Believe platform's breakout: mastering first principles, buying low at value洼地

TechFlow Selected TechFlow Selected

Believe platform's breakout: mastering first principles, buying low at value洼地

When a new narrative arrives, be among the first to believe—crypto needs dreamers.

Author: Yuyue

It's been exactly half a month since I first called the platform token of @believeapp on April 29. Some friends still remain skeptical about Launchcoin due to its clout background. For those who haven't caught up, please carefully review my four key tweets where I fully laid out the logic. Other fragmented thoughts were also shared on Twitter and during livestreams—this is the complete path to discovering undervalued opportunities.

【4/29】First and foremost, why doesn't clout's pivot affect my assessment of Launchcoin, i.e., the @believeapp platform?

I already explained this in my April 29 tweet: the reason I wanted to buy PASTERNAK (Launchcoin’s name before full rebranding) again was:

——“Today’s two small golden dogs $DUPE and $SUPERFRIEND both launched on @believeapp, the former 'clout me' meme launchpad incubated and backed by @alliancedao. Together, these two golden dogs have reached a market cap of $10M, while the platform token once peaked at $80M and currently stands at only $5M.”

Yes, from day one I clearly told you its origin was clout. The renewed purchase rationale came when community member @0xEdwin999 noticed the rename to $LAUNCHCOIN, which clearly suggested it would be the platform token—though the utility wasn’t yet clarified.

When two new golden dogs easily surged toward $10M while the platform token was only at $6M, isn’t that the perfect buying opportunity? There’s clear value mispricing—this is a value洼地.

Link to April 29 tweet:

https://x.com/yuyue_chris/status/1917061019802997068…

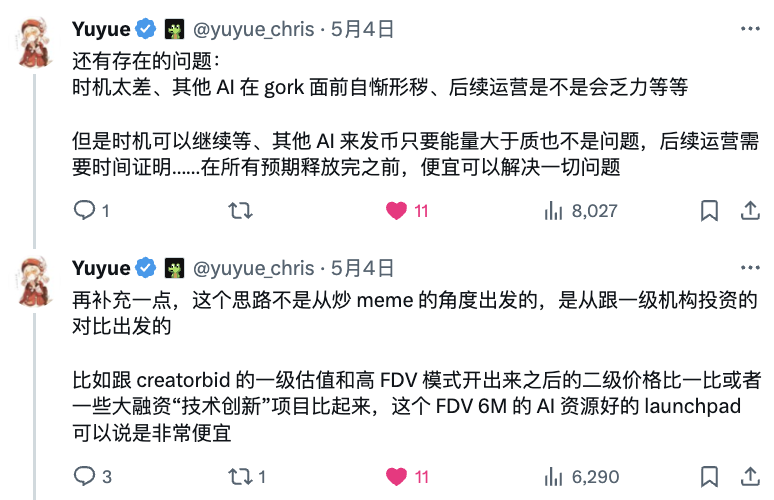

【5/4】Why did I buy more Launchcoin again? Largely because I got rugged on a meme launched via boop

The core logic lies here: 100 projects hitting $1M is far easier than one reaching $100M—no need for a single dominant leader——“Think about it: when we buy tokens like letsbonk or those on boop, they’re mostly tied to ‘strong association with bonkguy’ or ‘interactions with dingaling’. This high degree of centralization is hard to break free from in the short term and ultimately caps the platform’s ceiling. Initial traffic can be both a blessing and a curse… This approach differs completely from current new platforms… If @pasternak can bring in an experienced, savvy AI founder who knows how to manage projects, he’d be the scout who discovered the next-gen DK (Luna’s founder). Perhaps only a decentralized traffic model can lift the ceiling for tokens on the platform. ‘The platform token is fueled by revenue and golden dog earnings, not the other way around.’’”

A launchpad, after all, exists to launch projects and must be sustainably supported by revenue. People see pumpfun as impressive not because it issued a token, but because it standardized the process so every golden dog now comes from its platform.

Back then, I knew this idea was a slow cook, unlikely to be immediately validated by the market—a true Tier 1 investment mindset. I directly bought the platform token when its FDV was just $6M. Compared to other launchpads—especially boop, which launched with a $500M valuation—$6M offered nearly 100x upside potential. Clear value benchmarking—this is a value洼地.

After that, Launchcoin一度 dropped to $2M.

Link to May 4 tweet:

https://x.com/yuyue_chris/status/1918821240028205271…

【5/12】Internet capital market—the new narrative championed by Solana’s inner circle and Western crypto communities begins to emerge

At this point, my primary focus from the platform token perspective remained: “$DUPE has flown past $20M.”

So I reiterated its revenue-generation logic: “This asset offers exceptional value—it’s a launchpad with only $6M FDV, already gaining traction in crypto circles, incubated and backed by Alliance DAO @alliancedao, and led by a founder capable of bringing in top-tier AI founders.”

While posting, I also noticed key Solana figures—@rajgokal, co-founder of Solana and COO of Solana Labs, and @himgajria, a version god amid the AI boom—were discussing the concept of Internet capital market.

BTC returned to $100K, yet the market felt lifeless. Altcoins were pumping aimlessly without fundamentals. Clearly, the market needed a new narrative, a fresh concept, and a new vocabulary.

I realized this new term might represent the emerging narrative driven by Solana’s core group and Western crypto circles—exploring decentralized fundraising and tokenizing real-world equity and assets. This aligns closely with my recent mentions of RWA and my pinned article “Making Opportunity Fair on-chain: How AI Agents Are Transforming On-chain Narratives, Shifting Power, Driving Industry Change, and Informing Early-Stage Investing.” That’s why I even told Lizhuang I added another position when it broke $20M.

At the time, Launchcoin was at $22M, while the concept of Internet capital market had just surfaced—still a value洼地.

Link to May 12 tweet

https://x.com/yuyue_chris/status/1921673165056708707…

【5/13】When a new narrative arrives, be among the first to believe—crypto needs dreamers

“This new platform @believeapp is a decentralized YC accelerator, the AI-era version of a16z.”

“The product behind @pasternak, formerly clout, had a poor user experience, leading to bias against believe. But the founder didn’t have to take responsibility for the old token. Instead of launching a new token and abandoning the old, they kept evolving while migrating the old token—proving they aren’t the type to cash out and run.”

While biased against Launchcoin, don’t forget Virtual @virtuals_io transformed from PathDAO, a gaming guild, into today’s leading AI Agent launchpad. The market should reward persistence, not those who soft-rug old projects and keep launching new ones.

I had early contact with Virtual through @everythingempt0, but missed the boat. Before the AI wave, no one imagined its FDV could grow from $15M to today’s $2B.

When a new narrative emerges, be among the first to believe—crypto needs dreamers. The current rise reflects optimism about broader market trends and enthusiasm for the new narrative. Sure, you can say I’m blindly fomo-ing, but I already have a cost basis giving me tens of x leverage. I’m simply sharing logic and updates—the buy button remains in your hands.

At prices under $100M, whether this is a value洼地 requires imagination.

Link to May 13 tweet

https://x.com/yuyue_chris/status/1922197239168172544…

My thoughts on @believeapp, what new platforms need, and related topics have been gradually shared on Twitter these past few days. When the entire path to Launchcoin’s breakout was clearly signaled and logically grounded, the resulting new narrative becomes an open strategy. Even without knowing @alliancedao

or key Western insiders, I could still detect 100x opportunities at low levels by following clues, mastering first principles of assets and revenue, and buying at value洼地.

At the end of the day, investing is about buying low and selling high.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News