Stake PRIME or Buy PROMPT Directly? Wayfinder Yield Maximization Research

TechFlow Selected TechFlow Selected

Stake PRIME or Buy PROMPT Directly? Wayfinder Yield Maximization Research

Whether staking or buying, each has its own advantages and disadvantages. Learn risk management and master the game of returns.

Author: DMD

Translation: Tim, PANews

Note: This article does not constitute financial advice and is provided solely for informational purposes.

Over the past year, I’ve been sharing estimated returns for staking PRIME tokens to earn PROMPT, data that has frequently been cited by the community. After real-world validation post-TGE, I’m pleased to see these estimates have proven highly accurate:

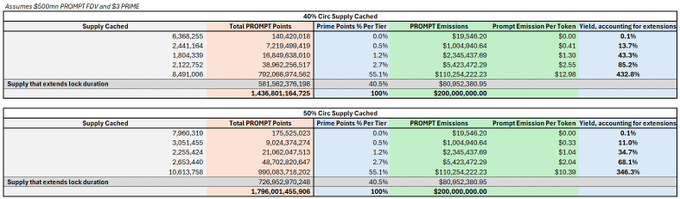

The model estimates total PROMPT points as = Locked PRIME amount × Duration × Multiplier. Stakers receive a share of points proportional to their stake.

When comparing the model against three different wallets—including my own—the estimated model overpredicted received PROMPT by approximately 20%. I believe this stems from two main factors:

1. I initially assumed 40% of circulating PRIME would be staked, but actual staking reached 45%, meaning more total points were generated than expected, resulting in greater dilution.

2. The total number of PROMPT points remains uncertain because some stakers may unstake (reducing total points) or extend their stakes (increasing total points).

Beyond this, yield estimates are highly sensitive to the prices of PRIME and PROMPT. When PRIME price drops, yields rise, incentivizing users to buy and stake more. Ultimately, however, returns depend on the final valuation of PROMPT.

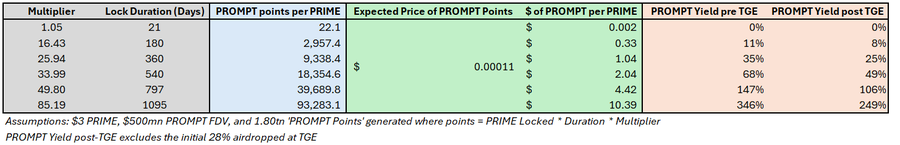

With more information revealed post-TGE, I believe the table below offers the most accurate prediction yet for staking PRIME yields. This update accounts for higher-than-expected staking levels (generating more PROMPT points), while maintaining the $500 million FDV assumption. Additionally, a new column excludes the 28% of tokens airdropped to the community at TGE:

Brief summary: Maximize your PRIME staking immediately to achieve a 106% return in PROMPT form over the next 797 days.

As shown above, earning opportunities have declined significantly since June 2024. This decline manifests in two ways: the multiplier effect continues to decay, and as time passes, more points accumulate—meaning later entrants capture a smaller share. This effect is especially pronounced post-TGE, with 28% of total supply already distributed and additional tokens being released weekly for claim.

Scenario Analysis: Staking PRIME vs. Buying PROMPT

We now compare two options currently available to market participants: buying PROMPT directly on the open market versus purchasing PRIME and staking it (thereby earning PROMPT rewards). We assume PRIME is maximally staked using the previously mentioned 49.8x multiplier over a 797-day period.

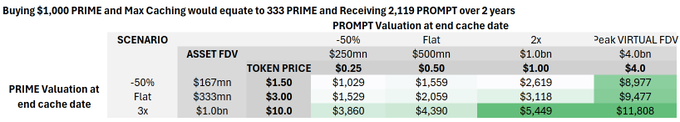

Purchasing $1,000 worth of PRIME today gets you approximately 333 PRIME tokens. Based on the table, fully staking these would generate 333 × 39,690 = 13.2 million points.

Given that 400 million PROMPT tokens will be distributed proportionally based on a total of 1.8 trillion accumulated points, 13.2 million points should yield about 2,944 PROMPT tokens. However, since 28% of PROMPT has already been distributed, we apply a proportional adjustment, reducing this to approximately 2,119 PROMPT. Note that this calculation isn't perfectly precise—actual distribution depends on daily point accrual—but this method provides a clear and reasonable estimation framework.

The table below applies this figure to various valuation scenarios for PRIME and PROMPT at the end of the staking period:

On the other hand, buying PROMPT directly is simpler. Assuming a $0.50 price, $1,000 buys 2,000 PROMPT tokens—fewer than what staking PRIME would yield.

That said, the advantage of buying PROMPT outright is the ability to exit at local price peaks whenever they occur.

Assuming a $1 billion valuation for PROMPT at the end of the staking period with PRIME price stable, the token value would reach $3,118 as shown.

However, given crypto volatility, PROMPT could very well hit an all-time high within the next two years—say, reaching a $4 billion FDV (similar to VIRTUAL at the peak of the AI agent craze)—before settling back down to a more reasonable $1 billion FDV.

If you bought $1,000 worth of PROMPT today and sold at that local high, you’d realize $8,000—more than double the value obtained via staking PRIME.

Conclusion

Those seeking exposure to PROMPT—whether through full PRIME staking or direct market purchases—should consider the following:

-

What do you expect the final values of PRIME and PROMPT to be at the end of the two-year staking period?

-

What do you think PROMPT’s all-time high might reach over the next two years—and critically, can you actually sell at that peak?

In the end, it largely comes down to individual circumstances. The undeniable truth is that most investors fail to sell at market tops. At the same time, as many PRIME holders have personally experienced, locking up tokens for over two years only to watch their value drop 90% is deeply painful. That said, given PRIME’s leading position in the Web3 gaming space and multiple upcoming catalysts this year—including the highly anticipated releases of games "Colony" and "Sanctuary"—I find it hard to imagine PRIME dropping more than 50% from current levels.

Moreover, the team is already exploring new tokenomic mechanisms to create deflationary pressure on PRIME and enhance value accrual, which convinces me that downside risk for this gaming token is effectively capped at this stage.

Finally, I must emphasize that none of the above constitutes financial advice, and I assume no responsibility for any errors in the calculations presented.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News