A Guide to the Characters in the Cryptocurrency Dark Forest

TechFlow Selected TechFlow Selected

A Guide to the Characters in the Cryptocurrency Dark Forest

Offer a clearer perspective, learning to distinguish narrative from reality.

Author: VannaCharmer

Translation: Ismay, BlockBeats

Editor's Note: Amid the relentless expansion narrative of the cryptocurrency market, tokens have long ceased to be mere carriers of technological or financial innovation—they've become chips in a structural game. From exchanges, VCs, and KOLs to communities, airdrop farmers, and retail investors, everyone is drawn into a high-stakes "Who will be the last bagholder?" game. This article does not aim to dismiss the potential of crypto technology itself, but rather to expose the obscured truths within current token issuance and circulation mechanisms: how they operate like multi-level marketing schemes, systematically concentrating benefits at the top. We hope this piece offers you a clearer perspective—to distinguish between narrative and reality in a market woven from illusion and hope.

Below is the original text:

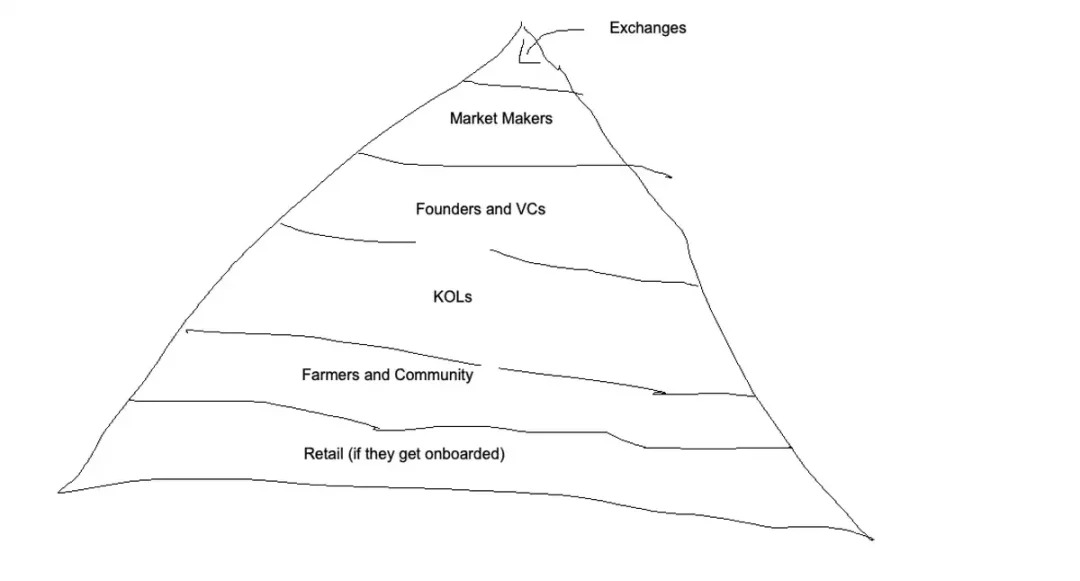

Cryptocurrencies are reenacting the worst aspects of pyramid schemes—only this time, it’s a native internet version, more efficient in distribution but far less transparent. Most tokens have evolved into sophisticated pyramid games: those at the top extract maximum gains, while retail investors are left holding worthless "air coins."

This is not accidental—it’s structural.

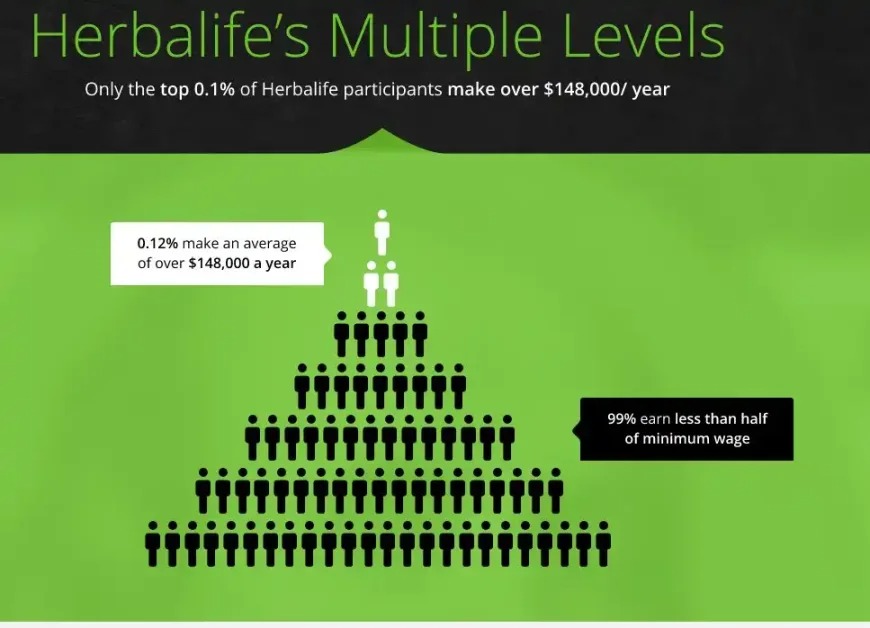

In traditional MLM schemes like Herbalife or Mary Kay, products are often overpriced and underperform compared to mainstream alternatives. The key difference isn't the product itself, but the sales model: instead of selling through retail stores, individuals first purchase inventory themselves, then recruit others to do the same.

It quickly shifts from "selling products" to "recruiting members." People don’t buy because they need the product—they buy hoping to resell it later at a higher price. Eventually, when only "speculators" remain and real users disappear, the pyramid collapses. Those at the top walk away with asymmetric profits, while those at the bottom are stuck with unsellable inventory.

The Token Pyramid

The logic behind crypto tokens mirrors that of multi-level marketing. The token itself is the "product"—an overvalued digital asset with little utility beyond speculation. Just as distributors in MLM systems aren't buying for personal use, token holders aren't acquiring them for functionality, but solely to sell at a higher price to the next buyer.

This pyramid structure resembles traditional MLMs, yet crypto has its own unique ecosystem of participants forming distinct tiers. Compared to physical MLM goods, tokens are an ideal vehicle: they leverage the internet and social networks more efficiently, are easier to trade and obtain, and spread faster and wider. The mechanism works roughly as follows:

In traditional MLMs, if you recruit downlines who make sales or purchases, you earn commissions. Crypto operates similarly: you get others to take your "inventory," pulling in newer entrants who join after you. This benefits both you and those above you—newcomers provide "exit liquidity," driving up prices. Meanwhile, these new buyers, now also holding tokens, begin promoting actively (they’ve got "inventory" too!), allowing early holders to cash out at elevated prices (multiples go up!). The mechanism is identical to MLMs—only far more powerful.

The higher your position in the pyramid, the greater your incentive to launch new tokens and perpetuate this cycle.

Gods: Exchanges

At the very top of the crypto pyramid sit the true "gods"—exchanges. Nearly every "successful" token owes its rise to deep manipulation by exchanges and their affiliated market makers. They control token distribution and liquidity. To gain platform access and distribution resources, projects often must pay tribute—i.e., hand over a portion of tokens for free.

If you don’t play by their rules, your token won’t get listed—or worse, it ends up in illiquid purgatory, quietly dying. Exchanges can abruptly remove market makers, demand project teams lend tokens so exchange staff can dump them, or unilaterally change terms at the last minute. Everyone knows this power imbalance exists—but silently accepts it, because it’s the price of gaining "liquidity" and "distribution."

For founders, exchanges are insurmountable walls. Whether a project lands on a top-tier exchange often depends more on "connections" than on actual product quality. This explains why so many projects today feature "stealth co-founders" or "former exchange employees" whose sole role is brokering deals and opening doors. Without experience or network, navigating the listing process is nearly impossible.

Semi-Gods: Market Makers

Market makers, theoretically meant to provide liquidity, often secretly help projects offload bags via OTC deals, using their informational edge to front-run and exploit ordinary users. They typically hold a significant chunk of total supply (sometimes several percentage points), enabling them to manipulate trading and secure asymmetric arbitrage opportunities. For tokens with small float sizes, this influence is massively amplified, placing them in an overwhelmingly favorable position.

Earnings from pure "liquidity provision" are minimal, but profiting from uninformed traders can be extremely lucrative. Among all market participants, market makers know the most about actual circulating supply—they understand real float dynamics and control large token reserves. They sit at the peak of information asymmetry.

For project teams, evaluating a market maker’s "quote" is extremely difficult. Unlike haircut services with fixed pricing, market-making fees vary widely. As a startup founder, you simply don’t know which terms are fair or inflated. This has spawned another gray-market phenomenon: the proliferation of "stealth co-founders" and "market-making consultants." Under the guise of advisory roles, they broker connections—but further complicate the launch process and increase strategic costs.

Kings: VCs and Project Teams

Beneath exchanges sit project teams and VCs, who capture the vast majority of value during private sales. Long before the public hears of a project, they acquire tokens at rock-bottom prices, then craft narratives to create "exit liquidity" for their dumps.

The business model of crypto VCs has become deeply distorted. Compared to traditional venture capital, achieving "liquidity events" in crypto is far easier, so there’s little incentive to support long-term builders. In fact, the opposite is true—VCs often turn a blind eye to predatory tokenomics as long as it benefits them. Many no longer pretend to back sustainable businesses, instead systematically participating in and enabling "pump-and-dump" speculation.

Tokens have also created a perverse incentive: VCs have strong motivation to artificially inflate valuations of their portfolio projects (effectively "harvesting" their LPs) to boost management fees. This is especially common with low-floating-supply tokens—using FDV (fully diluted valuation) to mark paper valuations far above what’s realistically exitable. Such practices are highly unethical, as full unlocks would make exiting at those prices impossible. This is one key reason why many VCs may struggle to raise future funds.

While platforms like Echo have slightly improved transparency, behind crypto’s curtain, countless black-box operations remain invisible to ordinary investors.

Influencers: KOLs

One level below are KOLs (key opinion leaders), who typically receive free tokens upon project launches in exchange for promotional content. The "KOL funding round" has become standard industry practice—KOLs participate in investments and get full refunds after TGE (token generation event). They leverage their reach to obtain free positions, then brainwash their followers into buying, turning fans into their personal "exit liquidity."

Soldiers: Community Members and Airdrop Farmers

"Communities" and airdrop hunters form the base labor force of the pyramid. They perform foundational tasks—testing products, creating content, generating activity—in hopes of token rewards. Yet even these activities have been industrialized: rewards shrink, workloads grow.

Most community members realize too late they’ve essentially served as outsourced marketing departments for free—only for the team to start dumping mercilessly post-TGE. Once awareness hits, anger spreads, and they "take up arms." This "angry community" dynamic is toxic for genuine builders, adding noise and friction.

Bagholders: Retail Investors

At the very bottom sits the mythical retail investor—the ultimate exit liquidity for everyone above. Fed narratives and stories, they assign "meme premiums" to assets, attracting more buyers so foundations and insiders can smoothly offload.

But this cycle is different—retail hasn’t truly shown up. Today’s retail is more cautious and skeptical, leaving community members stuck with worthless airdropped tokens while insiders have already cashed out via OTC deals. I suspect this is partly why timelines are flooded with complaints about crashing tokens or worthless airdrops: this cycle, retail didn’t really play along—and founders still got rich anyway.

Consequences

The core of today’s crypto industry isn’t product-building, but storytelling—crafting narratives of "high-illusion yields" to lure people into buying tokens. Focusing on actual product development is discouraged (though this is slowly changing).

The entire token valuation system has become completely detached from fundamentals, relying instead on "market cap comps" for horizontal benchmarking. The central question shifts from "What problem does this token solve?" to "How many X can it go?" In such an environment, rational pricing or evaluation becomes nearly impossible. You’re not buying into a developing company—you’re buying a lottery ticket. Anyone investing in crypto must recognize this truth.

The script for selling narratives is simple: fabricate a story that sounds plausible but is inherently unpriced, such as:

"This is a stablecoin project backed by Peter Thiel. Its token represents indirect exposure to Tether equity. You should buy because Circle is valued at $27B, while Tether generates far higher revenue and profit at lower operating costs. There’s currently no way to directly invest in Tether—this token fills that gap! They’re also building Circle-like payment infrastructure with privacy features. This is the future of finance—$100B market cap potential!"

If you want your friend to buy a token, this kind of narrative works perfectly. The key is: make the story sound "clear enough," yet leave "plenty of room for imagination," so they can dream up an ultra-high valuation future.

What Comes Next? Fixing the Token Market Structure

I still believe crypto remains one of the few areas where ordinary people can achieve massive asymmetric returns—but this advantage is fading. Speculation is crypto’s core product-market fit (PMF), the initial "hook" that draws attention to what we’re building. Precisely for this reason, we urgently need to fix the entire market structure.

Part two of this article will explore how platforms like Hyperliquid might fundamentally rewrite the rules of this game.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News