Revenue strategy tokenization, integrating CeFi and DeFi: Is Lorenzo building a Web3 version of "BlackRock + Goldman Sachs"?

TechFlow Selected TechFlow Selected

Revenue strategy tokenization, integrating CeFi and DeFi: Is Lorenzo building a Web3 version of "BlackRock + Goldman Sachs"?

Lorenzo Protocol creates a universal financial abstraction layer to tokenize traditional finance yield strategies and integrate them with DeFi scenarios, building an institutional-grade on-chain asset management platform that merges CeFi and DeFi. It aims to become the Web3 version of "BlackRock + Goldman Sachs," delivering diversified and sustainable real yields for on-chain assets.

On April 18, 2025, Binance Wallet launched the exclusive TGE event for Lorenzo Protocol, sparking widespread discussion within the community.

The spotlight centers on the strong performance of this TGE: despite stricter participation requirements—mandating users to have purchased Alpha tokens on Binance within the past 30 days—Lorenzo still achieved an impressive oversubscription of 183.29x;

On the other hand, many people first became aware of Lorenzo due to its prominent achievements in the BTCFi space: as a liquidity layer for Bitcoin, Lorenzo currently integrates over 20 blockchains and more than 30 DeFi protocols, providing yield services for over $600 million worth of Bitcoin.Notably, many observed that Lorenzo chose "BANK" as its token name.

BANK—the word evokes boundless imagination:

As crypto regulation becomes increasingly clear globally, institutional confidence in digital assets continues to grow. 2025 is seen as a pivotal year for on-chain finance, with growing capital accumulation on-chain fueling massive demand for "asset yield." Amid these opportunities:

How can participation barriers be lowered to better serve users and capital?

Moving from speculation to long-term value orientation, how can we build truly sustainable yield mechanisms centered on real returns?

Does Lorenzo's choice of BANK hint at its next strategic phase?

The team isn’t keeping secrets—as Lorenzo announces its brand upgrade, a new chapter unfolds with the vision of becoming an “institutional-grade on-chain asset management platform”:

Centered on building a “Financial Abstraction Layer,” Lorenzo integrates asset management and investment banking services. It focuses on tokenizing CeFi financial products and integrating them into DeFi environments, offering composable, verifiable, and plug-and-play modular yield products for project issuers. At the same time, through these yield products, it provides users with secure, low-barrier, and diversified options for generating yield, further establishing a new on-chain financial network built around real returns.

From BTCFi to a Web3 version of “BlackRock + Goldman Sachs”—how exactly will this be achieved? Let’s explore.

Capital Is On-Chain, But Yield Infrastructure Lags Behind

We can observe signs of capital moving on-chain from multiple angles:

According to CoinGecko data, as of April 25, 2025, the total market cap of RWA reached $38.3 billion—more than doubling from $19 billion at the end of 2024.

Per Artemis data, by April 2025, the total market cap of stablecoins had reached $231.6 billion, up 51% from $152.6 billion in the same period of 2024.

Coinbase’s latest survey also highlights this trend: among 352 institutional decision-makers surveyed, 83% plan to expand their cryptocurrency allocations this year, while 59% intend to allocate over 5% of their AUM to crypto assets in 2025.

This trend is driven not only by blockchain’s advantages—decentralization, transparency, and efficient capital flows—but also by clearer, more open, and inclusive global crypto regulations, led by the Trump administration in the U.S., removing compliance hurdles for institutional participation.

Increased institutional engagement has brought broader user adoption, accelerating the growth of financial access points such as wallets, neobanks, digital banks, and card issuers.

But once capital is on-chain, what’s next?

Yield is what resonates most with users—and this presents a massive growth opportunity for Lorenzo as an on-chain asset manager.

However, assets sitting idle in wallets do not generate returns. With broader user bases and larger capital inflows, building robust yield infrastructure has become a critical challenge in this new landscape:

DeFi, as a core pillar of the crypto industry, offers transparency, permissionless access, and fair participation. However, blockchain complexity creates higher entry barriers. Moreover, DeFi’s capital scale, liquidity depth, and market maturity still fall short compared to CeFi. More importantly, in a market dominated by speculation, most DeFi returns rely on short-term incentives, failing to meet users’ real demand for sustainable yields.

While traditional finance suffers from opaque asset management and trust issues due to “black box” operations, it boasts high liquidity, mature trading tools, and diverse yield strategies. Bringing these advantages on-chain, however, poses significant technical challenges.

How can we merge the strengths of both worlds to deliver transparent, fair, low-barrier, yet rich-yield on-chain earning experiences?

By building a universal Financial Abstraction Layer, Lorenzo is creating a bridge between traditional financial products and DeFi, enabling sophisticated yield strategies and financial use cases to go live.

Left Hand Capital, Right Hand Strategy: How Is Lorenzo Building an On-Chain Investment Bank?

How can we quickly grasp how Lorenzo builds an “institutional-grade, real-yield-based on-chain asset management platform”?

In short,we can view Lorenzo as a modular financial issuance middleware, operating under the principle of “on-chain fundraising, off-chain execution, on-chain settlement”:

If you want to package your yield strategy into a product and launch it to attract more capital and grow AUM, Lorenzo offers a one-click solution:

Lorenzo supports seamless integration of any yield strategy—including traditional financial strategies from CeFi and TradFi—such as BTC staking, stablecoin arbitrage, RWA yield custody, fixed income, principal protection, or dynamic leverage products. This broad coverage ensures users have ample choices across different risk appetites and return expectations.

Consider Ethena—one of DeFi’s most representative financial asset tokenization projects—which currently focuses solely on packaging USDe. Despite this narrow scope, its market cap has already reached $485 million. Lorenzo, by supporting tokenization and combination of multiple financial products, brings truly modular and diversified yield infrastructure to on-chain finance, unlocking exponential growth potential.

More importantly, many are deterred by complex product launches, but Lorenzo’s Financial Abstraction Layer simplifies everything: when launching a yield product, you don’t need to worry about implementation details. By calling Lorenzo’s Vault API, your yield strategy is automatically packaged into a standardized yield component.

Modularity and composability are Lorenzo’s other key advantages: each Vault represents a tokenized yield strategy—a single-strategy pool—and Vaults can be freely combined. By aggregating multiple Vaults, composite strategy pools can be formed, dynamically rebalanced by individuals, institutions, or AI as Portfolio Managers, enabling advanced yield strategies in complex markets.

Leveraging composability, Lorenzo will also offer customized yield design, secure custody mechanisms, and tailored product features for yield strategy issuers—especially institutional clients—to meet diverse institutional needs.

If you want to integrate yield products into your own project to offer better earning services to users, Lorenzo makes it equally simple—one click:

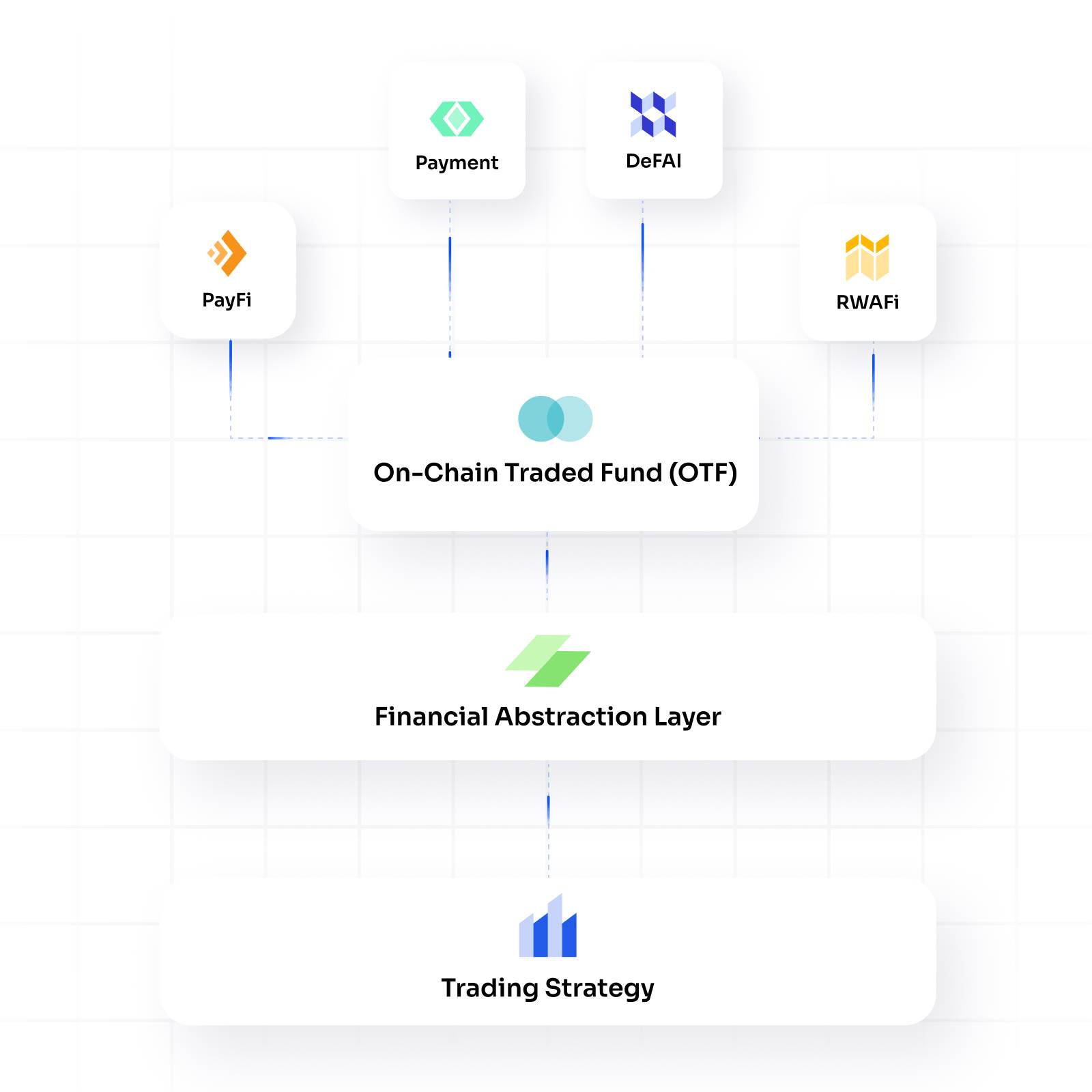

Once a yield strategy is packaged into a Vault, it issues an On-Chain Traded Fund (OTF)—similar to an ETF strategy fund—effectively tokenizing financial yield strategies. As a modular standard, OTFs can be easily integrated into wallets, PayFi platforms, RWA applications, and others via Lorenzo’s Vault API.

If you want to earn yield from your assets, Lorenzo offers a wide range of yield products to choose from.

Once a yield product is launched, a market based on yield strategies emerges: users can select a Vault matching their needs and provide funds to receive a share of the Vault’s returns.

After a Vault raises capital, it executes the yield strategy to generate returns. Distribution is handled transparently and automatically via smart contracts on-chain—simplifying payout logistics, ensuring public verifiability, and enhancing trust.

Meanwhile, Lorenzo will use $BANK as a core incentive mechanism to boost ecosystem participation and establish a sustainable, long-term value loop:

As the native token, $BANK has a total supply of 2.1 billion and serves functions including governance, yield from intelligent savings vaults, and dividends.

Lorenzo’s protocol revenue comes primarily from strategy aggregation, cross-chain bridge services, and ecosystem partnerships, with ongoing proceeds used to repurchase $BANK—creating a direct value linkage to protocol growth. The buyback program not only rewards users but also strongly backs the intrinsic value of the ecosystem. This move enhances $BANK’s market liquidity and value while injecting greater confidence and momentum into Lorenzo’s ecosystem.

Additionally, Lorenzo will introduce a veBANK model, deeply linking the token to protocol governance, ecosystem incentives, tier systems, and task mechanisms—further boosting user stickiness and long-term engagement. These initiatives aim to attract and empower users seeking asset appreciation, continuously expanding the ecosystem.

Both strategy issuers and capital providers will find their yield needs met through Lorenzo:

For institutions/projects:

They can either issue yield products to attract more capital and users; integrate existing yield products to enhance user offerings; or deploy their large-scale managed funds into yield products for better risk-return management.

For regular users:

Without complex operations, users simply purchase OTFs to indirectly participate in custodied strategy pools, achieving verifiable, sustainable, and real-yield returns on-chain.

Beyond this, by building an effective ecosystem incentive system around $BANK, Lorenzo aligns itself with all participants. Community members actively engaging in tasks, promotions, staking, and other activities will receive airdrop rewards and long-term benefits, sharing in the ecosystem’s growth and jointly driving project development.

In doing so, Lorenzo plays a crucial role as an “on-chain investment bank”:By offering tokenization of financial assets, modular yield infrastructure, and a full suite of tools for designing, packaging, and deploying yield products, Lorenzo transforms off-chain financial logic into composable, verifiable, and sustainable on-chain capabilities—efficiently matching yield strategies with capital. Through continuous ecosystem development, Lorenzo unlocks limitless potential for exponential growth.

From Payment, PayFi, RWAFi to DeFAI: Accelerating the Convergence of DeFi, CeFi, and TradFi

Before discussing ecosystem development, we must first identify the key participants.

Of course, users come first. Lorenzo’s focus on yield generation addresses a core need for most on-chain users. More importantly, unlike other DeFi projects, Lorenzo aggregates on-chain and off-chain yield strategies and tokenizes them—making participation simple while delivering truly sustainable, long-term real returns—gaining stronger user appeal.

When mapping out Lorenzo’s ecosystem participants around the question of “how to better serve users,” we see a much higher ceiling for its “on-chain investment bank” narrative—spanning DeFi, CeFi, and TradFi.

Who will become yield strategy issuers in Lorenzo’s ecosystem?

Aiming to productize their strategy capabilities and grow AUM, Lorenzo’s yield product issuance will attract attention from quant funds, RWAFi platforms, CEXs, DeFi protocols, and LP strategy providers.

Who would be interested in integrating Lorenzo’s yield products?

Whether wallets, payment platforms, RWAFi projects, or card networks—if their products involve assets, their users likely seek yield. Lorenzo’s low-barrier, efficient, and secure “embedded yield product” solution becomes highly attractive.

Who will become capital providers for Lorenzo’s yield products?

Undoubtedly, beyond retail investors seeking yield, institutions holding large user funds and looking for more efficient, secure custody, appreciation, and yield distribution channels will form the backbone—including neobanks, wallets, card issuers, PayFi platforms, CEX & trading platform yield accounts, and DeFi protocols.

This is a truly inclusive ecosystem, capable of supporting the healthy, sustained development of DeFi, CeFi, and TradFi—laying a solid foundation for Lorenzo’s rapid expansion.

Take RWAFi projects as an example: although RWA has become one of the fastest-growing sectors in 2025, it faces limited appeal due to low annual yields of 3–5%. By partnering with Lorenzo, RWA tokens can be staked via Lorenzo’s Vaults, used as collateral in CDPs, CEXs, or prime brokerage to borrow stablecoins, then deployed into yield strategies—easily doubling overall returns.

On May 9, 2025, Lorenzo announced a strategic partnership with leading RWA project Plume, collaborating on core assets like BTC and stablecoins to advance RWA use case adoption and explore more sustainable on-chain yield paths. With over 180 projects already integrated into Plume, this lays a solid foundation for Lorenzo’s product integration and ecosystem collaboration.

The case is similar for PayFi projects: most current PayFi platforms—like credit card services, wallets, or payment apps—require users to stake BTC or stablecoins as reserves. Lorenzo can deposit these underutilized “idle assets” into Vaults and deploy them into yield strategies, helping platforms improve asset utilization, reduce costs, and even share part of the yield with users.

Previously, Lorenzo partnered with stablecoin digital bank Infini to launch a co-branded payment card, enabling users to spend stablecoins in daily life and promoting crypto adoption in real-world consumer scenarios—all while earning on-chain yield. Going forward, the two will collaborate on more retail-focused yield products using Lorenzo’s Financial Abstraction Layer (FAL), extending the abstraction layer’s capabilities into consumer finance and Web3 use cases.

Further, while DeFAI has drawn significant interest, one reason it hasn’t taken off is the lack of reliable yield strategies. Lorenzo’s multi-strategy Vaults allow DeFAI Agents to act as “portfolio managers,” freely allocating across strategy combinations—operating like hedge funds without needing to build their own strategy or execution infrastructure.

In fact, beyond Plume and Infini mentioned above, since announcing its brand upgrade and core narrative around the Financial Abstraction Layer, Lorenzo has entered deep cooperation talks with multiple projects. As ecosystem development progresses, more partners will soon join Lorenzo in building a new on-chain financial infrastructure centered on real yield.

Web3 “BlackRock + Goldman Sachs”: Marching Toward Trillion-Dollar Asset Scale

The brand upgrade marks the first step in Lorenzo’s journey to become a “CeFi-DeFi-integrated on-chain asset management platform.” With the official roadmap revealing clear plans and strong execution, Lorenzo is steadily building a yield ecosystem truly driven by tokenized financial products.

In Q2 2025, Lorenzo’s primary goal is to launch the Financial Abstraction Layer,establishing foundational architecture to deliver intuitive, user-friendly financial services and break down complex on-chain operational barriers. Meanwhile, Lorenzo will launch its first flagship financial strategy product and begin deep integrations with early ecosystem partners, building a more synergistic financial network.

In Q3, Lorenzo will shift focus toward ecosystem expansion and diversification of business lines,offering users richer choices. Additionally, Lorenzo will launch a public financial reporting system, transparently sharing platform operations to further strengthen user trust.

In the final quarter of 2025, Lorenzo will concentrate on scaling its operations,and initiate its first $BANK token buyback program.

As these roadmap milestones are achieved, Lorenzo will gradually evolve into a comprehensive financial platform integrating asset management and investment banking. Many community members liken this brand upgrade to the birth of a Web3 “BlackRock + Goldman Sachs.”

This analogy stems partly from Lorenzo’s elite team, strong funding history, and reputation built through years of deep involvement in on-chain finance:

According to public information on its website, Lorenzo’s core team members are graduates of top universities and have held positions at Wall Street investment banks, ZetaChain, Magic Eden, Xterio, and other renowned organizations, bringing extensive experience in finance, crypto, and AI applications.

Moreover, Lorenzo is a favorite among investors: in May 2024, Lorenzo announced the close of its seed round, attracting support from notable firms including Yzi Labs, Gumi Cryptos, Portal Ventures, and Animoca Brands.

As a starting point in on-chain asset management, Lorenzo has already delivered yield services for over $600 million in Bitcoin through its standout performance in the BTCFi space—building valuable momentum across community, ecosystem, and users—forming essential groundwork for its ambition to become the Web3 equivalent of “BlackRock + Goldman Sachs.”

On the other hand, with BlackRock managing $11.48 trillion and Goldman Sachs $3.2 trillion in assets, many community members hold even higher expectations for Lorenzo’s future growth:By building a new on-chain financial ecosystem centered on real yield via a universal abstraction layer, Lorenzo delivers yield services that are more transparent, permissionless, intelligent, and composable than those of BlackRock and Goldman Sachs. Combined with Web3’s superior value capture and yield distribution mechanics, $BANK token incentives create a self-reinforcing growth flywheel among ecosystem participants.

And in 2025—a year when the U.S. leads the charge on crypto-friendliness, global crypto financial regulation becomes clearer, and more institutions, users, and capital actively explore crypto finance—amid rapidly growing demands for asset management and yield generation,can Lorenzo leverage yield products as a catalyst, bridge CeFi and DeFi, truly match the scale of a Web3 “BlackRock + Goldman Sachs,” and become the “yield hub” for trillions in on-chain assets?

With Lorenzo’s brand upgrade, TGE, ecosystem development, and other key milestones unfolding, perhaps we are standing at a pivotal window for a paradigm shift in on-chain asset management.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News