Where Can Web3 Projects Go Amid Singapore's New DTSP Regulations?

TechFlow Selected TechFlow Selected

Where Can Web3 Projects Go Amid Singapore's New DTSP Regulations?

A structural clearance under "administrative regulations."

Author: Portal Labs

You may have heard the news: the Monetary Authority of Singapore (MAS) has officially released its final regulatory response to the "Digital Token Service Providers" (DTSP) regime under the Payment Services Act, clearly announcing full implementation by June 30, 2025—with no grace period.

This time, it's not a policy probe during a consultation phase or a symbolic regulatory gesture.

The signal from MAS is crystal clear: no license, no token-related business—regardless of whether your clients are in Singapore or whether your operations are on-chain.

On the surface, this appears to be a new licensing requirement for token services. In reality, it represents a structural overhaul of how Web3 projects operate.

Last week saw numerous analyses of the document. Rather than rehashing those, Portal Labs will focus instead on our own perspective regarding this regulatory development.

A Structural Cleanup Under Administrative Regulation

Some view DTSP as an extension of VASP—but that’s inaccurate.

The introduction of DTSP marks MAS’s attempt to systematically redefine the vague yet broad concept of “token services,” establishing legal boundaries between what is permitted and what is not.

From MAS’s perspective, “token services” now extend far beyond mere token issuance. They include activities such as issuance, promotion, trading, transfer, custody, OTC matching, and even providing technical or operational support.

In other words, if you're part of the token mechanism—whether actively or passively—you could be considered a service provider.

The more critical shift lies in MAS abandoning criteria based on jurisdiction of registration or on-chain deployment. Instead, the core determinant now centers on: where people are, and where business activities occur.

This means: even if your smart contracts are deployed on-chain and your systems run in the cloud with global users, if you personally reside in Singapore and are advancing token-related work, you are very likely deemed to be operating within Singapore.

The classic remote-operating model—"person in SG, activity on chain"—has now officially entered a post-regulatory-vacuum era.

MAS leaves no room for ambiguity. In this round of responses, MAS explicitly stated it will take an “extremely cautious” approach toward issuing DTSP licenses, granting them only to a select few applicants.

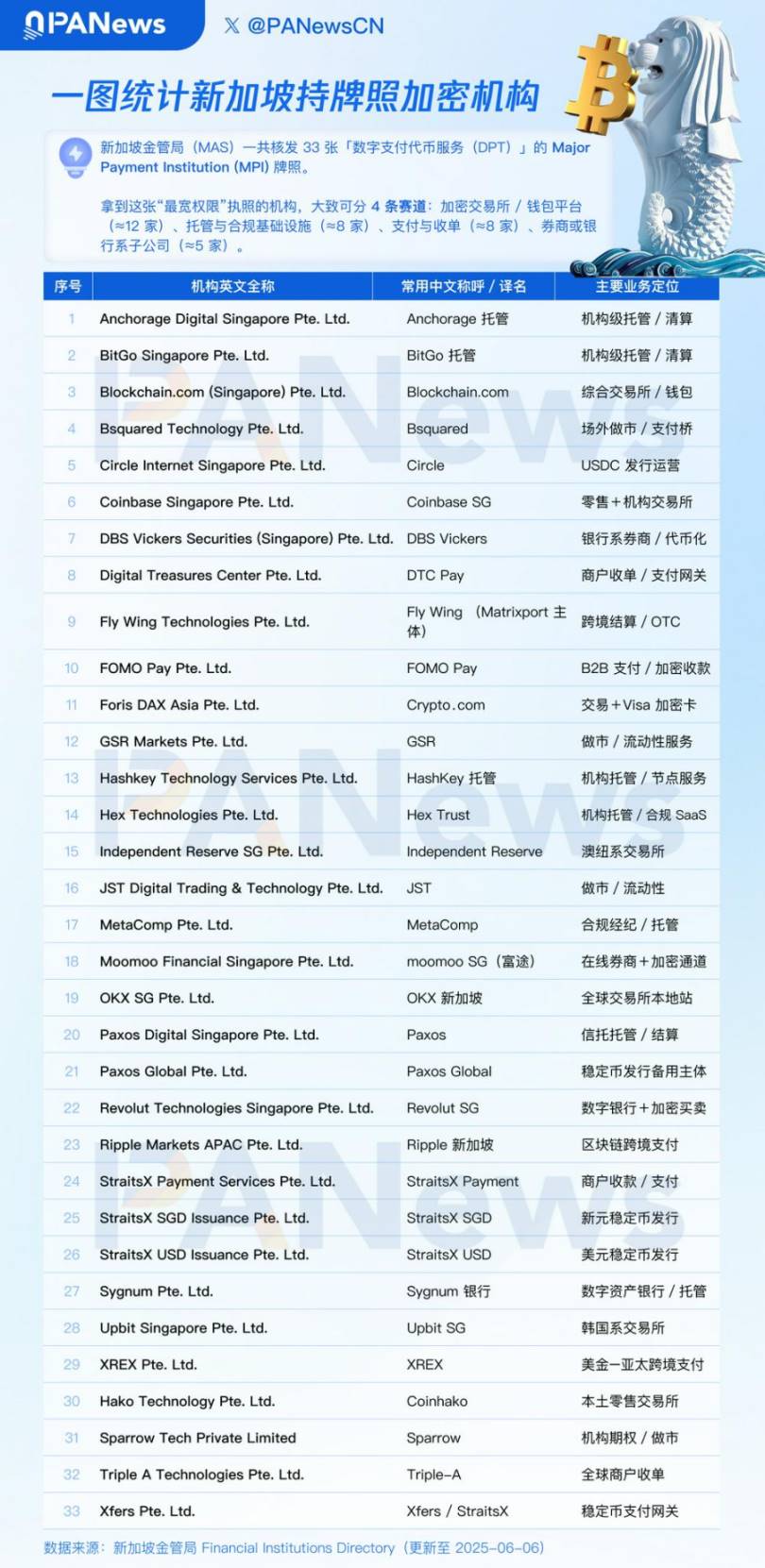

According to data from PANews, only 33 crypto projects currently hold MPI licenses—despite applications being open for five years. This gives us a sense of how difficult and rare DTSP approvals will be.

Therefore, Portal Labs believes this isn't a licensing race that technical effort alone can win. It's more like a proactive screening of project governance structures. Web3 projects lacking role separation, unclear fund flows, or ambiguous accountability will lose their eligibility to remain.

But this isn’t hostility from Singapore toward Web3—it’s a clearer signal that regulatory arbitrage is gradually coming to an end under mainstream regulatory trends.

"Where to Go" Is No Longer the Answer

So then—where else can you go?

The immediate reaction for many Chinese-speaking Web3 teams is: move to Hong Kong.

This expectation isn’t baseless. Over the past two years, Hong Kong has repeatedly signaled openness: pushing forward its VASP regime, public statements from officials, hosting Web3 festivals—making it appear a prime candidate to absorb projects exiting Singapore.

Shortly after the DTSP announcement, Hong Kong Legislative Council member Junius Wu quickly responded, posting bilingual messages on social media: “If you can no longer operate in Singapore and wish to relocate to Hong Kong, feel free to contact me. We’re ready to assist. Welcome to develop here!”

This undoubtedly signals Hong Kong’s intent to attract talent opportunistically. Yet regulatory realities are far more complex.

Hong Kong’s regulation is not loose—it’s another form of structured oversight:

At the CEX level, Hong Kong requires all trading platforms to operate under license, regulated by the SFC under the Securities and Futures Ordinance. Platforms must provide compliance solutions at key points including user access, coin listing, custody mechanisms, and must establish independent auditing, AML, and risk control systems. Compared to the previous gray-zone “build-as-you-go” model, Hong Kong emphasizes “pre-emptive structural design,” favoring institutional platforms committed to long-term compliance.

Regarding token issuance, Hong Kong currently lacks dedicated legislation for public token offerings. However, given recent regulatory directions in the U.S., EU, and Singapore, while some space exists today, future legislative moves may tighten the framework.

For broader Web3 project落地, despite frequent supportive rhetoric, Hong Kong’s actual implemented regulations remain focused primarily on virtual asset exchanges. Other Web3 forms—such as DeFi, DAOs, RWA issuers—still lack dedicated regulatory pathways. In practice, regulators prefer projects with clear structures, full disclosure, and traceable identities within existing licensing frameworks. In essence, this reflects a “financial-compliance-driven partial opening,” rather than universal acceptance of all innovations.

In short, Hong Kong welcomes Web3—but only if you can keep pace with its regulatory rhythm. If your operations already violate boundaries in Singapore, they likely won’t survive in Hong Kong either.

As for alternative jurisdictions—Dubai, Portugal, Seychelles, or seemingly friendly regional cities like Shenzhen—they either lack mature financial regulatory frameworks or offer unclear, unsustainable compliance paths. These may serve as short-term shelters but cannot support medium-to-long-term legitimacy.

The DTSP update isn’t isolated—it reflects a broader global trend: sovereign jurisdictions are no longer accepting “jigsaw-style” Web3 architectures. The focus has shifted to determining responsibility based on where people are and where actions occur.

Thus, the pressing question for Web3 projects is no longer “where to move,” but whether you can exist compliantly after moving.

From this vantage point, Singapore isn’t the endpoint, nor is Hong Kong the solution. The next stage for Web3 isn’t another “arbitrage haven,” but a comprehensive audit of architectural capability, governance logic, and compliance mindset.

The Real Question: How Do You Stay?

The most significant signal behind the DTSP rules isn’t suppression of certain projects or regions, but a systemic upgrade in regulatory thinking.

In the past, many Web3 projects thrived in gray zones using “jigsaw architectures”: registered in Country A, tech team in B, marketing in C, users worldwide, KYC outsourced to E, funds routed through F. This setup—appearing decentralized but effectively obscuring accountability—was once seen as standard practice.

Today, the regulatory lens has fundamentally changed. Regulators no longer care where your company is incorporated or where your code runs. Their focus is directly anchored on:

-

Who controls token issuance decisions?

-

Are user asset custody paths and fund flows transparent?

-

Where is the de facto controller located, and what roles do they perform?

-

Does the project have mechanisms for auditable governance, structural isolation, and clear delineation of responsibilities?

What’s being tested here isn’t just the wording of a legal opinion, but the overall “structural capability” of Web3 teams—their ability to build truly accountable, auditable, and sustainable role systems and responsibility frameworks.

Under this regulatory paradigm, changing your registration jurisdiction is no longer a real solution. It’s merely a risk-shifting game—transferring potential issues from one jurisdiction to another before regulators catch up—without reducing underlying exposure.

In this light, DTSP isn’t just a notice to Web3 operators—it’s a turning point for investor compliance perspectives. It forces a critical question into the open: “Am I investing in a project—or in an unidentified legal risk entity?”

For investors, this regulatory evolution raises the bar for due diligence. In traditional investment logic, a whitepaper, roadmap, or AMA session might suffice to build confidence. But in today’s tightening environment, the “structural transparency” of a Web3 project becomes non-negotiable:

-

Does the token have a legitimate issuance basis and pathway?

-

Is the control structure clear, without hidden proxies or overlapping duties?

-

Are founders exposed to excessive legal risks? Should their roles be segregated?

-

Does the project have viable paths for compliant fundraising, token issuance, or exit mechanisms?

These questions are no longer just for lawyers—they must be asked and scrutinized by investors themselves.

In other words, regulation is forcing the entire Web3 market into a new phase of “identity governance.” Web3 teams can no longer rely solely on narrative—they must present robust structural designs. Investors can no longer chase valuations alone—they must ask: “Are you ready to be regulatorily penetrated?”

DTSP is only the beginning. A broader wave of compliance resurgence is unfolding globally.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News