Crypto Project Valuation Models: A Multidimensional Analysis from Metcalfe's Law to Discounted Cash Flow

TechFlow Selected TechFlow Selected

Crypto Project Valuation Models: A Multidimensional Analysis from Metcalfe's Law to Discounted Cash Flow

Crypto projects have different characteristics, economic models, and token utilities, requiring the exploration of valuation models tailored to each sector.

Author: 0xCousin, IOBC Capital

Crypto has become one of the most dynamic and promising sectors in fintech. With increasing institutional capital inflows, properly valuing crypto projects has become a critical issue. Traditional financial assets have well-established valuation frameworks, such as discounted cash flow (DCF) models and price-to-earnings (P/E) ratios.

Given the wide variety of crypto projects—including public blockchains, CEX platform tokens, DeFi protocols, and meme coins—each with distinct characteristics, economic models, and token utilities—we must develop tailored valuation models for each category.

I. Public Blockchains — Metcalfe’s Law

Understanding the Law

Metcalfe’s Law states that the value of a network is proportional to the square of the number of its nodes.

V = K×N² (where V is network value, N is the number of active nodes, and K is a constant)

Metcalfe’s Law is widely accepted in forecasting the value of internet companies. For example, research in the paper “On the Value of Facebook and Tencent, China’s Largest Social Network” (Zhang et al., 2015) showed that over a 10-year period, company valuations closely followed the pattern predicted by Metcalfe’s Law relative to user count.

Ethereum Example

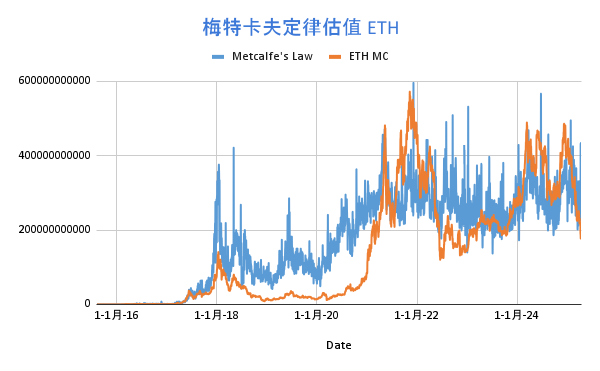

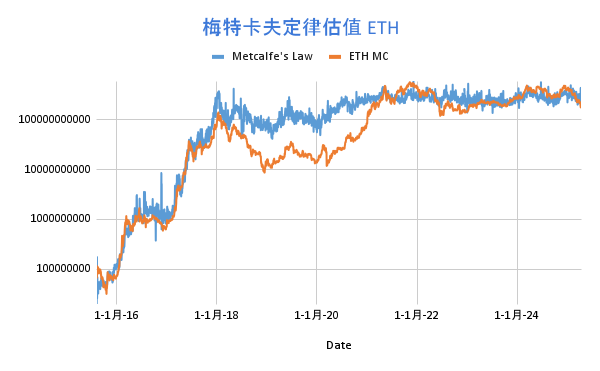

Metcalfe’s Law can also be applied to valuing public blockchain projects. Western researchers have found that Ethereum’s market cap exhibits a logarithmic-linear relationship with daily active users, broadly aligning with Metcalfe’s formula. However, Ethereum’s market cap correlates more closely with N^1.43 rather than N², with K set at 3,000. The adjusted formula is:

V = 3,000 × N^1.43

Statistics show a notable correlation between valuations derived from Metcalfe’s Law and ETH’s actual market cap trends:

Log-scale chart:

Limits of the Model

Metcalfe’s Law has limitations when applied to emerging blockchains. In early stages, when user bases are small, the law may not provide accurate valuations—this applies to early Solana or Tron, for instance.

Additionally, the model fails to account for factors such as staking rates’ impact on token prices, long-term effects of EIP-1559-style fee burning, or ecosystem dynamics around security ratios and Total Value Secured (TVS).

II. CEX Platform Tokens — Profit-Driven Buyback & Burn Model

Model Overview

Centralized exchange (CEX) platform tokens resemble equity tokens, deriving value from exchange revenues (trading fees, listing fees, financial services), exchange market share, and ecosystem growth. Most platform tokens include buyback and burn mechanisms, and some also incorporate gas fee burning akin to public chains.

Valuing platform tokens requires assessing both future cash flows—discounted to present value—and the impact of token burns on scarcity. Therefore, price movements generally correlate with trading volume growth and the rate of supply reduction. A simplified valuation formula under the profit-driven buyback & burn model is:

Token Value Growth Rate = K × Trading Volume Growth Rate × Supply Burn Rate (where K is a constant)

BNB Example

BNB is the most iconic CEX platform token. Since its launch in 2017, it has gained strong investor confidence. BNB’s value accrual mechanisms have evolved through two phases:

Phase 1: Profit-Based Buyback — From 2017 to 2020, Binance used 20% of quarterly profits to buy back and burn BNB.

Phase 2: Auto-Burn + BEP95 — Starting in 2021, Binance introduced an Auto-Burn mechanism independent of profits, calculating burn amounts based on BNB’s price and quarterly block production on BNB Chain. Additionally, BEP95 introduced real-time fee burning (similar to Ethereum’s EIP-1559), where 10% of each block’s reward is burned. To date, BEP95 has burned 2,599,141 BNB.

The Auto-Burn amount is calculated using the following formula:

Where N is the quarterly block production on BNB Chain, P is the average quarterly BNB price, and K is a constant (initially 1,000, adjustable via BEP proposals).

Assuming Binance’s trading volume grows by 40% in 2024, and the BNB supply burn rate is 3.5%, with K = 10:

BNB Value Growth Rate = 10 × 40% × 3.5% = 14%

This implies that under these assumptions, BNB should appreciate by 14% in 2024 compared to 2023.

To date, over 59.5 million BNB have been burned, averaging 1.12% of remaining supply per quarter.

Limits of the Model

In practice, this valuation approach requires close monitoring of exchange market share. If an exchange loses market share over time, even solid current earnings may not sustain future expectations, thereby lowering the token’s valuation.

Regulatory changes also significantly affect CEX token valuations, as policy uncertainty can shift market sentiment and long-term outlooks.

III. DeFi Projects — Discounted Cash Flow (DCF) Valuation

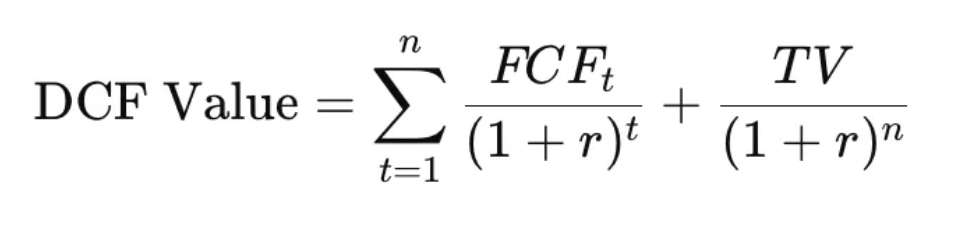

The core logic of applying DCF to DeFi projects is projecting future cash flows generated by the token and discounting them to present value.

Where FCFt is free cash flow in year t, r is the discount rate, n is the forecast period, and TV is the terminal value.

This method determines a token’s current value based on expected future protocol earnings.

RAY Example

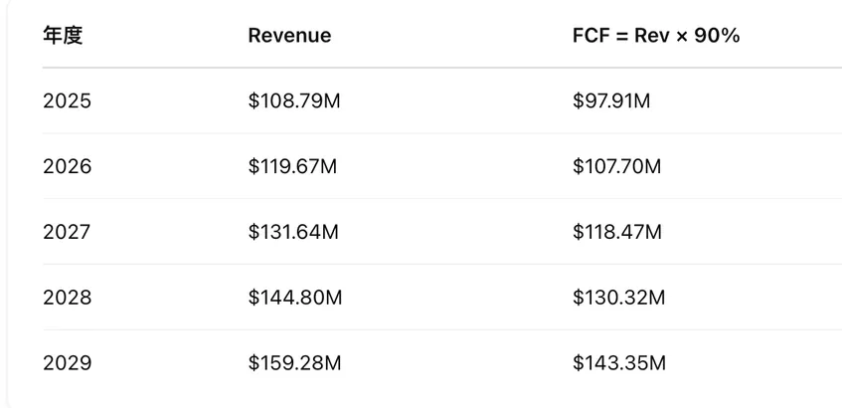

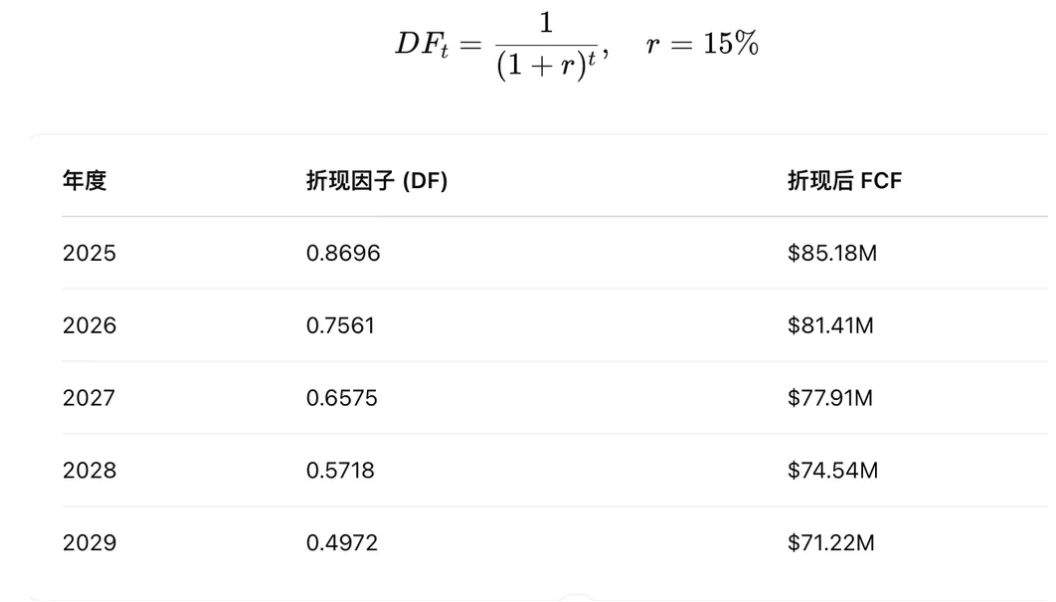

In 2024, Raydium generated $98.9 million in revenue. Assume 10% annual growth, 15% discount rate, 5-year forecast horizon, 3% perpetual growth rate, and 90% FCF conversion.

Projected cash flows over five years:

Total discounted FCF over five years: $390.3 million

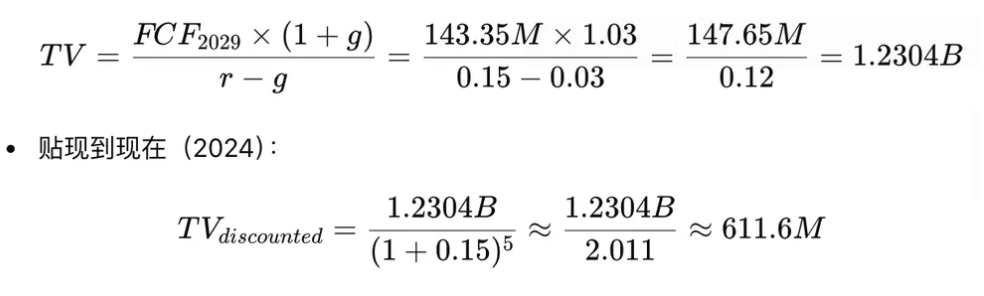

Terminal Value (discounted): $611.6 million

Total DCF Valuation = TV + FCF = $611.6M + $390.3M = $1.002B

Raydium’s current market cap is $1.16B, which is reasonably close. Of course, this assumes consistent 10% annual growth—unrealistic during bear markets (when negative growth is possible) or bull markets (where growth could exceed 10%).

Limits of the Model

DeFi valuation faces several challenges: First, governance tokens often do not capture protocol revenue due to SEC securities concerns, preventing direct dividends. While workarounds exist (e.g., staking rewards, buybacks), incentives to return profits to token holders remain weak. Second, forecasting cash flows is extremely difficult due to rapid market cycles, volatile protocol revenues, shifting competition, and unpredictable user behavior. Third, selecting an appropriate discount rate is complex, requiring assessment of market and project-specific risks—small changes in r can drastically alter valuations. Fourth, some DeFi tokens employ buyback-and-burn mechanisms, altering supply dynamics and potentially invalidating pure DCF approaches.

IV. Bitcoin — A Multifaceted Valuation Approach

Mining Cost Valuation

Data shows that over the past five years, Bitcoin’s price has spent only about 10% of the time below the operating cost of mainstream mining hardware. This highlights mining cost as a key floor for Bitcoin’s price. Historically, periods when price falls below mining cost have often presented excellent investment opportunities.

Gold Substitute Model

Bitcoin is often called “digital gold,” serving as a store of value similar to physical gold. Currently, Bitcoin’s market cap is about 7.3% of gold’s. If this ratio rises to 10%, 15%, 33%, or 100%, Bitcoin’s price would reach approximately $92,523, $138,784, $305,325, and $925,226 respectively. This model provides a macro-level benchmark by comparing Bitcoin to gold’s established role.

However, key differences remain: Gold has millennia of recognition as a safe-haven asset, industrial applications, and physical backing. Bitcoin, by contrast, is a virtual asset whose value stems from technological innovation and market consensus. These distinctions must be carefully weighed when applying the model.

Conclusion

This article advocates for developing robust valuation models for crypto projects to promote sustainable growth and attract institutional investment.

Especially in bear markets, when weak projects fall away, we must apply the strictest standards and simplest logic to identify those with enduring value. Just as savvy investors recognized post-bubble potential in Google and Apple around 2000, we should seek out the crypto-native equivalents—the future “Googles” and “Apples”—amid today’s downturn.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News