Binance Earnings Guide: BNB Holders vs. Alpha Points Participants – How to Maximize Your Returns?

TechFlow Selected TechFlow Selected

Binance Earnings Guide: BNB Holders vs. Alpha Points Participants – How to Maximize Your Returns?

A deep dive into Binance's four major mainstream token launch mining activities, summarizing practical strategies suitable for retail investors.

Author: Viee, Core Contributor at Biteye

From Launchpool mining to Megadrop, HODLer airdrops, and the highly anticipated Web3 wallet TGE events and Alpha airdrops under the Alpha points system, Binance’s profit-generating mechanisms continue to evolve, offering opportunities for users with varying risk appetites and capital sizes.

However, faced with a constant stream of new activities, most retail users often feel overwhelmed and unsure where to begin. This article provides an in-depth overview of Binance's four current mainstream earning activities—Binance Wallet Alpha Airdrop/TGE, Launchpool, HODLer Airdrop, and Megadrop—detailing the core rules, participation processes, and latest returns for each. More importantly, it concludes with actionable strategies and techniques under two core approaches—"steadily holding BNB" and "actively farming Alpha points"—to help users efficiently mine profits and maximize returns within the Binance ecosystem.

1. Overview Table of Binance’s Four Main Earning Activities

To quickly familiarize readers with Binance’s primary new project mining activities, below is a comparative summary of their rules and procedures:

Next, we will analyze each activity in detail.

2. Binance Wallet TGE Events & Alpha Airdrops: Securing Early Access to Projects

The Binance Alpha section features two high-value core activities: Token Generation Events (TGE) and Alpha token airdrops. The key is participating through the Binance Web3 Wallet during the initial public issuance (TGE) phase of a project or directly receiving airdropped tokens. These activities are closely tied to Binance’s Alpha points system—accounts with higher Alpha points generally have better access to participation eligibility.

2.1 Core Rules and Participation Process

Users gain eligibility for token purchases or airdrops via the Binance Web3 Wallet by meeting the Alpha points threshold, following this process:

2.2 Alpha Points System

Points consist of asset balance points and trading volume points. At 23:59:59 UTC daily, Binance snapshots users’ asset balances in their CEX main account and non-custodial wallet, along with the amount spent purchasing Alpha tokens in the past 24 hours, to calculate that day’s points. Points use a rolling 15-day mechanism, expiring 15 days after they are earned. Detailed rules are as follows:

Balance Points: Total asset balance is calculated in tiers to award points. For example: $100–$1,000 = 1 point/day; $1,000–$10,000 = 2 points/day; $10,000–$100,000 = 3 points/day; ≥$100,000 = 4 points/day. Maximum daily balance points: 4 (for holdings ≥ $100,000).

Trading Volume Points: Daily total purchase amount of Alpha tokens via Binance platform or wallet counts toward points (sales excluded). Points increase incrementally with doubled purchase amounts: $2 = 1 point, $4 = 2 points, $8 = 3 points, $16 = 4 points, $32 = 5 points, with each subsequent doubling adding one more point. For example, buying $600 and later selling $500 still earns points based on $600. Starting May, Binance introduced a double-points campaign: purchases of Alpha tokens on the BSC chain or via limit orders count double, significantly reducing the effort required to farm points.

Note: Alpha points are immediately consumed upon confirming participation in an Alpha event (e.g., Alpha airdrop or TGE).

2.3 Efficient Alpha Points Farming Tips

The following strategies are summarized from community experience and are for reference only. Please be mindful of costs and risks.

Key Notes:

-

Point Requirements: Thresholds are rising—recent airdrops require over 200 points for reliable eligibility.

-

Buy-and-sell Immediately: Buy Alpha tokens and sell them right away to manage risk; main costs are slippage and transaction fees.

-

Multiple Accounts: Farming across multiple accounts may be more cost-effective than heavy investment in a single account (subject to platform rules).

-

Double Trading Volume Campaign: Binance offers double trading volume credit—buy Alpha tokens on BSC or place limit orders. Note that limit orders may not always execute successfully.

-

Trading Tips: Choose pools with high liquidity; target coins showing upward price trends within minutes; split large trades (e.g., >2000U into 4 smaller trades); select tokens with 0.01% fee and <0.01% price impact. Consider using limit orders to sell to secure gains while earning double points. Currently, B2, AIOT, MYX, and ZKJ offer both points rewards and participation in trading competitions: https://www.binance.com/zh-CN/support/announcement/detail/afa3aa4588404598b42950885355bef4

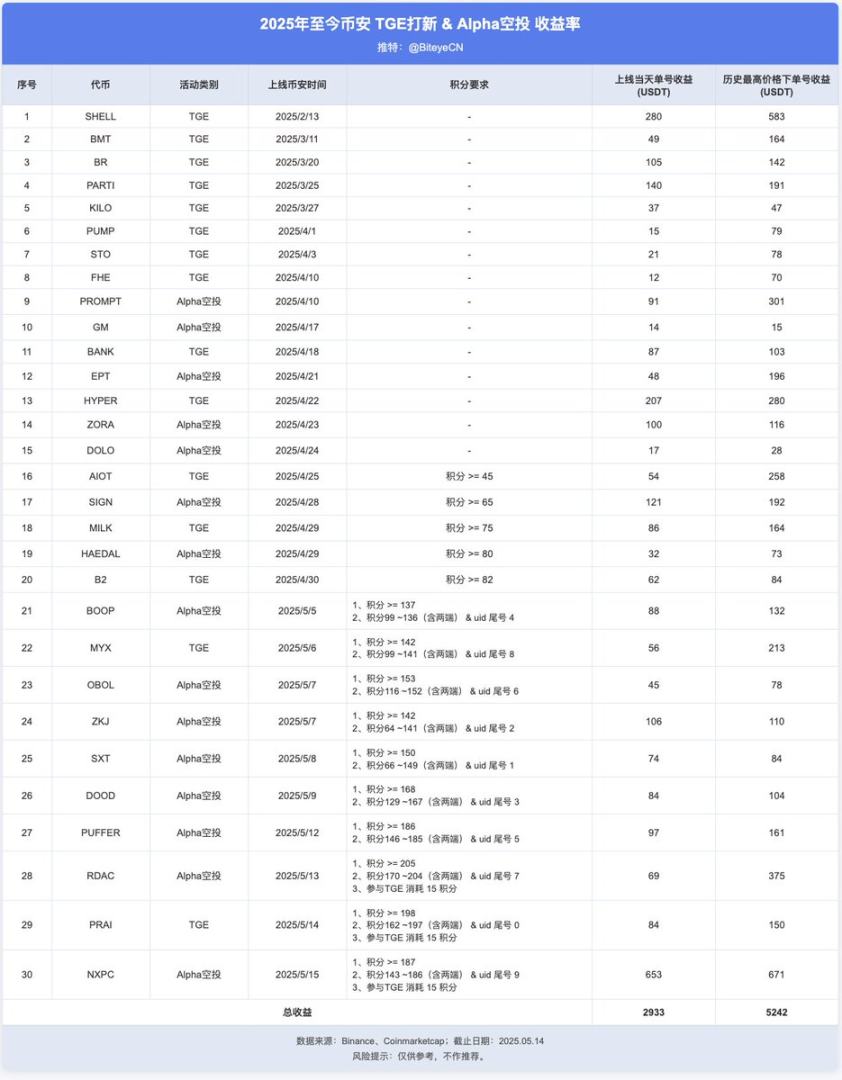

2.4 Return Analysis

The table below estimates historical returns from Binance’s TGE launches and Alpha airdrops, demonstrating consistently strong profitability. For instance, SHELL delivered same-day per-account gains of 280u, peaking at 583u historically; HYPER achieved 207u on launch day and up to 280u at its peak; PARTI yielded 140u on launch day. Assuming a qualified account participated in all these projects, total returns would reach approximately 2933u at listing prices, or as high as 5242u if sold at historical peaks. However, not all projects deliver high returns, and airdrop quantities and eligibility vary by project.

3. Launchpool: Stable Staking Mining

Binance Launchpool allows users to stake BNB, FDUSD, USDC, or other supported tokens to earn new project tokens for free through a “mining” mechanism. It is a relatively stable and straightforward way to earn crypto.

3.1 Core Rules and Participation Process

Users deposit eligible tokens into designated pools and receive new token rewards based on their share and staking duration.

3.2 Comparison of Pool Returns and Strategies

BNB and FDUSD Outperform USDC: As shown in the table, BNB pools typically offer competitive annual percentage yields (APY), though they carry BNB price volatility risk. Stablecoin pools (FDUSD, USDC) pose lower risk with stable principal value, ideal for risk-averse investors, and sometimes even exceed BNB pool APYs. FDUSD, Binance’s promoted stablecoin, often achieves APYs close to or higher than BNB pools in Launchpool events, and sometimes receives larger allocation quotas.

Fund Allocation:

-

Long-term BNB Holders: Naturally opt for the BNB pool to achieve “killing two birds with one stone” (benefiting from BNB appreciation + mining rewards).

-

Conservative Investors: Prioritize FDUSD pool, followed by USDC.

-

Large Capital Holders: Can diversify across pools or dynamically adjust based on changing APYs.

4. HODLer Airdrop: Exclusive Benefits for BNB Holders

HODLer airdrops are a passive reward mechanism designed by Binance specifically for long-term BNB holders. Simply hold BNB and subscribe it to Binance Earn’s flexible or fixed-term products to qualify for airdropped tokens from new projects.

4.1 Core Rules and Participation Process

Deposit BNB into Binance’s principal-protected wealth management products (fixed or flexible terms, or on-chain yield products). During the event, Binance randomly snapshots users’ BNB holdings and distributes new token airdrops accordingly. This ensures holders can benefit from new project listings without frequent actions. The process is as follows:

4.2 Return Analysis

Additionally, Binance’s HODLer airdrop program delivers continuous and substantial “passive income” for long-term BNB holders. Based on closing prices on airdrop days in the table below, BERA achieved an impressive 328.5% APY, while KAITO and LAYER reached 107.0% and 106.1% APY respectively. Even recent projects like SIGN achieved 55.9% APY. HODLer airdrops are not just rare surprises but a tangible way to boost overall holding returns, further reinforcing BNB’s perception as a “golden shovel.”

5. Megadrop: Combining BNB Lock-up with Web3 Tasks

Binance Megadrop is a new token distribution platform combining BNB lock-up (via Binance Earn fixed-term products) and Web3 tasks (completed through the Binance Web3 Wallet). Think of it as Binance’s version of an “interaction airdrop”: users must lock a certain amount of BNB in fixed-term products while completing specific on-chain tasks via Binance’s Web3 wallet—the combination determines final airdrop allocation.

5.1 Core Rules and Participation Process

Rewards in Megadrop are distributed based on points, with each user’s airdrop amount proportional to their share of total points. Points consist of two components:

-

Locked BNB Points: Users subscribe BNB to fixed-term wealth management products. The system calculates points based on locked amount and duration—more and longer locks yield higher points.

-

Web3 Task Points and Multipliers: Users complete project-related on-chain tasks (e.g., interacting with DApps, bridging assets) in the Binance Wallet. Completing all required tasks grants a fixed base points reward plus a multiplier bonus.

-

Total Score = (Locked BNB Score × Web3 Task Multiplier) + Web3 Task Reward.

5.2 Return Analysis

The table below estimates returns from the two Megadrop events this year. Historical data from SOLV and KERNEL show that completing Web3 tasks increases final token rewards and APY. Even without BNB staking, users can earn basic rewards by completing tasks.

6. Summary — Two Core Strategies to Help Retail Users Profit Efficiently

Faced with Binance’s diverse earning opportunities, users can choose the best strategy based on their capital size, risk tolerance, time availability, and view on BNB’s value.

Below are two main strategies and their earning pathways:

6.1 Strategy One: Steadily Hold BNB, Avoid Point-Farming

Target Audience: Suitable for users who believe in BNB’s long-term value and prefer medium-to-long-term holding, without interest in actively farming alpha points.

Main Income Sources:

-

Launchpool Mining: Participate in each new token mining round using held BNB to earn free token rewards.

-

HODLer Airdrops: Deposit BNB into Binance Earn products to passively receive periodic airdrops.

-

Megadrop Tasks: Use held BNB in Megadrop events—lock part of BNB and complete tasks to receive pre-launch airdrops.

-

BNB Appreciation and Other Benefits: Beyond the above “extra” income, BNB, as a core asset of the Binance ecosystem, offers capital gains from long-term price appreciation. Additionally, holding BNB grants trading fee discounts.

-

Recommended Combined Path: Deposit most BNB into BNB Vault (or simple flexible Earn) to earn daily interest while remaining eligible for Launchpool and Megadrop. At each Launchpool start, directly stake BNB from Vault for mining. These BNB also count toward HODLer snapshots, preserving future airdrop eligibility. When a Megadrop occurs, move part of BNB to fixed-term (e.g., >30 days) for higher points, complete all Web3 tasks using the BNB wallet. After claiming tokens, unlock BNB back to Vault. This cycle enables triple benefits from one BNB holding: regular interest + airdrops, mining new tokens during Launchpool, and earning extra tokens via Megadrop tasks.

6.2 Strategy Two: Farm Binance Alpha Points, Hold Little or No BNB

-

Target Audience: Ideal for users with little or no BNB who are willing to make frequent, small-capital investments to generate returns—in other words, so-called “Alpha points farmers” aiming to farm points for rewards.

-

Main Income Sources:

-

Alpha Airdrops: By farming high Alpha points, users can meet eligibility requirements for various Alpha airdrops and TGEs early, potentially earning over a thousand dollars in a month. However, users must monitor changing thresholds, and returns are uncertain.

-

Secondary Market Arbitrage: Some received airdropped tokens can be held if the project is promising, then sold at a higher price for greater profit.

-

Expected Costs and Returns: Under current conditions, ~200 points generally cover most monthly Alpha airdrop qualifications (though some may exceed 200). Assuming 9–10 airdrops per month, each worth ~60u, total earnings could reach ~540–600u, easily covering farming costs (~40u). If a major airdrop like NXPC occurs, single-project gains can exceed 500u.

6.3 Strategy Three: Get the Best of Both Worlds—Hold BNB While Farming Alpha Points

For most retail users, moderately combining both strategies may be optimal. For example, allocate part of capital to long-term BNB holding as a “foundation,” enjoying steady growth and base benefits; simultaneously, dedicate effort to learning and participating in Alpha point activities to pursue higher returns. This way, users enjoy ecosystem benefits from BNB holdings while using spare funds to farm Alpha points for airdrops—capturing advantages from both sides.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News