But she added, “It will be very interesting to see how things evolve in two or three years—what stablecoins have been issued, and who’s using which ones.”

In fact, in a white paper published several years ago, JPMorgan outlined the concept of deposit tokens and how they differ from stablecoins. The institution stated that the ongoing development of blockchain technology in commercial applications is creating demand for blockchain-native “cash equivalents”—assets that can serve as liquid means of payment and store of value within native blockchain environments. To date, stablecoins have largely fulfilled this role.

Yet, deposit tokens and central bank digital currencies (CBDCs) have emerged as key focal points in discussions about the optimal form of digital money. Deposit tokens refer to transferable tokens issued by licensed depository institutions on blockchains, representing holders’ claims on deposits at the issuing institution. Since deposit tokens are essentially commercial bank money in a new technological form, they naturally belong to the banking system and are subject to existing regulations and supervision applicable to commercial banks.

Deposit tokens can support various use cases comparable to traditional commercial bank money, including domestic and cross-border payments, trading and settlement, and provision of cash collateral. Their tokenized form also enables new functionalities such as programmability and instant, atomic settlements, accelerating transaction speeds and enabling automated execution of complex payment operations.

The white paper acknowledged that stablecoins have been a significant financial innovation over the past few years, driving growth in the digital asset ecosystem. However, as on-chain transaction activity grows in scale and complexity, widespread use of stablecoins may pose challenges to financial stability, monetary policy, and credit intermediation.

JPMorgan believes deposit tokens will become a widely used form of money within the digital asset ecosystem—just as today’s bank deposit-based commercial bank money accounts for over 90% of circulating currency. Their tokenized form will benefit from integration with traditional banking infrastructure and existing regulatory safeguards, systems already proven in supporting the stability of commercial bank deposits.

In short, deposit tokens are transferable digital currencies representing claims on deposits held at commercial banks. At their core, they are digital versions of customer deposits in bank accounts. They differ from stablecoins, which are fiat-pegged tokens typically backed 1:1 by a basket of securities such as Treasury bills or other highly liquid assets.

GENIUS Act Passes Senate, Set to Accelerate Stablecoin Adoption

This latest wave of stablecoin momentum has been significantly driven by progress on the U.S. GENIUS Act, a bipartisan bill aimed at establishing a regulatory framework for stablecoins and digital assets. It has also been bolstered by Circle—the issuer of USDC—going public.

On June 18, the U.S. Senate passed the stablecoin regulatory bill, the GENIUS Act, by a vote of 68 to 30. The bill now moves to the House of Representatives for consideration. It establishes a federal regulatory framework for stablecoins, mandating 1:1 reserves, consumer protections, and anti-money laundering mechanisms.

At the DigiAssets 2025 conference in London, an executive from asset management firm Franklin Templeton suggested that the European Union risks becoming a “fly-over region,” while the U.S. and Asia accelerate their adoption of digital assets.

Overall, the launch of JPMorgan’s JPMD marks a significant milestone in the bank’s blockchain strategy and reflects how traditional financial institutions are rapidly advancing their exploration of the future of on-chain payments.

Currently, multinational financial and tech firms including Spain’s Santander Bank, Deutsche Bank, and PayPal are also experimenting with blockchain technology to deliver faster, lower-cost payment and settlement services.

As blockchain technology integrates into mainstream financial systems, deposit tokens issued by commercial banks, protected by regulatory frameworks, and connected to existing account infrastructures may become the new standard for “on-chain cash” in the next phase.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News