How Lorenzo is redefining on-chain asset logic—from Bitcoin yields to CeFi tokenization?

TechFlow Selected TechFlow Selected

How Lorenzo is redefining on-chain asset logic—from Bitcoin yields to CeFi tokenization?

Lorenzo is now focused on on-chain asset management,致力于 bringing traditional financial products on-chain through tokenization technology and seamlessly integrating them with the DeFi ecosystem.

Author: 1912212.eth, Foresight News

The crypto market is by no means a sanctuary for gambling and speculation—it still faces numerous unmet real-world challenges, and vast amounts of capital remain underutilized. Maximizing Bitcoin's capital efficiency is one such challenge. The trillion-dollar Bitcoin liquidity business has drawn interest from many blockchain projects. Lorenzo, as a leading BTCFi protocol, once led the market trend, integrating with over 20 blockchains and more than 30 DeFi protocols in 2024, providing stable yield services for over $600 million worth of BTC assets. However, the vast crypto market extends far beyond Bitcoin. With the growth of stablecoins, DeFi, and RWA, focusing solely on Bitcoin is insufficient to meet market demand. As institutional demand rises and the convergence between CeFi and DeFi accelerates, evolving into an on-chain investment bank becomes an inevitable path.

Since 2020, DeFi’s total value locked (TVL) has at times surpassed $250 billion, making it a core engine of the crypto market. Yet in the domain of on-chain asset management and yield generation, complex operations, high gas fees, and fragmented protocols have made broad participation difficult for both institutions and retail users. DeFi’s yield models often rely on short-term incentives, lacking long-term stability and failing to meet institutional demands for risk management and consistent returns.

Meanwhile, the development of on-chain yield infrastructure lags significantly behind the growth of crypto assets. While PoS chains like Ethereum support staking, insufficient integration of cross-chain liquidity and asset management results in low capital efficiency. The rise of PayFi has driven the convergence of on-chain payments and financial services, while demand for tokenizing traditional financial products surges. Stablecoin transaction volumes now exceed the combined totals of Visa and Mastercard, with over $160 billion in stablecoins circulating on-chain—yet infrastructure for managing and deploying these funds to generate yield remains largely absent. Institutional investors are eager to bring mature CeFi financial tools into DeFi, but existing platforms lack a unified framework to achieve this.

Lorenzo Protocol sees a larger market opportunity here and naturally advances into the role of an "on-chain investment bank," aiming to serve more complex asset structures and higher-level financial service demands.

From BTCFi to Institutional-Grade On-Chain Asset Management: Moving Toward a Financial Abstraction Layer

Leveraging its accumulated technology and capital from the Bitcoin liquidity ecosystem, Lorenzo Protocol has evolved into an institutional-grade on-chain asset management platform. By tokenizing CeFi financial products and deeply integrating them with DeFi use cases, Lorenzo fills the gap in on-chain asset management, offering institutions and high-net-worth individuals secure, efficient, and transparent solutions. In short, it transforms core crypto assets like Bitcoin from mere stores of value into financial primitives within on-chain asset management, delivering a one-stop asset management experience.

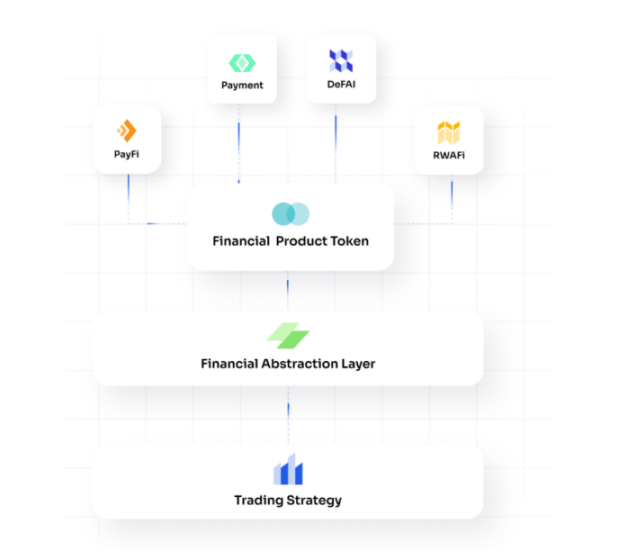

Lorenzo’s key advantage lies in its Universal Financial Abstraction Layer (FAL), a modular financial framework that abstracts the processes of asset management and yield generation. It supports the tokenization of assets like BTC, generating tradable on-chain tokens. At the same time, Lorenzo turns asset custody, yield generation, and strategy management into standardized, on-chain native components, enabling seamless integration between CeFi financial products and on-chain financial scenarios.

Lorenzo functions more like an "on-chain investment bank." After receiving assets such as Bitcoin and stablecoins, it packages them into standardized yield products through strategies like staking, arbitrage, and quantitative trading, allowing partners such as wallets, PayFi, or RWAFi platforms to integrate them with one click.

On April 18, 2025, Lorenzo Protocol completed its IDO via Binance Wallet and PancakeSwap, launching its governance token BANK (total supply of 2.1 billion, initial circulation of 425 million). TGE attracted over $35 million in subscriptions, exceeding its target by 18,329%, reaching its fundraising goal in under a minute after launch. Since the IDO, Lorenzo has evolved from a "Bitcoin liquidity-focused financial layer" into an institutional-grade on-chain asset management platform, specializing in the tokenization of CeFi financial products and their integration with DeFi.

Through a unified financial framework, Lorenzo abstracts on-chain asset management and yield generation, offering institutions and users a seamless interaction experience. Moreover, Lorenzo focuses on real yield and sustainable business models: it delivers stable returns through DeFi yield aggregation and tokenized financial products, generating revenue from protocol fees, cross-chain bridging fees, and ecosystem partnership shares. The BANK token’s governance mechanism (veBANK) further incentivizes community participation, ensuring long-term stability.

Going forward, Lorenzo plans to solidify its leadership through technical optimization, ecosystem expansion, and community empowerment (via tiered systems and task-based rewards).

Operational Logic

Lorenzo’s product design and technical architecture revolve around the core needs of institutions and on-chain asset management, covering asset tokenization, yield generation, cross-chain liquidity, and risk management.

Lorenzo establishes a clear and sustainable asset flow pathway: first, users deposit on-chain assets such as stablecoins into co-managed accounts operated by Lorenzo and its partners (e.g., PayFi or RWAfi platforms) as the base input. These assets are then deployed via Lorenzo’s internally designed strategy modules across multiple on-chain protocols to generate stable yields, forming the first layer of value appreciation.

Next, these yield-bearing assets (or their representative tokens) are standardized and packaged into composable asset modules, which are further integrated into PayFi products, wallet yield accounts, lending protocol deposits, and RWA platforms, thereby enabling yield reuse and value amplification. Throughout this process, users earn continuous returns, while the Lorenzo protocol achieves a closed-loop logic of asset inflow, yield generation, and reinvestment—enhancing system reusability and capital utilization.

Lorenzo’s core product suite consists of three main components. The first is the Vault model, divided into simple strategy pools and composite strategy pools. In simple strategy pools, each Vault corresponds to a specific yield strategy, offering clear structure and transparent execution. Composite strategy pools aggregate multiple simple pools, allowing dynamic management and rebalancing by individuals, institutions, or even AI, enabling more flexible yield optimization.

The second component is modular API output. Lorenzo provides a suite of interfaces that deliver yield calculation and distribution logic, asset value status data, and ready-to-integrate frontend UI components, enabling ecosystem projects to connect quickly and easily.

The third component is the ability to tokenize financial services, covering the entire cycle from on-chain fundraising, off-chain execution, and back to on-chain settlement—bridging traditional financial services with on-chain asset management.

Summary

Lorenzo Protocol successfully fills the void in on-chain asset management by tokenizing CeFi financial products and deeply integrating them with DeFi scenarios. Its Universal Financial Abstraction Layer unlocks the liquidity and yield potential of assets like BTC, delivering secure, transparent, and efficient asset management solutions for institutions and high-net-worth individuals. From its origins as a "Bitcoin liquidity infrastructure layer," through its IDO that captured market attention, Lorenzo has never stopped advancing. On its journey toward becoming a "financial abstraction layer," Lorenzo truly demonstrates long-term vision and determination.

Ethena, one of the leading stablecoin projects in this cycle, has seen its tokenized dollar USDe reach a market cap soaring into hundreds of millions. If tokenizing a single financial asset can already achieve such scale, Lorenzo—by supporting and fully integrating multiple tokenized financial products—could emerge as a pioneer in on-chain asset management, leading the next wave of crypto finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News