Uncovering MANTRA's Dark History: Market Manipulation, Legal Disputes, and Offline OTC Promotion Model

TechFlow Selected TechFlow Selected

Uncovering MANTRA's Dark History: Market Manipulation, Legal Disputes, and Offline OTC Promotion Model

This sudden plunge is not just a technical issue, but more like a long-buried landmine finally exploding.

Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

"This is even worse than LUNA."

In the early hours of today, Beijing time, a sudden plunge kept many crypto investors awake all night. The MANTRA token OM dropped approximately 10% within an hour, then plummeted from $5.21 to $0.50 in a cliff-like collapse—a staggering 90% decline.

Shockwaves rippled through the community, with sharp criticism emerging: "There are still plenty of people staking OM for yield, and they weren't even given time to exit. This is more deadly than LUNA’s crash back then."

This sudden crash wasn't merely a technical issue—it resembled more like a long-buried landmine finally detonating.

The Weight of a “Dark Past”: Uncovering MANTRA's Controversial History

In the Web3 world, valuations diverging from fundamentals isn't uncommon. But when a DeFi protocol has only $4 million in TVL yet commands a fully diluted valuation (FDV) as high as $9.5 billion, it’s hard not to question its market legitimacy.

MANTRA’s collapse may not have come out of nowhere—its recent history has been marred by controversies and questionable practices:

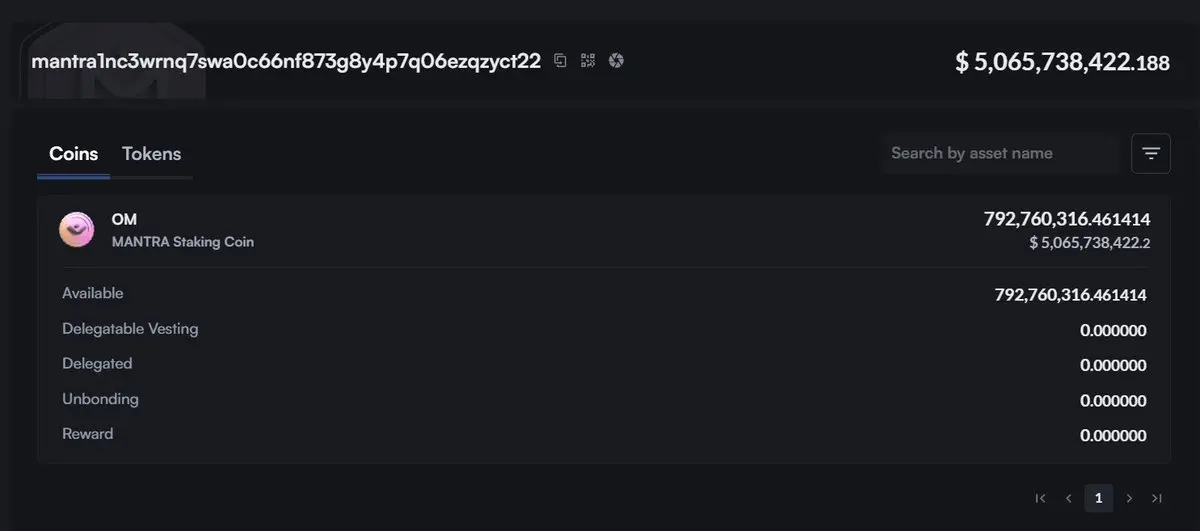

Heavy centralization by the project team. Crypto analyst Mosi pointed out that MANTRA controls the majority of $OM’s circulating supply. As much as 90% of $OM tokens (792 million) were reportedly held in a single wallet address controlled by the team.

A never-ending relay race of token sales. KOL Rui noted that OM’s underlying mechanism resembles a sophisticated OTC funding scheme. Allegedly, over the past two years, OM raised more than $500 million through OTC sales via grassroots promotion. The model relied on issuing new OTC tokens to absorb selling pressure from earlier investors, creating a cycle of “new buyers covering old sellers.” Once liquidity dries up or unlocked tokens can no longer be absorbed by the market, the entire system risks collapsing.

The project team itself also took advantage of each price surge, cashing out opportunistically by activating contracts and riding bullish momentum for extra profits.

Acquisition by Middle Eastern capital. According to Ye Su, in 2023, OM’s FDV had fallen below $20 million, and the project was nearly abandoned. Subsequently, through an intermediary, a Middle Eastern investor acquired the OM shell, retaining only the original CEO while replacing the rest of the team. This investor brought extensive real-world assets—including luxury homes and resorts—and rebranded OM as an RWAfi project. Leveraging the popularity of the RWA narrative and tight supply control, OM surged over 200x in 2024.

Entangled in legal disputes over alleged asset misappropriation. As reported by the *South China Morning Post*, Hong Kong’s High Court previously ordered six members of MANTRA DAO to disclose financial information after accusations surfaced that the team had misused DAO funds.

Failure to fulfill promised payments and token deliveries. Crypto influencer Phyrex revealed he invested in the project early on but never received the promised tokens. Even after winning a court judgment in 2023, the MANTRA team failed to comply, citing their relocation “from Hong Kong to the U.S.” He accused them: “Not a single cent or token has ever been paid.”

Widely criticized airdrop practices. As disclosed by Bingwa, from the outset of its airdrop campaigns, the MANTRA team repeatedly altered rules and progressively delayed unlock schedules, consistently disappointing user expectations. During distribution, the team lacked transparency and ignored community concerns, even implementing a witch-hunt-style purge mechanism—revoking users’ airdrop eligibility under vague claims of “Sybil attacks,” without ever disclosing criteria or data.

Deconstructing the Crash: Liquidations and Whale Exits

Following the cliff-like price drop and amid growing panic and skepticism, the MANTRA team issued an emergency statement within hours, attempting to distance themselves from direct responsibility for the market turmoil. Multiple theories emerged to explain the crash, largely centered around two key factors:

Liquidations Trigger Market Turmoil

According to MANTRA co-founder JP Mullin, the extreme volatility stemmed from reckless forced liquidations of OM positions on centralized exchanges. He emphasized that these positions were liquidated abruptly, without sufficient warning or prior notice.

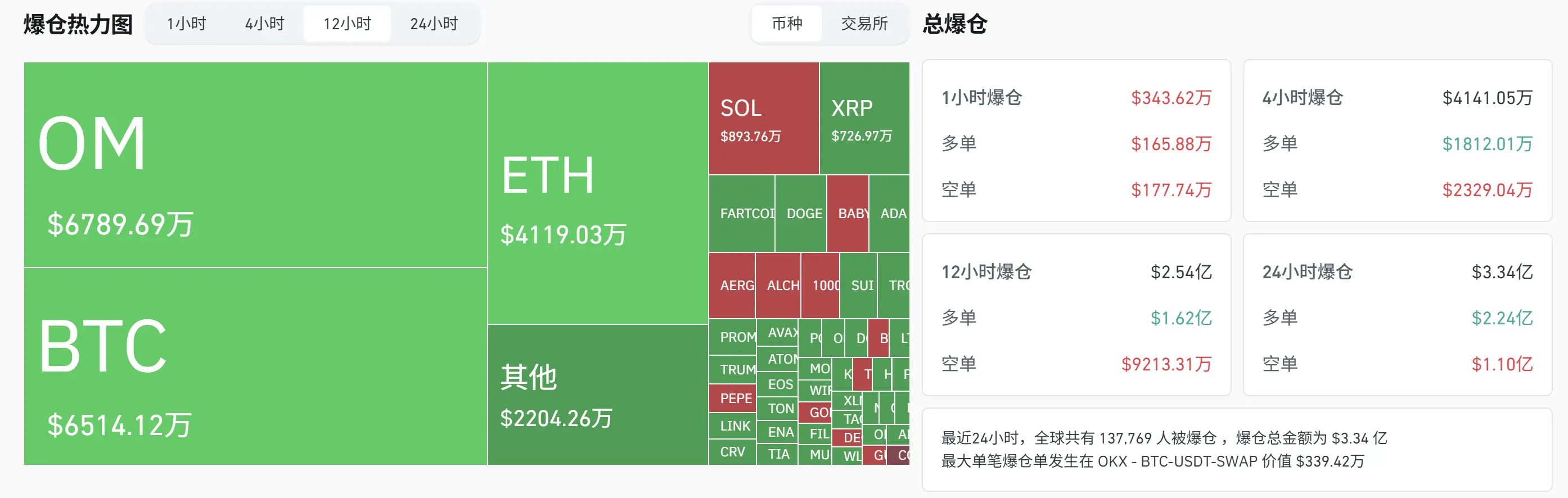

Data shows that within the past 12 hours, the OM crash triggered over $66.97 million in forced liquidations, with ten individual positions exceeding $1 million each.

Strategic Investors Make a Mass Exit

According to Lookonchain monitoring, at least 17 wallets transferred 43.6 million OM tokens (worth about $227 million at the time) to exchanges before the crash—equivalent to 4.5% of the circulating supply. Among them, two addresses were linked to Laser Digital, a strategic investor in MANTRA.

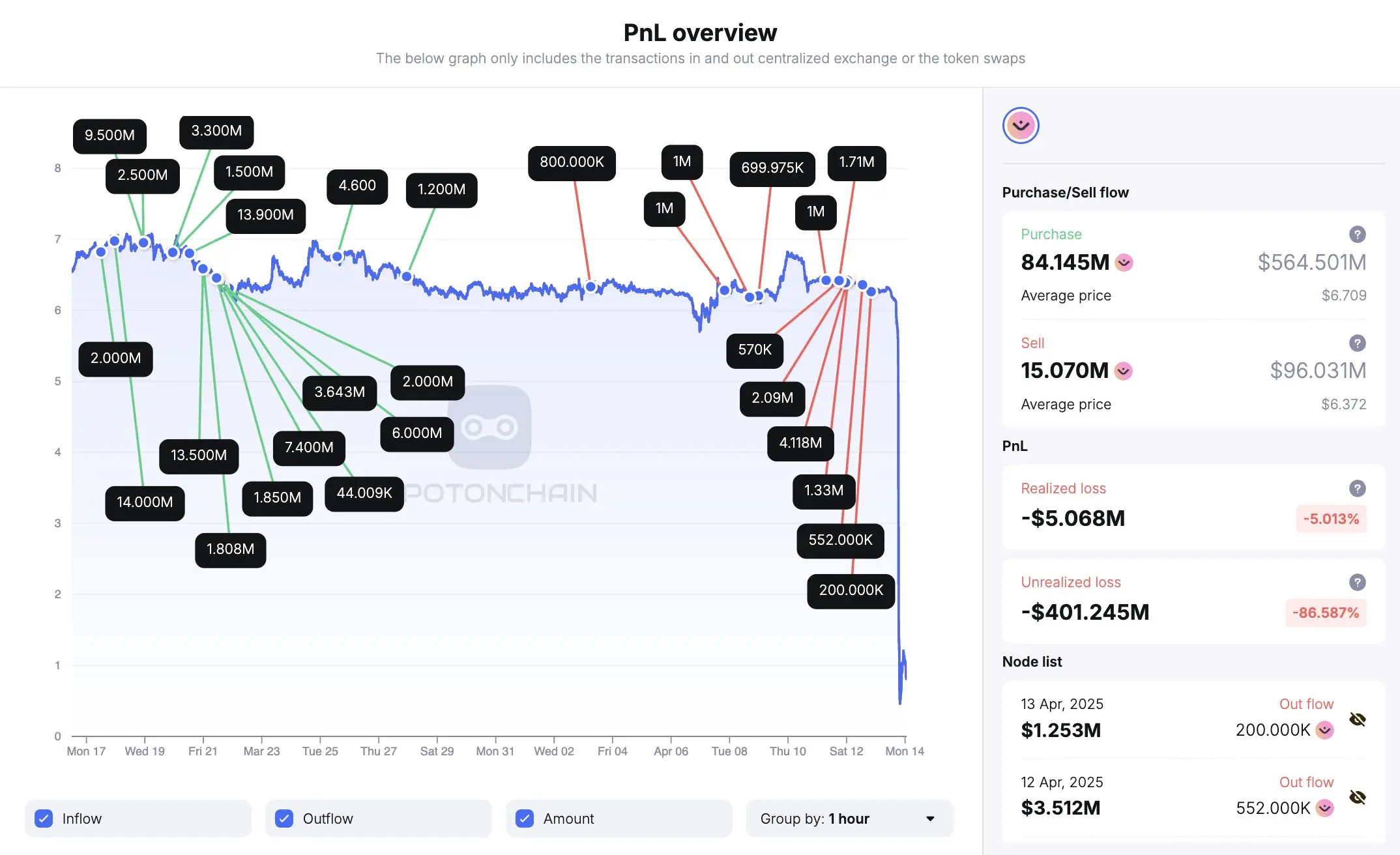

Additionally, Spot On Chain reported that 19 wallets believed to belong to the same entity moved 14.27 million OM tokens (worth ~$91 million) to OKX over three days preceding the crash, at an average price of $6.375. Back in late March, these wallets purchased 84.15 million OM tokens from Binance for approximately $564.7 million at an average cost of $6.711. These entities may have hedged part of their position on other platforms, exacerbating the downward spiral.

The 90% collapse of OM once again underscores the harsh reality of the “harvesting logic” in the crypto market. OM is neither the first project to suffer such a fate, nor will it be the last. In the cryptocurrency industry, hype and bubbles coexist. Only vigilance and rational investing can help one navigate steadily through this complex and volatile landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News