BOB 101: What Exactly Is a Hybrid Layer2?

TechFlow Selected TechFlow Selected

BOB 101: What Exactly Is a Hybrid Layer2?

This article focuses on exploring BOB's unique hybrid Layer 2 model and how it combines the strengths of Bitcoin and Ethereum.

On May 28, the hybrid Layer 2 project BOB (Build on Bitcoin) launched its "BOB 101" user education section on its official website and published its first article titled "What is a Hybrid Layer2?"—aimed at helping more people easily understand BOB’s underlying logic, high-level architecture, and how it achieves its vision of becoming the “DeFi home for Bitcoin” in a zero-barrier, foolproof way.

Below is a compiled and edited version based on the original article released on BOB's official website. This article focuses on exploring BOB’s unique hybrid Layer 2 model and how it integrates the strengths of both Bitcoin and Ethereum to place Bitcoin at the core of the DeFi world—enjoy:

A once-in-a-decade opportunity in crypto

Imagine you have a large bank vault filled with gold coins—extremely secure, nearly impenetrable. But this vault has one problem: it only allows you to deposit or withdraw coins, without enabling any complex financial “Lego” operations to earn interest.

This is exactly Bitcoin’s current situation. As widely known, Bitcoin is an excellent store of value and the oldest, most recognized, and most secure blockchain and asset in the crypto space. Recently, it reached new all-time highs, breaking the psychologically significant $110,000 mark and continuing to set record highs.

However, unlike Ethereum, Bitcoin cannot build financial “Lego blocks” via smart contracts—such as restaking or recursive lending. The vast majority of Bitcoin remains idle in wallets, generating no returns, resulting in nearly zero capital utilization for Bitcoin holders.

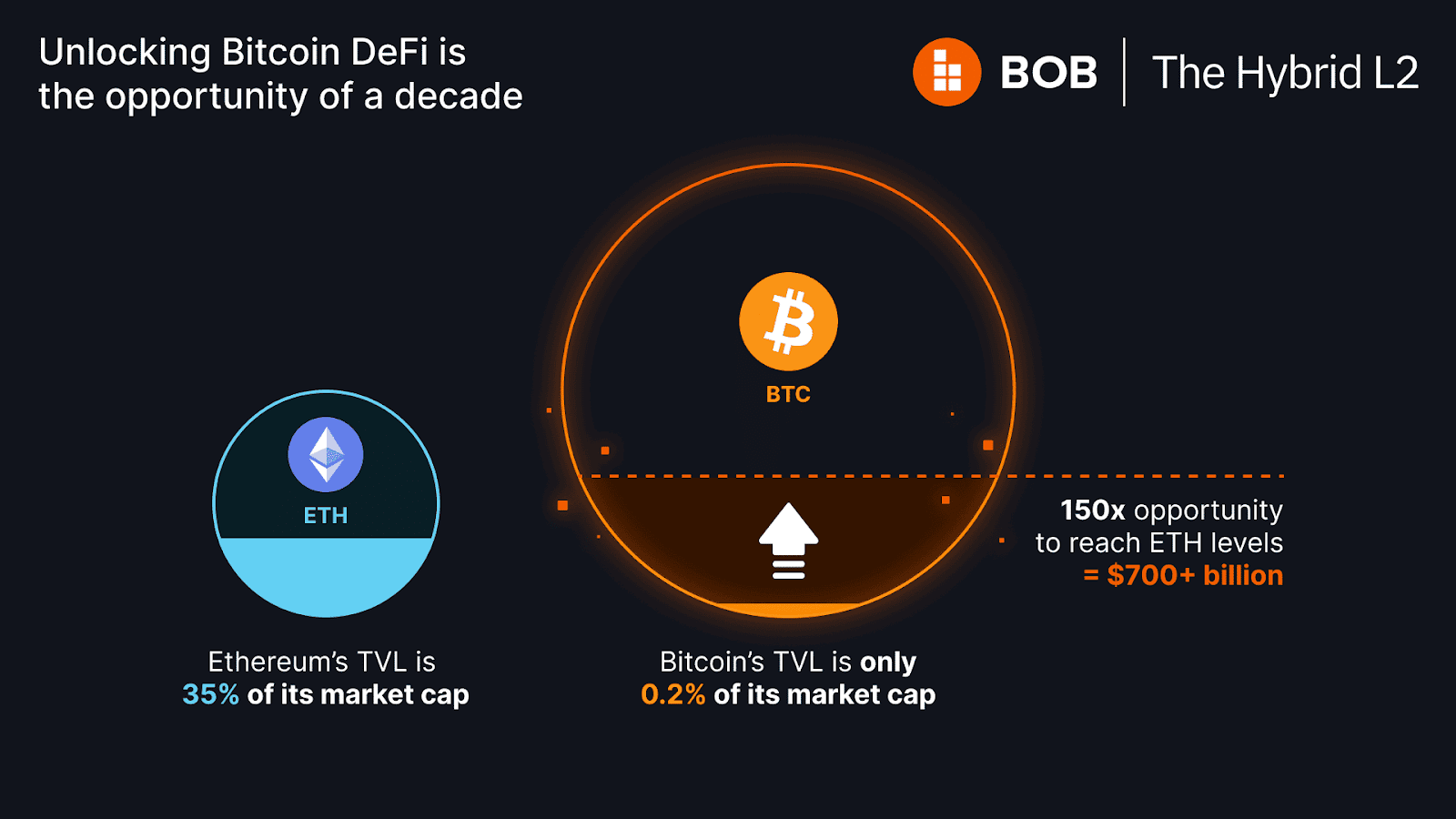

As shown in the chart below, Bitcoin’s TVL accounts for only 0.2% of its market cap, while Ethereum’s TVL represents 35% of its market cap—a 150x difference in DeFi capital efficiency. BOB aims to close this gap by unlocking trillions of dollars worth of Bitcoin liquidity and bringing it into the DeFi space.

Bitcoin on the Bitcoin network is extremely secure—like gold in a bank vault—but once you move it elsewhere to earn yield, you face certain risks. To use Bitcoin in DeFi composability, you must bridge it from the native Bitcoin network to other public chains, where third-party custodians or multisig bridges are required to mint wrapped BTC. This introduces centralization risks—your BTC could be stolen without your knowledge.

If we could enable flexible use of Bitcoin in the DeFi world while maintaining its inherent high level of security—from Bitcoin Layer 1, bridging to another chain, then deploying in applications to earn yield—Bitcoin DeFi would explode just like Ethereum’s DeFi ecosystem, potentially surpassing it in scale and vitality. Building a native Bitcoin DeFi ecosystem will become one of the hottest emerging sectors in crypto in 2025, and a once-in-a-decade opportunity for the entire industry.

Bitcoin is the core of the DeFi world

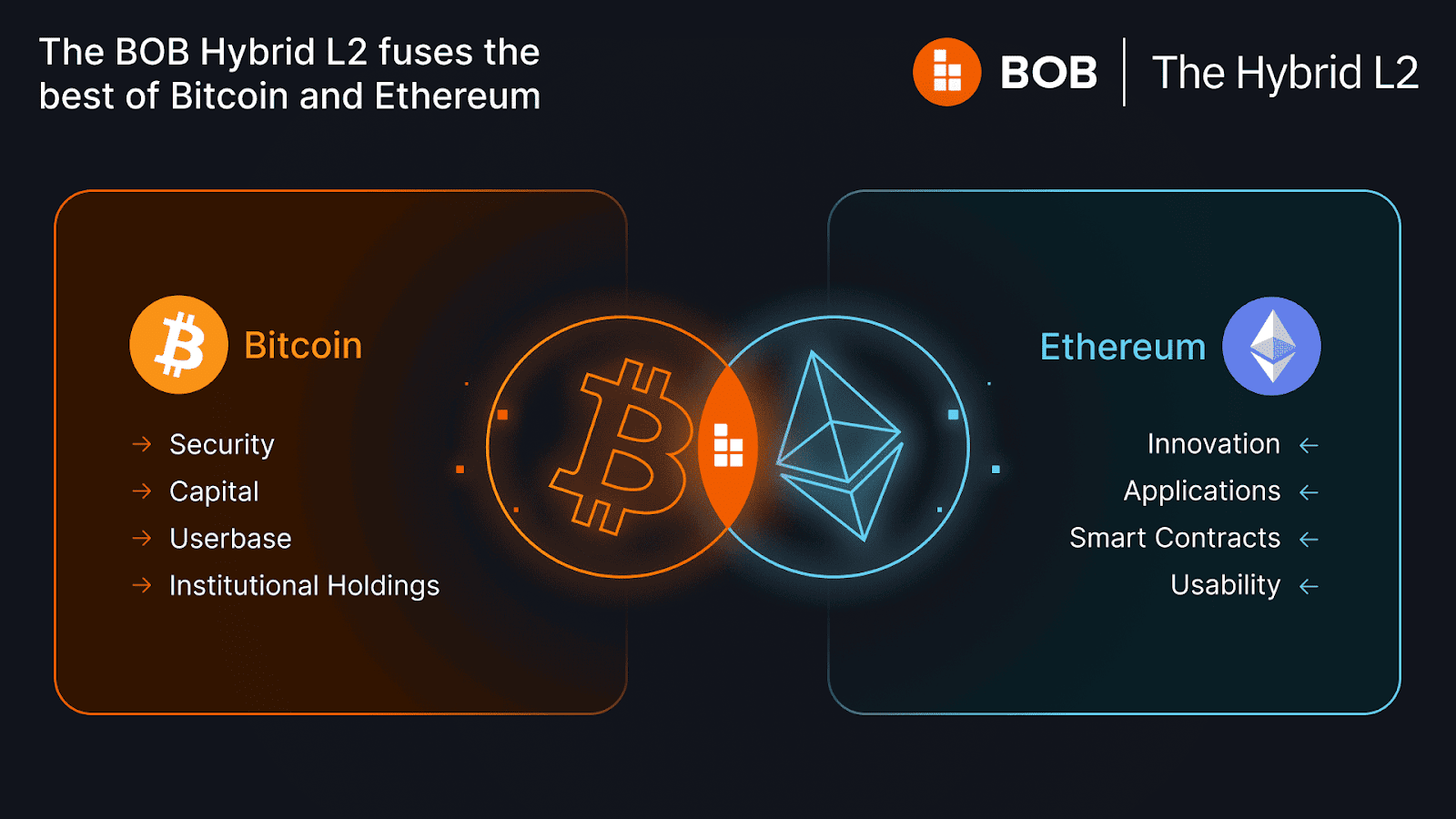

BOB’s unique hybrid L2 model combines the strengths of two ecosystems—Bitcoin’s security and dormant BTC capital, along with Ethereum’s DeFi innovation and versatility.

By merging Bitcoin’s unparalleled security with all the innovative DeFi features available on Ethereum, BOB aims to position Bitcoin at the center of the DeFi world and unlock trillions of dollars in currently idle liquidity sitting on the Bitcoin network.

BOB’s unique hybrid L2 model makes it the best and safest place to earn yield on Bitcoin, primarily for three reasons:

-

Bitcoin security: In December last year, BOB announced integration with Babylon’s Bitcoin Secure Network (BSN), creating a more secure, low-barrier, and easy-to-use channel for users to participate in Bitcoin staking. Security during the process—from BTC bridging to DeFi transactions—is protected by billions of dollars worth of Babylon BTC staking assets.

-

Ethereum DeFi: BOB is not only part of BSN but also an Ethereum rollup within the Superchain ecosystem, offering fast, low-cost transactions and access to a wide range of innovative DeFi applications such as DEXs, lending platforms, NFTs, and on-chain games.

-

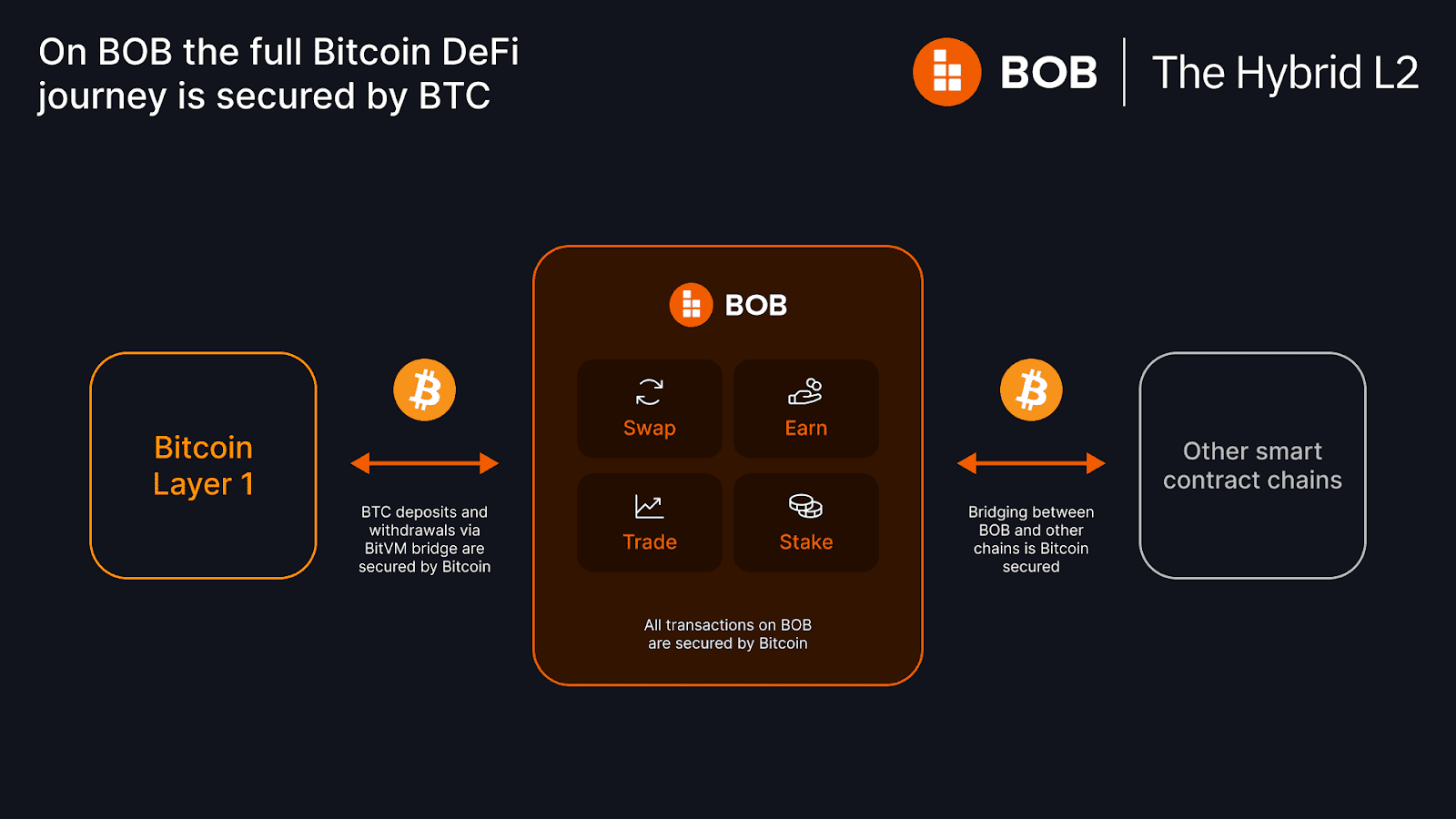

Trustless Bitcoin deposits: Using BOB’s BitVM bridge, users can send Bitcoin directly from the Bitcoin mainnet to BOB without trusting any third party. All security is guaranteed by Bitcoin itself, making it safer and more decentralized than other Bitcoin bridges reliant on third-party custodians.

In one sentence: All DeFi operations on the BOB network are secured by the Bitcoin network itself—not by any third-party entity—a feature no other Layer 2 offers.

The hybrid L2 is the best place to use Bitcoin in DeFi

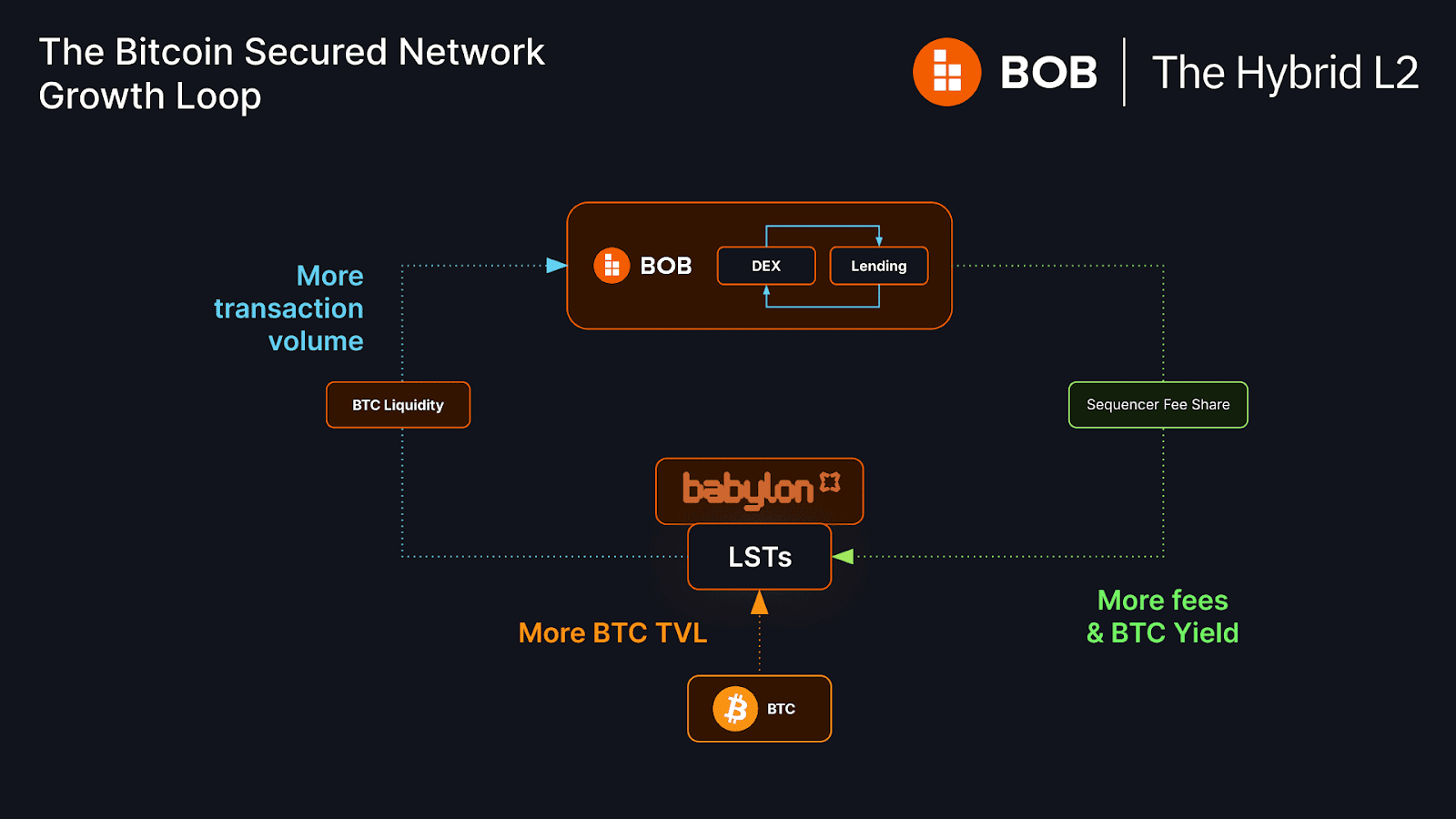

Thanks to its hybrid L2 model, BOB is the optimal platform for using Bitcoin and Bitcoin liquid staking tokens (LSTs) in DeFi. Because BOB inherits Bitcoin-level security through Bitcoin LSTs, it creates a powerful self-reinforcing flywheel effect.

The more LSTs staked and used in DeFi on BOB, the more transaction fees the BOB network generates—some of which are returned to stakers as yield. The more LSTs on BOB, the higher the yield for stakers, attracting even more LSTs to be staked, further increasing yields—and so on, creating a virtuous cycle.

Safer Bitcoin bridging with the BitVM bridge

It is well known that existing Bitcoin bridges often rely on centralized entities—such as Wrapped Bitcoin (wBTC)—whose security depends entirely on the honesty and cost of misbehavior of these centralized parties, introducing single points of failure. If they run away, you lose everything. The BitVM bridge introduces a superior security mechanism: as long as Bitcoin L1 is secure and there is at least one honest node in the network capable of executing on-chain dispute resolution, users can securely deposit and withdraw BTC. Users do not need to trust any company or organization to safeguard their assets.

Eliminating the need for third-party bridges in BTC DeFi applications is a crucial step toward unlocking Bitcoin’s multi-trillion-dollar potential in DeFi. The BitVM bridge solidifies BOB’s position as the DeFi home for Bitcoin, providing the safest and most trust-minimized method for Bitcoin DeFi and yield-generating activities.

Making Bitcoin DeFi more accessible

BOB offers top-tier cross-chain services between the BOB network, Bitcoin network, and Ethereum network, allowing users to access Bitcoin DeFi on BOB more easily and conveniently. Additionally, BOB Earn enables users to one-click deploy into Bitcoin liquid staking tokens (LSTs), Uniswap, and numerous leading DeFi applications.

Looking ahead, any blockchain capable of reading the Bitcoin network—such as Solana, Tron, Sui, Polkadot, and others—will be able to connect to the BOB network via the BitVM bridge. This means fewer detours, simpler bridging and trading, and, of course, security guaranteed by Bitcoin’s base layer.

What does BOB’s hybrid L2 model mean for you?

-

Bitcoin holders: Users can move idle BTC into BOB’s hybrid L2 layer and easily earn yield in Bitcoin DeFi through BOB’s “one-click Bitcoin DeFi” feature.

-

DeFi enthusiasts: For those active in Ethereum DeFi, it becomes easy to bridge ETH and stablecoins to the BOB network and quickly convert them into Bitcoin derivative assets. BOB’s BitVM bridge offers Bitcoin Finality, significantly enhancing the security and decentralization of Bitcoin bridging. Users also gain direct access to the massive liquidity pool from BTC, meaning higher trading volumes and new yield opportunities.

-

Developers: On the BOB network, developers can use the same tools as on Ethereum while tapping into Bitcoin’s vast user base. They can leverage Ethereum’s best-in-class development infrastructure to rapidly launch DApps. And if they want to access other chains, BOB’s hybrid L2 model allows seamless connection between BOB and other public networks—all secured by Bitcoin’s security.

BOB’s hybrid Layer 2 aims to build a DeFi ecosystem fully secured by Bitcoin’s base-layer security, helping unlock trillions of dollars in “sleeping” BTC liquidity waiting for the right opportunity to generate yield. For Bitcoin holders—whether retail investors or large institutions—achieving this requires the security of the Bitcoin network itself, made possible by BOB’s hybrid Layer 2 model.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News