The Cryptographic Scaling Law: Where Is DeFi's Hard Ceiling?

TechFlow Selected TechFlow Selected

The Cryptographic Scaling Law: Where Is DeFi's Hard Ceiling?

Once again, I'm impressed by Bitcoin's brilliant design.

Author: Zuoye

Once again, I'm deeply impressed by Bitcoin's brilliant design.

DeepSeek R2 did not launch as rumored in May, but instead rolled out a minor R1 update on May 28. Musk's Grok 3.5 has also repeatedly missed its deadlines—less reliable than Starship, which at least makes a real sound when it launches.

Amid狂热 capital inflows, the scaling law in the large model field is burning through its lifecycle even faster than Moore's Law for chips.

If software, hardware, and even human lifespan, cities, and nations all have upper limits to their scale effects, then blockchain must also follow certain patterns. As SVM L2 enters its token issuance phase and Ethereum returns to the L1 battlefield, I attempt to adapt the concept of scaling laws into a crypto-native version.

Ethereum’s Soft Scale, Solana’s Hard Cap

We begin with full node data size.

Full nodes represent a complete "backup" of a public chain. Owning BTC/ETH/SOL does not mean we truly own the corresponding blockchain. Only when we download the full node data and participate in block production can we say, “I own the Bitcoin ledger.” In doing so, Bitcoin also gains another decentralized node.

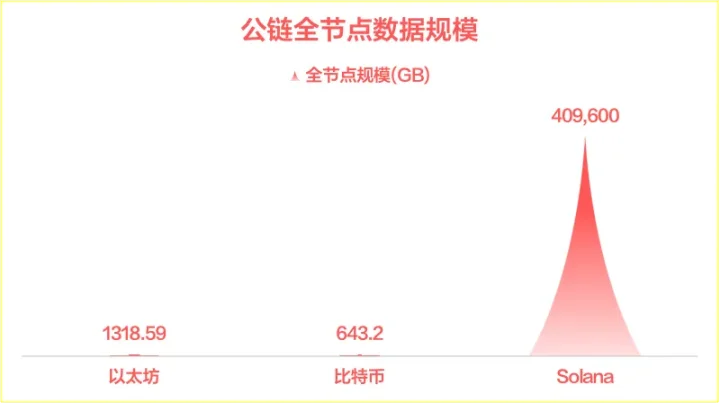

Solana maintains a delicate balance between decentralization and consensus efficiency with around 1,500 nodes. Correspondingly, its ~400TB full node data size leads among all public chains and L2s.

Image caption: Public chain full node data sizes. Source: @zuoyeweb3

Without comparing to Bitcoin, Ethereum has done exceptionally well in controlling data growth. Since its genesis block on July 30, 2015, Ethereum’s full node data stands at only about 13TB—far less than its so-called "killer," Solana, at 400TB—while Bitcoin’s 643.2GB is nothing short of art.

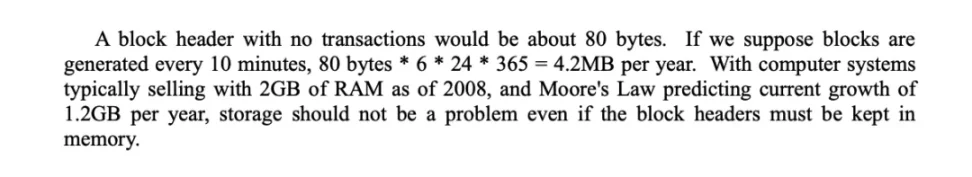

In its original design, Satoshi carefully considered Moore’s Law growth curve, strictly constraining Bitcoin’s data growth within the trajectory of hardware advancement. This makes the argument for larger Bitcoin blocks untenable today, as Moore’s Law has already reached the edge of diminishing returns.

Image caption: Comparison of Bitcoin node growth vs Moore’s Law. Source: Bitcoin Whitepaper

In CPUs, Intel’s 14nm++ has become a family heirloom; in GPUs, NVIDIA’s 50-series didn’t significantly surpass the 40-series; and in storage, despite innovations like YMTC’s Xtacking architecture, 3D NAND stacking is gradually hitting its ceiling, with Samsung’s 400-layer stack representing the current engineering high-water mark.

In short, scaling laws imply no major improvements ahead for blockchain’s underlying hardware. Indeed, this isn't just a short-term technical limitation—it will likely persist for a long time.

Facing these constraints, Ethereum focuses on ecosystem optimization and restructuring. Trillions in RWA assets are its battleground. Whether emulating Sony with custom L2s or accelerating adoption of the RISC-V architecture, these moves aren’t about achieving极致 hardware-software synergy—they’re about defending existing advantages.

Solana chooses to push speed to the extreme. Beyond current upgrades like Firedancer and AlpenGlow, its massive node requirements have effectively excluded individual participants. A 13TB hard drive might still be assembled by an enthusiast, but 400TB is pure fantasy. Even Bitcoin’s 600GB could theoretically be sustained under constant fire-fighting conditions at Samsung, LG, and SK Hynix factories.

The only question remains: where do the lower and upper bounds of on-chain scale lie?

The Limits of Token Economics

AI hasn't embraced Crypto as expected, yet Virtuals’ token price continues to surge. Holding both blockchain and AI, they've become ideological allies of MAGA in the current U.S. administration. 5G and the metaverse are outdated; the new titans are SBF and stablecoins.

Let’s briefly discuss key limit indicators for token economic systems. Bitcoin, despite lacking practical utility, has a market cap of $2 trillion; Ethereum, $300 billion; Solana, $80 billion. Taking Ethereum as our baseline, we estimate the economic system limit for a public chain at $300 billion.

This isn’t to say Bitcoin is overvalued or that new chains can’t exceed this figure. Rather, it suggests that current market performance likely represents the optimal solution—“the market is reasonably efficient as-is.” Thus, directly adopting this value is more effective than complex calculations. Entia non sunt multiplicanda praeter necessitatem.

We borrow two concepts from the book *Scale*:

-

Superlinear scaling: When a system grows, its output or benefits increase faster than proportionally.

-

Sublinear scaling: When a system expands, certain metrics (e.g., cost, resource consumption, maintenance needs) grow slower than linearly.

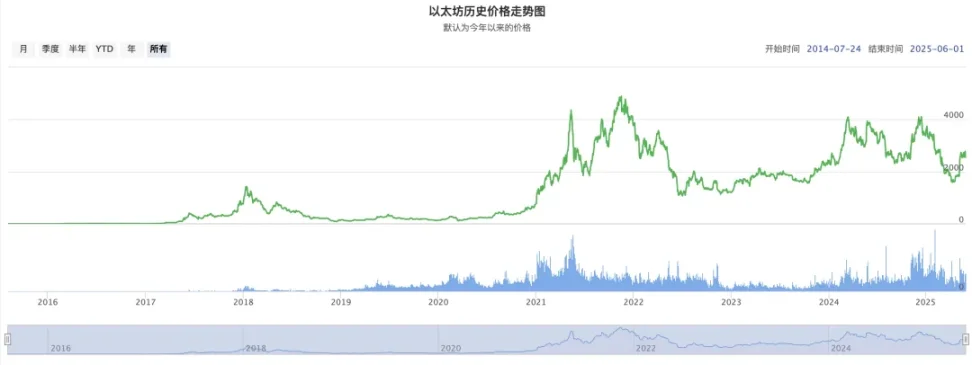

Image caption: Ethereum price trend. Source: BTC123

Understanding these is straightforward. For example, Ethereum’s rise from $1 (2015) to $200 (2017) exemplifies superlinear scaling—it took roughly half the time compared to its climb from $200 to ATH (2021), which reflects classic sublinear scaling.

Everything has its limits. Otherwise, blue whales, elephants, and redwoods would keep growing indefinitely—but Earth’s gravity imposes a hard ceiling.

Digging deeper: Has DeFi hit its limit?

We can use Ethereum to bound DeFi’s total scale, then examine yields—the core proposition of DeFi. The driving force behind entropy increase is the relentless pursuit of yield. Let us consider three benchmarks: UST’s 20% APY, DAI’s 150% over-collateralization ratio, and Ethena’s sUSDe 90D MA APY of 5.51%.

We can assume DeFi’s yield capture capacity has declined from 1.5x to 5%. Even using UST’s 20% as reference, DeFi appears to have already reached its upper bound.

Note: Onboarding trillions in RWA assets will only lower average DeFi yields, not raise them—consistent with sublinear scaling. Extreme expansion of system scale does not lead to extreme increases in capital efficiency.

Also note: DAI’s 150% over-collateralization ratio reflects a market incentive—the ability to earn additional returns beyond that threshold. I treat this as a market benchmark, though this is my personal view and may not be correct.

To be blunt: today’s on-chain economic systems, based on tokenomics, have a practical upper limit of ~$300 billion in total size and ~5% yield. Again, this isn’t about individual token caps or floors, but about the total tradable market size being inherently constrained.

In reality, you cannot sell $2 trillion worth of Bitcoin—the U.S. Treasury market itself couldn’t absorb such a dump.

Conclusion

Looking back at blockchain history since Bitcoin, the divergence among public chains has not narrowed. Bitcoin continues to decouple from on-chain ecosystems, while failures in on-chain reputation and identity systems have cemented over-collateralization as the dominant model.

Whether stablecoins or RWAs, they are essentially leveraged representations of off-chain assets—off-chain assets naturally possess higher trustworthiness. Under current on-chain scaling laws, we may have already reached the limits of scaling law or Moore’s Law. It’s been only five years since DeFi Summer, and barely ten since Ethereum’s inception.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News