DeFi Bull Market Guide: The U.S. SEC Has Sent Positive Signals, Three Categories Worth Watching

TechFlow Selected TechFlow Selected

DeFi Bull Market Guide: The U.S. SEC Has Sent Positive Signals, Three Categories Worth Watching

For mature investors, the current environment presents a rare convergence of regulatory clarity, technological advancement, and market undervaluation.

Author: Cryptofada

Translation: Felix, PANews

On June 9, a cryptocurrency task force roundtable hosted by U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins signaled potential favorable developments for crypto and DeFi participants across multiple dimensions. This marks the most supportive stance toward DeFi ever taken by a U.S. regulator—though most have yet to realize it. While no formal legislation has been passed, these statements:

-

Create a regulatory environment that encourages innovation

-

Reinforce the legitimacy of self-custody and on-chain participation

-

Suggest more flexible and thoughtful rules for DeFi experimentation

This could very well ignite a new wave of DeFi revival led by the United States. If you're in crypto, this clearly signals that a new era of U.S.-regulated DeFi is emerging. This isn't just a regulatory shift—it's an investment paradigm shift.

Key Positive Signals from the SEC Roundtable

1. Financial Independence

Atkins linked economic freedom, innovation, and private property rights with the ethos of DeFi. This narrative repositions DeFi as an extension of American financial independence rather than a regulatory threat—a sharp contrast to previous adversarial stances.

2. Clarifying the Howey Test: Staking, Mining, and Validators Are Not Securities

The explicit clarification that staking, mining, and validator operations do not constitute securities transactions lifts a major regulatory cloud that has long hindered institutional involvement in consensus mechanisms. This resolves the fundamental concern that network participation itself might trigger securities regulation under the Howey Test. This clear guidance directly benefits the $47 billion liquid staking market. The U.S. SEC stated that participating in proof-of-stake or proof-of-work networks as a miner/validator—or through staking-as-a-service—is inherently not a securities transaction. This reduces regulatory uncertainty for:

-

Liquid staking protocols (e.g., Lido, RocketPool)

-

Validator infrastructure companies

-

DeFi protocols with staking functionality

3. Exemption for On-Chain Product Innovation

Atkins proposed a "conditional exemption" or "innovation exemption" policy, allowing rapid testing and launch of new DeFi products without burdensome SEC registration. The proposed "conditional exemption" mechanism creates a regulatory sandbox specifically designed for DeFi innovation. Drawing inspiration from successful fintech frameworks in jurisdictions like Singapore and Switzerland, this approach allows controlled experimentation even when full securities registration requirements aren’t met—potentially paving the way for:

-

Permissionless innovation

-

Faster DeFi product launches in the U.S.

- Faster integration with traditional finance

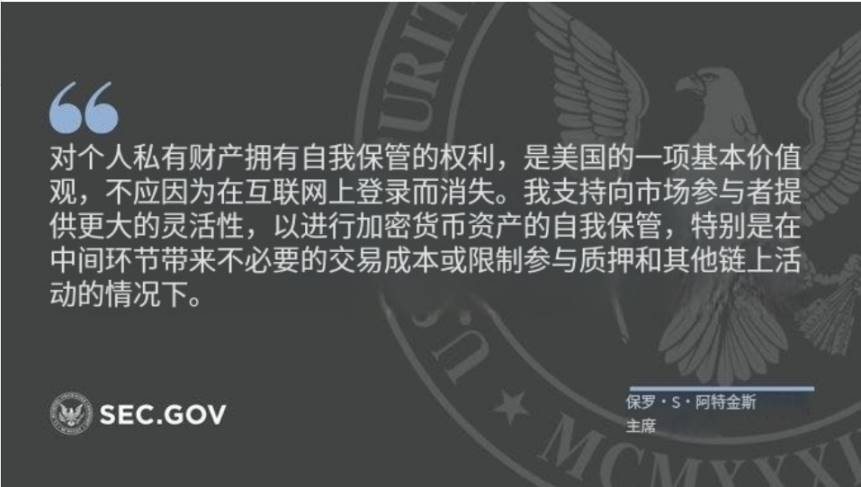

4. Self-Custody Is Protected

Atkins advocated for the right to self-custody digital assets, calling it a “fundamental American value.” This provides support for products such as:

-

Wallet providers (e.g., MetaMask, Ledger)

-

Non-custodial exchanges (e.g., Uniswap)

-

On-chain trading and investment tools

5. Public Support for Trump’s Pro-Crypto Agenda

Atkins referenced Trump’s goal of making the U.S. the “global capital of cryptocurrency,” aligning the regulatory tone with the current political leadership. With the 2024 U.S. election settled, this political alignment may unlock more favorable regulatory policies and accelerate government-backed crypto infrastructure development.

6. Encouragement of On-Chain Resilience

Citing data from S&P Global, Atkins praised DeFi’s ability to remain operational during collapses in centralized finance (e.g., FTX, Celsius). This is direct recognition of DeFi’s reliability under stress conditions.

Strategic Positioning Framework

Layer One: Core Infrastructure Protocols

The clearest beneficiaries of regulatory clarity are protocols forming the backbone of DeFi infrastructure. These typically feature high total value locked (TVL), mature governance structures, and clear utility aligned with traditional financial services.

Liquid Staking Protocols: With clearer staking rules, protocols like Lido Finance ($LDO), Rocket Pool ($RPL), and Frax Ether ($FXS) are poised to attract institutional capital seeking compliant staking solutions. As regulatory barriers fall, the $47 billion liquid staking market could see significant growth.

Decentralized Exchanges: Uniswap ($UNI), Curve ($CRV), and similar platforms benefit from both self-custody protections and innovation exemptions. These platforms can now roll out more complex financial products without regulatory delays.

Lending Protocols: Aave ($AAVE), Compound ($COMP), and MakerDAO ($MKR) can expand their institutional offerings under clearer regulations, especially in automated lending and synthetic asset creation.

Layer Two: Real-World Asset Integration

The innovation exemption framework particularly benefits protocols bridging traditional finance and DeFi. Real-world asset (RWA) protocols can now experiment with tokenization models without going through cumbersome securities registration processes.

Leading RWA projects—Ondo Finance, Maple Finance, and Centrifuge—are positioned to accelerate institutional adoption of tokenized securities, corporate credit, and structured products. With RWA TVL currently around $8 billion, this sector could rapidly expand under clearer regulatory pathways.

Layer Three: Emerging Innovation Categories

The conditional exemption mechanism opens doors for entirely new categories of DeFi products previously stalled by regulatory uncertainty.

Cross-chain Infrastructure: Protocols enabling secure cross-chain asset transfers can now develop more sophisticated products without fear of inadvertently violating securities laws.

Automated Financial Products: Yield optimization protocols, automated trading systems, and algorithmic wealth management tools can now be developed and deployed faster in the U.S. market.

How to Prepare for the Next DeFi Bull Run?

1. Double Down on High-Reliability DeFi Protocols

Focus on protocols likely to benefit from regulatory clarity:

-

Staking & LSTs: Lido, RocketPool, ether.fi, Coinbase’s cbETH

-

Decentralized Exchanges: Uniswap, Curve, GMX, SushiSwap

-

Stablecoin Protocols: MakerDAO, Ethena, Frax

-

RWA Protocols: Ondo, Maple, Centrifuge

2. Accumulate Governance Tokens

Tokens of core DeFi infrastructure—especially those with high TVL and strong regulatory positioning—stand to gain: $UNI, $LDO, $AAVE, $RPL, $MKR, $FXS, $CRV.

3. Participate in On-Chain Governance

Engage in governance forums and vote via delegation. Regulators may favor protocols with transparent and decentralized governance.

4. Build or Contribute Within the U.S. Crypto Ecosystem

The SEC’s signals make the following roles safer:

-

On-chain startups

-

Wallet developers

-

Staking-as-a-service providers

-

Open-source software contributors

Now is the time to:

-

Launch or contribute to public goods

-

Apply for grants or join DAO ecosystem programs (e.g., Optimism Retro Funding, Gitcoin)

-

Join U.S.-based DeFi organizations or DAOs

5. Get Ahead of Institutional Participation Projects

Monitor institutional inflows and innovation exemption pilot programs:

-

Establish positions in liquid DeFi protocols suitable for institutional integration

-

Track pilot announcements from firms like Coinbase, Franklin Templeton, and BlackRock

-

Keep a close eye on the Ethereum ecosystem, especially given staking clarity and high infrastructure adoption

6. Closely Monitor “Innovation Exemption” Guidelines

If the U.S. SEC releases clear criteria, you can:

-

Launch new DeFi tools eligible for exemption

-

Receive airdrops or incentives from compliant protocols

-

Create content or services that simplify the exemption framework

Institutional Adoption Catalyst Analysis

Capital Flow Forecast

Regulatory clarity opens multiple pathways for institutional adoption previously blocked:

-

Traditional Asset Managers: Firms like BlackRock and Fidelity can now explore integrating DeFi into their operations for yield generation, portfolio diversification, and improved efficiency. Institutional adoption in DeFi remains below 5% of traditional AUM, indicating massive growth potential.

-

Corporate Treasury Management: Companies can now consider using DeFi protocols for treasury operations—including yield-bearing cash reserves and automated payment systems. With a corporate treasury market of approximately $5 trillion, even partial migration to DeFi could significantly boost protocol TVL.

-

Pension Funds and Sovereign Wealth Funds: Large institutional investors can now treat DeFi protocols as legitimate asset classes for allocation. Typically investing between $100 million and $1 billion per position, these actors represent exponential growth potential for protocol TVL.

Innovation Acceleration Indicators

The innovation exemption framework could dramatically speed up DeFi development:

-

Product Development Cycle: Previously, new DeFi products required 18–24 months of legal review and possible SEC engagement. The exemption framework could shorten this to 6–12 months, accelerating financial innovation.

-

Geographic Repatriation: Many DeFi protocols were developed overseas due to U.S. regulatory uncertainty. The new framework may lure them back into U.S. jurisdiction, boosting domestic blockchain development.

-

Case Study: Scaling from $10K–$100K to $100K–$1M

The above strategic framework applies across different capital sizes, enabling tailored asset allocation strategies based on risk tolerance and investment horizon.

-

Timeline: 12–24 months

-

Capital Range: $10K–$100K

-

Target ROI: 10x return via portfolio strategy

Retail Investor Strategy (Capital: $10K–$25K)

Retail participants should focus on mature protocols with clear regulatory positioning and strong fundamentals. A conservative strategy might allocate 60% to liquid staking and major DEXs, 25% to lending protocols, and 15% to high-potential emerging categories.

The key is gaining access to governance participation and yield opportunities previously reserved for professional investors. Under regulatory clarity, these protocols offer more transparent and accessible mechanisms.

High-Net-Worth Strategy (Capital: $25K–$100K)

This capital range supports more sophisticated strategies, including direct protocol participation, delegated governance, and use of institutional-grade DeFi products. Strategic allocation might emphasize governance tokens of leading protocols (40%), direct staking positions (30%), exposure to RWA protocols (20%), and early-stage innovative protocols (10%).

High-net-worth individuals can also actively engage in governance and create additional value through governance mining and early protocol development participation.

Institutional Strategy (Capital: $100K+)

Institutional-scale capital enables participation in wholesale DeFi activities, including operating validator nodes, managing protocol treasuries, and deploying advanced yield strategies. These players can also engage in protocol partnerships and custom integration development.

Institutional strategies should emphasize operational involvement, clear regulatory compliance frameworks, robust governance, and institutional-grade security. At this scale, direct staking becomes viable and may offer higher risk-adjusted returns compared to liquid staking protocols.

Return Potential Analysis

Conservative estimates based on past DeFi cycles suggest the following returns within these capital ranges:

-

Token Appreciation: Regulatory clarity, combined with accelerated institutional adoption and enhanced protocol utility, could lead to 3x–5x gains for well-positioned governance tokens.

-

Yield Generation: DeFi protocols offer 4–15% annual yields through staking rewards, trading fees, and lending interest. Regulatory clarity may stabilize—and potentially increase—these yields as institutional capital enters.

-

Innovation Access: Early participation in innovation-exempt protocols could yield outsized returns (5x–10x) as they develop new financial primitives and capture market share in emerging categories.

-

Compounding Effect: The combination of token appreciation, yield generation, and governance participation creates compounding returns that could vastly outperform traditional investment vehicles over a 12–24 month period.

Implementation Timeline Considerations

Phase One (Q3–Q4 2025): Initial regulatory guidelines issued, early institutional pilots launched, governance tokens of well-positioned protocols appreciate.

Phase Two (Q1–Q2 2026): Broader institutional adoption, new product launches under innovation exemptions, significant TVL growth across major protocols.

Phase Three (Q3–Q4 2026): Full institutional integration, potential launch of hybrid TradFi-DeFi products, mature regulatory framework implemented.

The U.S. SEC’s DeFi roundtable in June 2025 marks not just a regulatory evolution, but the dawn of the institutional DeFi era. The convergence of regulatory clarity, political support, and technological maturity creates a unique window for early positioning—before broader market recognition drives valuations higher.

For seasoned investors, today’s environment presents a rare alignment of regulatory clarity, technological advancement, and market undervaluation. Protocols and strategies capable of attracting institutional capital flows over the next 18 months will likely define the next phase of DeFi growth and value creation.

The shift from experimental technology to regulated financial infrastructure represents a fundamental transformation in DeFi’s value proposition. Those who strategically position themselves during this regulatory transition stand to benefit from both the immediate impact of institutional adoption and the long-term value creation of mature, regulated financial markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News