From deterministic optimism to deterministic pessimism, the real opportunity lies hidden beyond disillusionment

TechFlow Selected TechFlow Selected

From deterministic optimism to deterministic pessimism, the real opportunity lies hidden beyond disillusionment

Although most projects tend to imitate and play it safe, real opportunities still lie hidden in the margins of "deterministic pessimism."

Author: Matti

Translation: zhouzhou, BlockBeats

Editor's Note: This article traces the evolution of the crypto industry from early idealism to realism, pointing out that we are currently at a critical turning point following disillusionment. While most projects have become imitative and conservative, real opportunities still lie within the marginal zones of "definite pessimism."

The following is the original content (slightly edited for readability):

Once again, I bring you a mash-up piece inspired by Peter Thiel. As someone who fancies himself a "Thielogian," I often view the future through the lens of his classic book *From Zero to One*. Thiel’s analytical framework is highly adaptable, capable of dissecting various ideas, trends, and movements. Yet at times it feels more like Wittgenstein’s ruler—the reliability of which depends heavily on the observer’s position, not always offering a clear or consistent perspective.

As a crypto investor, I frequently analyze narratives to better understand underlying opportunities. At this inflection point in the industry—where we’re narrowing the arbitrage gap in emerging tech markets—I’ve also been reflecting on how to uncover and catalyze higher-quality ideas and products.

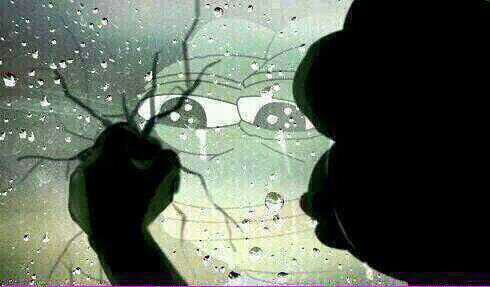

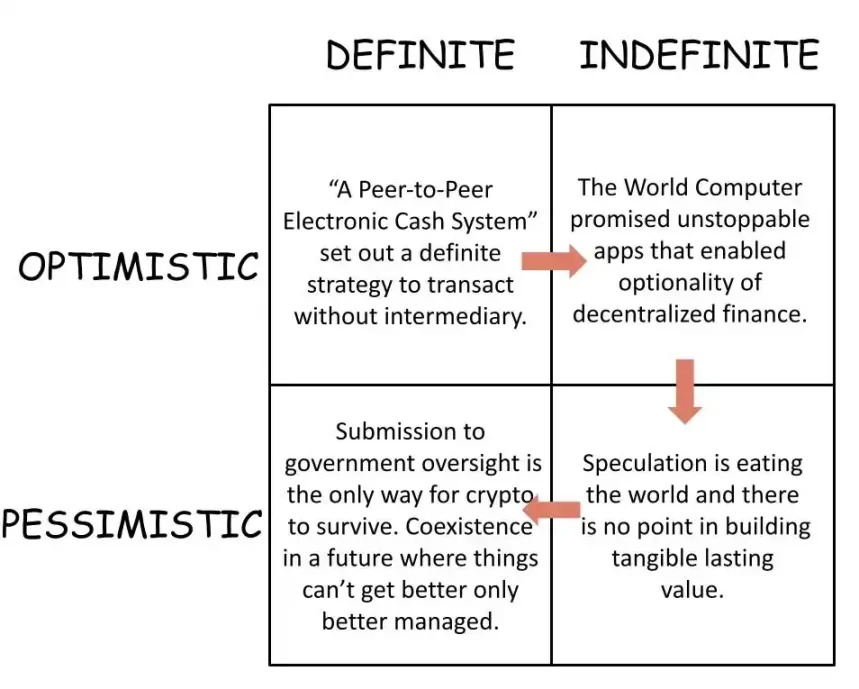

Through Thiel’s lens, I see the timeline of crypto as an evolution: from Bitcoin’s early “definite optimism,” to Web3’s grand vision of “indefinite optimism”—where finance ultimately emerged as the killer app; then into the “indefinite pessimism” of the meme coin casino era; and now, with regulation becoming clearer, we seem to be strategically embracing a form of “definite pessimism.”

This has been a journey starting from cypherpunk idealism, passing through startup mania, slipping into decadent swamps, and finally moving toward standardization.

Is this trajectory common across all kinds of trends? A revolutionary idea, once partially validated, is often mythologized into a panacea; when it fails to meet sky-high expectations, it gets vilified, only to gradually settle into the status quo. Revolution is never truly completed, yet we keep reenacting a certain (for some, satisfying) cycle within the closed loop of the Gartner Hype Cycle.

In crypto, this overarching hype cycle is often masked by price volatility. Each crypto cycle—Bitcoin, ICOs promising a “world computer,” DeFi, meme coins, and now regulatory integration and alignment with traditional finance—appears fractal-like within a larger pattern. Currently, we are in the “Trough of Disillusionment.” According to Carlota Perez’s framework of technological waves, this marks a crucial inflection point.

Web3 once promised to “on-chain” Web2’s profit model—decentralizing and tokenizing it. But neither Web2 nor Web3 is a place, nor a clearly defined “thing.” As I said years ago, it’s more like a “user preference”; today, that preference remains niche. If you constantly need to rely on the language of the old world to explain the new, you aren’t really creating something new.

The crypto industry is no longer a frontier market, but opportunities still exist at the edges of this established domain. At this stage of maturation, where do the biggest wins come from? Intuitively, they come from players in growth phases or those leveraging late-mover advantages.

It’s also worth noting that centralized exchanges—once standard-bearers of “definite optimism” driving crypto adoption—have now turned into pessimists, focusing more on defending their existing market share than advancing on-chain adoption.

In the past, exchanges and Layer 1 blockchains (L1s) delivered the highest returns to investors. Ironically, the fiercest competition, the retreat of optimism, and the rise of pragmatism have produced the industry’s biggest winners.

Does this mean there are no more “secrets” left to discover? I don’t think so. Today’s “secrets” are yesterday’s lessons. Have we truly built many innovative and valuable companies or networks?

The low-hanging fruit has already been picked—most current projects either imitate predecessors or slightly repackage ideas, pretending to be original. Many “solutions” chase problems that don’t actually exist, while others simply aim to port traditional finance onto the blockchain.

Crypto was originally a revisionist force by nature, yet failed to complete a true revolution. Today, it is trapped by a central (perhaps false) dilemma: “Do you want to do what’s right, or do you want to make money?” In other words, are you willing to sell out at the price the old system is willing to pay? Revolutionaries worn out from crying in the meme coin casinos are increasingly accepting this trade.

The combination of building vague products that developers assume users “should want” (no, people don’t really care about owning their data) and the obvious success of centralized service providers has pushed the industry into its current stalemate. Today, genuine “definite optimists” are nearly extinct in crypto. Yet it is precisely within this “nearly impossible” space that frontier investment opportunities lie.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News