How can Web3 companies securely and compliantly manage mainland capital expenditure?

TechFlow Selected TechFlow Selected

How can Web3 companies securely and compliantly manage mainland capital expenditure?

Public blockchain development, DePIN, real-world asset tokenization (RWA), privacy protection, and cross-border payment PayFi are not actually prohibited in mainland China at present.

Authors: Lu Wenlong, Liu Honglin

The 2025 Web3 Festival, co-organized by Wanxiang Blockchain Lab and HashKey Group, was successfully held in Hong Kong from April 6 to 9. The event covered a wide range of trending sectors including public chain development, DePIN, real-world asset tokenization (RWA), privacy protection, and cross-border payment (PayFi). Both the venue size and the number of registered attendees significantly increased compared to last year, with a majority being ethnic Chinese, including many participants and professionals from mainland China.

* Image source: Internet

This reflects an interesting phenomenon within the Chinese-speaking Web3 community. Due to differing regulatory policies toward the Web3 industry between mainland China and Hong Kong, many Chinese teams choose to locate their market-facing operations and project implementation in Hong Kong while conducting core technical development in mainland China—thus meeting compliance requirements. On one hand, they can leverage Hong Kong’s status as an international financial hub and its policy innovations to build global brand influence; on the other, they benefit from mainland China’s deep pool of skilled technical talent for continuous product iteration.

However, this model creates a key industry challenge: how can Web3 companies compliantly sustain interaction between their mainland and overseas business units and achieve smoother cross-border capital flows? For example, how can mainland-based projects go global compliantly, how can overseas profits be repatriated legally, and how can offshore financing support mainland teams in a compliant manner?

In practice, ManQin Law has encountered numerous mainland clients who rely on informal methods such as founders using personal funds to cover expenses, paying employees through foreign bank accounts, or disbursing salaries in USDT to maintain daily operations. While these approaches may offer short-term relief, we believe they are neither compliant nor sustainable in the long run.

Compliance risks of several common current market practices

1. Founder uses personal account to front company expenses

This is effectively a form of corporate loan but lacks sustainability. Subsequent withdrawals from company revenue into the founder's personal account may lead to commingling of corporate and personal assets. Long-standing balances could be treated as dividends, triggering tax liabilities. If such advances are not properly recorded in the company’s books, it may be deemed concealment of employee income, potentially leading to allegations of individual income tax evasion.

2. Paying employees via overseas bank accounts

This violates existing wage payment regulations, causes inconvenience to employees, and may result in tax avoidance issues, creating significant tax risks. Additionally, social insurance (such as pension, medical, unemployment, work injury, maternity) and housing fund contributions for mainland employees are tied to declared wages. Direct offshore payments may deprive employees of statutory benefits, and enterprises may later face claims for back payments and administrative penalties.

3. Payment in USDT or other cryptocurrencies

This does not comply with current wage payment rules and introduces major compliance risks when converting crypto to fiat currency. It is a common scenario for both administrative and criminal violations in mainland China. Once authorities get involved, consequences range from frozen bank accounts and seized funds to serious criminal charges such as illegal business operations, aiding information network crime activities, or concealing and hiding proceeds of crime.

Root causes of these challenges

1. Regulatory policies restrict certain product applications to offshore markets only

From the 2013 "Notice on Preventing Bitcoin Risks," to the 2017 "Announcement on Preventing Risks of Token Issuance Financing," and the 2021 "Notice on Further Preventing and Addressing Risks of Virtual Currency Trading Speculation," regulatory scrutiny has continuously tightened—especially regarding product deployment and trading. Currently, mainland China strictly prohibits three main areas: initial coin offerings (ICOs) and virtual currency derivatives trading, virtual currency exchange services, and Bitcoin mining operations.

This means that such businesses must operate exclusively outside mainland China, with strict precautions against engaging mainland users.

However, other segments mentioned earlier—such as public chain development, DePIN, real-world asset tokenization (RWA), privacy-preserving technologies, and cross-border payments (PayFi)—are not explicitly banned in mainland China. In fact, some areas like RWA are encouraged under legal and compliant frameworks. For instance, Shanghai previously promoted the first agricultural-sector RWA project in China—the “Maju Grape RWA.” Interested readers may refer to ManQin Law’s prior article: ManQin Lawyers | In-depth Analysis of the First Agricultural RWA Project 'Maju Grape RWA' Model.

2. Mainland professionals primarily focus on neutral technical development

According to policy documents such as the *Regulations on the Administration of Blockchain Information Services* and the *Guidance on Accelerating the Application and Industrial Development of Blockchain Technology*, mainland China encourages blockchain technology mainly in the areas of underlying technical development (consortium chains, privacy computing), digital transformation of industries (supply chain finance, digital government, food traceability), and industry standard setting—aiming to integrate blockchain with the real economy. Furthermore, the 14th Five-Year Plan explicitly lists blockchain as a key digital economy industry and emphasizes synergistic innovation with AI, big data, and other technologies. Local governments also provide policy support in areas such as fiscal subsidies, talent recruitment, and blockchain industrial park construction.

Common compliant methods for legally repatriating overseas income or financing to mainland China

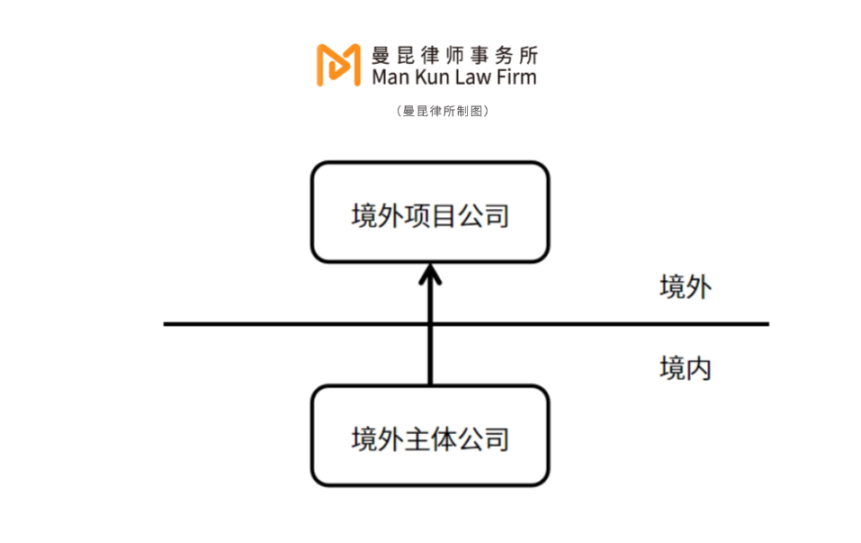

1. Establishing subsidiaries or making investments overseas, then remitting profits back

Mainland companies can set up overseas subsidiaries or make equity investments to conduct international business and subsequently remit subsidiary profits back to the mainland parent company in a compliant manner.

Procedures: Under the *Measures for the Administration of Overseas Investment by Enterprises* (NDRC Order No. 11) and the *Measures for the Administration of Overseas Investment* (MOFCOM Order No. 3), along with foreign exchange control regulations, mainland enterprises must submit applications to local NDRC, MOFCOM, and SAFE (delegated to banks) after demonstrating the authenticity, necessity, and rationality of the overseas investment. Upon obtaining required approvals or registration, funds can be transferred overseas for use by the subsidiary. When applying, enterprises should assess whether the destination country/region or target industry is classified as sensitive and prepare documentation accordingly.

Additionally, regulators often evaluate the reasonableness and necessity of outbound investments based on criteria such as the mainland enterprise’s age, profitability, and debt levels.

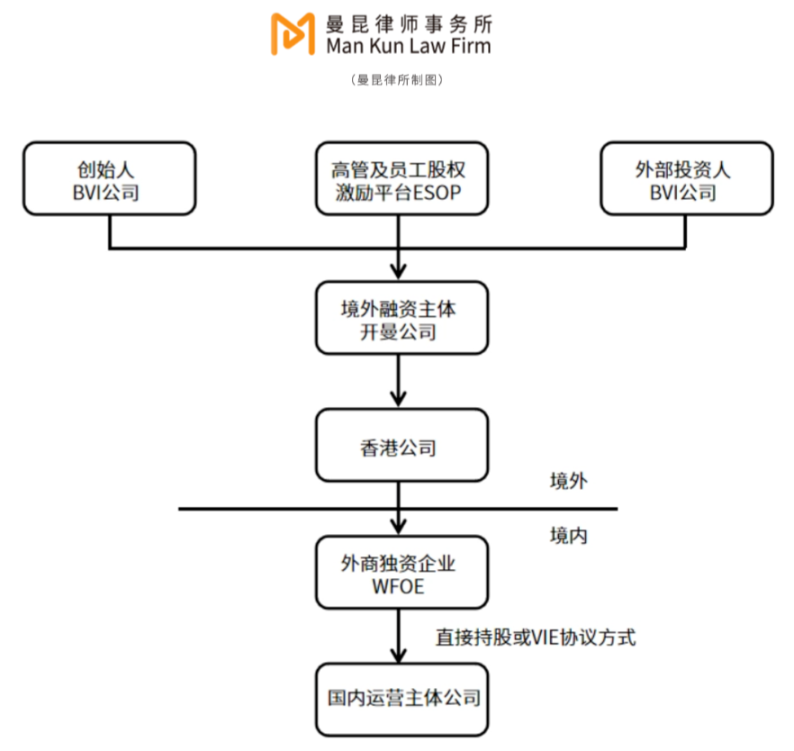

2. Repatriation of overseas financing proceeds

Mainland residents or enterprises can raise capital overseas through offshore structures and reinvest those funds back into mainland operations.

Procedures: Based on the *Circular on Issues Concerning Foreign Exchange Management for Overseas Financing and Round-Trip Investment by Domestic Residents Through Special Purpose Companies* (SAFE [2014] No. 37) and the *Foreign Exchange Regulations*, mainland individual shareholders must apply to the local foreign exchange authority (delegated to banks) to register, provided the source of funds and intended use abroad are genuine. After completing SAFE registration, they may proceed with domestic company equity changes or sign control agreements, receive capital from foreign investors, and repatriate offshore financing proceeds for use in mainland operations or round-trip investments.

3. Receiving service fees under service trade contracts with overseas clients

Companies can enter into service agreements with overseas clients for services such as telecommunications, computer and information services, research and development, or professional management consulting, and collect fees according to contract terms.

For example, if a company engages in software export, and delivery occurs electronically (e.g., via download), it can complete foreign exchange receipt procedures at a bank using contracts, invoices, and other transaction records. If the software is delivered on physical media and grants perpetual usage rights, foreign exchange receipts must follow goods trade regulations instead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News