Antalpha IPO Explained: A Key Move in Bitmain's Financial Strategy?

TechFlow Selected TechFlow Selected

Antalpha IPO Explained: A Key Move in Bitmain's Financial Strategy?

Antalpha is a financial solutions provider in the Bitcoin mining sector, but its close ties with mining giant Bitmain, as disclosed in its prospectus.

Author: Frank, PANews

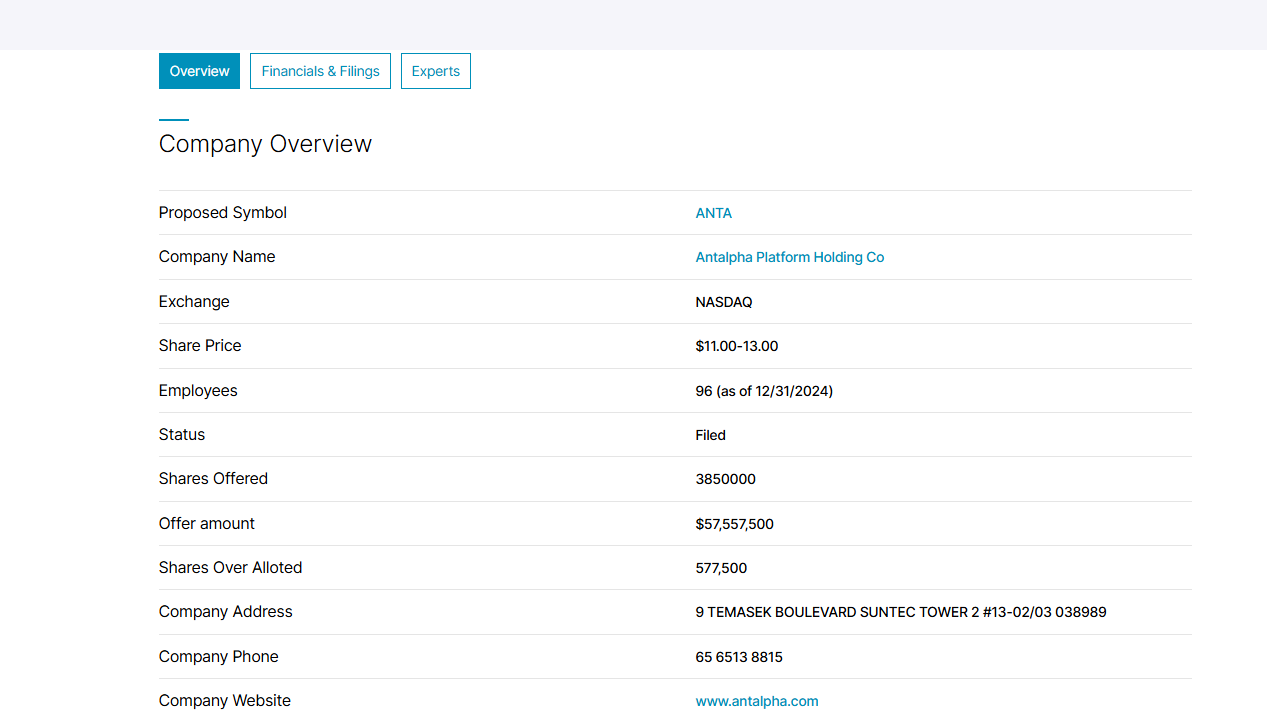

Recently, a fintech company named Antalpha filed its prospectus with Nasdaq, planning to go public (IPO) under the ticker "ANTA." Antalpha is a financial solutions provider in the Bitcoin mining sector. However, the close ties revealed in its prospectus—both with Bitmain, a major player in the mining industry, and Jihan Wu, Bitmain's co-founder—lend significant intrigue to this IPO. Beyond the surface narrative of a fintech firm going public, could this represent a pivotal move in Bitmain’s broader financial expansion?

The Financial Lifeline Behind Bitcoin Mining

Founded in 2022, Antalpha provides minimal self-description on its official website, focusing primarily on highlighting its strategic partnership with Bitmain. According to its prospectus and public disclosures, Antalpha’s core business involves offering financing, technology, and risk management solutions to digital asset institutions—particularly Bitcoin miners. Its goal is to help miners scale operations and better manage volatility in Bitcoin prices through tailored financing, including supporting their "HODLing" strategies.

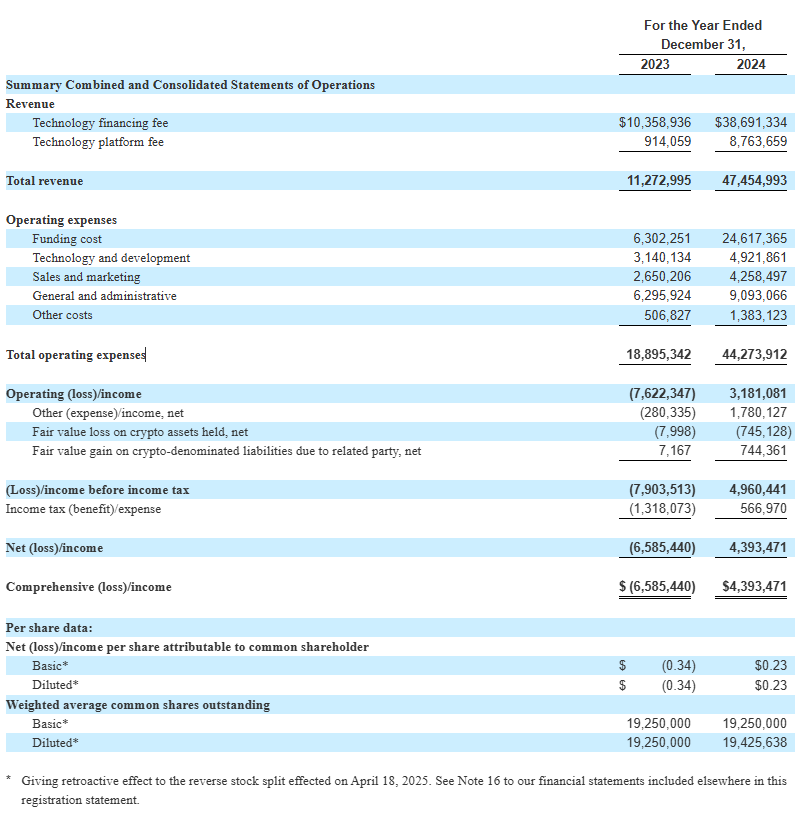

Antalpha delivers its core products and services via its technological platform, Antalpha Prime. This platform enables clients to initiate and manage digital asset loans while monitoring collateral positions in near real-time. The company generates revenue from two primary sources.

The first is supply chain financing, recorded as “technology financing fees,” which serves as Antalpha’s main revenue pillar. This includes: miner financing, providing loans for purchasing Bitcoin mining equipment (typically shelf-ready machines from Bitmain), secured by the acquired miners; and hashrate financing, funding operational costs related to mining (such as hosting fees), with collateral usually being mined Bitcoin. According to data disclosed by Antalpha, as of December 31, 2024, it had facilitated a total of $2.8 billion in loans, with approximately 97% of its supply chain loan customers using BTC as collateral.

Besides direct lending, Antalpha’s other key business is Bitcoin loan matchmaking services, generating income as “technology platform fees.” Through the Antalpha Prime platform, Antalpha offers Bitcoin margin lending services to non-U.S. clients. Notably, these loans have historically been funded primarily by its affiliate, Northstar. In this model, Antalpha acts solely as a technology and service provider, earning platform fees without assuming credit risk for the loans.

Financially, Antalpha reported total revenue of $47.45 million for the most recent fiscal year (ended December 31, 2024), a 321% year-on-year increase. Of this, technology financing fees amounted to $38.7 million, up 274% year-on-year, while technology platform fees reached $8.8 million, surging 859% year-on-year. The company also turned profitable, posting a net profit of $4.4 million, compared to a net loss of $6.6 million in the prior fiscal year.

In terms of loan volume, as of December 31, 2024, Antalpha’s total loan book reached $1.6 billion. Its own originated supply chain loan portfolio (miner and hashrate loans) grew from $344 million at the end of 2023 to $428.9 million, a 25% year-on-year increase. Meanwhile, the Bitcoin loan volume serviced for Northstar surged from $220.8 million at the end of 2023 to $1.1987 billion, representing a staggering 443% growth. Geographically, the lending business is heavily concentrated in Asia: as of the end of 2024, 77.4% of loans (approximately $1.26 billion) were extended to Asian clients.

Bitmain’s “Financial Special Forces”

Antalpha openly acknowledges its close relationship with Bitmain in the prospectus, referring to itself as “Bitmain’s primary lending partner.” The two parties even signed a memorandum of understanding agreeing that Bitmain will continue to use Antalpha as its financing partner, mutually refer clients, and grant Antalpha preferential subscription rights to serve Bitmain’s clients seeking financing—provided Antalpha offers competitive terms.

This preferential right allows Antalpha first access to Bitmain’s vast customer base of mining machine buyers, significantly lowering customer acquisition costs and ensuring a steady stream of business. The prospectus further notes that Antalpha collaborates closely with Bitmain across all levels—from sales and operations to senior management—and is an integral part of Bitmain’s sales and business origination process.

However, the connection between Antalpha and Bitmain extends beyond mere business cooperation. A deeper link lies with Jihan Wu, Bitmain’s co-founder.

The prospectus details Antalpha’s complex relationship with Northstar. Historically, Northstar provided nearly all the funding for Antalpha’s loans and used the Antalpha Prime platform to offer Bitcoin margin loans to Antalpha’s non-U.S. clients. Crucially, Antalpha and Northstar were initially sister companies, both operating under a parent entity ultimately controlled by Jihan Wu.

Following the “2024 restructuring,” Antalpha was spun off and transferred to the current listed entity, Antalpha Platform Holdings. Subsequently, the original parent company divested all its interests in Northstar. Currently, Northstar is owned by an irrevocable trust, with Jihan Wu serving as both settlor and beneficiary, while being managed by a professional trust company. The prospectus emphasizes that Jihan Wu does not participate in Northstar’s day-to-day operations.

Despite the restructuring, Northstar remains a key funding source for Antalpha’s Bitcoin lending services. As the ultimate beneficiary of the Northstar trust, Jihan Wu maintains indirect yet significant economic interests tied to Northstar’s performance—and by extension, to the scale of Antalpha’s business.

Thus, although Antalpha Platform Holdings may now be legally distinct from Jihan Wu’s direct control, from the perspectives of business logic, capital flows, and strategic alignment, Antalpha remains a crucial component of Bitmain’s financial ecosystem. It functions more like a carefully designed and separated “financial special forces” unit, dedicated to supplying financial firepower to Bitmain’s mining empire.

A Strategic Pawn for Bitmain in the Post-Halving Era

The deeper strategic significance of Antalpha’s IPO is inseparable from the industry environment following the 2024 Bitcoin halving and Bitmain’s corresponding strategic adjustments.

The April 2024 Bitcoin halving predictably reduced block rewards for miners, directly challenging profitability across the mining industry. For Bitmain, this means market demand for its products will increasingly focus on high efficiency and low power consumption. Over the past year, to maintain leadership in mining hardware, Bitmain has accelerated the rollout of next-generation efficient miners such as the Antminer S21 series, securing procurement agreements with partners like BitFuFu and Hut8. By deepening collaborations with large-scale mining farms, Bitmain strives to ensure substantial orders for its latest models.

On one hand, post-halving competition in mining has intensified, forcing miners to upgrade equipment performance to sustain profits—significantly increasing their operating costs. This poses a potential future risk to Bitmain’s business growth. On the other hand, as Bitcoin prices rise, more external companies—and even public firms—are entering the mining space, presenting new opportunities for Bitmain. Yet, these opportunities remain contingent on Bitcoin price movements. Therefore, by offering loan support through Antalpha for clients purchasing next-gen miners like the S21 series, Bitmain not only directly boosts its sales but also helps miners overcome capital hurdles arising from equipment upgrades.

Antalpha’s IPO has attracted interest from several notable investors. Tether has expressed interest in subscribing to $25 million worth of Antalpha common stock at the IPO offering price. Assuming a midpoint share price of $12, this investment would account for approximately 54.1% of the total base offering shares, or about 2.08 million shares. According to the prospectus, Antalpha typically settles its loan transactions in USDT. This move marks another strategic play in Tether’s diversified investment strategy, though the prospectus clarifies that this expression of interest “is not a binding purchase agreement or commitment.”

Additionally, Antalpha mentioned in the prospectus its plans to explore financing solutions for GPUs required in AI applications. For Bitmain, Antalpha’s ability to expand into new areas serves as a barbell strategy to hedge against uncertainties in the crypto industry. If Antalpha succeeds in emerging fields like AI GPU financing, its growth would indirectly strengthen the resilience of Bitmain’s entire ecosystem.

Therefore, Antalpha’s IPO is far more than a simple fintech listing—it represents a critical step by Bitmain in the post-halving era to consolidate its mining empire, optimize its financial tools, and build long-term strategic capacity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News