How to uncover the wealth code from HTX's new trends?

TechFlow Selected TechFlow Selected

How to uncover the wealth code from HTX's new trends?

In times of uncertainty, Huobi HTX's "new listing logic" might be the beacon guiding retail investors through bull and bear markets.

As of April 15, Huobi HTX has launched 47 projects in 2025, covering multiple current hot sectors. Since the second half of 2024, Huobi HTX has emphasized "Brother Sun's Careful Selection," meaning Brother Sun personally reviews every new asset listing. Can ordinary investors also uncover industry trends and wealth opportunities from this?

MEME Remains the Main Battlefield in 2025

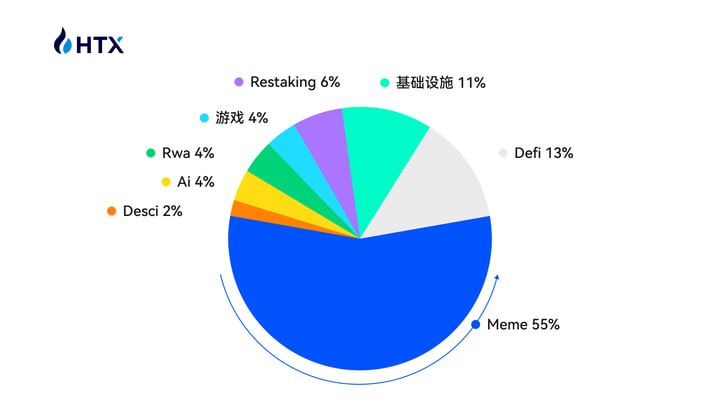

The chart below clearly shows that Huobi HTX has covered most of today’s popular market sectors, broadly categorized into seven: MEME, DeFi, Infrastructure (L1/L2), Restaking, Gaming, RWA, AI, and DeSci. MEME accounts for 55%, followed by DeFi at 13%, Infrastructure at 11%, and RWA and AI each at 4%.

(Data as of 2025.4.15)

In 2025, MEME projects have shown significant polarization, with top projects' average lifecycle shortening to 14 days—40% shorter than in 2024. This rapid rotation reflects oversupply caused by mass launch platforms (e.g., Pump.fun V3), widespread adoption of leveraged MEME farming tools accelerating capital turnover, and new models incorporating NFT holdings into token distribution weights.

Over recent months, market funds have primarily focused on short-term speculation in MEME coins, with trading热度 concentrated in these assets. The tokens listed on Huobi HTX largely meet users’ demand for MEME speculation. The platform’s listing strategy is clear: it includes both short-term speculative MEME assets and long-term growth potential assets in sectors like RWA and AI. Given BTC’s weak performance this year, a large number of short-term-oriented MEME tokens were inevitably selected.

DeFi and Restaking Sectors Show Growth Potential

Although MEME listings are numerous, their opportunity windows are extremely short. Unlike previous periods when MEMEs achieved 10x or 100x gains, no MEME in 2025 has yet delivered strong returns—partly due to increased launch speed and frequency diluting market capital. In contrast, Huobi HTX’s carefully selected DeFi and Restaking assets have provided solid wealth opportunities.

(STO price trend since listing on Huobi HTX)

StakeStone is a decentralized, cross-chain liquid infrastructure protocol in the Restaking sector. It was listed on Huobi HTX on February 11 and subsequently rose steadily, achieving a peak return of 3x.

(PLUME price trend since listing on Huobi HTX)

Plume Network is the first full-stack L1 RWA chain and ecosystem built specifically for RWAFi, falling under the RWA sector. Listed on Huobi HTX on January 21, its price has steadily climbed with consistent upward volatility, achieving over 3x peak returns.

(BUZZ price trend since listing on Huobi HTX)

MEME projects, by contrast, mostly exhibit sharp declines after high openings, often lasting less than two weeks before entering prolonged lows.

(BTC price trend since beginning of 2025)

This year, BTC has mainly trended downward, only rebounding in recent weeks, resulting in fewer opportunities from new assets compared to other cycles. Despite this, Huobi HTX has still delivered multiple new assets with strong performance.

Strategies for Trading New Assets

MEME assets show extreme 80-20 polarization—most eventually go to zero, while only a rare few may achieve over 10x gains. Therefore, MEME trading either involves participating in as many launches as possible to bet on hitting a 10x+ outlier, or riding short-term hype and exiting quickly with small profits.

Non-MEME assets, however, are suitable for long-term positioning. Investors should monitor Huobi HTX’s new listings and targeted sectors to identify promising projects. Exchanges inherently possess superior market insight compared to retail investors, and given that Brother Sun personally oversees Huobi HTX’s listings, nearly all potentially explosive or long-term-viable sectors are already covered.

As Huobi HTX continues launching high-quality new assets in 2025, Brother Sun’s personal “careful selection” mechanism has created a strong wealth effect. For investors, “launch new tokens, go to Huobi” is becoming a habit for discovering early-stage, high-potential assets. Whether long-term prospects like StakeStone and Plume or short-term viral MEMEs, investors can seize opportunities第一时间 on Huobi HTX and capture premium assets.

The crypto market has entered a new cycle dominated by professional institutions. Retail investors can build new investment frameworks based on exchange strategies to capture structural gains amid volatility. Amid uncertainty, Huobi HTX’s “listing logic” may serve as a lighthouse guiding retail investors through bull and bear markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News