After the Metaplanet saga, more traditional companies go all-in on Bitcoin

TechFlow Selected TechFlow Selected

After the Metaplanet saga, more traditional companies go all-in on Bitcoin

Michael Saylor's prediction has come true—orange flags are being raised around the world.

By CryptoLeo, Odaily Planet Daily

"Value investing leads to nothing, go all-in on 'big cake' and live in a palace"—the truth behind this saying continues to gain weight.

First, El Salvador defied IMF loan agreement terms by continuously accumulating Bitcoin. Then, Michael Saylor—the die-hard Bitcoin fan—keeps publishing weekly Bitcoin Tracker reports as his company Strategy continues buying BTC aggressively. Over the past year, numerous non-crypto companies have announced their Bitcoin reserve strategies and disclosed their BTC holdings. For example, Japanese listed company Metaplanet transformed from an underperforming hotel business into a firm executing a Bitcoin strategy, seeing its market cap surge over 50x to $5 billion. Similarly, GameStop, the traditional video game and entertainment software retail giant, saw its stock price skyrocket after announcing its Bitcoin reserve strategy.

Odaily Planet Daily compiles seven recent traditional enterprises that have transitioned toward implementing Bitcoin reserves.

1. Ritr Logistics Technology Group

Company Overview: Ritr Logistics Technology Group (Nasdaq: RITR) is a Hong Kong-based Nasdaq-listed company adopting a "Real Estate + Logistics Tech" (PLT) model that leverages logistics technology to empower real estate development. Ritr provides asset management services for logistics real estate investors such as funds, family offices, property owners, and high-net-worth individuals. It also offers professional logistics tech solutions to logistics operators and end users. The group launched its real estate investment and asset management program in 2015 and went public on Nasdaq in August 2024 (Nasdaq: RITR).

Its business includes: asset management (investing in apartments and office buildings), construction and building, engineering development, design and renovation, consulting services, logistics technology, and intelligent Warehouse-as-a-Service (iWaaS).

Bitcoin Reserves: On June 6, Ritr Logistics Technology Group announced it had signed a Bitcoin acquisition agreement with a BTC investor. Under the agreement, Ritr may purchase up to 15,000 Bitcoins from the investor at a total transaction value of up to $1.5 billion. According to its official website, Ritr plans to issue a digital token called "RBTC," which will be fully backed 1:1 by Bitcoin reserves. Customers can use Hong Kong dollars or U.S. dollars to exchange for RBTC, then pay warehouse rental fees, value-added service charges, Warehouse-as-a-Service (WaaS), and related service fees at discounted rates across all Ritr smart warehouses. This aims to further digitize, intelligentize, and increase transparency in warehousing payment processes, promoting upgrades in smart logistics.

Following Hong Kong's passage of the Stablecoin Bill, Ritr Logistics Technology Group is studying relevant regulatory details and plans to apply for a Hong Kong stablecoin issuance license after the regulation takes effect (August 1), launching the stablecoin "RHKD." RHKD will primarily serve payments and settlements in cross-border e-commerce, logistics, and supply chains.

Accumulation Statement: Chen Jianzhong, Chairman and CEO of Ritr Logistics Technology Holdings, said: "Using Bitcoin as the cornerstone of our corporate financial strategy helps lay a solid foundation for the long-term development of our PLT ecosystem and leads the digital transformation of logistics, enabling us to seize massive opportunities within Asia’s multi-trillion-dollar supply chain modernization wave."

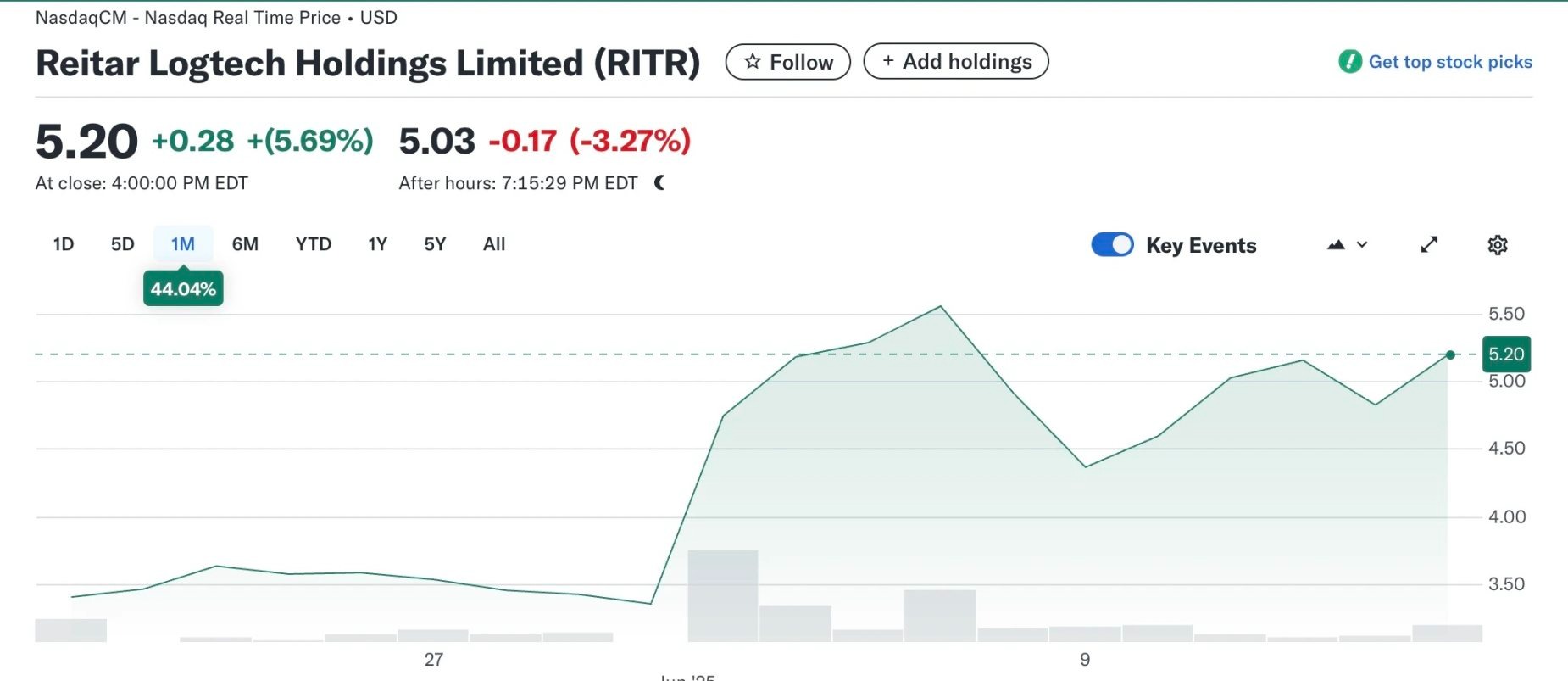

Stock Performance: At the time of writing, the company's stock was trading at $5.20, up 44.04% month-to-date. Since announcing its $1.5 billion Bitcoin reserve plan, the share price has not experienced significant fluctuations. However, given the recent bullish trend among crypto-linked U.S.-listed stocks, future price movements are worth watching.

2. Cango (Cango Auto Financial Services)

Company Overview: Cango (NYSE: CANG) started as an automotive financial services provider in China, founded in 2010 with headquarters in Shanghai and nationwide operations. Starting with auto loans, Cango built a vast distribution network deeply rooted in lower-tier cities and counties, expanding into full-value-chain automotive industry services including transactions and after-sales markets. Its business thrived and attracted investments from Warburg Pincus, Primavera Capital, Tencent Group, Taikang Life Insurance, and Didi Chuxing.

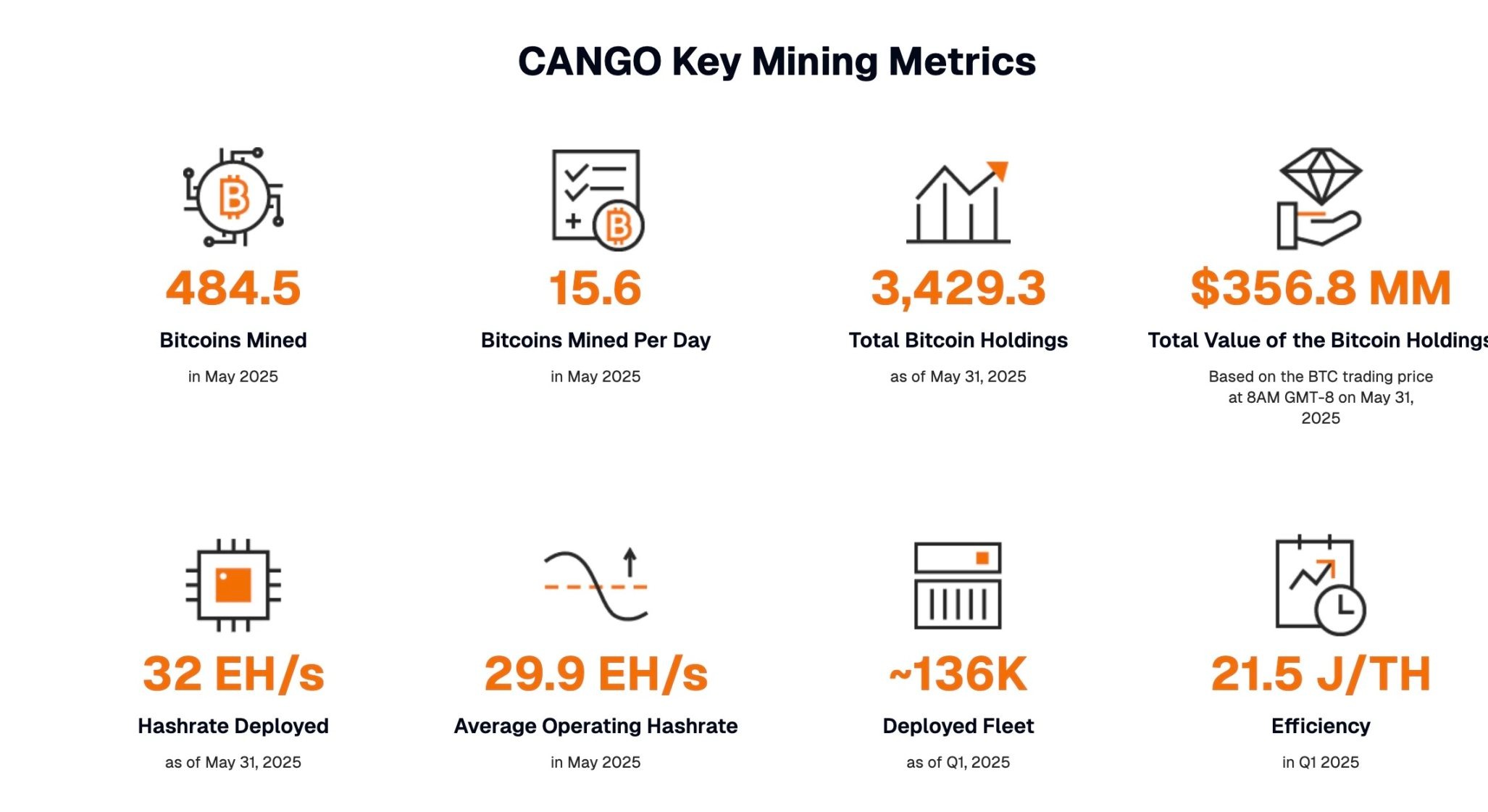

Bitcoin Reserves: In late 2024, Cango began transitioning into a Bitcoin mining company. As part of this transformation:

-

Cango announced the sale of its domestic auto finance business to Ursalpha Digital Limited—a firm linked to Bitmain affiliate Antalpha—for $352 million;

-

Cango issued a public announcement stating its intention to purchase cryptocurrency mining equipment, spending $256 million to acquire Bitcoin miners with 32 EH/s computing power from Bitmain. Additionally, Cango agreed to issue $144 million worth of common stock to Golden TechGen (led by Max Hua, former CFO of Bitmain) and other entities to acquire additional rack-mounted Bitcoin miners totaling 18 EH/s in computing power.

Official data shows that as of this article’s publication, Cango mined 484.5 BTC in May alone—an average of 15.6 BTC per day—increasing its total Bitcoin holdings to 3,429.3 BTC.

Accumulation Statement: Juliet Ye, Senior Communications Director at Cango, said: "I think this is surprising for people in the [Bitcoin mining] industry because no one had heard of Cango before, but Cango's history is one of constant adaptation. Since our founding in 2010, we’ve entered different fields two or three times already."

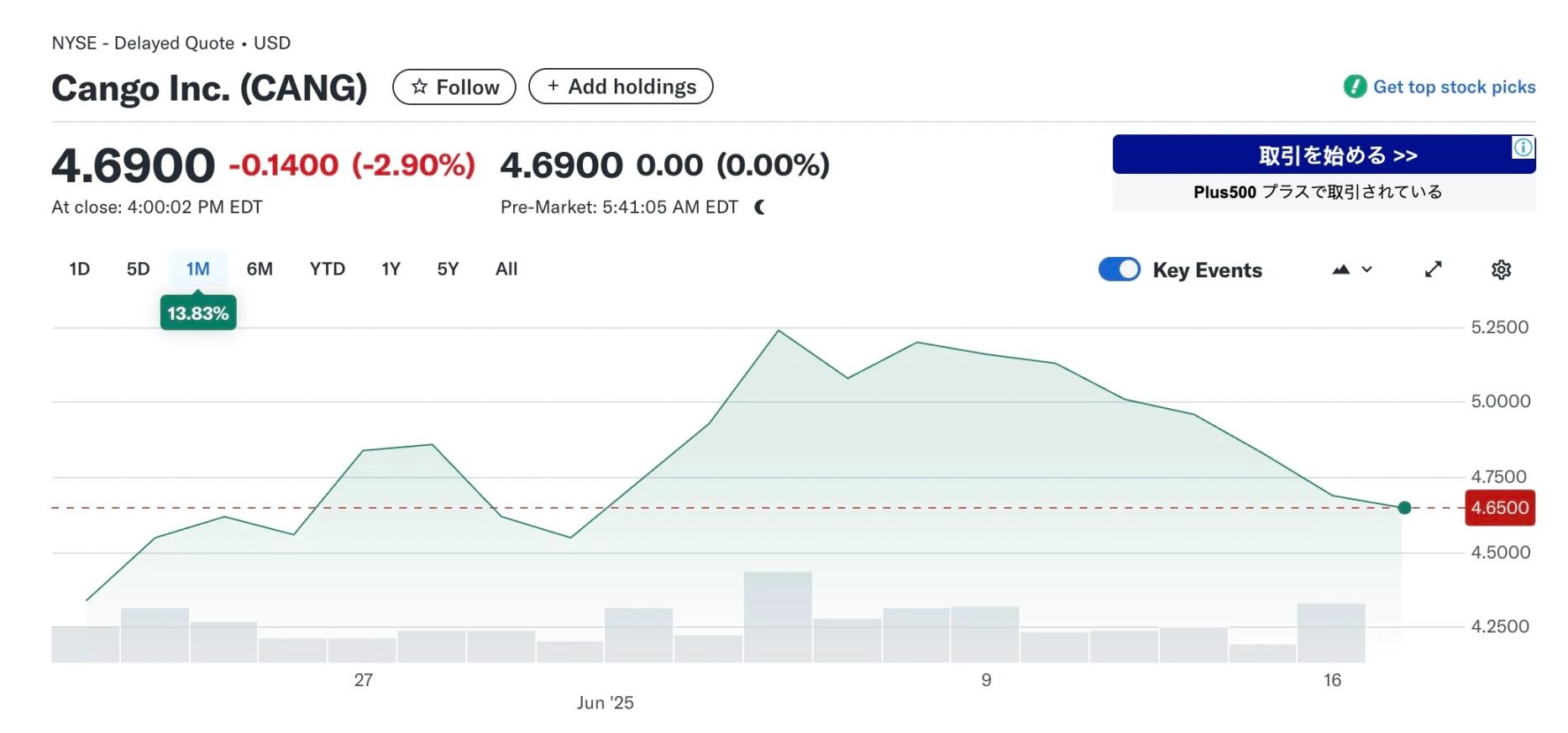

Stock Performance: CANG currently trades at $4.69. Prior to its transformation announcement, the stock showed little movement. After disclosing its partial divestiture of Chinese operations and shift toward Bitcoin mining, the stock rose significantly.

3. Heritage Distilling

Company Overview: Heritage Distilling (Nasdaq: CASK) is one of America's better-known independent craft distillers, established in 2011, offering various whiskies, vodkas, gins, rums, and ready-to-drink canned cocktails. Heritage has been named North America’s most awarded craft distillery for ten consecutive years by the American Institute of Wine & Spirits. It has also won numerous awards in national and international spirits competitions. (The official website accepts Visa and other conventional payments; cryptocurrency payments are not yet available.)

Heritage Distilling Co. went public on Nasdaq on November 22, 2024, issuing 1,687,500 shares of common stock at $4.00 per share, raising approximately $6.75 million in gross proceeds before underwriting discounts and offering expenses.

Bitcoin Reserves: Heritage’s Bitcoin reserve initiative has been in progress for some time, with the following timeline:

-

January 7, 2025: Established a cryptocurrency committee;

-

January 10, 2025: Announced plans to launch a cryptocurrency reserve policy;

-

May 15, 2025: Officially adopted its corporate cryptocurrency reserve policy;

-

June 3, 2025: Announced pre-launch of new “Bitcoin Bourbon” whiskey.

Specifically, on May 15, 2025, Heritage Distilling announced that its board approved the final version of its cryptocurrency reserve policy, allowing the company to accept BTC and DOGE as payment for products and services on its direct-to-consumer e-commerce platform, and permitting the acquisition and holding of cryptocurrencies as strategic assets. This initiative is led by the Board’s Technology and Cryptocurrency Committee chaired by Matt Swann, former Amazon Vice President and Payments Business Manager. Under Swann’s leadership, Heritage’s crypto committee will also roll out: on-chain loyalty programs, product-linked NFTs, tokenized supply chains, and decentralized consumer engagement tools.

Justin Stiefel, CEO of Heritage, stated the company is actively evaluating financing opportunities related to its cryptocurrency reserve policy.

Accumulation Statement: Matt Swann said: "A new era of commerce is emerging, with cryptocurrencies leading the way in reducing friction between buyers and sellers. After nearly two decades focused on integrating technology and money, it's exciting to see Heritage boldly seize the opportunity to combine consumer power with cryptocurrency."

CEO Justin Stiefel commented: "Heritage has always been at the forefront of innovation. We are preparing to accept BTC and DOGE as payment methods for online e-commerce sales and to acquire and hold these cryptocurrencies as assets. Unlike traditional investors who buy crypto with cash and immediately face potential price volatility, as a company producing goods for sale, the acceptable profit margin between our retail prices and production costs is expected to offset any potential fluctuations in the value of our held cryptocurrencies, giving us substantial financial flexibility."

Stock Performance: Heritage stock CASK is currently trading at $0.52, down 87% from its IPO price. There has been little movement since announcing its Bitcoin reserve strategy. Its current liquid assets amount to $3,249,767, limiting purchasing power. However, Heritage appears to be following Metaplanet’s path—facing low stock performance and now seeking funding to buy Bitcoin. Given it's still in preparation stages, there remains room to hope for future stock value.

4. Paris Saint-Germain Football Club (PSG)

Company Overview: Most readers are familiar with French football club Paris Saint-Germain (PSG), a top-tier team in Ligue 1, which won the UEFA Champions League final on the evening of May 31. Just one day before their victory (May 30), PSG announced it had incorporated Bitcoin into its treasury reserves.

Strictly speaking, PSG isn’t a “non-crypto” organization—we know them for fan tokens like PSG on CHZ, previous NFT launches, and partnerships with Crypto.com. But publicly disclosing Bitcoin reserves is a first, marking PSG’s latest move aligning with the growing global trend of Bitcoin treasury adoption.

Accumulation Statement: Pär Helgosson, Head of PSG, said: "We began acquiring Bitcoin through fiat reserves last year. About 80% of our global fan base of roughly 550 million are under the age of 34. We focus on the future, and we focus on Bitcoin. We’re accelerating the growth of Bitcoin entrepreneurs and Bitcoin businesses, leveraging our global fan base of over 500 million to help expand Bitcoin’s reach worldwide."

5. Genius Group (Artificial Intelligence Education)

Company Overview: Genius Group (NYSE: GNS) is a Singapore-headquartered edtech company specializing in personalized, innovative AI-driven education solutions. Founded by Roger Hamilton, the company aims to deliver comprehensive learning experiences—from basic to higher education—using digital technologies and global resources for schoolchildren, university students, adults, and entrepreneurs. It currently serves over 5.7 million students across more than 100 countries/regions.

Bitcoin Reserves: In November 2024, Genius Group announced its intention to adopt a Bitcoin-first reserve strategy, allocating over 90% of its reserves to Bitcoin, launching a Web3 education series, and enabling Bitcoin payments on its EdTech platform.

Genius Group’s Bitcoin accumulation journey has faced setbacks. In February, it announced increasing its Bitcoin holdings by $2 million, bringing total reserves to 440 BTC. However, due to a U.S. court injunction prohibiting the use of investor funds to buy Bitcoin (effective from February 14 to May 6), Bitcoin purchases were suspended. During this period, Genius Group was forced to sell much of its Bitcoin holdings. Later, the company announced that the U.S. appeals court lifted the Bitcoin purchase ban, allowing it to restructure operations and rebuild its Bitcoin treasury. Its Bitcoin holdings have since increased by 52%, reaching 100 BTC purchased at $100,600 each, totaling $10.06 million.

In addition, Genius Group launched THE BITCOIN ACADEMY, featuring a Learn-to-Earn model where users earn GEM tokens by completing courses, redeemable for rewards.

Accumulation Statement: After shifting to a Bitcoin reserve model, Roger Hamilton, CEO of Genius Group, said: "Genius Group is currently the only Asian Bitcoin-reserve company listed on a major U.S. securities exchange. We’ve found growing interest among international investors in Bitcoin’s global exposure, zero capital gains tax, and access to U.S. financial market liquidity. With the launch of our Bitcoin Academy, we’re educating corporations, executives, and investors about the benefits of institutional Bitcoin adoption. We’re excited to sponsor and attend events like the Institutional Digital Assets Summit in Hong Kong and Bitcoin Investor Week in New York as part of our outreach efforts."

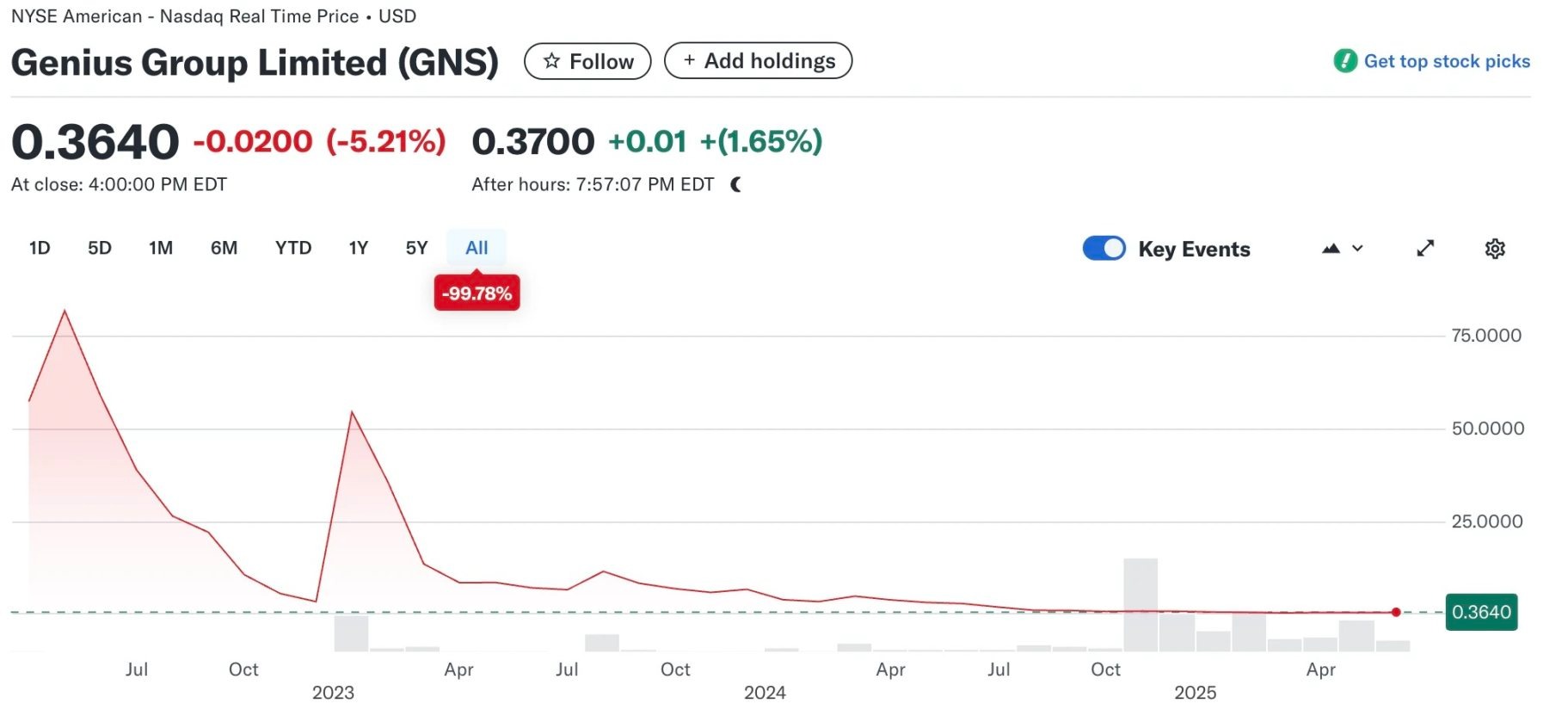

Stock Performance: Genius Group stock GNS is currently trading at $0.364. Adopting a Bitcoin reserve strategy similar to Strategy may be one of several attempts to recover its declining market cap and stock price.

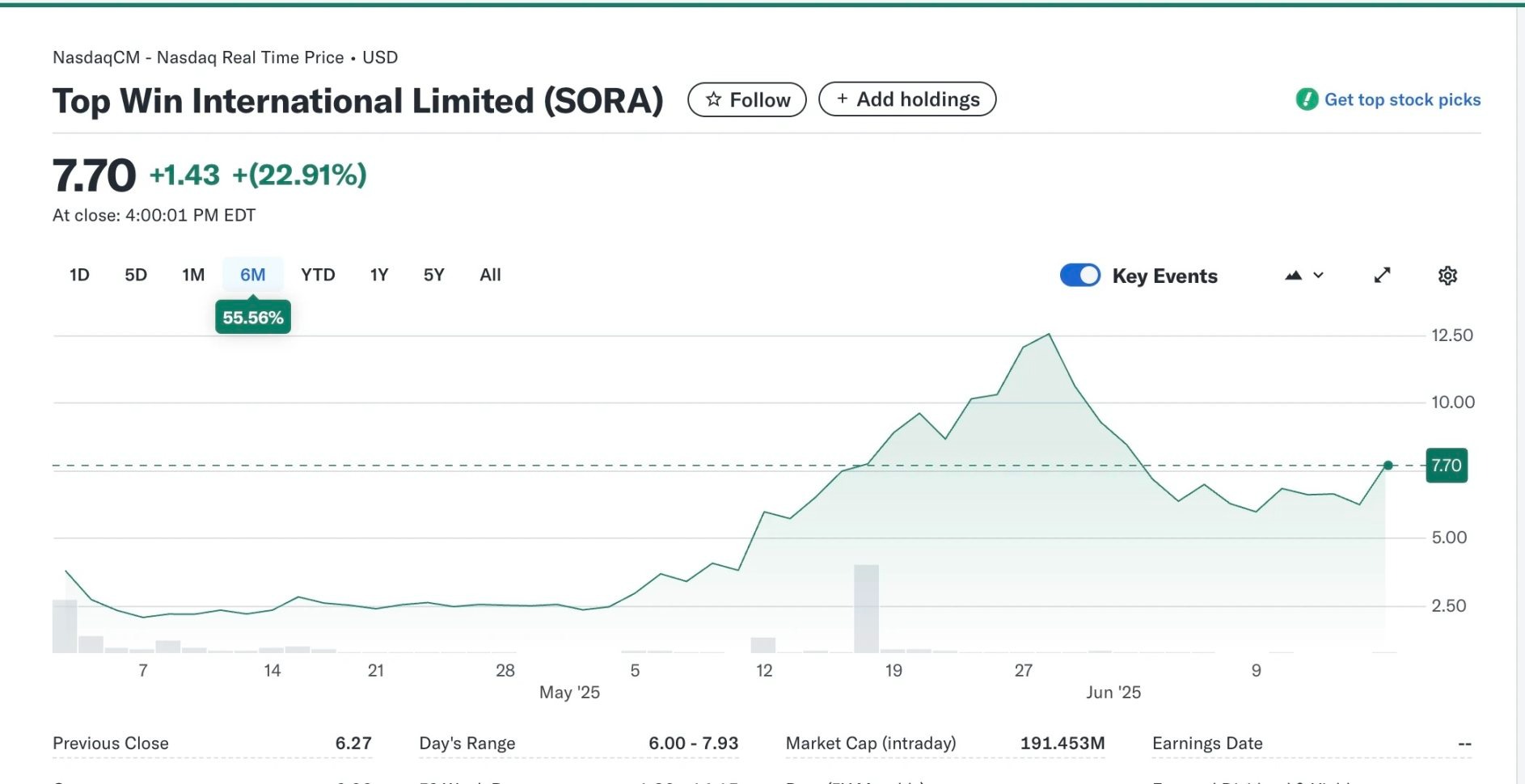

6. Luxury Watchmaker Top Win

Company Overview: Top Win (Nasdaq: TOPW, later renamed SORA) is a Hong Kong-based luxury watch company focusing on trade, distribution, and retail of internationally renowned luxury watches, founded in 2001. It successfully listed on Nasdaq on April 2, 2025.

Bitcoin Reserves: On May 19, 2025, Top Win officially entered the crypto space, partnering with prominent Web3 fund Sora Ventures to promote a Bitcoin-centered asset reserve strategy.

Sora Ventures is a well-known investment fund previously focused on DeFi, BTC, and NFTs, having invested in projects like Pendle, Tap Protocol, and Xverse. After pivoting to Bitcoin reserves, its main business shifted toward BTC accumulation and expanding the Strategy Bitcoin reserve model across Asia. Previously, Sora Ventures launched a $150 million fund aiming to drive Bitcoin reserve adoption among Asian listed companies. It also partnered with Metaplanet to create the first “Asian version of MicroStrategy.”

Recently, it merged with Top Win, rebranding the combined entity as “AsiaStrategy” and listing on Nasdaq—an example of a classic reverse merger.

Accumulation Statement: Jason Fang, founder of Sora Ventures and Co-CEO of AsiaStrategy, said: "Bitcoin asset management firms like SORA will play a dominant role in pushing Bitcoin prices to new highs."

Stock Performance: SORA is currently trading at $7.70, up 55.56% since listing. The stock rose shortly after announcing its BTC strategy, making it one of the few recent companies turning to Bitcoin accumulation that actually saw its stock price rise.

7. Davis Commodities (Singapore Agricultural Trading Company)

Company Overview: Davis Commodities (Nasdaq: DTCK) is a Singapore-based agricultural commodities trader primarily engaged in trading sugar, rice, and oil, distributing these products to multiple markets including Asia, Africa, and the Middle East. According to its official website, for the fiscal year ended December 31, 2024, Davis Commodities reported total revenue of $132.4 million, down 30.6% compared to $190.7 million in 2023. The decline was mainly attributed to slowing sales of sugar and rice products in key markets, especially Southeast Asia and Africa.

Bitcoin Reserves: Likely due to declining year-on-year revenues, Davis Commodities has turned toward Bitcoin reserves and RWA (real-world asset) tokenization.

On June 16, it announced a $30 million strategic growth plan, allocating 40% ($12 million) in phases to Bitcoin reserves, with the first phase investing approximately 15% of funds ($4.5 million) into Bitcoin. Davis Commodities expects its Bitcoin holdings to generate measurable returns over the next 36 months depending on market conditions and continued global adoption trends. This allocation is expected to enhance financial resilience, diversify asset management frameworks, and strengthen long-term growth potential.

Additionally, 50% of the funds ($15 million) will be invested in leading RWA tokenization projects, focusing specifically on agricultural commodities. By tokenizing physical assets such as sugar, rice, and oil, the company aims to unlock new liquidity channels, streamline trading processes, and improve efficiency in agricultural trade.

The remaining 10% ($3 million) will be used to build advanced technical infrastructure, implement robust security measures, and establish strategic partnerships.

Accumulation Statement: The CEO of Davis Commodities stated: "The $30 million fundraising plan marks a crucial step for Davis Commodities in redefining the global commodities trading landscape. By integrating Bitcoin reserves and RWA tokenization, we not only reinforce our position as a leading agricultural trader but also seize broad opportunities at the intersection of traditional commodities and digital assets. This strategy aims to drive sustainable growth, enhance investor returns, and ensure we remain at the forefront of global trade innovation."

Stock Performance: DTCK is currently trading at $0.786, up 12.29% over the past five days, though still significantly below its IPO price.

Conclusion

As Matt Levine, Bloomberg’s chief financial writer, noted in his article “The Underlying Logic Behind U.S. Listed Companies Going Crazy for Cryptocurrencies,” the above U.S.-listed companies (excluding the football club) share a common trait: they were initially barely surviving on the stock market, suffering severe post-IPO stock declines. Yet they possess a valuable asset—an American listed shell—that hasn’t been fully utilized.

"This makes them ideal candidates for a 'transformation into crypto vaults.' As I've often said, U.S. equity markets are willing to pay over $2 for every $1 worth of crypto assets. This phenomenon has long been recognized by crypto entrepreneurs. If you hold large amounts of BTC, ETH, Solana, Dogecoin, or even TRUMP tokens, the best move is to place them inside a U.S. listed company and sell them at a premium to secondary market investors. Right now, it feels like the crypto world keeps tricking the U.S. stock market—and the latter keeps falling for it again and again."

Especially recently, with Circle—the issuer of USDC stablecoin—going public and its stock surging from $31 to $151—once again validating the market potential of blockchain-related concepts. The companies mentioned above will certainly not be the last to adopt Bitcoin reserves. In the future, we’ll see more and more traditional enterprises ride the crypto wave to achieve strategic transformation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News