Is the crypto market entering a winter?

TechFlow Selected TechFlow Selected

Is the crypto market entering a winter?

Any geopolitical changes or regulatory breakthroughs could quickly rewrite the current market narrative.

Author: Liu Jiaolian

Coinbase Institute has released a report expressing bearish views on the crypto market. In this report, the Coinbase research team conducted an in-depth analysis of whether the cryptocurrency market has entered a bear market. The original link to the report is available in the internal reference. Here, we discuss some of its key perspectives.

The report notes that both Bitcoin and the COIN50 Index have recently fallen below their 200-day moving averages—a technical indicator widely regarded as a signal for long-term trend reversals. Meanwhile, the total market capitalization of cryptocurrencies excluding Bitcoin has declined by 41% from its peak of $1.6 trillion in December 2024 to $950 billion, while venture capital funding has dropped 50–60% compared to the 2021–2022 peaks. These indicators collectively suggest the market may be entering a new "crypto winter."

The report first explores how bull and bear cycles in the cryptocurrency market should be defined.

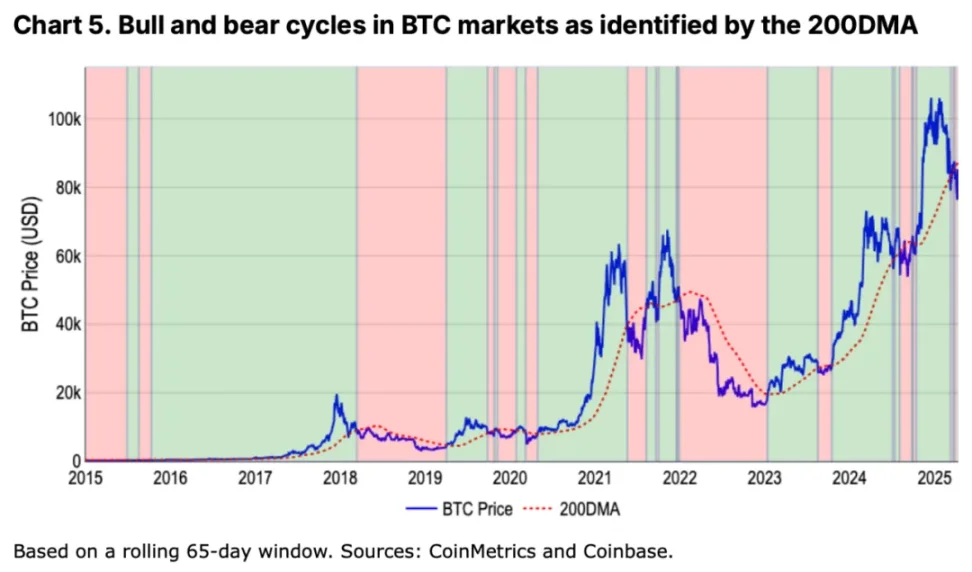

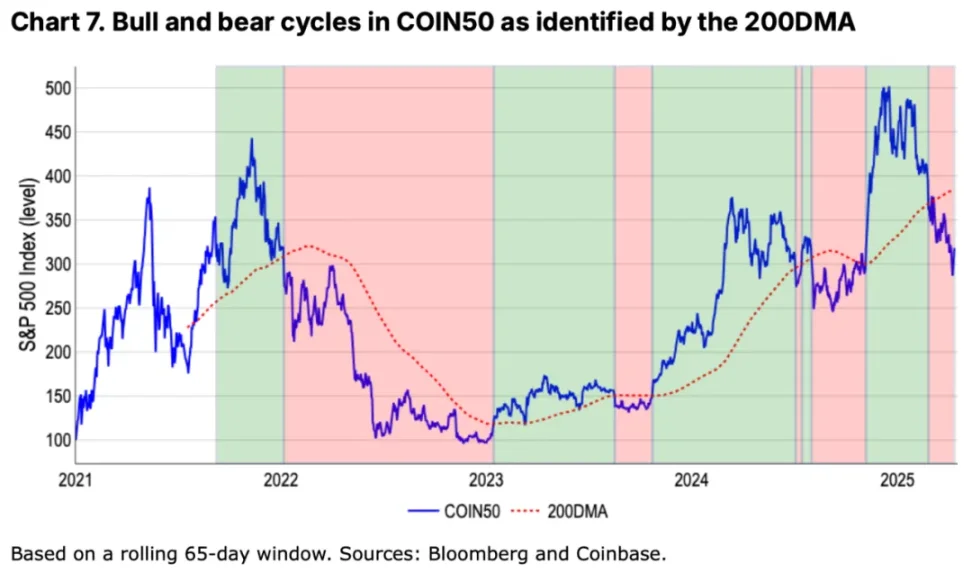

The traditional stock market often uses a 20% price change threshold to distinguish between bull and bear markets, but this benchmark proves inadequate in the more volatile crypto space. For example, Bitcoin once dropped over 20% within a single week while still being in a long-term uptrend. In contrast, the 200-day moving average (200DMA) has proven to be a more reliable tool—when prices trade persistently below this level with downward momentum, it is considered indicative of a bear market.

Data shows that Bitcoin began meeting this criterion in late March 2024, while the COIN50 Index, which tracks the top 50 tokens, entered bear market territory as early as late February.

Multiple structural pressures underlie the current market weakness. The implementation and potential escalation of global tariff policies have intensified negative sentiment, and traditional risk assets continue to face pressure amid fiscal tightening. This macroeconomic uncertainty has directly spilled over into the crypto market. Although venture capital investment saw a sequential rebound in Q1 2025, it remains roughly half of its cycle highs, resulting in particularly limited new capital inflows into the altcoin sector. Notably, Bitcoin’s drawdown during this correction has been less than 20%, whereas other tokens have collectively declined by 41%. This divergence confirms the higher risk premium characteristic of altcoins.

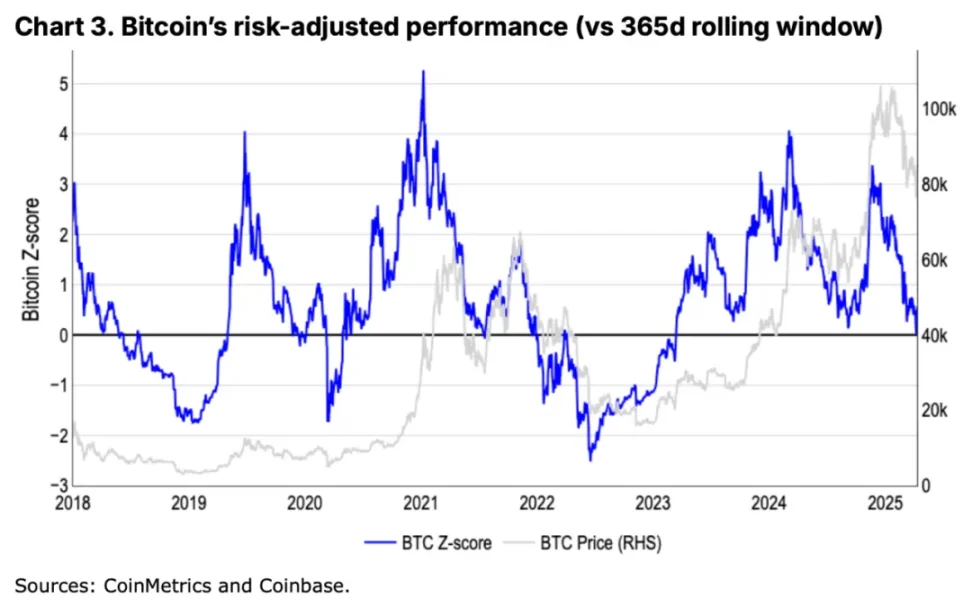

The report validates the severity of the current trend using risk-adjusted performance metrics (z-scores). From November 2021 to November 2022, Bitcoin’s price fell 76%, equivalent to a 1.4 standard deviation move. This risk-adjusted magnitude was comparable to the S&P 500’s 22% decline (1.3 standard deviations) over the same period. While such quantitative methods effectively filter out market noise, they often suffer from lagging signals. For instance, the model did not confirm the end of the bull market until late February and has since maintained a “neutral” rating, failing to capture the sharp March downturn in a timely manner.

Historical data reveals the essential characteristics of bear markets. True structural shifts are typically accompanied by shrinking liquidity and deteriorating fundamentals—not merely percentage price changes. During past phases such as the 2018–2019 crypto winter, the 2020 pandemic shock, and the Federal Reserve's rate-hiking cycle in 2022, the 200-day moving average model accurately identified trend reversals. In the current environment, early warning signs such as narrowing market depth and defensive sector rotation are already emerging—phenomena that historically preceded significant downturns.

The Coinbase research team believes that although a defensive posture remains necessary in the short term (over the next 4–6 weeks), the market could bottom out in mid-to-late Q2 2025, setting the stage for a recovery in Q3.

This outlook is based on two key insights: first, the crypto market is extremely sensitive to shifts in sentiment, and once a turning point occurs, rapid reversals are common; second, marginal improvements in the current regulatory landscape could serve as a unique catalyst for future rebounds. However, the report also emphasizes that in the context of weak performance in equity markets, standalone upward momentum in crypto faces significant challenges.

As the cryptocurrency ecosystem continues to expand into new domains such as Memecoins, DeFi, and AI agents, relying solely on Bitcoin as a market barometer is increasingly insufficient. The report recommends investors adopt a more comprehensive evaluation framework, incorporating multi-dimensional data such as total market cap, risk capital flows, and technical indicators.

The research team’s market forecasts since 2022 have demonstrated high predictive value, including accurate calls on the Q1 2023 rebound and the Q4 2024 rally.

The report ultimately conveys a cautious yet non-pessimistic core message. While technical indicators and capital flows clearly signal that the market has entered a correction phase, the inherent high volatility of crypto assets also implies that recovery could come faster than in traditional markets. For investors, this phase is better suited for tactical portfolio positioning—managing overall risk exposure while preparing for a potential shift in market sentiment.

Nonetheless, all analyses are based on existing data, and the cryptocurrency market is famously unpredictable. Any geopolitical developments or regulatory breakthroughs could rapidly rewrite the current market narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News