A former SEC enforcement expert's paper draws 200,000 views—cryptocurrency one step closer to breaking into the mainstream?

TechFlow Selected TechFlow Selected

A former SEC enforcement expert's paper draws 200,000 views—cryptocurrency one step closer to breaking into the mainstream?

Cryptographic technology is no longer a toy for niche players.

By TechFlow

Last night, news that Coinbase's stock would enter the S&P 500 index sparked widespread discussion, signaling a higher status for pure crypto companies in the eyes of traditional capital markets and investors.

But beyond individual companies, the entire cryptocurrency industry and its underlying technology still require broader recognition.

Also last night, a thread titled "Crypto and the Evolution of Capital Markets" was published, quickly amassing 200,000 views and nearly 1,000 likes, rapidly becoming a hot topic within the English CT community.

The paper has not only received broad support from the crypto community but also drawn attention from traditional finance professionals. Haseeb, founder of Dragonfly, said he had printed out the paper to study it, captioning his post with LFG (Let's fxxx go).

Beyond its academic rigor, what this paper brings is primarily an "emotional value"—a growing sense that U.S. regulators are gradually acknowledging crypto technology:

The author, TuongVy Le, has fewer than 10,000 followers. One reason her post gained such traction is her background as a senior advisor and attorney in the SEC’s (U.S. Securities and Exchange Commission) enforcement division, where she handled enforcement cases involving securities markets, including some of the SEC’s earliest investigations into cryptocurrencies.

The core argument of the paper is that blockchain technology and tokenization can solve inefficiencies in traditional securities markets. While crypto technology isn’t perfect, it remains worth adopting.

The original thread states: "Blockchain and tokenization represent the natural evolution of capital markets, just as paper stock certificates were naturally phased out half a century ago."

Moreover, a former SEC enforcement expert asserting the usefulness of crypto technology in securities markets aligns with thinking by current SEC commissioner Hester Peirce, who has indicated she is considering similar ideas and suggests using distributed ledger technology for issuing, trading, and settling securities.

Some community members joked in response: if even the SEC is starting to endorse it, how far off can crypto's spring be?

We’ve also read through the paper, offering you another macro-level reference amid the noise of market fluctuations.

Insiders Writing About Crypto

First, let’s take a closer look at the background of the paper’s author, TuongVy Le.

TuongVy Le spent nearly six years at the SEC, eventually rising to Chief Counsel in the Office of Legislative and Intergovernmental Affairs, directly engaging with powerful institutions like Congress and the Treasury Department, helping shape regulatory policies for digital assets.

During the 2021 GameStop event—where retail investors clashed with Wall Street, exposing numerous flaws in traditional markets—TuongVy Le was inside the SEC, assisting in crisis response and advising on market structure reforms.

After leaving the SEC, she entered the crypto industry, first joining Bain Capital Crypto as a partner focused on advancing blockchain applications in traditional finance. She briefly served as legal counsel and compliance officer at Worldcoin, and now serves as General Counsel at Anchorage Digital, helping the first crypto firm to receive a federal banking charter from the OCC establish itself securely.

With extensive experience spanning financial regulation, traditional finance, and the crypto sector, TuongVy Le likely possesses a more comprehensive background than most crypto practitioners—someone who understands both the regulatory “unwritten rules” and crypto’s “new game mechanics.”

When an insider writes a paper advocating for integrating crypto technology into traditional capital markets, it not only benefits firms currently operating in crypto asset management but also leverages her influence to foster positive perceptions of crypto technology among current SEC colleagues.

Overly Complex Capital Markets

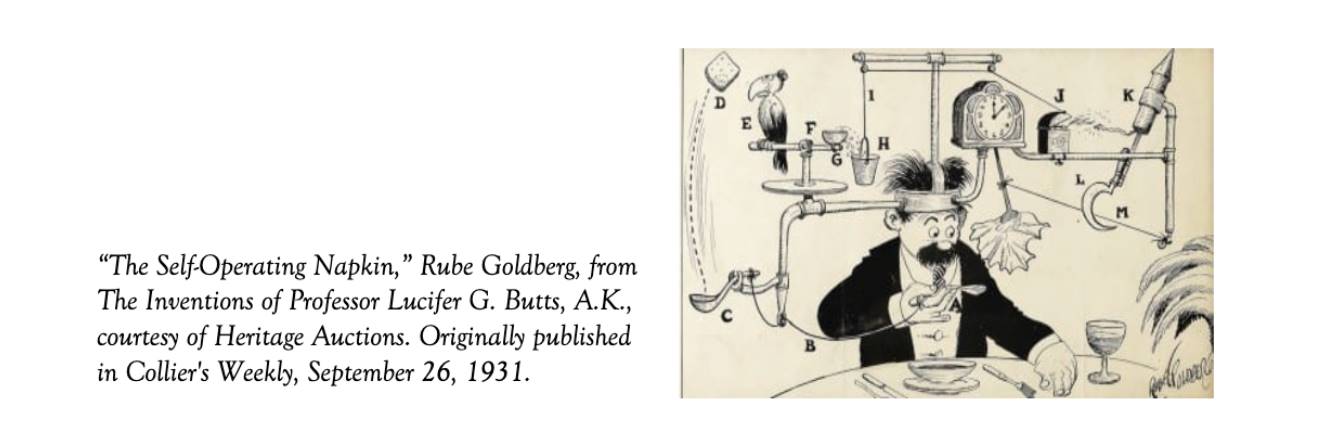

TuongVy’s paper doesn’t dive deep into technical details or formulas. Instead, it starts with an interesting point—an illustration titled The Self-Operating Napkin.

This drawing depicts an extremely complex and absurd mechanical contraption designed to perform a very simple task—wiping one’s mouth with a napkin. It features all sorts of odd components and actions: levers, rolling balls, springs, even animals—all forming a seemingly precise yet comical system.

The satire is clear: the central theme is over-complexification. By designing a multi-step mechanical system to accomplish the simple act of “wiping one’s mouth,” it reflects how humans sometimes turn simple problems into unnecessarily complicated ones.

This closely mirrors today’s securities trading systems, which involve multiple roles and unnecessary steps. Though they appear to function collaboratively, they are widely criticized.

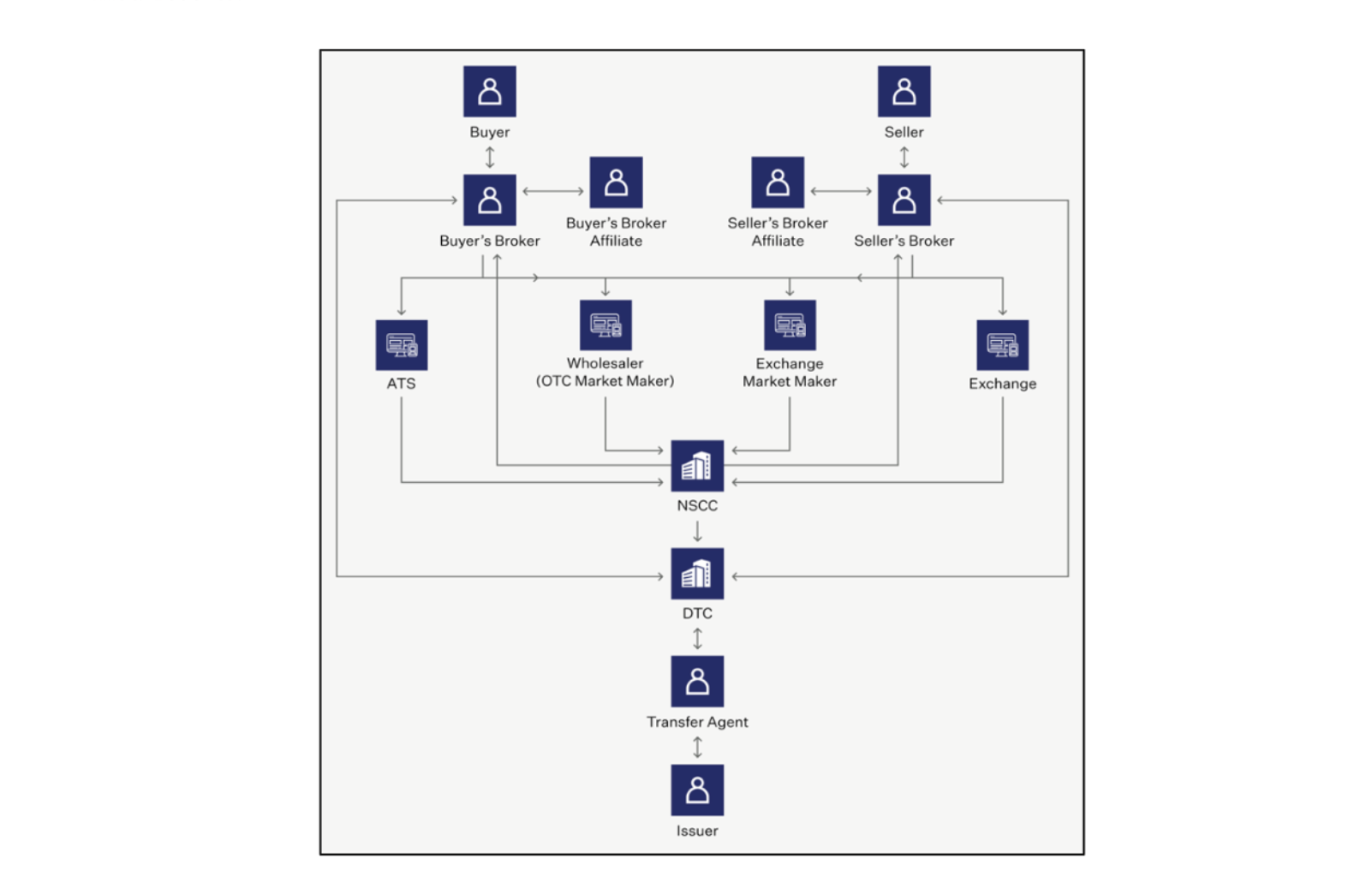

Traditional securities trading involves numerous intermediary layers. Each transaction isn’t simply a direct exchange between buyer and seller—it must pass through brokers, clearinghouses, transfer agents, and others. These intermediaries add friction and fees at every level.

Second, the author notes that the current market structure was designed in response to the 1960s “paperwork crisis.” At the time, stock trading relied heavily on paper certificates, and manual processing became unsustainable as trading volumes surged.

Back-office operations couldn’t keep up with the volume of paper documents, leading many brokerages to face failed settlements—or outright collapse.

To address this crisis, the market adopted more complex clearing and settlement systems, introducing additional intermediaries and regulations. While this highly intermediated system solved the immediate problem, it also introduced greater complexity and inefficiency.

For example, individual investors must rely on a broker to trade on exchanges, which introduces principal-agent risk—brokers may engage in excessive trading or recommend unsuitable investments for their own benefit.

In addition, national securities exchanges and alternative trading systems must follow complex rules to prevent trades from executing at worse prices than those available elsewhere, yet these rules are difficult to fully enforce in practice.

The existence of clearing and transfer agents adds another layer of intermediation. Clearinghouses act as central counterparties to ensure settlement, but this system leads to settlement delays and risks, requiring extra intermediaries to guarantee finality.

Every stage involves intermediaries, creating redundancy and inefficiency—yet these were policy choices made in an era of technological limitations.

One insight from the author’s paper is thought-provoking: if paper stock certificates could be phased out, then today’s stock trading systems can also be replaced.

Are CEXs Better Than Stock Exchanges?

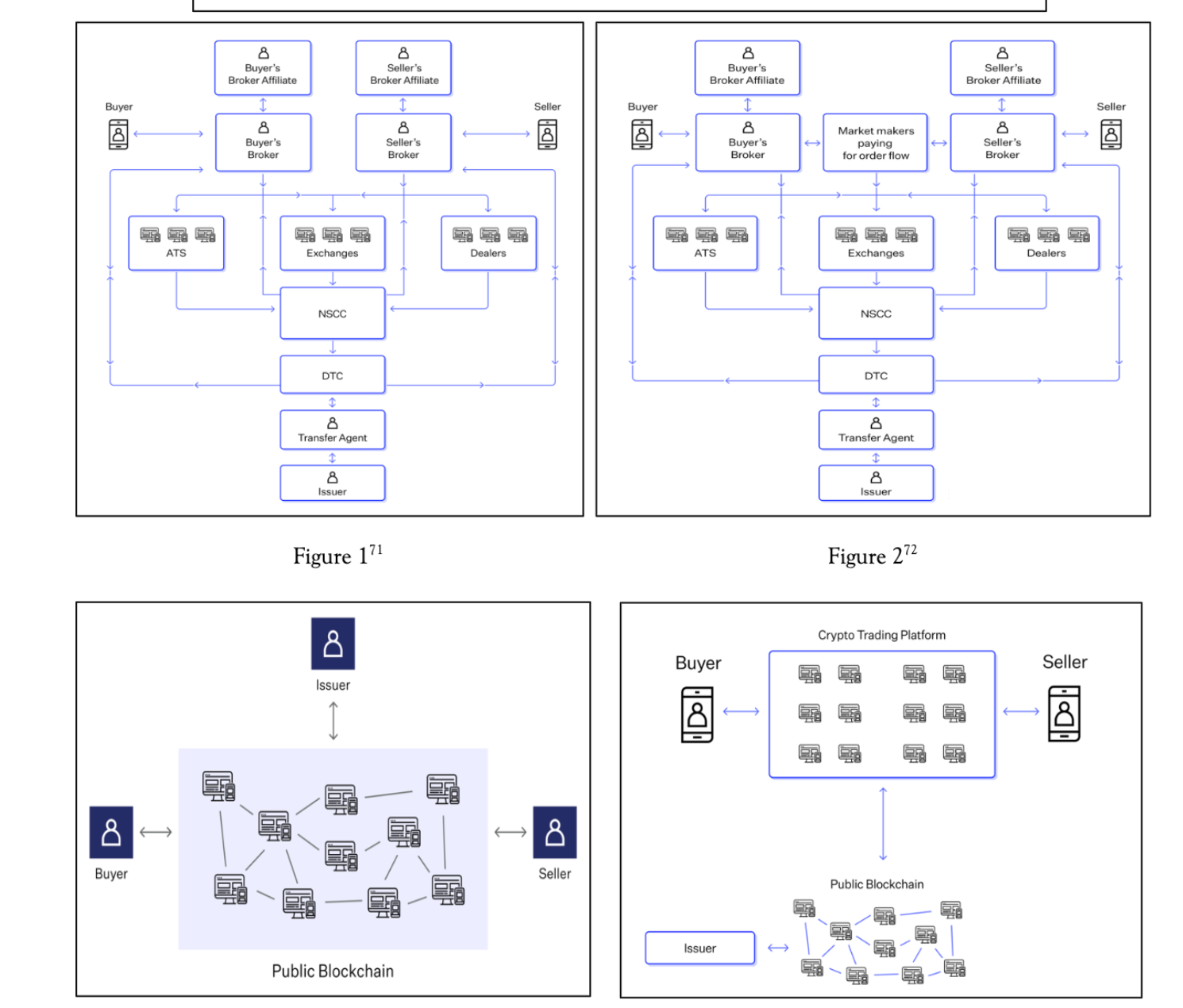

While crypto technology has its own issues—such as lost private keys or poorly designed smart contract code—the author proposes a bold idea:

P2P trading and using CEXs can actually be better than traditional securities market trading in certain aspects.

For instance, CEXs allow users direct access to trading platforms without needing a registered broker, reducing agency costs and enabling more direct control over order execution.

On CEXs, trades settle instantly upon execution, eliminating counterparty risk associated with T+1 settlement in traditional markets. This removes the need for clearing agents, custodians, or transfer agents. Additionally, CEXs support 24/7 trading, allowing users to respond to market changes anytime, reducing liquidity gaps and pricing inefficiencies during non-trading hours.

Furthermore, users can withdraw crypto assets to self-custodied wallets at any time, giving them direct ownership of their assets—a contrast to the indirect ownership model prevalent in traditional markets.

These features make CEXs superior to traditional securities markets in terms of efficiency, flexibility, and user control. However, the author acknowledges CEXs have their own problems, including custodial theft, hacking risks, insider trading, and lack of clear rules.

The diagram in the author’s paper is refreshingly simple: in plain terms, use technology to replace excessive intermediaries. But this feels somewhat surreal—an ex-SEC enforcement expert not only refrains from taking a hardline or dismissive stance toward crypto technology but instead actively seeks to extract its strengths to guide improvements in securities markets.

Although the paper does not address the classification or regulation of crypto assets per se, the mere publication and spread of such a paper is itself a positive signal—one that makes it easier for sitting regulators to examine and embrace crypto technology rather than treating it entirely as a threat.

Still, I believe the perspective presented here brings a long-overdue sense of clarity:

Crypto technology is no longer just a toy for niche players; it truly has the potential to break into the mainstream and become a “new engine” for traditional financial markets.

Better days for the industry lie ahead—may you also taste their sweetness.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News