Movement Token Crash Behind the Scenes: Secret Contracts and Dual-Faced Market Making

TechFlow Selected TechFlow Selected

Movement Token Crash Behind the Scenes: Secret Contracts and Dual-Faced Market Making

The company claims it was induced to sign a problematic agreement, and experts point out that the agreement's mechanism could encourage price manipulation.

By Sam Kessler, Coindesk

Translated by Scof, ChainCatcher

Key Points:

-

Movement Labs is investigating whether it was misled into signing a market-making agreement without full awareness, handing control of 66 million MOVE tokens to an unidentified intermediary, resulting in a massive $38 million dump immediately after the token launch.

-

Internal contracts show that Rentech, a company with virtually no digital footprint, appears on both sides of the transaction: as a subsidiary of Web3Port and as an agent for the Movement Foundation, raising concerns about self-dealing.

-

Insiders at the Movement Foundation initially warned against the deal, calling it “the worst agreement they had ever seen.” Experts suggest the contract may have been structured to incentivize artificial price inflation before dumping tokens onto retail investors.

-

The incident has exposed deep divisions within Movement’s senior leadership: executives, legal counsel, and project advisors pushed forward with the deal despite internal opposition, and their actions are now under scrutiny.

A financial agreement meant to boost the launch of the MOVE cryptocurrency instead spiraled into a token dump scandal, triggering a trading ban by Binance and sparking internal turmoil.

Contract documents obtained by CoinDesk reveal the core of the crisis and explain how events unraveled.

According to internal documents reviewed by CoinDesk, blockchain project Movement—the developer behind the MOVE cryptocurrency—is investigating whether it was induced into signing a financial agreement without full understanding, granting one single entity disproportionate control over the MOVE token market.

The agreement led to 66 million tokens being rapidly dumped onto the market the day after MOVE’s initial exchange listing on December 9, causing a sharp price drop and igniting strong suspicions of insider trading. Notably, the project is backed by World Liberty Financial, a crypto venture platform supported by Donald Trump.

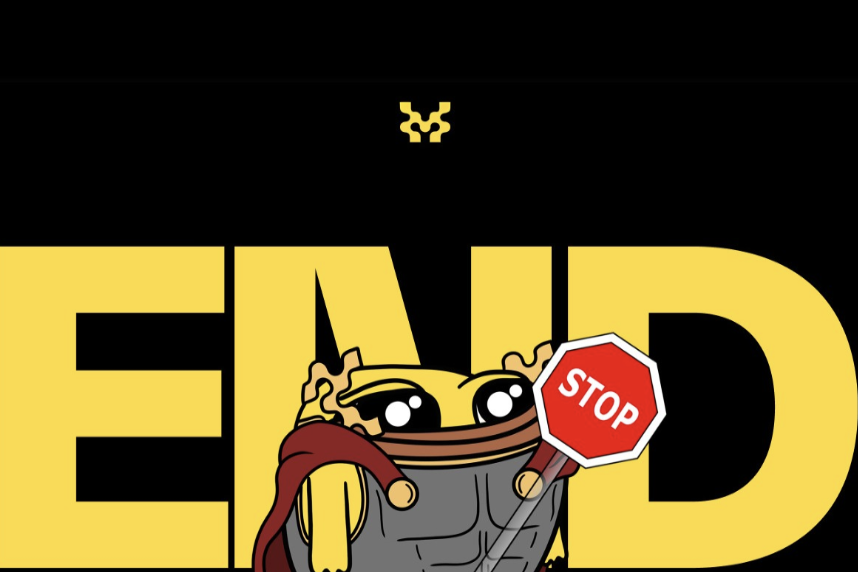

Cooper Scanlon, co-founder of Movement Labs, said in a Slack message to employees on April 21 that the company is investigating why more than 5% of MOVE tokens originally intended for market maker Web3Port were transferred through an intermediary named Rentech. He noted, “The foundation was led to believe Rentech was a subsidiary of Web3Port, but clearly that is not the case.” Rentech denies any misrepresentation or misleading conduct.

Slack message from Movement co-founder Cooper Scanlon. Rentech is spelled as "Rentek." (Obtained by CoinDesk)

According to an internal memo from the Movement Foundation, the contract signed between Movement and Rentech effectively lent out approximately half of the publicly circulating supply of MOVE tokens to a single counterparty, giving that entity unusually large influence over the early-stage token. Multiple experts told CoinDesk this arrangement is highly unusual.

More troubling, versions of the contract obtained by CoinDesk include incentives to “manipulate the token price above a fully diluted valuation of $5 billion, then dump tokens to retail investors and split profits proportionally.” After reviewing the documents, veteran crypto founder Zaki Manian said bluntly: “Even participating in a contract explicitly written like this is insane.”

Market makers are typically hired to provide liquidity for newly issued tokens, usually using funds loaned by the issuing party to trade on exchanges and stabilize prices. However, this role is easily abused, allowing insiders to quietly manipulate markets and cash out large token holdings without immediate detection.

A series of contract documents obtained by CoinDesk expose the weak regulation and opaque legal structures in the crypto industry—loopholes that often turn public-facing projects into private profit schemes for a select few.

While rumors of abused market-making mechanisms are common in crypto circles, specific details rarely become public.

This time, however, the market-making contract reviewed by CoinDesk shows Rentech appearing in the agreement with the Movement Foundation simultaneously as an agent for the Movement Foundation and as a subsidiary of Web3Port—a dual role that theoretically enables it to dominate terms and profit from the arrangement.

In the end, the collaboration between Movement and Rentech enabled a wallet linked to Chinese financial firm Web3Port to dump $38 million worth of MOVE tokens the day after the token launched on exchanges. Web3Port claims past collaborations with projects including MyShell, GoPlus Security, and Trump-backed World Liberty Financial.

Following improper conduct, exchange Binance subsequently suspended the market-making account, and Movement announced plans to initiate a token buyback program.

Similar to stock options in startups, tokens in crypto projects often come with vesting periods to prevent insiders from selling large amounts during early trading stages.

However, Binance's suspension decision triggered market skepticism toward Movement—many suspect the project team may have reached an early unlock agreement with Web3Port, though Movement denies this claim.

Blame Game

Movement is one of the most watched crypto projects in recent years, positioning itself as a next-generation Layer 2 blockchain aiming to enhance Ethereum’s scalability using the Move programming language introduced by Facebook.

The project was founded by two 22-year-old Vanderbilt University dropouts, Rushi Manche and Cooper Scanlon. It raised $38 million, joined the World Liberty Financial portfolio, and gained significant attention on social media.

According to a Reuters report in January, Movement Labs was nearing completion of a $100 million funding round, potentially valuing the company at $3 billion.

CoinDesk interviewed over a dozen sources familiar with Movement’s internal operations (most requested anonymity to avoid retaliation), who offered conflicting accounts about who drove the Rentech deal—industry experts widely agree the arrangement was highly abnormal.

Galen Law-Kun, head of Rentech, denies that the foundation was misled during the signing process and insists Rentech’s overall structure was built with full assistance from YK Pek, general counsel of the Movement Foundation.

However, according to an internal email and other communications reviewed by CoinDesk, Pek denies involvement in Rentech’s formation and initially strongly opposed the deal.

Movement Labs co-founder Scanlon stated in messages to employees that Movement was “a victim in this incident.”

Four sources say Movement is currently investigating the responsibility of co-founder Rushi Manche—he was the one who first forwarded the Rentech deal to the team and advocated for it internally. Informal advisor Sam Thapaliya is also under investigation; he is also a business partner of Law-Kun.

Web3Port did not respond to multiple requests for comment.

“Could be the Worst Agreement I’ve Ever Seen”

Although Movement initially rejected the high-risk market-making agreement with Rentech, it eventually signed a revised version nearly identical in substance, relying only on guarantees from an untraceable middleman.

In the loosely regulated crypto industry, project structures are often divided between nonprofit foundations and for-profit development companies. The developer (in this case, Movement Labs) handles technical development, while the foundation manages tokens and community resources.

Theoretically, the two should remain independent to avoid securities regulatory risks. But internal communications reviewed by CoinDesk suggest Rushi Manche, an employee at Movement Labs, also played a leading role within the nonprofit Movement Foundation.

Movement co-founder Rushi Manche forwarding the first Rentech contract to an employee in the Movement ecosystem. (Obtained by CoinDesk)

On March 28, 2025, Manche sent a draft market-making agreement to the foundation via Telegram, saying it needed to be signed quickly.

November 27, 2025: Rentech submitted a draft market-making agreement to Movement. In the proposal, Rentech was the borrower and Movement the lender. This draft was ultimately not signed. For privacy, CoinDesk redacted certain personal names in disclosed documents, some of which were already obscured in the originals.

The draft proposed lending up to 5% of MOVE tokens to Rentech, a company with no digital footprint whatsoever.

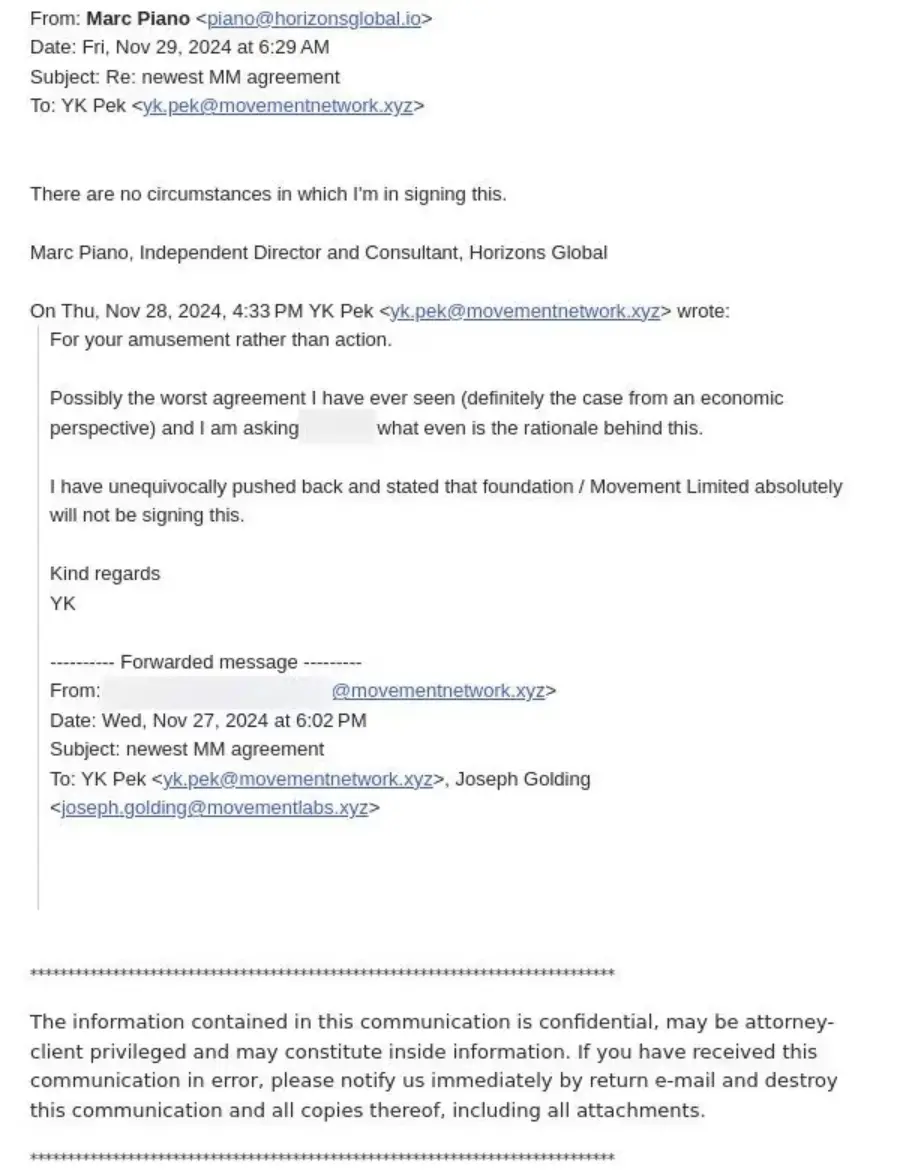

Foundation legal counsel Pek wrote in an email that the agreement was “possibly the worst contract I’ve ever seen.” In another memo, he warned that the move would hand control of the MOVE market to an unknown external entity. Marc Piano, director of the foundation in the British Virgin Islands, also refused to sign.

Reactions from Movement Foundation general counsel YK Pek and director Marc Piano to the Rentech agreement. (Obtained by CoinDesk)

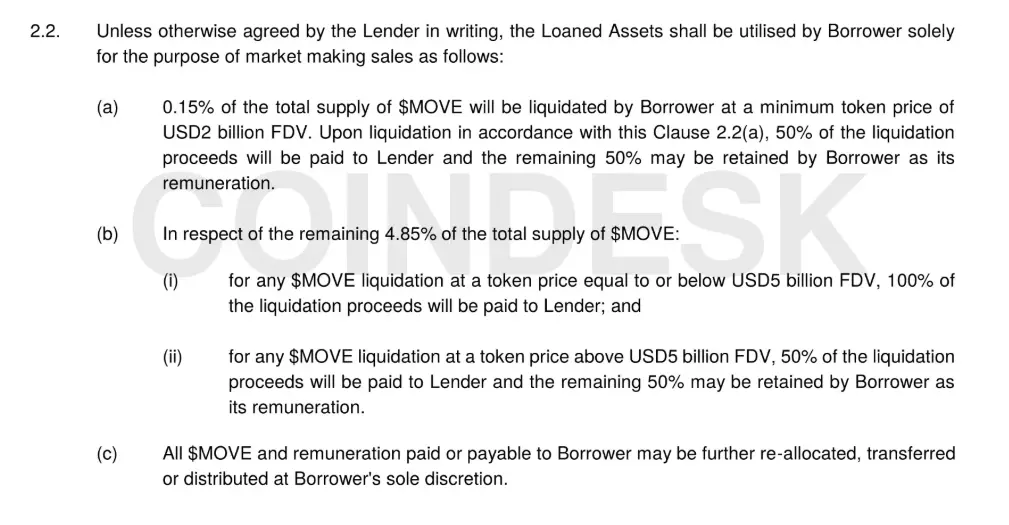

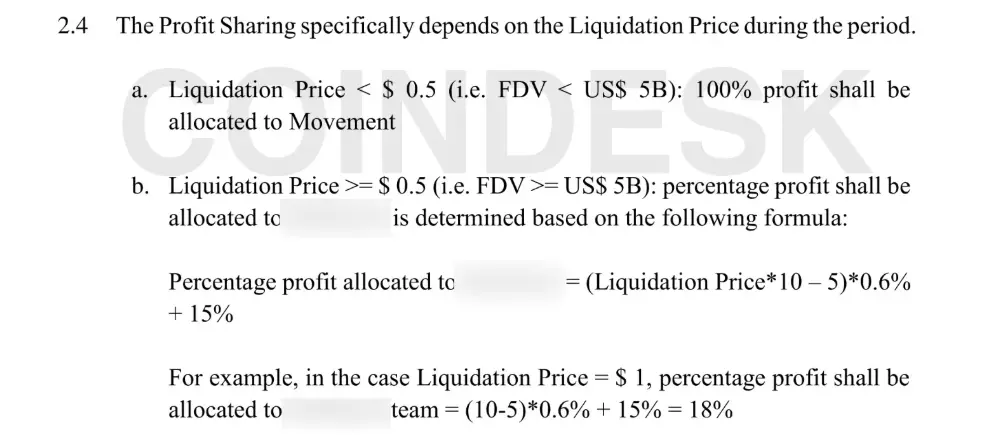

A particularly controversial clause allowed Rentech to immediately liquidate its token holdings when the MOVE token’s fully diluted valuation exceeded $5 billion, sharing profits with the foundation at a 50:50 ratio.

Manian pointed out that this design effectively incentivizes the market maker to artificially inflate the price before dumping large volumes of tokens for profit.

Although the Movement Foundation ultimately rejected the draft, negotiations with Rentech continued.

According to three people familiar with the talks and legal documents obtained by CoinDesk, Rentech later claimed to be a subsidiary of Chinese market maker Web3Port and offered to provide $60 million in collateral from its own funds—an offer that swayed the foundation.

On December 8, 2024, the Movement Foundation finally signed a revised market-making agreement with Rentech, removing some of the most contentious clauses, including one that would allow Web3Port to sue the foundation for damages if it failed to list MOVE on specific exchanges.

December 8, 2025: Rentech and Movement reached a revised market-making agreement. Rentech remained the borrower, but its identity was clearly labeled as “Web3Port” in the document (name blurred in file), with the Movement Foundation as the lender. The agreement was formally signed. For privacy, CoinDesk processed certain personal names in the document; some were originally obscured.

Although this revised agreement was drafted by Pek, the foundation’s legal counsel who previously opposed the deal, its core content remains highly similar: it still allows Web3Port to borrow 5% of the total MOVE token supply and sell for profit under certain mechanisms, though fund disbursement methods were adjusted.

The borrower’s name in the new contract is Web3Port, signed by a director of Rentech.

Notably, domain records show that the email domain used by the signing director, web3portrentech.io, was registered only on the day the agreement was signed.

Prior Agreement Already in Place

Three sources said foundation officials involved were unaware at the time of signing on December 8 that Web3Port had already signed another agreement with “Movement” weeks earlier.

On November 25, 2024, Rentech and Web3Port signed a market-making agreement (Web3Port name blurred in file). In this agreement, Rentech was the lender and Web3Port the borrower, and Rentech was referred to as “Movement” in the document. When CoinDesk obtained this contract, parts had already been redacted, and personal names were further anonymized for privacy.

This version shows Web3Port had already reached an agreement with “Movement” containing terms highly similar to the initial market-making proposal previously rejected by the Movement Foundation. In this contract, Rentech is listed as the representative of Movement.

The Web3Port-Rentech contract allows the borrower to liquidate assets for 50% profit. (Obtained by CoinDesk)

The structure of this agreement resembles the November 27 contract, explicitly allowing the market maker to liquidate when the MOVE token reaches certain price targets—one of the key clauses in the original proposal and precisely the kind of mechanism industry experts like Zaki Manian are particularly wary of.

“Shadow Co-Founder”

Sources say there is internal speculation about who orchestrated the connection with Rentech. This partnership ultimately led to the token dump in December last year and thrust Movement into a public relations firestorm.

According to Blockworks, the agreement was initially circulated internally by Rushi Manche. Manche was briefly suspended last week pending investigation.

In response to CoinDesk, Manche said: “Throughout the market maker selection process, the MVMT Labs team trusted several advisors and members within the foundation team to provide input and help design the deal structure. Clearly, at least one foundation member represented both sides in this transaction, which is exactly what we are now investigating deeply.”

The incident has also raised questions about the role of Sam Thapaliya, founder of crypto protocol Zebec and one of Manche and Scanlon’s advisors.

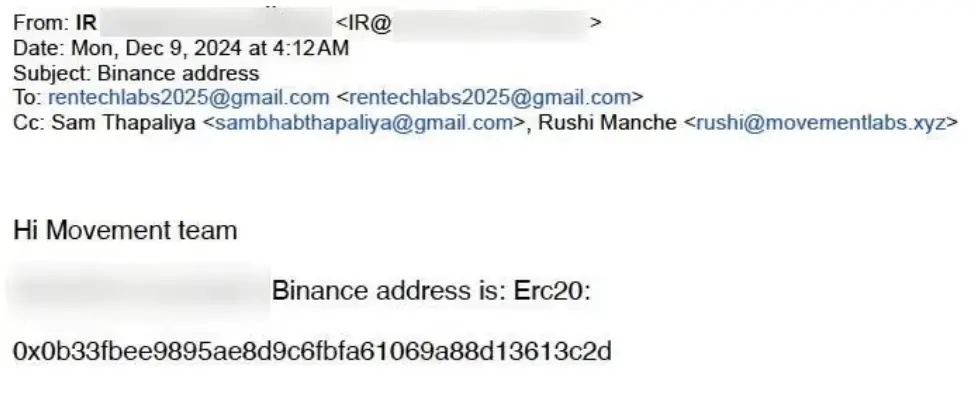

Communications reviewed by CoinDesk show Thapaliya was copied on emails from Web3Port to the “Movement team,” and appeared in other correspondence related to market-making arrangements alongside Rentech and Manche.

Web3Port copied Sam Thapaliya and Rushi Manche in an email to Rentech. (Email obtained by CoinDesk)

One employee said: As far as I know, Sam is Rushi’s close advisor, in a way almost like a shadow third co-founder. Rushi has kept this relationship low-key—we usually only hear his name occasionally.

We often make internal decisions, only to have them suddenly changed at the last minute, another employee said, and whenever that happens, we know it’s probably Sam’s doing.

Three attendees said Thapaliya was present in Movement’s San Francisco office on the day MOVE tokens launched to the public.

Telegram screenshots reviewed by CoinDesk also show Movement co-founder Scanlon tasked Thapaliya with helping screen the whitelist for the MOVE token airdrop—a tightly controlled list of wallet addresses eligible for community giveaways (an event previously delayed multiple times).

This arrangement further reinforced the impression among some employees that Thapaliya’s influence within Movement far exceeds what the company has publicly disclosed.

Thapaliya told CoinDesk he met Manche and Cooper Scanlon when they were university students and later advised Movement as an external consultant. He emphasized he holds no equity in Movement Labs, received no tokens from the Movement Foundation, and has no decision-making authority in either organization.

Who Is Rentech?

Rentech is the central entity in this token controversy, created by Galen Law-Kun, who is also Thapaliya’s business partner. Law-Kun told CoinDesk he established Rentech as a subsidiary of Autonomy, a Singapore-based financial services firm, aiming to connect crypto projects with Asian family offices.

In a statement to CoinDesk, Galen Law-Kun said YK Pek “assisted in setting up and served as general counsel of Autonomy SG,” which is Rentech’s parent or affiliated company. He also claimed that although Pek internally opposed the initial Rentech agreement, he had advised on structuring Rentech to advance the project launch and participated in drafting the first version of the contract, which was nearly identical to the one he later drafted and approved for the foundation.

However, CoinDesk’s investigation has found no evidence that Pek ever represented Autonomy in establishing Rentech or drafted that first version of the contract.

In response, Pek stated clearly: “I am not, and never have been, general counsel for Galen or any of his entities.” He explained that a corporate services firm he co-founded did serve as company secretary for over 150 Web3 entities, including two companies under Law-Kun’s name. But both companies reported zero assets in their 2025 annual filings, and neither is Rentech.

Pek said he “spent two hours in 2024 reviewing a consulting agreement between Law-Kun and a project”; he also recalled Law-Kun contacting him regarding FTX-related filing deadlines, and in August, forwarding a Docusign NDA which he only glanced at briefly and did not charge for.

Pek concluded: “I have absolutely no idea why Galen claims I was his general counsel—I find this claim confusing and unsettling.” He added that in email exchanges between Law-Kun and his company secretary partner, the latter was actually represented by a private lawyer from a firm called

Hillington Group.

According to YK Pek: The Movement Foundation (where I serve), along with the two general counsels of Movement Labs, were introduced to GS Legal through Rushi Manche and referred to as legal representatives of Rentech.

In Galen Law-Kun’s account, Pek was introduced to 10 projects as Autonomy’s legal counsel and never objected or corrected the designation. Law-Kun also claimed introducing GS Legal was merely a formality as requested by Movement.

Movement co-founder Scanlon said in a Slack message to employees that the company has engaged external auditing firm Groom Lake to conduct an independent third-party investigation into the recent market-making irregularities.

In the message, he wrote: In this incident, Movement is the victim.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News