LaunchCoin 200x in one day, how did Believe create a $200 million golden dog after going to zero?

TechFlow Selected TechFlow Selected

LaunchCoin 200x in one day, how did Believe create a $200 million golden dog after going to zero?

Believe重生 from the concept of influence to the concept of trust, rising from the ruins of a meteoric surge and subsequent crash.

By: BUBBLE

LAUNCHCOIN has today surpassed a $200 million market cap, with liquidity reappearing after a long absence and drawing in nearly half the crypto CT community into this high-market-cap "memecoin." The community is abuzz discussing the token, half driven by FOMO and half by FUD. Originally issued under the personal name of Believe founder Ben Pasternak as Pasternak, it has now been rebranded into a new platform token.

How did it go from near zero to a $200 million valuation?

The Rise of PASTERNAK

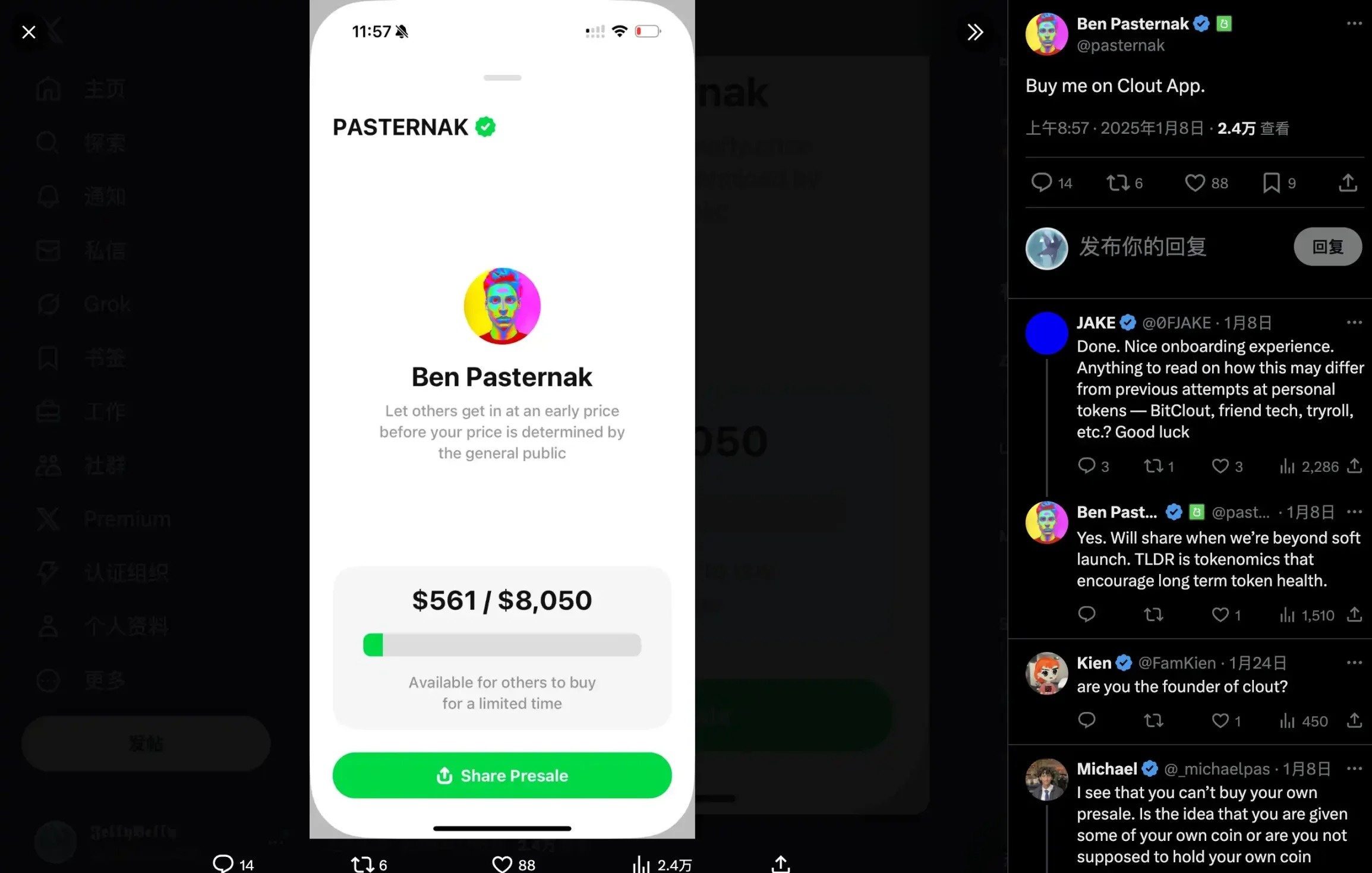

On January 8, 2025, 25-year-old Australian entrepreneur Ben Pasternak posted a tweet on X saying "Buy me on Clout APP." At that time, few in the crypto space knew him. But two weeks later, on January 24, the token met Clout's fundraising threshold of 100%, becoming the first token launched on the platform and quickly surging to an $80 million market cap.

That’s when we learned that Ben had developed the popular game *Impossible Rush* at age 15, founded the social app Monkey at 17—growing it to over 20 million users—and launched plant-based chicken nuggets called NUGGS at 20, successfully entering Walmart stores. When he turned his attention to crypto, he introduced Clout, a concept rooted in "SocialFi."

Clout's core idea was to turn "personal influence" into tradable digital assets. Once a social media account reached a certain follower threshold, the system would automatically generate a corresponding token contract, making influence quantifiable and tradeable. At the time, Ben likened Clout to “Wall Street meets Hollywood in the Web3 era.”

As the first token on the Clout platform, $PASTERNAK broke an $80 million market cap within five hours. A key driver was support from influential investors and members of the Solana community, particularly Imran Khan of AllianceDAO. Not only did AllianceDAO publicly back the project, but Imran’s own token became the second one launched on Clout. Given AllianceDAO’s strong track record—including investments in or support for dYdX, Pumpfun, and others—the market reacted with intense FOMO.

Mobile App Frontend Crashes, Then Silence

Unfortunately, the good times didn’t last. Aside from $PASTERNAK, the general perception of the platform was that profit potential was extremely low, and most participants lost money investing in celebrity tokens on the platform. Matters worsened when the mobile app launched: frontend failures caused newly listed tokens to fail deployment on external markets. Meanwhile, early participants found themselves stuck—unable to trade and not receiving their tokens.

$PASTERNAK generated $250 million in trading volume within 24 hours, but the next day the price began a steady decline. Within a week, its market cap had shrunk to just 1/30 of its peak. By March, it had plummeted to a mere $180,000. Most assumed the platform would fade like so many other failed SocialFi projects—an outcome the market had long grown accustomed to.

Believe: The Power of Belief

On April 28, Clout announced it would rebrand as Believe, captioning the post “Believe in someone → Believe in something.” The team deleted all prior tweets, signaling a fresh start. The platform’s vision shifted from being a traffic-driven “Nasdaq for celebrity socials” to a value-driven “Silicon Valley-style independent investment hub.”

The following day, $PASTERNAK was renamed $LAUNCHCOIN, matching the name of Believe’s launcher on X—confirming community speculation that PASTERNAK had become the official platform token.

Nikita Bier, former product growth lead and advisor at Solana, xAI, and Coinbase, praised Believe as a “killer viral app,” backing his claim with compelling data. As a serial entrepreneur whose past products were acquired by tech giants like Meta and Discord, Nikita’s endorsement carried significant weight. His vocal support helped push the token’s market cap from $1 million to $22 million within 24 hours.

In the two weeks that followed, new projects continued to emerge on LaunchCoin, though none made major waves—until around May 12, when entrepreneurs launching with tokens like $GOON, $BUDDY, and $NOODLE gained solid valuations, gradually drawing attention back to the ecosystem. At the time of writing, the token’s market cap has exceeded $260 million. Thus, LaunchCoin completed its comeback.

Community Reactions

Well-known on-chain trader James recently shared on X how he lost $340,000 trading LaunchCoin—a sentiment echoed by many who participated in the Clout-era ecosystem. Having been burned before, distrust kept many from joining this latest surge.

Trading often goes against human nature. Take Gake, better known as “DNF”—a prominent alpha caller—who demonstrated her trading philosophy on this token. On-chain data shows that after LaunchCoin’s initial hype faded and the price dropped 70% from its peak to a $25 million market cap, she chose to “buy the dip” with $20,000.

But prices didn’t rebound as expected; instead, they kept falling to a $280,000 market cap. At that point, DNF doubled down, buying another $3,500—just 17.5% of her previous position size, despite the price having fallen 90% since her first buy-in. She then exited portions of her position at 50%, 400%, and 800% gains, progressively lowering her average cost basis.

She then waited patiently for two months. After Clout rebranded to Believe, she gradually sold off her holdings in batches. Her current position stands at around 13% of the original, with total profits reaching $1.3 million. This wasn’t DNF’s largest win or highest multiple, but it serves as a textbook example of how to assess holding potential, decide when to hold long-term, and identify true bottoms—key considerations for every trader.

This 100x case study on LaunchCoin isn't about a pristine project—it's about a once-tarnished memecoin making a comeback. Yet it reflects the reality of thousands of token trades: a zero-sum game. From “influence (Clout)” to “trust (Believe),” this shift marks Ben’s deeper understanding of monetary first principles after failure—and mirrors what’s currently unfolding in the market.

What our market lacks isn’t influence—it’s trust.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News