Viewpoint: Trump's tariff policy will trigger the end of the Kondratiev wave and a transformation in Bitcoin

TechFlow Selected TechFlow Selected

Viewpoint: Trump's tariff policy will trigger the end of the Kondratiev wave and a transformation in Bitcoin

Kangbo inflection point, Bitcoin transformation.

Author: Gary Yang, Incubation Investor of CICADA

Written in Singapore on April 14, 2025

Trump's tariff policy has triggered global market turmoil and widespread anxiety. The VIX index reached 52 on April 8, but clearly, this is still far from sufficient to release the complex superimposed contradictions of this phase. With fiscal and monetary policies seemingly offering only temporary emotional relief, the simultaneous sell-off across bonds, equities, and currencies—occurring amid mass panic—has pushed asset allocation into a dead end. What should one hold now? This has become the central question on everyone’s mind in Q2 2025.

Will Bitcoin rebound and rise again? This was undoubtedly the most frequently asked question during the Web3 Festival in Hong Kong in the first two weeks of April. Across numerous panels and meetings, participants repeatedly raised and pondered how Trump’s tariff policies might impact the crypto market and the trajectory of Bitcoin prices. Honestly, this seemingly simple question isn’t easy to answer—which is why I’ve written this article upon returning, as a reference for readers.

1. The Bond-Equity-Currency Triple Sell-Off and the Failure of the Merrill Lynch Investment Clock

Why has Trump adopted such extreme tariff policies? At first glance, it appears MAGA-aligned—aimed at reducing import dependency, boosting employment, and mobilizing political sentiment. Unfortunately, American citizens aren’t simply loyalist followers; persistently high inflation and a $1.3 trillion fiscal deficit are hardly fertile ground for public buy-in on “Made in America.” Real survival concerns have become urgent and irreconcilable. When neither fiscal nor monetary policy proves effective, tariffs become a last-resort, suboptimal move. As Buffett recently stated in an interview: “They (tariffs) are an act of war to some degree.” While many of Buffett’s views may be outdated relative to the next paradigm, this assessment remains highly accurate: the world stands at the juncture of a new Kondratiev wave transition, where the postwar peace and credit system have largely collapsed, and the reshaping of new mechanisms in this chaotic era has already begun.

Beyond the elevated VIX, the synchronized decline in bonds, equities, and currencies is a clear signal. At the recent Web3 Festival in Hong Kong, I had the pleasure of discussing with Dr. Yi the historical parallels between today’s triple sell-off and those observed in 1929 and 1971. The economic indicators and external environments of those two periods bear striking resemblance to 2025. Whether history repeats with depression plus regional wars, Cold War-style confrontation, or an entirely new script will depend on (or rather, be reflected by) safe-haven financial assets—especially gold. The adage “hoard gold in turbulent times” captures the essence of such Kondratiev turning points. It's important to note that gold’s current role differs fundamentally in dimension from its commodity function during overheating phases within the Merrill Lynch framework.

According to the standard view of the Merrill Lynch Investment Clock, the shift from stagflation to recession transitions dominance from cash to bonds, with inertia leading to expectations of recovery and eventually equity-led growth. Clearly, we are not in such a state. External conditions do not support entry into a recovery phase, rendering the Merrill Lynch Clock unable to progress further. Against this backdrop, gold repeatedly hitting new highs clearly operates outside the logic of the Merrill Lynch model. This divergence becomes even more evident when comparing other commodities: crude oil, silver, copper, soybeans, rubber, cotton, rebar—all remain roughly flat or slightly above pre-pandemic levels, lagging significantly behind gold’s surge.

The failure of the Merrill Lynch Clock indicates that both economic policy and market experience in this phase deviate from conventional expectations. Trump’s tariff policy, from a macro perspective, is merely a passive agent driven by historical patterns.

Three additional points are worth noting: ① The breakdown of the Merrill Lynch Clock applies only under cross-Kondratieff junctions where its underlying assumptions fail; however, the model’s intrinsic logic remains valid under appropriate external conditions. ② Besides gold, other safe-haven financial assets also gain relevance during such transitions—for example, the recent global rush into quant funds and CTA strategies is no accident. Whether Bitcoin can seize this moment to prove itself as “digital gold,” breaking positive correlations with other financial assets and charting an independent course, remains to be seen. ③ The exact stage at which the Merrill Lynch Clock fails varies across different historical Kondratieff transitions and is not crucial from a pattern-recognition standpoint. However, for specific asset allocators—particularly asset managers and family offices still relying on outdated strategies—this demands immediate attention and strategic adjustment.

2. Thucydides’ Trap and Comparison with the Endings of Five Historical Kondratieff Cycles

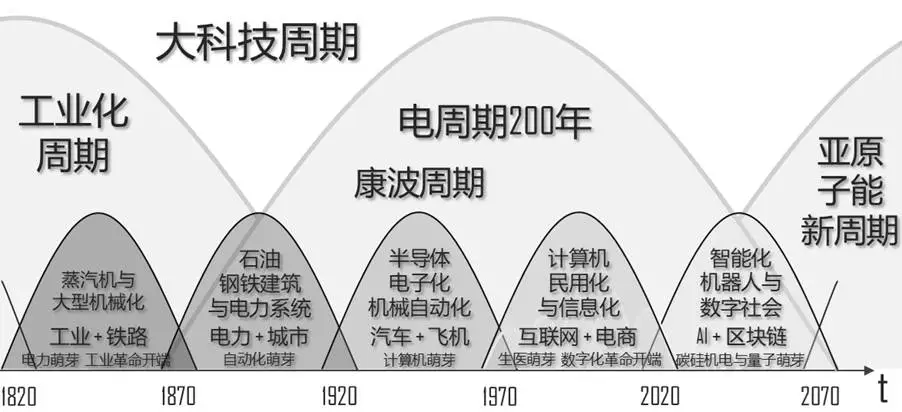

In 2020, I compiled a diagram illustrating industry evolution and geopolitical dynamics across five past Kondratieff cycles. Yet few have personally experienced two such cycle intersections. Only now, feeling the real-world impacts through economic and policy shifts, does the situation become truly tangible.

Historically, Kondratieff turning points often coincide with intensifying tensions—or perceived threats—associated with Thucydides’ Trap. This time is no exception, though the dynamic now centers on China and the U.S., two nations with vastly different civilizational trajectories. That Trump’s tariff policy erupts at this juncture is therefore entirely predictable.

The table below compares key aspects of the final stages of the five previous Kondratieff waves:

(Note: Thucydides’ Trap parties are presented in order of Ruling Power – Rising Power)

When viewed over the long arc of history, the failure of the Merrill Lynch Clock and conventional economic policy appears natural. The energy conflicts at Kondratieff boundaries vastly exceed the cyclical fluctuations described by the investment clock, shattering its progression and plunging us into a chaotic era.

A direct comparison makes our current position and likely decade ahead starkly clear. Rather than dwell on similarities, we must consider paradigm-shifting questions: ① Will the new technological paradigm—digitalization and AI—drive fundamental innovation in global production relations and governance models? ② Are China and the U.S. truly the core parties in a modern Thucydides’ Trap? ③ What role do Bitcoin and crypto play in addressing these two questions?

3. Greenspan’s Prophecy and the Significance of Crypto at the Kondratieff Junction

Like tariff policies during past Kondratieff transitions, Trump’s current measures risk triggering butterfly effects. Whether handling domestic economic issues or Sino-U.S. relations, any clumsy or unreasonable approach will inevitably catalyze cascading disruptions characteristic of chaotic eras.

Yet what may fail extends beyond just the Merrill Lynch Clock under this Kondratieff crossover. In the longer term, the very essence of production units and labor organization—shaped over two centuries since the Industrial Revolution—is being transformed by digitalization and AI. The historical era in which the Fed used traditional monetary and fiscal tools to manage the U.S. economy—and thereby influence global trade and stability—is now facing severe challenges, if not outright obsolescence.

In his 2013 reflective work The Map and the Territory: Risk, Human Nature, and the Future of Forecasting, Alan Greenspan noted:

“We must accept that monetary and fiscal policy cannot permanently boost economic growth in the presence of deeply rooted structural constraints.”

It’s likely most people now recognize—or at least sense—that the world faces profound structural constraints. The global order and economic policy frameworks evolved since the Industrial Revolution increasingly mismatch the needs of rapid digital and AI advancement. Since the explosive onset of the digital and AI era, production tools have evolved exponentially. Combined with 16 years of four-cycle development in the crypto market and degenerate culture since Bitcoin’s emergence in 2009, the accumulated forces of productivity and production relations are poised for qualitative transformation at this fragile Kondratieff juncture.

We cannot definitively claim that Crypto and Blockchain Protocol Management will immediately assume all economic governance functions from the prior paradigm. But this trend is unmistakable. For decades to come, the world will likely exist under a dualistic parallel governance structure: on one hand, Crypto and Blockchain Protocol Management gradually expanding their dominance over global economics, finance, transactions, settlements, and even aspects of social governance; on the other, nation-state-based systems—covering society, economy, monetary and fiscal policy—continuing to operate in certain regions according to established cultural norms and interest structures. This aligns with the resolution path previously outlined in my article “Post-Trump Victory: A New Global Order” regarding today’s “primary global contradiction.”

In summary, the significance of crypto at this intersection and inflection point is immense—it will comprehensively reshape the global economic and social landscape.

4. What Is the Real Thucydides’ Trap This Time?

I don’t believe the current Thucydides’ Trap lies strictly between China and the U.S.—not because their economies aren’t competitive, nor because Huntington was right in suggesting future major clashes would occur between the West and the Islamic world. This paradigm shift transcends national and ethnic boundaries.

As early as 2014, a renowned Korean investor friend who backed Kakao told me he believed major cities around the world were becoming culturally similar—so much so that urban consensus across nations now exceeds that within individual countries. Recent trends among Digital Nomads and Degens further validate this observation.

When analyzing historical patterns like Thucydides’ Trap, we must compare both historical analogies and examine them through the lens of technological and productive change. Especially at this juncture breaking deep structural constraints, the differences between Chinese and American governance approaches are arguably smaller than those between TradFi and DeFi, common law and crypto protocols, or conservative ideologies and degenerate culture.

As I previously wrote: “Most nations and stakeholders globally remain in a semi-feudal, semi-centralized state-capitalist environment. The current primary contradiction is driving a transition toward a hybrid system blending semi-centralized state capitalism with semi-decentralized digital information governance.” The ongoing Kondratieff crossover, accumulating contradictions, and transformative momentum will inevitably steer us toward the latter.

Looking back at changes following the past five crossovers, chaos and reconstruction, surges in safe-haven assets, and rapid advancement of new production technologies were inevitable. What differs this time is that while the accumulated energy is stronger and more globalized, the direction of change is decentralized and systemically abstract. Therefore, to revisit the earlier question, I believe this node of energy release is more likely to follow an entirely new, independent script—one of high global disorder, but without concentrated adversarial focus.

5. Bitcoin’s Shifting Correlation with Chaos: Changing Perceptions and Parallels with the Merrill Lynch Problem

Under these conditions, Bitcoin appears fully prepared to claim its title as “digital gold.” Yet history remains nonlinear. As of Q2 2025, despite rising chaos and panic, Bitcoin still lags behind gold in safe-haven strength. During periods of heightened disorder, it continues to exhibit performance similar to bonds, equities, and currencies—its price remaining negatively correlated with chaos levels.

Defining “chaos” precisely is beyond the scope here. However, useful indicators include the VIX, MOVE index, implied volatilities across asset classes, Libor-OIS spread, gold volatility, deviations between Fed and central bank rates, share of negative-yielding countries, war risk indices, and degrees of global trade fragmentation.

This residual negative correlation stems primarily from holder psychology. A significant portion—likely half or more—of Bitcoin holders still view it through the lens of capital appreciation or outright speculation. These holders also exhibit high turnover rates. (The estimate of “around half” accounts for long-term locked or lost private keys, as well as inactive wallets—irrational sources of positive correlation.)

Nevertheless, over the past six months, Bitcoin has increasingly diverged from other altcoins. Though not negatively correlated with alts, Bitcoin’s resilience during market downturns has become progressively evident—especially amid rising chaos since late 2024. This suggests a quiet shift: Bitcoin’s negative correlation with chaos is weakening, while its positive correlation grows stronger.

Since taking office for his second term, Trump has signed over 100 executive orders, consistently advancing pro-crypto regulatory easing. Combined with the recent tariff policy acting as an accelerant, these actions collectively fuel the Kondratieff crossover, intensifying the clash between old and new paradigms—and accelerating Bitcoin’s reversal in chaos correlation.

By mid-April 2025, the SEC has formally dropped lawsuits against multiple crypto projects, including Uniswap, Gemini, OpenSea, Kraken, Consensys, Cumberland, Coinbase, and Ripple. Additionally, the FDIC and OCC have made major regulatory adjustments, eliminating requirements for banks to seek approval or file reports before engaging in crypto-related activities. These developments remain largely unpriced amid prevailing panic, leaving the $2.6 trillion market exposed to numerous unrealized catalysts—notably the rapidly growing RWA and PayFi sectors yet to be discussed.

Standing at the end of history’s “junk time,” we must ask two questions: ① Before achieving positive correlation with chaos, will there be another emotionally driven selloff? ② How long until Bitcoin achieves strong positive correlation with chaos, solidifying its status as a safe-haven asset like gold? Catalysts that ignite such trends typically require shifting entrenched market and public perceptions—a process that usually takes considerable time. But given the compressed timeline of this historical juncture, smooth transitions are unlikely. Bitcoin, however, has always challenged mainstream cognition, educating markets through counter-consensus moves. Thus, extreme or counterintuitive market movements are highly probable in the near future.

Similar to the Merrill Lynch Clock, Bitcoin’s halving cycle creates a four-year bull-bear rhythm in crypto markets. Emotionally and behaviorally, the cycle mirrors traditional markets—but 2.5 times faster. After 16 years and four cycles, however, irregularities emerged this year, leading many to believe we’re in a “bull market in name only” and blaming ETF inflows and meme-driven confidence collapses for strategy failures. Fundamentally, I believe these disruptions stem from interference by Kondratieff-level energies—global chaos disrupting crypto’s internal rhythms. Past cycles helped institutionalize Bitcoin and establish it in national strategic reserves and professional portfolios. Now, precisely at this Kondratieff crossover, breaking those familiar patterns may be the very moment Bitcoin undergoes its metamorphosis into digital gold.

In sum, 2025—as a pivotal Kondratieff turning point—may bring a brief, experience-breaking downturn. But soon after, we’ll witness Bitcoin’s qualitative shift toward positive correlation with chaos, catalyzing the next phase of broad crypto market growth: the second curve of crypto expansion.

6. The Fundamental Drivers Behind the Sustained Growth of Crypto’s Second Curve

At the early April 2025 Web3 Festival in Hong Kong, RWA topics dominated discussions, surpassing previous skepticism from native degens.

Pursuit of real yield and sustainable development has gradually become a new consensus in the crypto market this year. History progresses through necessity: after enduring the 2024 meme and BTCFi frenzy, continued reliance on narrative-driven evangelism—the logic of the first curve—is no longer credible without integration of real yields and real applications.

In my earlier article “The Second Curve of Crypto Growth,” I discussed initial phenomena and causes behind the rise of RWA and PayFi. Through the lens of the Kondratieff crossover described here, we now see the deeper reason: the irreversible institutional demand for new paradigms amid chaos and transformation.

Many wonder whether RWA and PayFi might fade like past narratives, never to return. But unlike fleeting stories or empty staking, long-term institution-building delivers sustained value.

By Q1 2025, numerous practical PayFi applications and RWAFi funds have rapidly emerged. Projects, protocols, and public chains like CICADA.Finance and Plume are developing at pace, set to transform the 2025 market landscape and lay a robust foundation for sustained growth along crypto’s second curve.

Trump’s tariff policy is merely a butterfly effect—but it ignites a Kondratieff crossover brimming with historic opportunities. The anticipated and imminent reversal in Bitcoin’s correlation with chaos will serve as a key driver for the growth of second-curve crypto sectors—including RWA and PayFi—marking the beginning of crypto and blockchain protocol management’s deeper integration into global economics, finance, transactions, settlements, and broader societal governance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News