TRON: The DeFi Ecosystem Engine Behind the "Stablecoin King"

TechFlow Selected TechFlow Selected

TRON: The DeFi Ecosystem Engine Behind the "Stablecoin King"

Restructure the crypto asset aggregation logic to build a multi-layered DeFi ecosystem.

In the turbulent landscape of the cryptocurrency market, TRON is reshaping the industry with unstoppable momentum, and its dominance in the stablecoin sector has become a crucial anchor for the crypto economy.

As of June 12, USDD's issuance exceeded $437 million, with the protocol's TVL (Total Value Locked) reaching approximately $475 million, accounting for the majority of the global stablecoin market, far surpassing Ethereum (USDT issuance at $7.3 billion). These figures not only confirm TRON’s status as the preferred network for stablecoin issuance but also highlight its core value within the infrastructure of crypto finance.

A recent "Stablecoin Payments Report" jointly released by blockchain analytics firm Artemis, Dragonfly, and Castle Island Ventures further substantiates this trend: USDT dominates the stablecoin payment transaction volume with an absolute 90% market share, and TRON, as its primary settlement network, handles about 60% of these transactions.

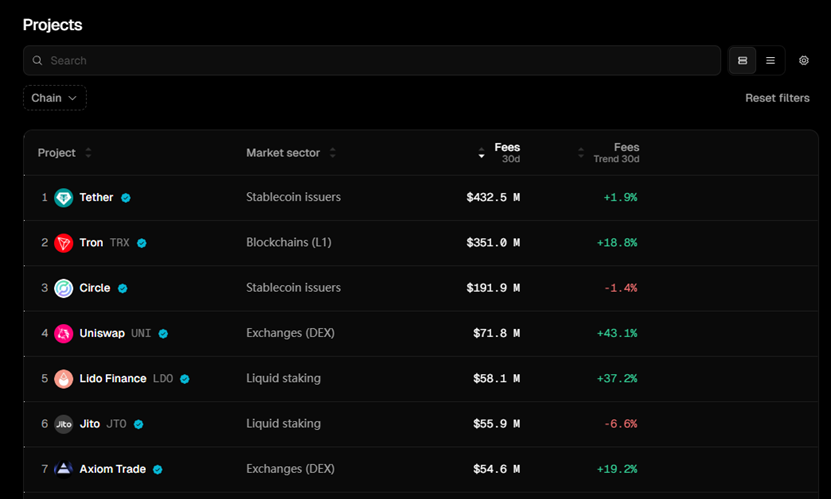

From a commercial value perspective, TRON's profitability is equally impressive. According to TokenTerminal data, TRON’s protocol revenue surpassed $350 million over the past 30 days, outperforming all crypto projects except Tether (issuer of USDT), which recorded $432 million, making TRON the second most profitable crypto product in the entire market. This achievement validates the business logic behind its title of “stablecoin king”—leveraging an efficient settlement network and ecosystem synergy to convert traffic advantages into sustainable revenue growth.

As critical infrastructure for the crypto economy, stablecoins serve not only as a bridge connecting traditional finance and Web3 but also as the cornerstone of DeFi ecosystem prosperity. With TRON currently hosting over $78 billion in circulating stablecoins, its DeFi ecosystem could unlock hundreds of billions of dollars in new market value. As the scale effects of stablecoins drive synergistic ecosystem development and expand application scenarios, the TRON network is accelerating its evolution from the "stablecoin king" to the "value hub of DeFi," with significant future growth potential.

The DeFi Engine Behind the “Stablecoin King”

TRON’s firm seat on the stablecoin throne represents a dual victory of its underlying technical architecture and on-chain ecosystem synergy. This "king" status not only confirms the network’s performance strengths in low cost and high efficiency but also reveals the thriving state of its on-chain ecosystem.

The prosperity of the TRON ecosystem stems first from the powerful network effect of its stablecoins, which continuously inject vitality and liquidity into DeFi protocols, creating a unique virtuous cycle between “stablecoins and DeFi.” Whenever Tether (USDT) conducts a minting event, TRON’s on-chain TVL increases correspondingly. This symbiotic relationship between “stablecoins and DeFi” is fundamentally a resonance between technological efficiency and ecosystem vibrancy.

According to DeFiLlama data, as of June 12, the total value locked (TVL) in DeFi applications on the TRON network exceeded $5 billion, consistently ranking among the top five public blockchains globally. Behind this massive figure lies a complex and highly efficient DeFi ecosystem—a precision financial machine redefining the flow patterns and value creation logic of crypto assets.

TRON has built a comprehensive and advanced DeFi ecosystem matrix for stablecoins, enabling assets like USDT to circulate freely on-chain while maximizing returns. Its product framework can be summarized as a “three-tiered progressive” value circulation system created through synergies among various DeFi applications.

● At the foundational layer, the all-in-one asset trading and issuance platform Sun.io enables direct exchange of USDT for hundreds of cryptocurrencies; the cross-chain protocol BTTC connects major networks such as BNB Chain and Ethereum with TRON, expanding the usage scenarios and circulation scope of stablecoins.

● At the value-adding application layer, the JustLend DAO lending protocol offers diversified avenues for stablecoin yield generation, supporting USDT as a base asset for staking, lending, and liquidity mining across full-cycle use cases—generating returns while improving capital utilization.

● At the yield-enhancement layer, innovative RWA products like stUSDT bridge users to traditional financial yields—depositing USDT earns U.S. Treasury-level returns (over 4.5% APY), merging digital assets with high-quality traditional assets. The decentralized stablecoin USDD allows 1:1 direct conversion from USDT with zero fees and zero gas costs. Holding USDD also grants access to multiple DeFi staking opportunities for additional yield.

Through this tiered progression of DeFi applications, the TRON ecosystem has become not only the preferred settlement network in the stablecoin space but also provides robust circulation and value-appreciation channels via a well-developed ecosystem—offering users diversified options while advancing the development of crypto finance.

Flagship Components of the DeFi Ecosystem Matrix: Integrated Trading Hub Sun.io and SunPump, Lending Platform JustLend DAO, Stablecoin USDD

I. Transaction Hub SUN.io: Building a Diversified, One-Stop Asset Issuance and Trading Platform

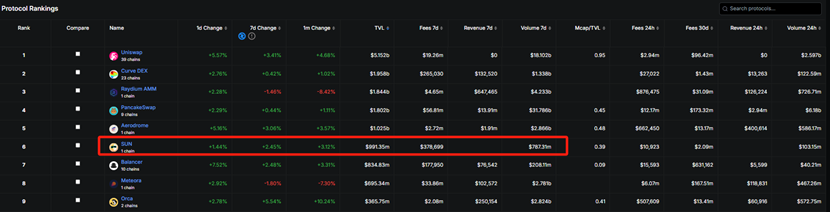

SUN.io is the flagship DEX platform of the TRON ecosystem. According to DeFiLlama data, as of June 11, the value of crypto assets locked (TVL) on SUN.io exceeded $991 million, consistently ranking among the top three on the TRON network and within the top six across all DEXs.

Unlike Uniswap, which primarily supports asset swaps, SUN.io serves as the central trading hub for TRON’s DeFi ecosystem, integrating asset exchange, liquidity mining, stablecoin swapping, and meme coin issuance into a unified “issuance-trading-yield” service model.

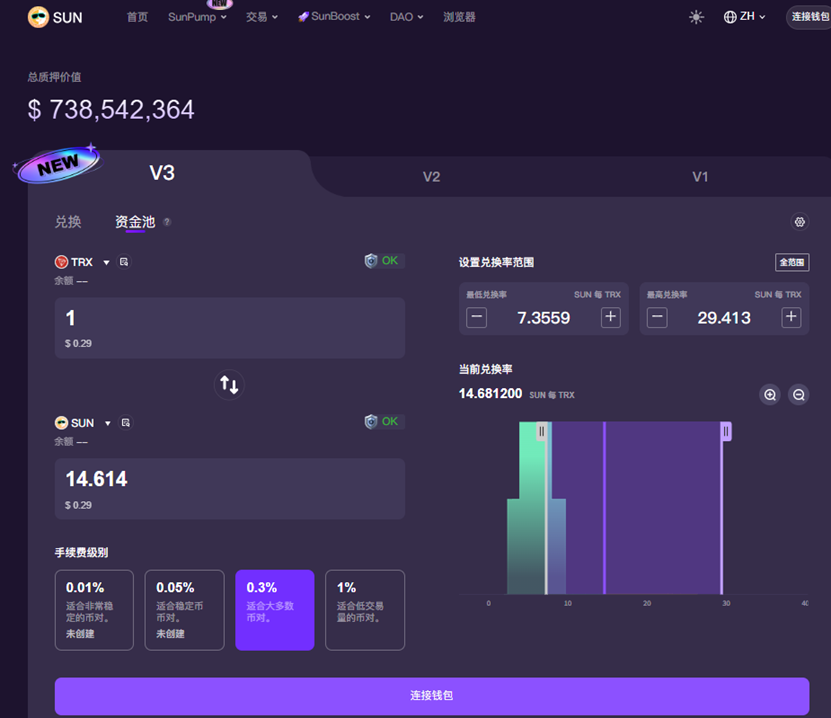

Currently, the SUN.io suite includes key components such as the mainstream DEX SunSwap, the stablecoin-focused SunCurve and its Peg Stability Module (PSM), and the meme coin launchpad SunPump.

● SunSwap is the leading DEX on TRON, providing asset swap services. Thanks to high liquidity and fast transaction confirmation, it has attracted substantial user activity and capital. According to SunScan’s official browser data for June 11, SunSwap processed over 110,000 transactions in the past seven days, involved more than 14,000 addresses, and achieved a trading volume exceeding $800 million.

As of June 11, SunSwap has undergone three iterations—V1, V2, and V3—with the latest version introducing a “dynamic fee model.” This allows liquidity providers (LPs) to allocate funds within specific price ranges and set different fee tiers based on token risk levels, enabling customized pools for various tokens. Currently, most SunSwap trading occurs on V3.

● SunCurve specializes in stablecoin trading, operating similarly to Curve by offering lower fees (only 0.04% per trade) and minimal slippage. It currently supports seamless swaps between USDD, USDT, TUSD, and USDC.

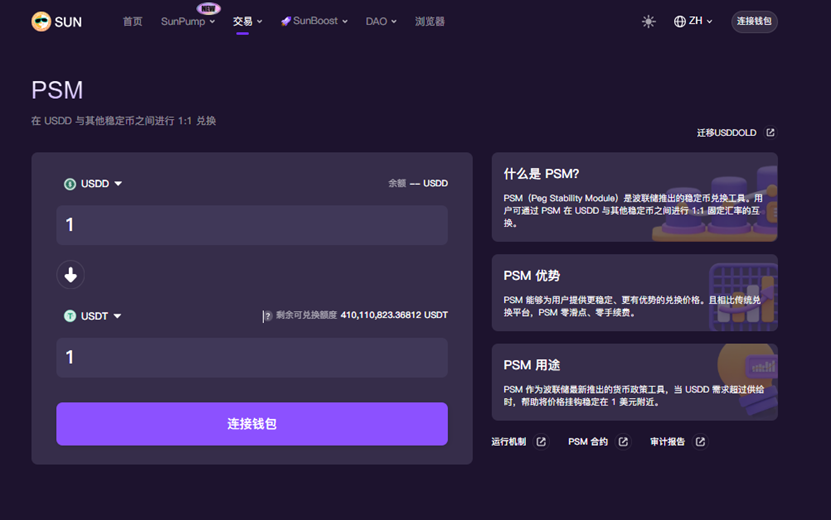

● PSM (Peg Stability Module) is a stablecoin swap tool launched by TRON DAO Reserve (TDR) specifically for USDD. It enables 1:1 fixed-rate swaps between USDD and other stablecoins like USDT, USDC, and TUSD, offering users zero slippage and zero transaction fees—the primary venue for USDD conversions today.

● SunPump is a fair-launch meme coin platform under Sun.io, allowing users to create and issue their own meme coins with one click.

In terms of product strategy, SunSwap, SunCurve, and SunPump form a complementary trio, delivering convenient and comprehensive one-stop DeFi services. Users can conduct asset trading, stablecoin swaps, and token issuance within a single platform without switching between apps—enhancing usability and long-term potential.

II. Innovation Showcase: Meme Coin Launchpad SunPump

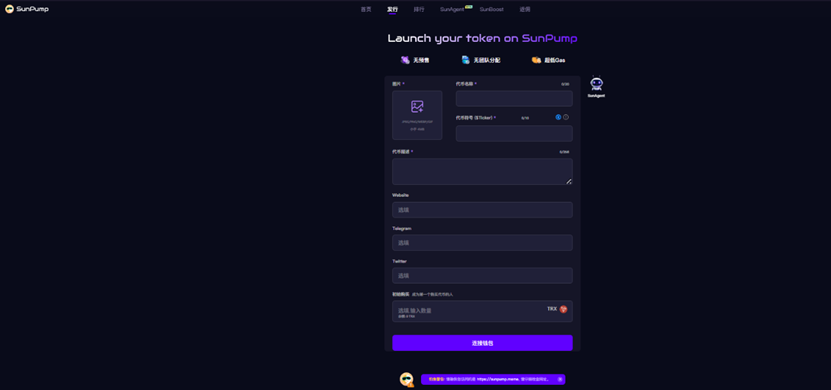

SunPump, the newest addition to the Sun.io ecosystem, is positioned as TRON’s first dedicated meme coin issuance platform, enabling users to instantly create and launch their own meme coins for a small creation fee of approximately 20 TRX (around $5).

SunPump operates on a community-driven model with zero pre-mine and zero team allocation, incorporating a fair launch mechanism that prevents whale manipulation at launch and protects retail investor interests.

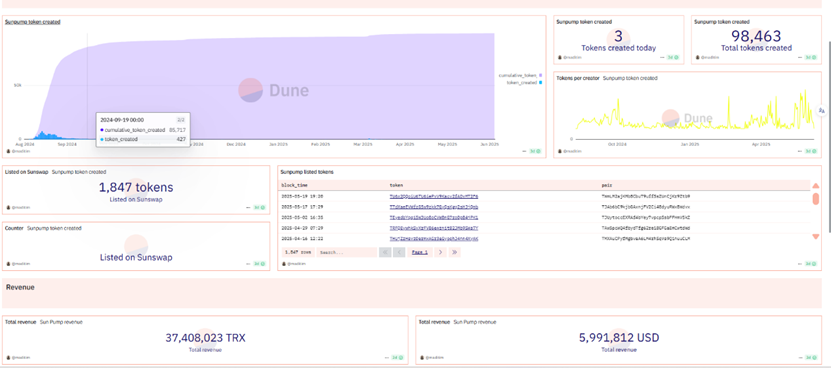

Leveraging TRON’s vast user base, SunPump has experienced explosive growth since its August 2024 launch. In its first month, it set a record of issuing 7,351 meme coins in a single day, generating up to $560,000 daily in revenue—outperforming even market leader PumpFun at times. It has successfully incubated high-market-cap meme assets such as SunDog and SZN.

According to Dune Analytics, as of June 11, SunPump has created over 98,000 tokens, with more than 1,800 successfully graduating (listed on SunSwap), and cumulative revenue surpassing $10 million (based on TRX priced at $0.275). SunPump has become the go-to platform for meme token issuance and trading.

In product innovation, SunPump actively integrates AI technology to expand its ecosystem boundaries. At the end of 2024, it launched the AI agent SunAgent; in March of this year, it introduced SunGenX—an AI tool for X (formerly Twitter)—enabling users to generate meme coins effortlessly via social media. Through a feature called “post-to-mint,” users simply @Agent_SunGenX on X with token details (name, symbol, description, image) or a creative idea, and the AI automatically creates and deploys the meme coin to SunPump—for free and at high speed. This innovative integration delivers intelligent user interaction and reinforces SunPump’s leadership in merging blockchain with AI.

III. JustLend DAO: Creating Multiple Yield Streams and Enhancing Capital Efficiency

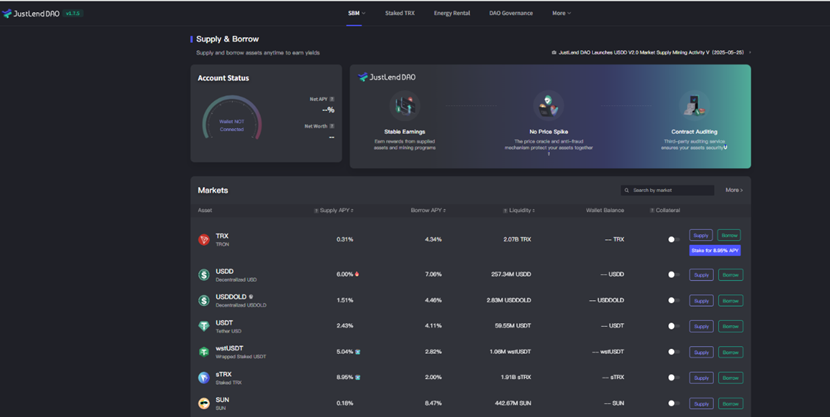

JustLend DAO is the first native lending protocol in the TRON ecosystem. As an evolving DeFi ecosystem, its offerings now span collateralized lending, TRX staking (sTRX), energy rental, and broader DeFi exploration.

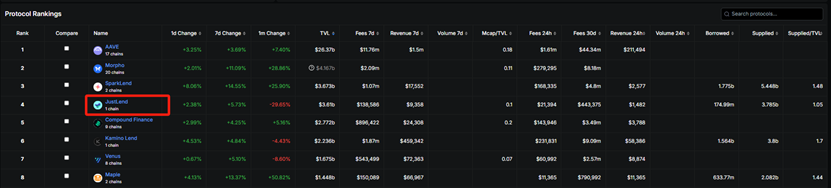

According to DeFiLlama, as of June 11, the platform’s TVL reached $3.61 billion, maintaining the #1 spot among TRON-based applications and ranking within the top four decentralized lending platforms globally.

● SBM: The largest lending market in the TRON ecosystem, SBM allows users to earn interest by supplying idle funds and gain leverage by borrowing other crypto assets against collateral. Supported assets include TRX, sTRX, USDD, USDT, and SUN.

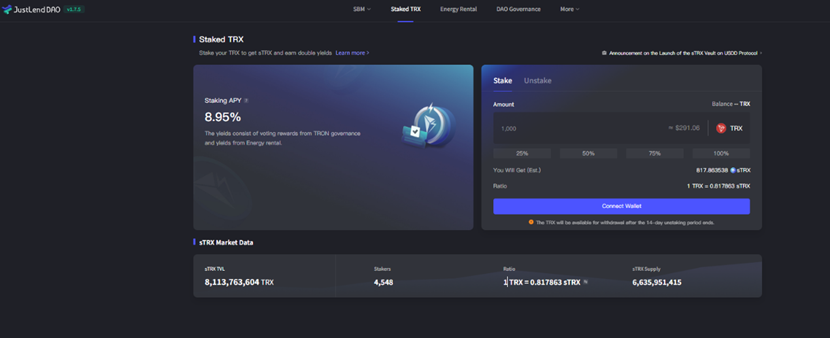

● Staked TRX (sTRX) is JustLend DAO’s liquid staking solution for TRX and has become the preferred method for TRX staking. By staking TRX, users receive sTRX tokens that automatically capture node voting rewards and energy rental income from the TRON network. Additionally, sTRX can be used across various DeFi activities—including deposits and liquidity provision—to further boost capital efficiency and yield.

As of June 11, over 8.1 billion TRX have been staked on Staked TRX, valued at around $2.5 billion, yielding 8.95%, with participation from over 4,500 addresses.

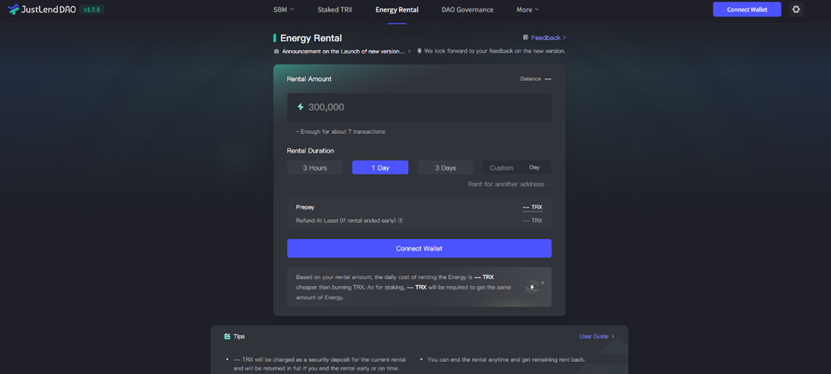

● Energy Rental: A unique service on the TRON network, energy rental stems from TRON’s distinctive “Energy and Bandwidth” gas model. Wallets typically use energy and bandwidth first to cover transaction costs; if insufficient, they must burn TRX. TRON provides continuous energy output to users who stake TRX.

To better match supply and demand for on-chain energy, dedicated rental platforms emerged as a unique component of the TRON ecosystem. Through JustLend DAO’s energy rental service, users can flexibly rent energy by time or per-use to offset gas fees without burning TRX—effectively lowering transaction costs.

For example, spending just 7.297 TRX allows renting 100,000 energy points (equivalent to staking 9,529 TRX), sufficient for about two transactions. This innovation improves network resource efficiency and opens an additional revenue stream for stakers. Official data shows over 65,000 addresses have participated in energy rental as of June 11.

Through its integrated product suite—collateralized lending, TRX staking (sTRX), and energy rental—JustLend DAO has established multiple paths for asset appreciation and yield generation, significantly enhancing capital utilization.

IV. Decentralized Stablecoin USDD: The Stable Value Anchor of the TRON Ecosystem

USDD is an over-collateralized decentralized stablecoin within the TRON ecosystem, pegged 1:1 to the U.S. dollar. In January, USDD upgraded to USDD 2.0, featuring an optimized collateral mechanism and fully decentralized governance. Under the new framework, the community holds absolute control over minting, allowing users to deposit collateral and customize collateral ratios when minting new USDD—enhancing decentralization and capital efficiency.

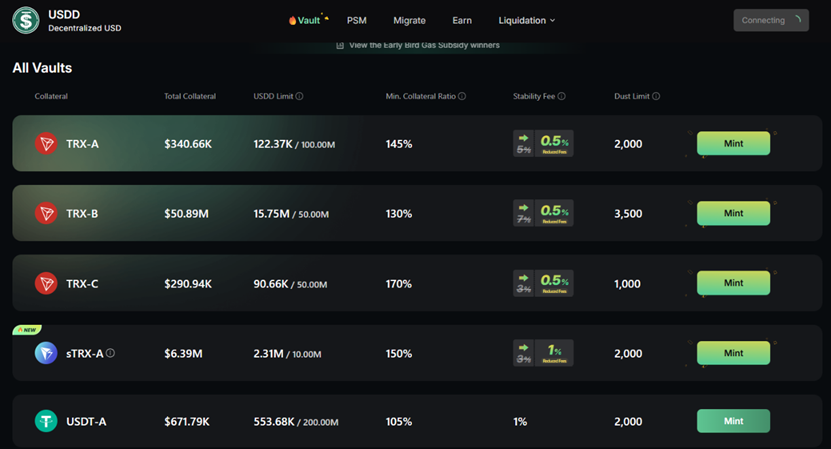

Currently, users can mint USDD by over-collateralizing high-quality crypto assets such as TRX, sTRX, and USDT.

To incentivize participation, USDD launched a series of minting fee discounts and yield programs. On May 15, a one-month promotional campaign began, reducing stability fees to 0.5% across TRX-A, TRX-B, and TRX-C vaults (each with different collateral ratios and minting fees), while sTRX-A vault fees were cut from 3% to 1%. The promotion ends on June 15, after which standard rates will resume.

In addition, PSM—the stablecoin tool from Sun.io—provides seamless, zero-cost conversion between USDD and other stablecoins like USDT, with zero slippage and no fees. It is currently the main venue for USDD exchanges.

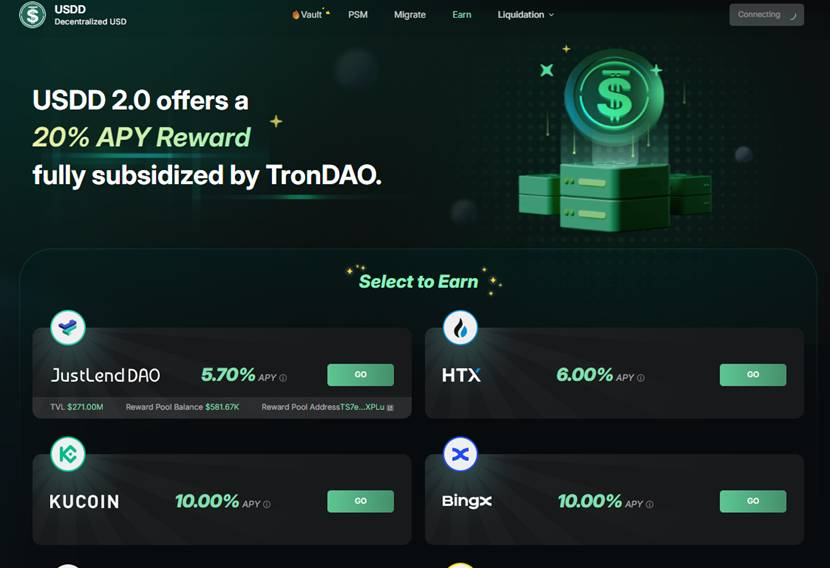

USDD is now deeply integrated into multiple DeFi applications across the TRON ecosystem, enabling broad participation in lending, staking, and trading to generate higher yields. On May 24, USDD 2.0 launched its fifth round of a 20% staking incentive program, offering users high-return opportunities with rewards fully subsidized by TronDAO across platforms including JustLend DAO, HTX, and KUCOIN.

The article "Yields Over 20% Annually: Unlocking the 'Multiple Uses' Wealth Strategy for TRX" detailed the lucrative “sTRX + USDD” combo strategy. Specifically, users stake TRX to obtain sTRX, use sTRX to mint USDD, then deposit that USDD into JustLend DAO—achieving combined yields exceeding 15%, offering diversified income streams.

As of June 12, USDD’s issuance exceeded $437 million, with protocol TVL around $475 million. Since launching on April 25, the sTRX Vault has grown its TVL to approximately $6.4 million in just over a month—demonstrating strong momentum in the USDD ecosystem.

TRON Ecosystem: Strengthening the “Stablecoin King” Status and Redefining Asset Aggregation Logic

TRON’s comprehensive and deep exploration in DeFi demonstrates its firm commitment to building a diversified, efficient, stable, and high-yield multi-layered DeFi ecosystem.

Within TRON’s ecosystem, flagship DeFi products such as Sun.io, SunPump, JustLend DAO, and USDD form a powerful and well-structured matrix. They function like a complete financial toolkit, covering every stage—from asset issuance and trading, to lending, yield enhancement, stablecoin innovation, and meme coin support. Together, they create a one-stop on-chain financial superstore where users can easily meet diverse financial needs. These products work in concert, forming an interconnected organic whole that delivers rich yield options and seamless, comprehensive financial services—serving as the key infrastructure driving TRON’s ecosystem growth.

From this strategic layout, it’s clear that the title of “stablecoin king” is merely the tip of the iceberg in TRON’s achievements. Beneath lies a sophisticated and robust DeFi infrastructure—a high-performance engine powering asset circulation and value creation. TRON is systematically building a new logic of asset aggregation, using stablecoins as a lever and leveraging its advantages in low cost and high efficiency to lead the evolution of the DeFi sector.

On June 9, new SEC Chair Paul Atkins signaled a positive regulatory stance toward DeFi, indicating plans to study an “innovation exemption” policy for DeFi platforms. This move acts as a shot in the arm for the industry, signaling a more relaxed and supportive regulatory environment and renewing optimism for DeFi’s future.

Yesterday (June 11), TRON founder Justin Sun retweeted the news on X with the comment “DeFi first.” The post was interpreted by the community as a signal of TRON’s “DeFi-first” strategic direction—an approach likely to accelerate the growth of its DeFi ecosystem.

On the same day, Justin Sun announced on X that USD1, the stablecoin backed by the Trump family’s WLFI, had successfully begun minting on the TRON network. This development adds fresh momentum to TRON’s expansion.

Overall, while reinforcing its position as the “king of stablecoin settlement,” the TRON ecosystem is simultaneously redefining the logic of crypto asset aggregation.

While securing the “stablecoin crown” through its powerful advantages in cost and efficiency, TRON is also proactively expanding into next-generation stablecoins such as USDD 2.0 and USD1, strengthening its moat and competitive edge. Meanwhile, its DeFi ecosystem—centered on Sun.io, JustLend (sTRX), and USDD—has established a solid chain of asset circulation and yield generation.

Within the crypto industry, TRON has established a new value coordinate system—one where approximately $80 billion worth of stablecoins flows continuously on-chain, empowering its DeFi ecosystem to unlock hundreds of billions in future asset growth, with boundless possibilities ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News