In-depth Analysis of the Origins and Ambitions of Stablecoins: A Spark Igniting a Prairie Fire, Gradually Reaching Its Prime

TechFlow Selected TechFlow Selected

In-depth Analysis of the Origins and Ambitions of Stablecoins: A Spark Igniting a Prairie Fire, Gradually Reaching Its Prime

RWA has become a key engine driving the development of the cryptocurrency market, and traditional financial institutions are actively adopting stablecoins, promoting stablecoin adoption in traditional payment markets.

Authors: Song Jiaji, Ren Heyi, Jishi Communications

Executive Summary

Stablecoins refer to cryptocurrencies whose value is pegged to various fiat currencies. As blockchain-based assets, stablecoins have the advantage of deep integration with crypto projects (such as DeFi) at the blockchain infrastructure level, offering excellent network scalability. With traditional financial institutions in regions like the U.S. and Hong Kong advancing into the RWA space, exploration and adoption of stablecoins in traditional payment markets are accelerating.

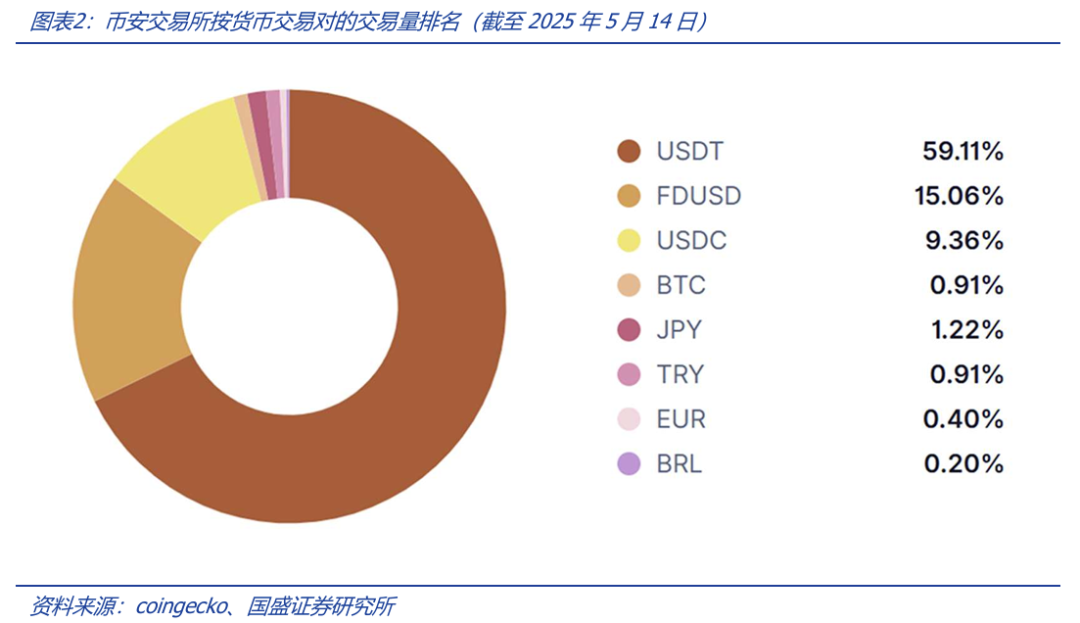

Stablecoins, to some extent, serve as a "pricing tool" for the cryptocurrency market, supplementing or even replacing traditional fiat transactions. Shortly after their emergence, stablecoin trading pairs became the dominant trading pairs in the cryptocurrency market. Therefore, in terms of trading instruments and value circulation, stablecoins play a "fiat-like" role. On major exchanges (including DEXs), Bitcoin spot and futures trading pairs are primarily denominated in stablecoins such as USDT. Especially for high-volume futures contracts, the mainstream exchanges’ linear contracts (futures contracts using USD-pegged stablecoins as margin) are almost exclusively traded against USDT.

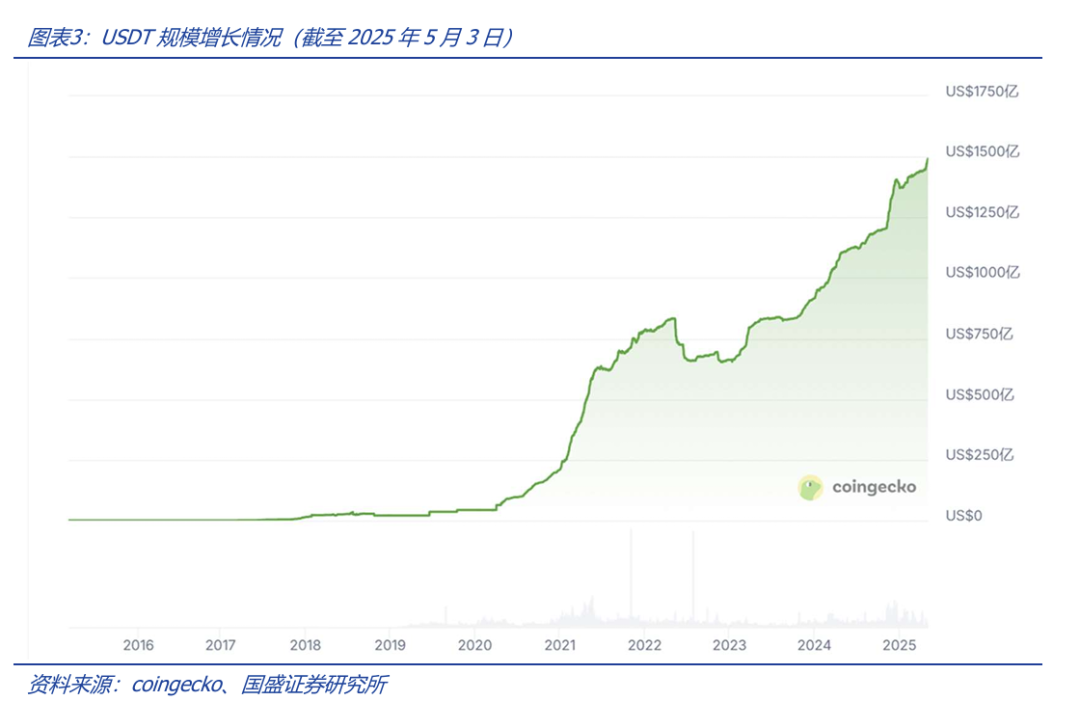

USDT was among the first stablecoins issued, backed one-to-one by dollar reserves held by Tether, and is currently the most widely used stablecoin. Launched by Tether in 2014, 1 USDT is pegged to 1 USD. USDT was among the earliest stablecoins listed on centralized exchanges and has gradually become the most widely used stablecoin product in the market, mainly serving as a trading pair for cryptocurrency spot and futures. USDT is a stablecoin backed by U.S. dollar assets, with the company claiming that each token is supported by one dollar in reserve. Tether provides an auditable balance sheet consisting primarily of cash-like traditional financial assets. Since its launch, USDT has maintained rapid growth, reflecting the underlying real demand for stablecoins—making their emergence "inevitable."

Currently, there are three methods to achieve this credit transmission: centralized institutions issuing fully-reserved asset-backed stablecoins, blockchain smart contract-based over-collateralized issuance of stablecoins backed by crypto assets, and algorithmic stablecoins. Among stablecoins, those issued by centralized entities like USDT dominate; the mechanisms of over-collateralization and algorithmic stablecoins are less intuitive, making it difficult for users to directly perceive the intrinsic value anchoring logic of these stablecoin products—especially during periods of extreme cryptocurrency price volatility, when users cannot clearly anticipate the outcomes of liquidation mechanisms. These factors have constrained the development of the latter two models.

RWA has become a key engine driving the cryptocurrency market, with traditional financial institutions actively adopting stablecoins and pushing stablecoin applications in traditional payment markets. For example, in the tokenized U.S. Treasury market, leading funds such as BUIDL (launched by BlackRock in partnership with Securitize) and BENJI (by Franklin Templeton) indicate that traditional financial institutions' embrace of RWA is becoming a trend.

Stablecoin regulation is gradually progressing. Currently, stablecoins develop first while simultaneously aligning with regulatory frameworks. Although they have faced skepticism during their development, alongside BTC’s entry into mainstream capital markets, stablecoin development is expected to accelerate.

Risk Warnings: Blockchain technology R&D falling short of expectations; uncertainty in regulatory policies; Web3.0 business model implementation lagging behind expectations.

1. Core Views

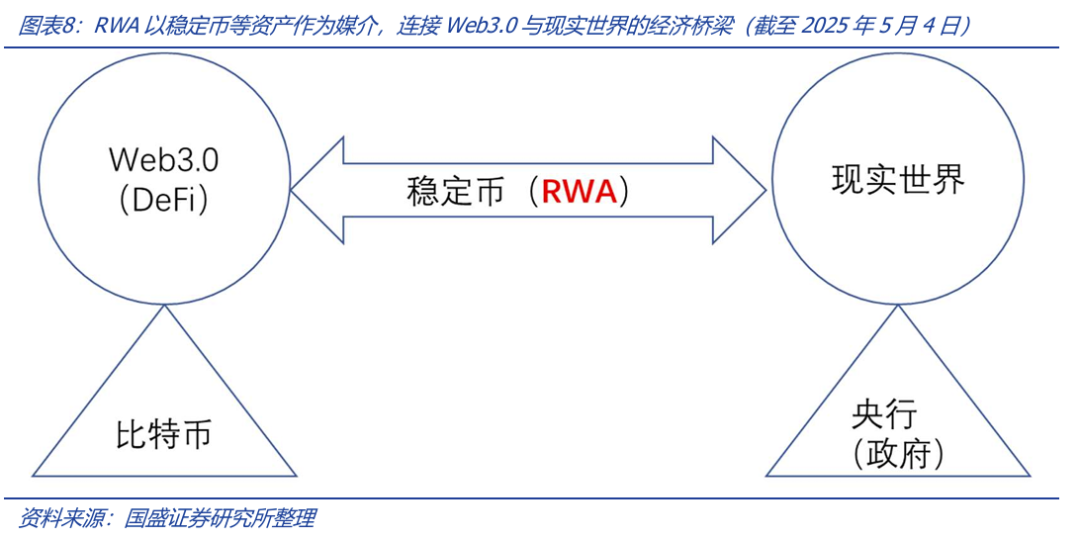

Stablecoins emerged from the "wild west" era of Web3.0, initially serving as a fiat-denominated instrument for trading cryptocurrencies. As the crypto market expanded, stablecoins became foundational tools indispensable to exchanges, DeFi, and the RWA ecosystem. A critical success factor for stablecoins is earning market trust, which hinges on the mechanism of credit transmission. Stablecoins are not only essential within the Web3.0 world but also act as a bridge connecting it with the real economy. Today, as stablecoins gain widespread use, traditional financial institutions are accelerating their adoption of stablecoins and embracing crypto assets. Stablecoins connect two worlds.

This article analyzes the origin, development, current state, and mechanisms of stablecoins, and offers outlooks on future opportunities.

2. The Inevitability of Stablecoins: Bridging Traditional Finance and Web3.0

2.1 Underlying Demand for Stablecoins: "Fiat" Tools on Chain

Stablecoins refer to cryptocurrencies whose value is pegged to various fiat currencies (or a basket of currencies). Intuitively, stablecoins map the value of real-world fiat money onto blockchain account balances (i.e., cryptocurrencies). In this sense, stablecoins represent a typical form of RWA (Real World Assets, real-world asset tokenization). As blockchain assets, their advantage lies in deep integration with crypto projects (e.g., DeFi) at the blockchain infrastructure level—such as swapping or combining with other on-chain crypto assets for DeFi operations like staking. Traditional fiat currency does not exist on blockchains and thus cannot benefit from on-chain scalability.

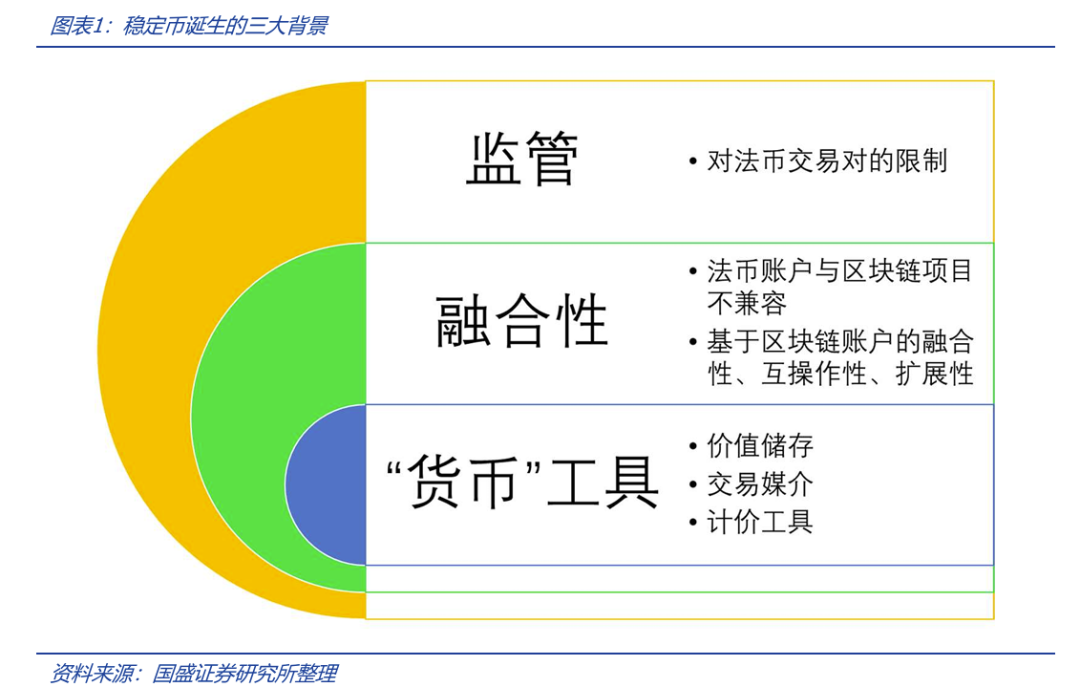

In the early days of the cryptocurrency market, users primarily conducted Bitcoin-fiat transactions via centralized exchanges (CEXs) or OTC markets—Bitcoin being an asset stored on the blockchain, while fiat relies on traditional bank accounts. Such transactions involve completely isolated operations between Bitcoin blockchain accounts and bank fiat accounts, similar to how stock registries and bank accounts operate separately in equity markets. In the early stages of crypto development, as governments tightened exchange regulations, bank fiat accounts became more susceptible to regulatory restrictions. Under these unique early conditions, demand gradually emerged for stablecoins pegged to fiat value—to create coin-to-coin trading pairs (e.g., Bitcoin vs. stablecoin), thereby detaching from traditional financial account systems. More importantly, since cryptocurrencies are blockchain-account-based assets, having pricing pairs also based on blockchain accounts enables ledger interoperability and fusion—something impossible with traditional fiat, which exists off-chain.

In other words, crypto assets like Bitcoin are incompatible with fiat accounts; smart contracts cannot operate on fiat accounts, limiting network scalability. Hence, due to demands for integration and interoperability, the market requires all assets to be represented as digital entries in blockchain accounts. Additionally, due to the high volatility of cryptocurrencies—which fails to satisfy the three functions of money (store of value, medium of exchange, unit of account)—investors struggle to hold or exit positions in the crypto world, creating demand for low-volatility stable currencies.

Stablecoins, to some extent, function as a "pricing tool" in the cryptocurrency market—a complement or even substitute for traditional fiat transactions. Soon after their creation, stablecoin trading pairs became the dominant pairs in the crypto market. Thus, in transaction tools and value circulation, stablecoins perform a "fiat-like" role. As shown in Figure 2, on mainstream exchanges like Binance, Bitcoin spot and futures trading pairs are primarily denominated in various stablecoins such as USDT. Especially for higher-volume futures contracts, linear contracts on major exchanges (futures contracts using USD-pegged stablecoins as margin, e.g., perpetual futures) are almost entirely traded against USDT.

Tether USD (USDT) was among the first stablecoins launched, introduced by Tether in 2014, with 1 USDT pegged to 1 USD. USDT became one of the earliest stablecoins listed on centralized exchanges and has since evolved into the most widely used stablecoin product in the market, primarily used in cryptocurrency spot and futures trading pairs. USDT is a stablecoin backed by U.S. dollar assets, with the company asserting that every token is supported by one dollar in reserve. Tether provides an auditable balance sheet composed mainly of cash-like traditional financial assets. Other stablecoin projects launched around the same time include BitUSD and NuBits. Since its release, USDT has sustained rapid growth, reflecting strong underlying market demand—making the emergence of stablecoins "inevitable."

Due to meeting actual market needs, since 2017, as major cryptocurrency platforms began listing USDT trading pairs (spot and futures), stablecoins have gained favor in the crypto market. Early concerns centered on whether various stablecoins could effectively maintain their peg to corresponding fiat values. Because early issuers like Tether failed to provide convincing, compliant audit reports, market skepticism about their credibility persisted. To address excessive reliance on centralized entities like companies for USDT's credibility, in 2017 MakerDAO launched DAI—a decentralized, multi-asset collateralized stablecoin based on smart contracts. DAI is over-collateralized by crypto assets managed through smart contracts, maintaining its dollar peg via automated systems, allowing permissionless minting. As of May 3, 2025, DAI’s circulating supply exceeded $4.1 billion, ranking fifth among stablecoins (excluding MakerDAO’s newer stablecoin USDS).

DAI’s emergence was a milestone. Decentralized stablecoins differ from centrally issued ones (like USDT) in credit transmission and are native products of the DeFi system—DAI itself is an RWA product created through DeFi staking. Therefore, decentralized stablecoins like DAI are not only adopted on centralized exchanges but also serve as essential components in the RWA ecosystem—commonly referred to as part of the "Lego stack."

As stablecoin applications deepened, centralized exchanges began launching their own stablecoins, notably USDC led by Coinbase and BUSD by exchange giant Binance.

Since 2019, with the growth of DeFi projects, stablecoins have been widely used in DeFi systems (lending markets, decentralized exchanges). To pursue greater decentralization and deeper integration with DeFi infrastructure, algorithmic stablecoins—using smart contract algorithms to regulate value stability—have entered the market. Building on DAI, these use algorithmic mechanisms within smart contracts to transmit credit between stablecoins and fiat currencies. Major current examples include USDe.

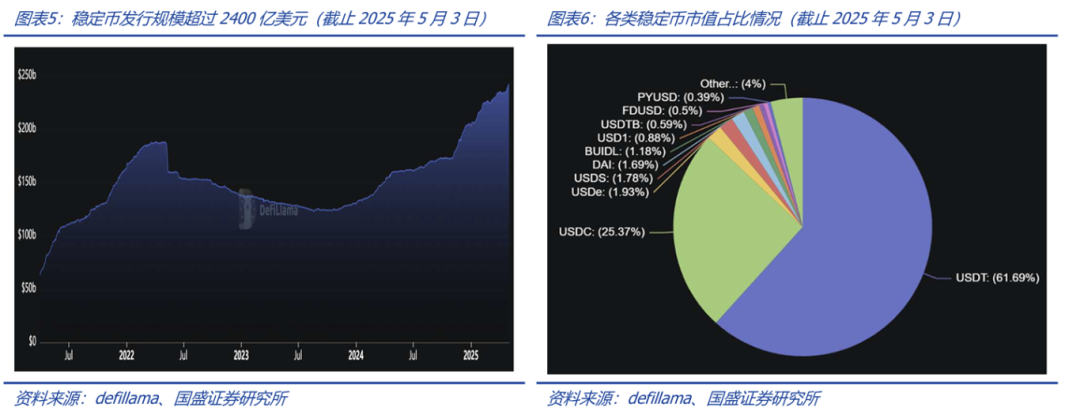

Although the crypto industry strives for full decentralization, the stablecoin market (particularly USD-pegged stablecoins) remains dominated by centralized, asset-backed stablecoins like USDT and USDC, holding an absolute monopoly. As shown in Figure 4, as of May 3, 2025, USDT ranked first with over $149 billion in supply, USDC second with over $61 billion, and USDe third with less than $5 billion. USDT and USDC, the two centralized stablecoins, hold overwhelming dominance. The blockchain-based algorithmic stablecoin USDe ranks third with approximately $4.7 billion. Blockchain smart contract-collateralized stablecoins USDS and DAI rank fourth and fifth, with supplies of about $4.3 billion and $4.1 billion respectively.

Currently, stablecoins are primarily used in the cryptocurrency market because the market predominantly prices assets against stablecoins. During the past year’s crypto bull market, stablecoins (mainly USD-pegged) saw rapid issuance growth. As shown in Figures 5 and 6, total issuance surpassed $240 billion as of May 3, 2025; USDT and USDC accounted for 61.69% and 25.37% respectively. Notably, decentralized stablecoins have not demonstrated sufficient advantages—practically speaking, stablecoins backed by traditional financial assets (USDT, USDC) dominate. Multiple factors contribute to this, including the rapid development of RWA, which correlates with the adoption of USDT and USDC, further analyzed below.

2.2 More Than a Pricing Tool: A Bridge Between Web3.0 and Traditional Financial Markets

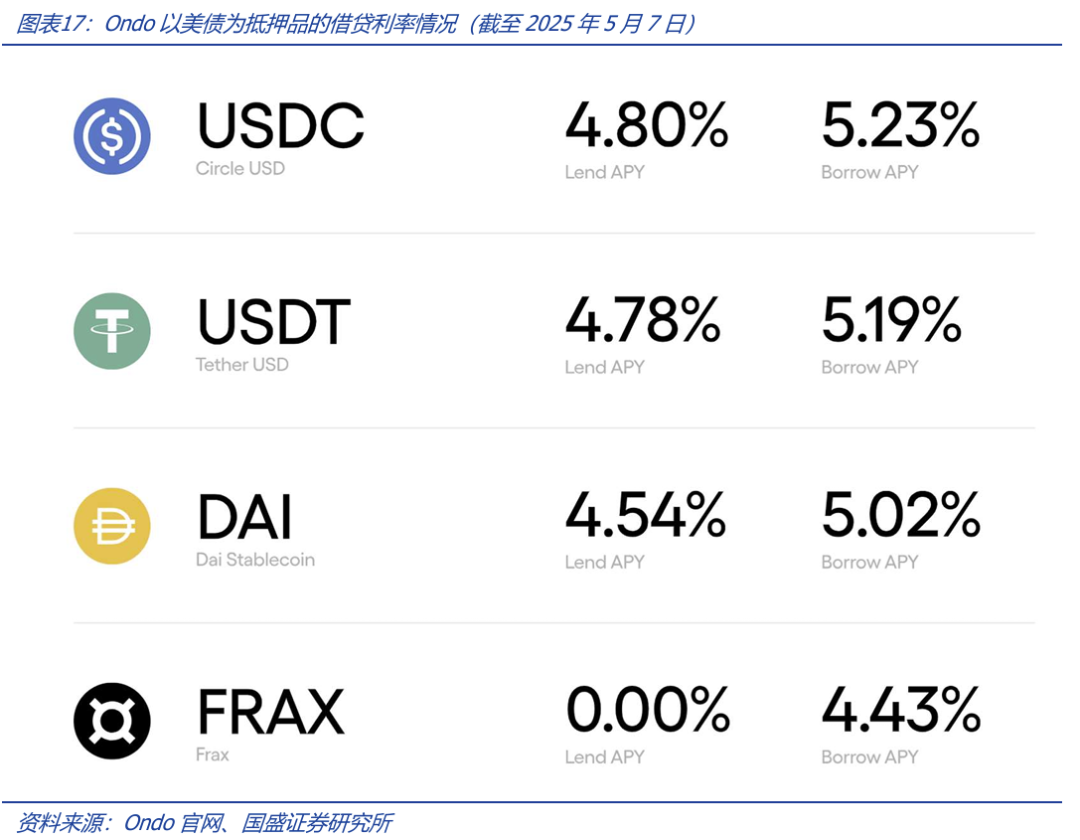

In DeFi lending markets, stablecoin assets like USDT are common collateral or borrowing assets—not just functioning as deposits, but existing as crypto assets. Users can either pledge crypto assets like Bitcoin/ETH to borrow stablecoins or use stablecoins as collateral to borrow other crypto assets. For example, in AAVE—the top project by DeFi locked value—three of the top six lending markets are USD stablecoin-based, with USDT, USDC, and DAI ranking second, third, and sixth respectively.

Whether in trading or DeFi lending markets, stablecoins resemble privately issued currencies or notes. Due to blockchain infrastructure characteristics, stablecoins offer potential advantages over traditional finance in settlement speed, integration, and scalability. For instance, stablecoins can seamlessly switch across DeFi projects (exchanges, lending markets, leveraged products) with just a few taps on a mobile device, whereas fiat cannot move so quickly across traditional financial markets.

The convergence between the Web3.0 world (represented by cryptocurrencies) and the real economy is an inevitable trend, and RWA serves as a key driving force—directly mapping real-world assets onto blockchains. Broadly speaking, stablecoins themselves are a fundamental RWA product, anchoring fiat currencies like the dollar to the blockchain. For traditional financial market participants, stablecoins and RWA serve as bridges into the crypto market. For traditional financial institutions entering the Web3.0 world, stablecoins represent crucial positions—holding stablecoins allows them to freely navigate asset allocation within Web3.0. Conversely, crypto investors can convert holdings into traditional financial assets or purchase goods, re-entering traditional markets. On April 28, 2025, payments giant Mastercard announced customers may spend and merchants may settle using stablecoins. Stablecoin usage is now spreading back into the traditional economy.

2.3 Three Models of Stablecoin Credit Transmission

Digital numbers in bank accounts represent users’ fiat deposits—ensured by traditional economic rules. Stablecoins attempt to transfer fiat value to on-chain account digits, requiring different credit transmission methods than banks—this is a core issue in stablecoin credibility. Overall, there are currently three ways to achieve this: centralized institutions issuing fully reserved asset-backed stablecoins, blockchain smart contract-based collateralization of crypto assets to issue stablecoins, and algorithmic stablecoins.

Among stablecoins, those issued by centralized institutions like USDT dominate. This model is logically simple, leveraging traditional market credit transmission, making it easy for users to understand and adopt—thus the most natural choice in the early stage of stablecoin development. The mechanisms of over-collateralization (second model) and algorithmic stablecoins (third model) are less intuitive. Users often cannot directly grasp the intrinsic value anchoring logic of these products (i.e., novice users struggle to accept their logic), especially during sharp crypto price swings when users cannot intuitively predict the outcomes of liquidation mechanisms—during volatile periods, liquidation mechanisms may lead to irrational market outcomes, constraining the development of the latter two models.

2.3.1. Relying on Traditional Markets for Credit: USDT

Centralized institutions issue fully reserved asset-backed stablecoins, relying entirely on traditional markets for credit transmission. The simplest stablecoin model involves a centralized entity holding full reserve assets and issuing an equivalent amount of stablecoins on the blockchain (the issuer assumes responsibility for issuance and redemption), pegging the stablecoin 1:1 to fiat—thus the centralized institution acts as the credit backer. This requires effective auditing of the issuer’s balance sheet, typically composed of traditional market instruments such as government bonds and cash, with minor allocations possibly in cryptos like Bitcoin. Through 1:1 custodial collateralization, this model ensures users can redeem equivalent collateral from the issuer, maintaining price stability. However, this model heavily depends on secure custody of collateral, involving issuer compliance, custodian compliance, and collateral liquidity. Typically, whether the issuer can provide compliant and effective audit reports is of greatest concern.

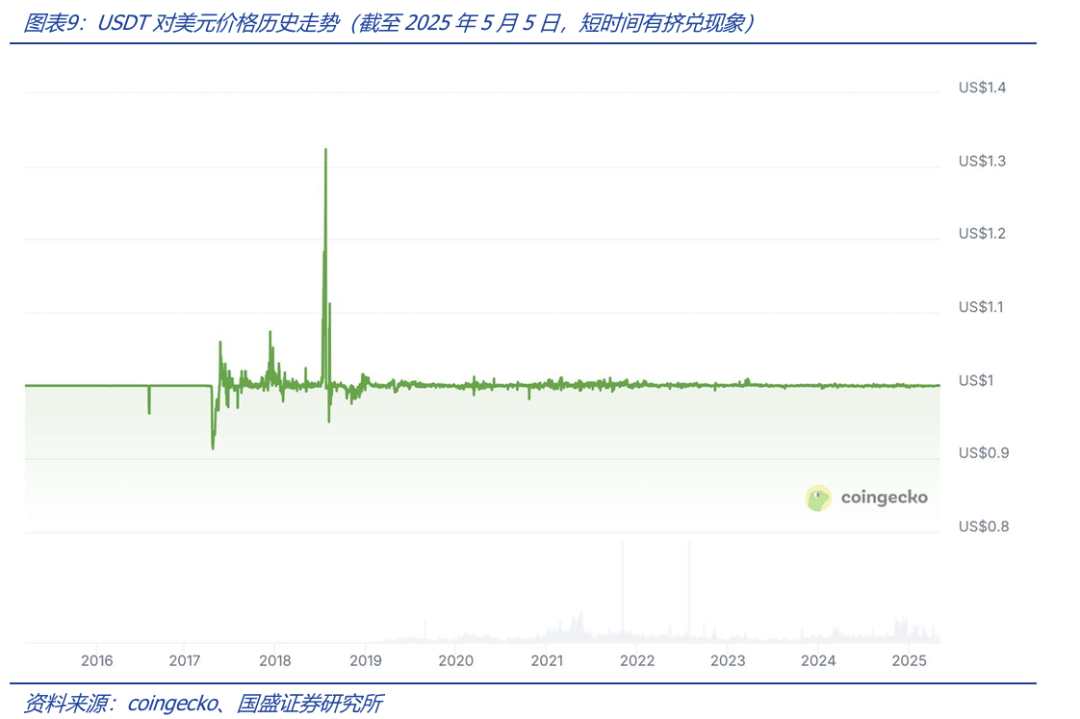

USDT’s early start gave it significant first-mover advantage and is now the most circulated stablecoin, accounting for over 60% of the market. To ensure broad applicability, USDT is issued across multiple blockchains including Omni, Ethereum, Tron, and Solana. In its early scale-up phase, issues such as liquidity constraints and doubts about its balance sheet—amplified by market volatility—occasionally caused USDT to de-peg (sometimes at a premium). However, these were temporary. Overall, USDT’s dollar peg has been largely successful. We believe strong market demand played a key role—after all, USDT is a must-have product for the crypto market.

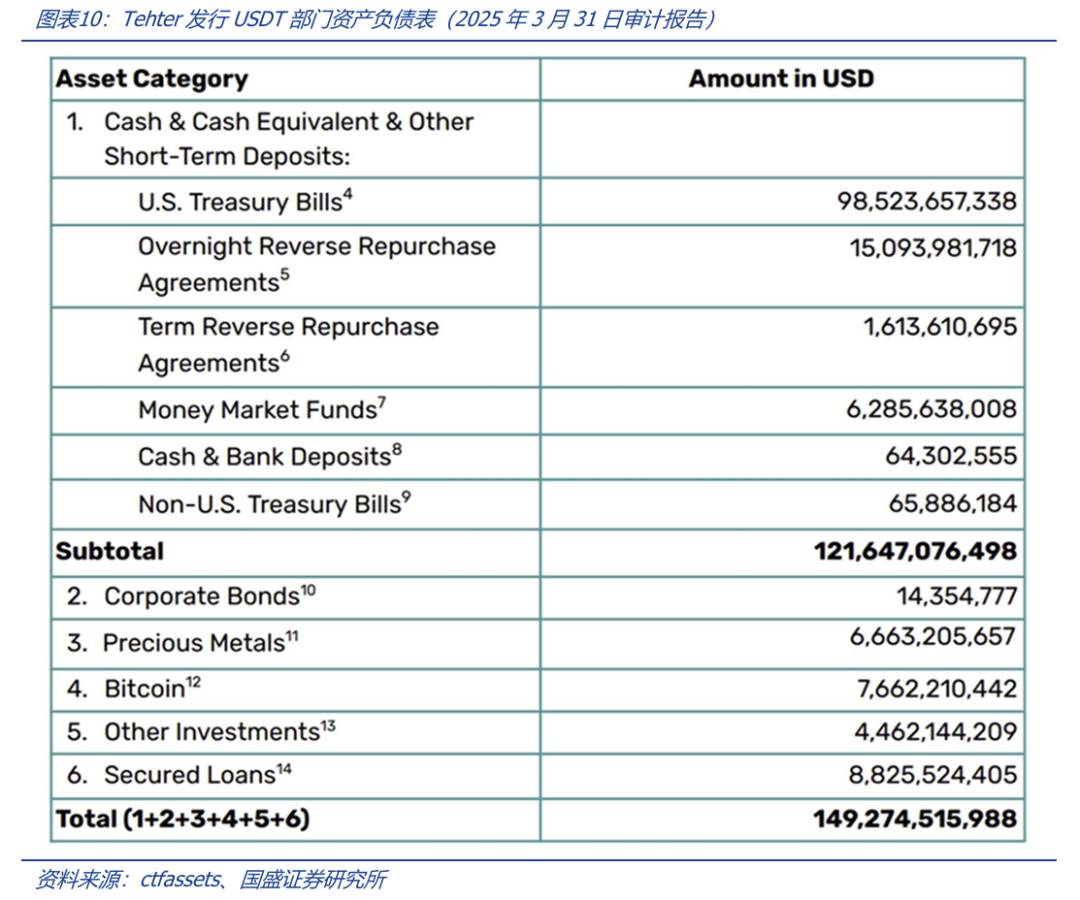

To address market concerns about its reserves and redemption capacity, Tether now publishes complete and valid audit reports. According to independent audits, as of March 31, 2025, Tether’s USDT division held total assets of approximately $149.3 billion, matching its issued USDT supply. A detailed look reveals that 81.49% of its reserves consist of cash, cash equivalents, and short-term deposits—primarily U.S. Treasuries—ensuring balance sheet resilience and adequate liquidity measures for redemptions. Interestingly, its assets also include $7.66 million in Bitcoin reserves—though small, this highlights the fact that Bitcoin (and by extension, other cryptos) can serve as reserve assets for stablecoins. In sum, USDT’s reserve composition is diversified, balancing liquidity and portfolio variety.

As USDT’s issuer, Tether reported over $13 billion in total profit in 2024, with only about 150 employees. During the Fed’s rate hike cycle, U.S. Treasuries contributed core profits. Of course, USDT redemptions incur fees. As a compliant entity responsible for issuing and redeeming stablecoins, Tether’s model is currently the most favored by the market. We believe USDT’s early market entry secured a first-mover advantage in both the CEX and DeFi eras. Moreover, relying on publicly audited companies for credit backing makes stablecoins acceptable to both traditional finance and Web3.0 markets.

2.3.2. Market Trust Can Also Be Achieved via Decentralized Collateral Issuance

Over-collateralizing crypto assets via blockchain smart contracts to issue stablecoins can also earn market trust. Crypto assets are pledged to smart contracts, which lock the assets on-chain and issue a corresponding amount of stablecoins. Since on-chain crypto assets do not naturally maintain dollar price stability, collateral carries price volatility risk. To ensure price stability and redeemability, such stablecoins use over-collateralization for credit transmission—i.e., the value of collateral exceeds the issued stablecoin amount—and during market fluctuations (especially collateral price drops), blockchain smart contracts liquidate collateral (while buying back stablecoins) to ensure redeemability. This differs from the first model by not relying on centralized institutional credit. The largest and most representative examples are USDe and DAI—USDe, built on DAI via the new Sky protocol, can be seen as an upgraded version (freely exchangeable 1:1 with DAI). In 2024, MakerDAO rebranded as Sky Ecosystem and launched a new stablecoin USDS. Collateralizable crypto assets can generate DAI via smart contracts called Maker Vaults under Sky protocol control. If collateral prices fall, risking insufficient value, the protocol triggers auctions (buying back DAI) to support DAI’s 1:1 dollar peg.

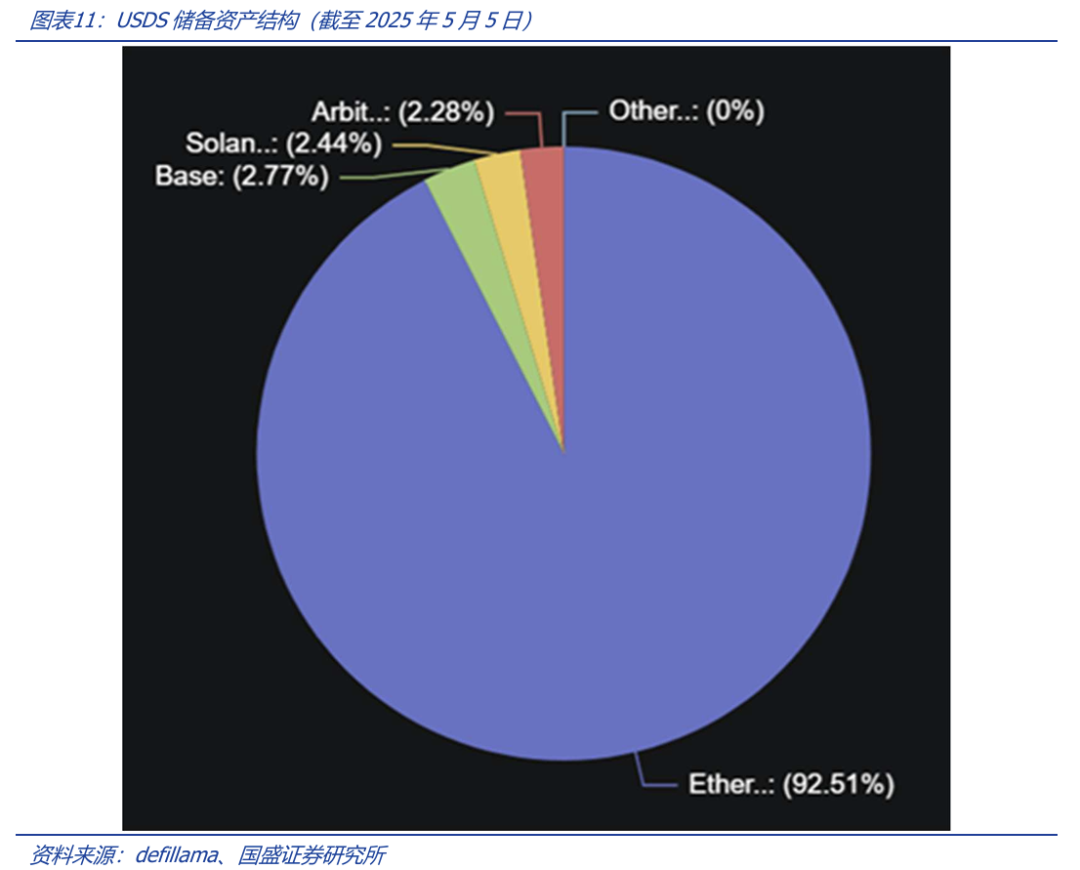

Looking at collateral composition, as of May 5, 2025, ETH tokens made up over 92% of USDS’s primary collateral.

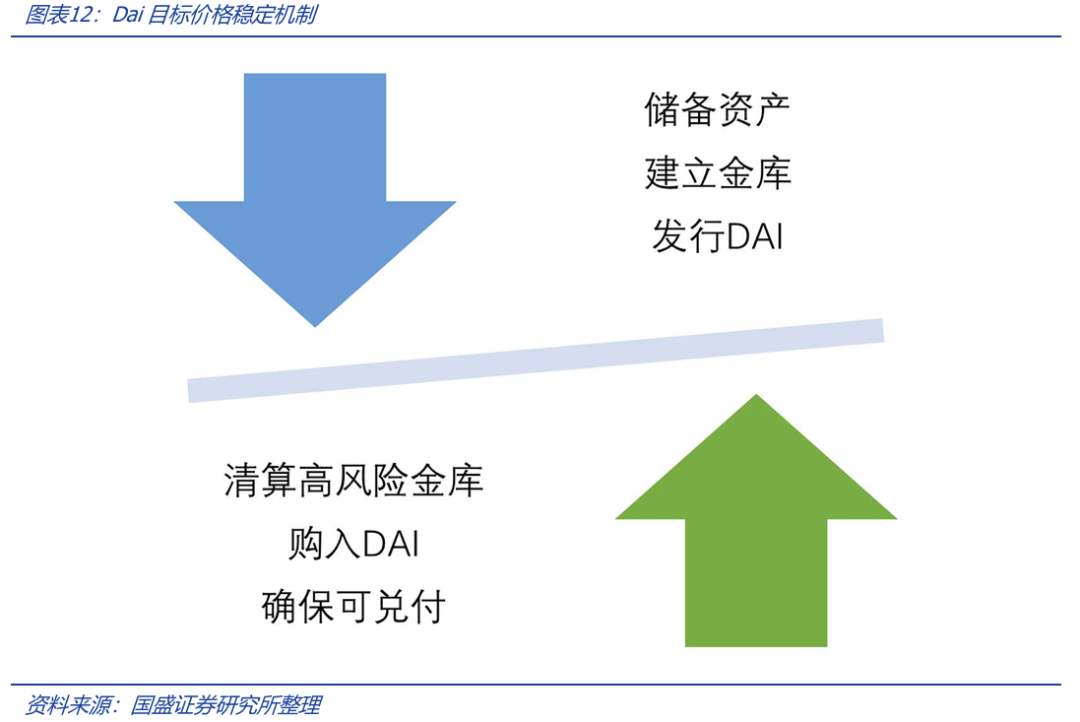

How is DAI kept stable? Ensuring holders can redeem DAI is central to its stability. The DAI issuer interacts with the on-chain Sky Protocol Vault contract, depositing sufficient collateral (value exceeding DAI issuance to ensure redeemability). If collateral prices drop during market volatility, risking inability to cover DAI redemptions, the vault automatically auctions the collateral (to redeem DAI) per contract protocols. This mechanism resembles futures margin requirements—positions are liquidated early if margins fall below thresholds. The Sky protocol designs auction pricing mechanisms to ensure vault collateral value covers circulating DAI, thus maintaining DAI’s "stability."

2.3.3. Algorithmic Stablecoins: Full Trust in Blockchain Algorithms, Currently Small in Scale

The first two stablecoin models rely on collateralized issuance—USDT uses company-held auditable reserves, while USDS/DAI use blockchain smart contracts for collateral and redeemability. However, DAI’s liquidation pricing and vault governance are not fully decentralized. Driven by native DeFi users’ demand for fully decentralized stablecoins, fully algorithmic models emerged—relying solely on algorithms to maintain price stability. These algorithmic stablecoins use algorithmic market arbitrage/hedging mechanisms to theoretically maintain their peg, though in practice, deviations from the peg are not uncommon. Algorithmic stablecoins remain relatively small in scale. Compared to the second model, algorithmic stablecoins rely entirely on decentralized smart contract algorithms, requiring minimal human intervention. As an innovative sector, several different arbitrage/hedging mechanisms have existed historically, but long-term successful projects remain rare.

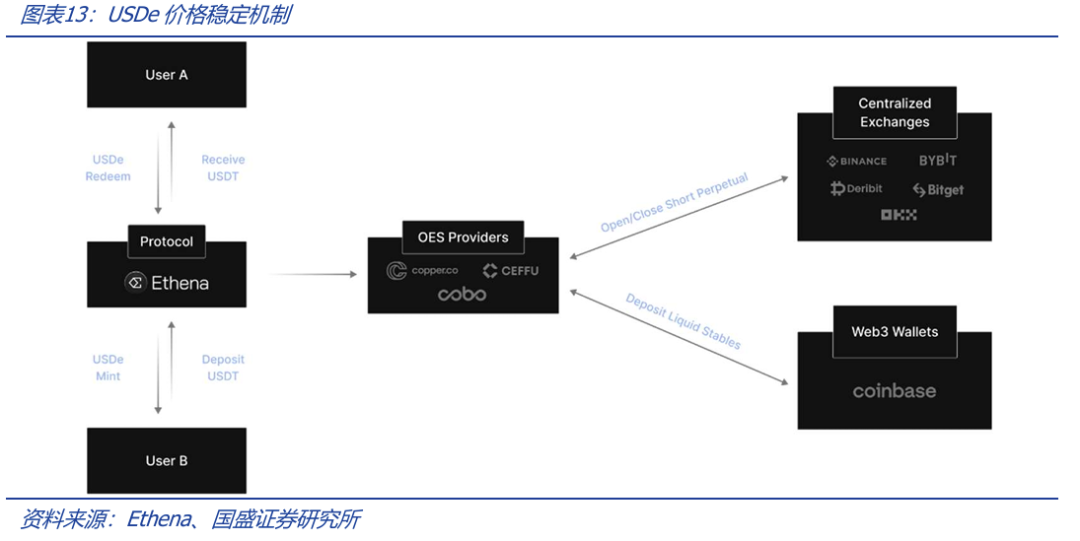

The current representative algorithmic stablecoin is USDe, ranked third by market cap, issued by the Ethena protocol. Broadly, whitelisted users deposit crypto assets (BTC, ETH, USDT, USDC, etc.) into the Ethena protocol to mint an equivalent amount of USDe. The protocol then establishes short positions on CEXs to hedge reserve asset price fluctuations, keeping the issued stablecoin value stable. This resembles hedging mechanisms in commodity futures—an automated neutral hedging strategy fully controlled by algorithms.

3. RWA: A Key Application Area for Stablecoins Today

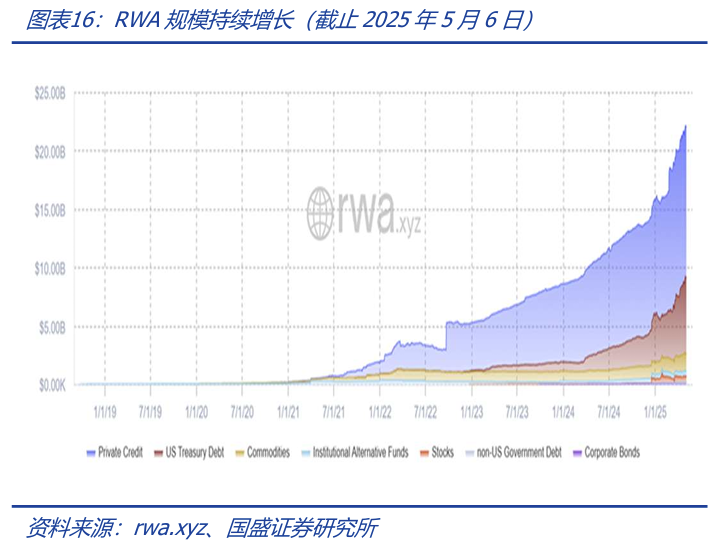

This year, Bitcoin prices have declined somewhat, dragging down the broader crypto market, while the RWA market maintains a solid upward trend. According to rwa.xyz, as of May 6, RWA’s total size exceeded $22 billion, showing continuous growth unaffected by Bitcoin’s price drop. In terms of composition, private credit and tokenized U.S. Treasuries contribute significantly to scale and growth.

RWA has become a key driver for the crypto market, thanks to active participation from traditional financial institutions. In the tokenized U.S. Treasury market, flagship funds like BUIDL (launched by BlackRock with Securitize) and BENJI (by Franklin Templeton) show that traditional institutions’ embrace of RWA is becoming a trend.

RWA, as a high-potential sector, clearly drives stablecoin demand—RWA brings real-world assets on-chain, and USDT serves as the bridge between the real world and Web3.0.

3.1 Institutionalization of RWA Highlights the Critical Role of Stablecoins

Though born in Web3.0’s wild west, RWA now shows signs of "institutionalization"—especially as Bitcoin ETFs boost traditional finance’s recognition of Web3.0, making this trend natural. Take Ondo, a U.S.-based blockchain tech company aiming to accelerate traditional wealth’s transition to Web3.0 by building platforms, assets, and infrastructure to bring financial markets on-chain. Recently, the company announced Ondo Nexus—a new tech initiative providing real-time liquidity for third-party issuers of tokenized U.S. Treasuries. In other words, Ondo Nexus offers redemption and exchange services for tokenized Treasuries, enhancing their liquidity and utility, while building infrastructure for broader RWA categories. Clients include Franklin Templeton, WisdomTree, Wellington Management, and Fundbridge Capital, with 24/7 liquidity powered by existing relationships with firms like BlackRock and PayPal. On February 12, the company announced a strategic partnership with World Liberty Financial (WLFI), backed by Donald Trump Jr., to bring traditional finance on-chain through RWA advancement. RWA has accelerated into the "institutional" era.

Through Ondo Nexus, investors in partner-issued tokenized Treasuries can seamlessly redeem their RWA assets using various stablecoins, enhancing liquidity and utility across the ecosystem, increasing RWA’s investability, and boosting confidence in on-chain asset liquidity. In 2024, the company achieved over $3 billion in total value locked (TVL) in tokenized Treasury RWA assets, a strong performance.

Backed by traditional financial institutions, Ondo enjoys strong liquidity support—critical for attracting traditional market clients, whose assets mostly reside off-chain.

4. Traditional Payment Markets Embrace Stablecoins: Payments and Yield

As a bridge between Web3.0 and the real world, stablecoins work bidirectionally—not only bringing real-world assets on-chain but also seeing stablecoin applications penetrate real-world markets. We can expect promising developments in cross-border payments, and if holding stablecoins earns interest—similar to shadow "fiat"—that would be another major breakthrough.

Traditional payment providers like Mastercard supporting stablecoin usage is no longer novel—it reflects traditional financial institutions actively capturing Web3.0 financial traffic. Since DeFi offers yield on crypto assets, this is an advantage for on-chain assets. On yield generation, traditional institutions are seeking higher appeal. Payment giant PayPal is aggressively expanding its PYUSD stablecoin market. Recently, the company plans to offer U.S. users 3.7% interest on PYUSD holdings, launching this summer—users will earn interest while storing PYUSD in PayPal and Venmo wallets. PYUSD can be used via PayPal Checkout, transferred to others, or converted into traditional USD.

As early as September 2024, PayPal announced allowing payment partners to settle cross-border remittances via Xoom using PayPal USD (PYUSD), enabling them to leverage blockchain’s cost and speed benefits. In April that year, the company allowed U.S. Xoom users to send PYUSD to overseas relatives without transaction fees. Xoom, a PayPal service and pioneer in digital remittances, offers fast, convenient money transfers, bill payments, and mobile top-ups to friends and family in about 160 countries worldwide.

In other words, stablecoins are now being adopted by traditional payment markets, and offering yield is a potentially powerful customer acquisition tool.

On May 7, 2025, Futu International Securities announced the official launch of deposit services for crypto assets including BTC, ETH, and USDT, offering users Crypto+TradFi (traditional finance) asset allocation. Recently, Meta—three years after abandoning its Libra/Diem project—is engaging with multiple crypto firms to explore stablecoin applications, aiming to reduce fees for cross-border payments to content creators. Traditional finance and internet firms are beginning to build crypto asset services to share Web3.0 financial traffic—a clear trend.

Crypto project teams are also actively expanding into traditional finance. On April 1, U.S. time, Circle, the issuer of stablecoin USDC, filed an S-1 form with the U.S. Securities and Exchange Commission (SEC) to list on the New York Stock Exchange under ticker CRCL. Circle reported that as of end-2024, its stablecoin-related revenue reached $1.7 billion, accounting for 99.1% of total revenue. Circle could become the first publicly listed stablecoin issuer in the U.S. If successful, this would further drive the U.S. stablecoin market and accelerate acceptance among traditional financial users—especially institutional ones—since today’s stablecoin users still largely come from the crypto market.

5. How Should Stablecoins Be Regulated?

Cryptocurrencies emerged from the wild west—an entirely new phenomenon that has constantly clashed with regulators during development. In the U.S., multiple agencies—including the SEC, CFTC, FinCEN (responsible for AML/CFT), and OCC (overseeing national banking)—all claim regulatory authority over crypto. In reality, crypto touches many of these agencies’ jurisdictions, and each seeks greater dominance in regulating the space. But without mature regulations, agencies apply existing rules or interpretations independently. Throughout development, crypto projects frequently face regulatory interventions and lawsuits. Tether, issuer of USDT, is a prime example—facing allegations from the New York Attorney General’s office over opacity and investor deception. After a 22-month investigation, the NY AG announced a settlement in February 2021: Tether paid an $18.5 million fine and was barred from offering services to New York residents. Such regulatory actions against crypto projects are common—highlighting the current reality: lacking robust legal frameworks, crypto operates in a gray zone.

Since the approval of Bitcoin spot ETFs in the U.S., the crypto market has not only grown in scale but also received more positive regulatory attitudes. The U.S. overall takes a constructive stance toward crypto. On March 7, the White House hosted its first-ever crypto summit, inviting industry leaders including Coinbase CEO and MicroStrategy founder (MSTR). President Trump stated the federal government supports the development of Bitcoin and digital asset markets and backs congressional legislation to provide regulatory clarity.

For U.S. stablecoin regulation, the most important proposal is the GENIUS Act, requiring stablecoins to be backed by liquid assets like USD and short-term Treasuries—establishing a legal framework for stablecoin issuance in the U.S. The U.S. Senate held a key vote on the GENIUS stablecoin bill on May 8 (local time), but unfortunately, it failed to pass. Looking at the most popular stablecoin USDT, its reserves are primarily USD and Treasuries—closely aligned with the bill’s requirements. However, DAI and USDe—two major stablecoin types—fall far short of GENIUS standards. Correspondingly, on April 4 (local time), the SEC released guidance stating that stablecoins meeting specific criteria are deemed "non-securities" and exempt from trading reporting requirements. The SEC defines such "compliant stablecoins" as tokens fully backed by fiat reserves or short-term, low-risk, highly liquid instruments, redeemable 1:1 for USD. This definition explicitly excludes algorithmic stablecoins that maintain their dollar peg via algorithms or automated trading strategies, leaving regulatory status uncertain for algorithmic stablecoins, synthetic dollar assets (RWA), and yield-bearing fiat tokens.

Currently, despite stablecoins’ market advances, no complete, clear legal framework supports them. This mirrors the broader crypto regulatory landscape—crypto, unlike any prior financial or technological innovation, faces unprecedented regulatory challenges.

From a practical standpoint, stablecoins are the "simplest" form of cryptocurrency. Given their link to fiat, they can permeate payment systems and attract intense regulatory scrutiny. Not just in the U.S., but also in places like Hong Kong, stablecoin regulation is accelerating. On February 27 this year, Hong Kong’s Legislative Council committee began reviewing the Draft Stablecoin Ordinance. He Hongzhe, HKMA’s Head of Digital Finance, said they hope the legislature passes the draft this year, after which HKMA will publish regulatory guidelines explaining how the law will be interpreted, including operational details for issuers, and will implement the licensing regime for interested applicants. On April 22, Shen Jiguang, JD Group’s Vice President and Chief Economist, stated that JD has already entered Hong Kong’s stablecoin issuance "sandbox" testing phase. This reflects proactive responses to regulation by Hong Kong-based firms, indicating existing market demand expectations for stablecoins in Hong Kong.

In summary, stablecoins today are in a phase of deployment-first, concurrently aligning with regulation. Regardless, stablecoin application demand and business logic are largely mature. Regulatory policies from authorities in the U.S. and Hong Kong will only serve to standardize development, providing traditional financial institutions with clearer operational frameworks.

6. Risk Warnings

Blockchain technology R&D falling short of expectations: Blockchain-related technologies and projects underlying Bitcoin are still in early development, facing risks of R&D delays.

Regulatory policy uncertainty: The operation of blockchain and Web3.0 projects involves multiple financial, internet, and other regulatory policies. Current global regulations remain in research and exploration phases, without a mature model, exposing the industry to regulatory uncertainty.

Web3.0 business model implementation lagging behind expectations: Web3.0 infrastructure and projects are still in early stages, facing risks that business models may fail to materialize as expected.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News