Find Your Role: Which Type of On-Chain Player Are You? And Which Type Suits You Best?

TechFlow Selected TechFlow Selected

Find Your Role: Which Type of On-Chain Player Are You? And Which Type Suits You Best?

On-chain users can generally be divided into three categories: airdrop farmers, DeFi farmers, and traders.

By Yue Xiaoyu

On-chain users can generally be divided into three categories: airdrop hunters, DeFi users, and traders.

Airdrop Hunters: These users focus on participating in Web3 project airdrops to obtain token rewards at low or even zero cost. Their goal is typically short-term profit, and they are often referred to as "reward farmers" or "airdrop chasers."

DeFi Users: These users are passionate about DeFi, earning returns through liquidity provision, staking, lending, arbitrage, and other strategies, aiming for more stable long-term yields.

Traders: This group specifically refers to meme coin traders who primarily speculate, hoping to catch the next “diamond hand” opportunity and get rich quickly.

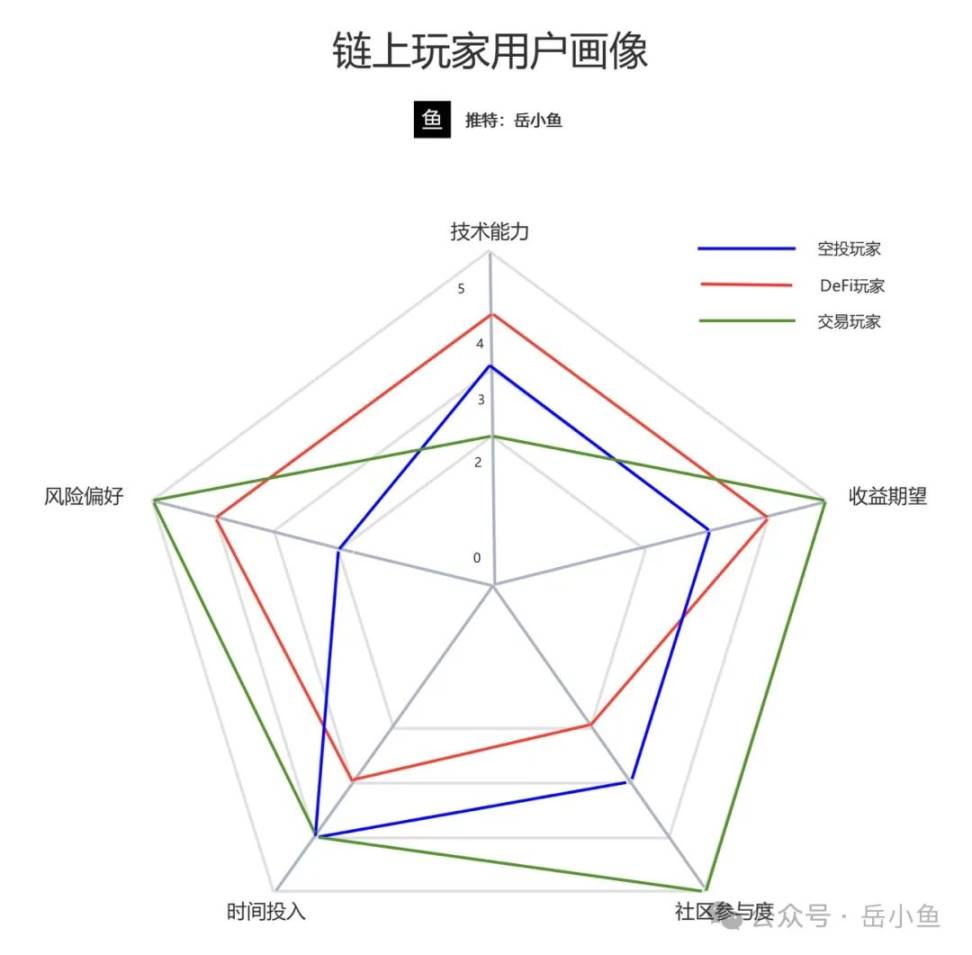

These three user groups have very distinct characteristics. I’ve used a radar chart to compare them across key dimensions so you can see which type you currently are—and which one you’d like to become.

The comparison covers five dimensions: technical ability, risk tolerance, time commitment, community engagement, and return expectations.

Each dimension is scored from 1 to 5 (1 being the lowest, 5 the highest).

Key Takeaways:

Airdrop Hunters: The radar chart shows a shape skewed toward "time commitment," with moderate technical ability and community involvement, but lower risk tolerance and return expectations—forming a relatively balanced but inward pentagon.

p>DeFi Users: The chart highlights "technical ability" and "risk tolerance," with high return expectations, but lower community engagement and time commitment—forming an outward-extending shape that narrows at the base.Meme Coin Traders: The chart strongly favors "risk tolerance," "return expectations," and "community engagement," with low technical ability—resulting in an overall outward-facing profile.

You can reflect on your own behavior and preferences:

-

If you have plenty of time, limited capital, and low risk tolerance, airdrop hunting might be the right fit for you;

-

If you're technically inclined, enjoy research, and have some capital, becoming a DeFi user could suit you well;

-

If you enjoy speculation, can tolerate high risk, and aim to get rich through trading, then meme coin trading may be your path.

Here’s a detailed breakdown:

1. Airdrop Hunters

-

Technical Ability (3/5): Requires basic blockchain operations (e.g., wallet usage, testnet interactions), but no deep understanding of smart contracts or complex DeFi mechanisms.

-

Risk Tolerance (2/5): Low risk, as the main costs are time and minimal gas fees; failure results in negligible losses.

-

Time Commitment (4/5): Requires significant time researching new projects and completing tasks (e.g., Discord events, test interactions) to avoid missing opportunities.

-

Community Engagement (3/5): Active on platforms like Discord and Twitter, but mostly to complete tasks rather than deeply engage with community culture.

-

Return Expectations (3/5): Hope to gain substantial rewards from airdrops, but due to varying project quality, outcomes are highly uncertain.

2. DeFi Users

-

Technical Ability (4/5): Requires understanding of complex DeFi protocols (e.g., Uniswap, Aave), liquidity pool mechanics, and risk management (e.g., impermanent loss).

-

Risk Tolerance (4/5): Willing to take on higher risks (e.g., smart contract vulnerabilities, market volatility), but often mitigate losses through diversified strategies.

-

Time Commitment (3/5): Requires regular monitoring and strategy adjustments, but not as frequent as airdrop hunting.

-

Community Engagement (2/5): More focused on personal gains than community activities; engagement is low unless governance voting is involved.

-

Return Expectations (4/5): Seek stable and relatively high annualized returns (e.g., 10%-100%), with little interest in quick, massive gains.

3. Meme Coin Traders

-

Technical Ability (2/5): Simple operations—only basic wallet and trading knowledge required; no deep technical expertise needed.

-

Risk Tolerance (5/5): Extremely high risk tolerance, willing to participate in projects with high chance of going to zero, chasing dreams of 100x or even 1000x returns.

-

Time Commitment (4/5): Heavily reliant on market sentiment and trends, requiring constant monitoring of chains and community updates—high time investment.

-

Community Engagement (5/5): Highly active in meme coin communities (e.g., Twitter, Telegram), driving price increases through hype and promotion.

-

Return Expectations (5/5): Aim for extremely high returns (e.g., 100x or more), though success rates are very low—often driven by gambling mentality.

In Summary

There is no single “best” type of user—only the one most suited to you. It's essential to find the path that aligns with your strengths and goals.

For me, my learning journey has evolved like this:

Starting as an airdrop hunter—earning while experiencing products and learning about projects;

Then moving into DeFi—deepening my understanding of protocols and on-chain operations, farming yields across different platforms;

And now, becoming an on-chain trader—chasing trending narratives and searching for wealth-generating opportunities on-chain.

My identity and role have shifted multiple times, but one thing remains unchanged: I keep learning new things, pushing beyond my limits, and striving to keep pace with the industry’s rapid evolution.

Once you find the path that fits you, just keep moving forward!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News